We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Investing often feels like navigating through a maze, especially for those just starting out. With a plethora of options, understanding the Types of Investment becomes essential for financial growth.

Each Investment type offers unique opportunities and challenges. Recognising the distinct advantages and risks associated with each is vital for success. So, people beginning their financial journey must be aware of these types.

Explore various Types of Investments in our comprehensive blog and understand the risks, returns, and strategies for effective financial portfolio management. Both seasoned investors and beginners can benefit from this knowledge. Step into the domain of informed and strategic investing!

Table of Contents

1) What are Investments?

2) Eight Types of Investments

a) Stocks (equities)

b) Bonds (fixed-income securities)

c) Mutual funds

d) Real estate

e) Commodities

f) Certificates of Deposit (CDs)

g) Cryptocurrencies

h) Exchange Traded Funds (ETFs)

3) Investment strategies

4) Conclusion

What are Investments?

Investing is the process of distributing resources, usually in the form of money, into different products or businesses to make profits later on. These monetary obligations can come in stocks, bonds, real estate, or company endeavours, among other things. Gaining income or capital appreciation—or both—is the main objective of Investments. Investors make strategic decisions based on their financial objectives, risk tolerance, and market conditions.

People, companies, and organisations can increase their wealth through Investments. A sustainable future, long-term financial planning, and wealth building all heavily depend on Investments. The changing nature of the financial environment necessitates managing risk, keeping up with economic developments, and adjusting strategies to maximise returns while minimising volatility in the market. Investors frequently consult experts, conduct in-depth research, and monitor market trends to make well-informed and wise investment selections.

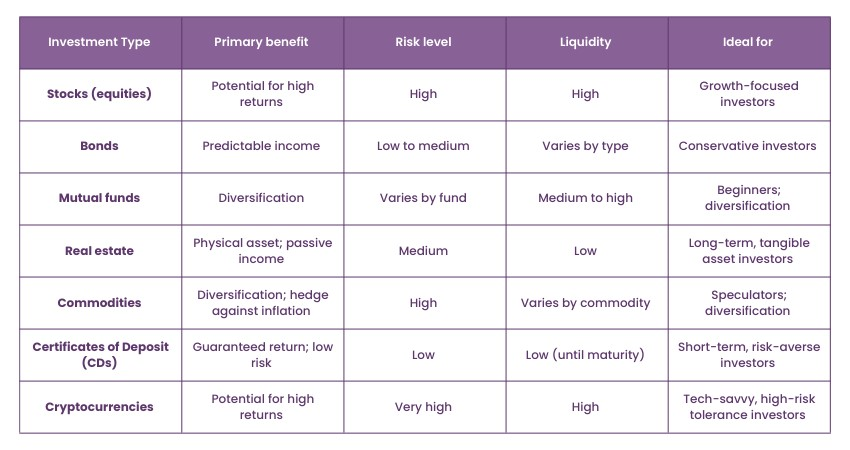

Eight Types of Investments

From tangible assets like real estate to digital currencies in the virtual world, Investments are diverse pathways to wealth accumulation. Understanding their intricacies is key to navigating the vast financial landscape effectively.

While there numerous Types of Investments, let's look at the most common ones:

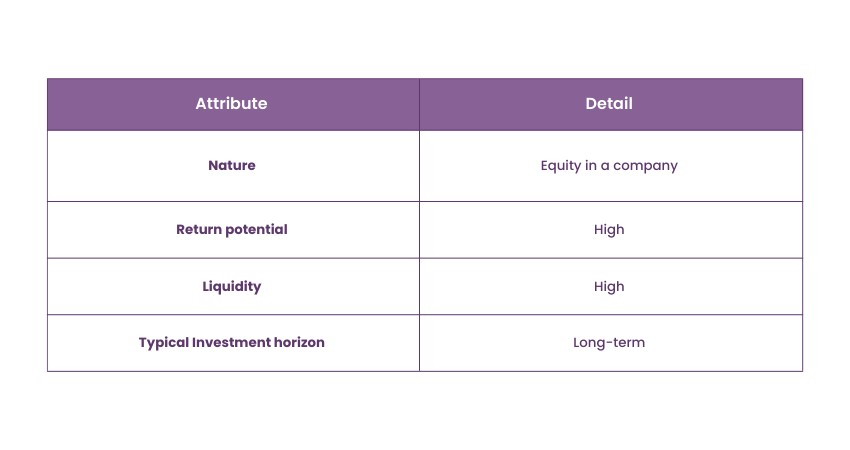

1) Stocks (Equities)

Stocks, also known as equities, represent ownership in a company. By purchasing stocks, investors essentially buy a share of that company's assets and earnings. The stock market provides a platform where these shares are bought and sold.

Advantages of stocks:

Investing in stocks offers the potential for high returns, especially over long durations. As companies grow and profit, stockholders benefit from price appreciation and, sometimes, dividends. Additionally, stocks are easily traded, providing liquidity to investors.

Disadvantages of stocks:

Stock Investments can be volatile, with prices fluctuating based on market sentiments and company performance. There's also the risk of loss, especially if a company underperforms or faces bankruptcy. It demands an understanding of market dynamics.

Who should invest in stocks?

Those with a higher risk tolerance, seeking growth over time, might find stocks appealing. It's suitable for individuals who can withstand market downturns and stay invested for the long haul.Individuals must consider the following before Investment:

How to invest in stocks?

To invest in stocks, one needs a brokerage account. Many online platforms offer easy access. Once set up, investors can research, select, and buy shares of desired companies. Regular monitoring and perhaps consultation with financial advisors can optimise the Investment journey.

Discover expert insights and elevate your trading skills with the Stock Trading Masterclass – get started now!

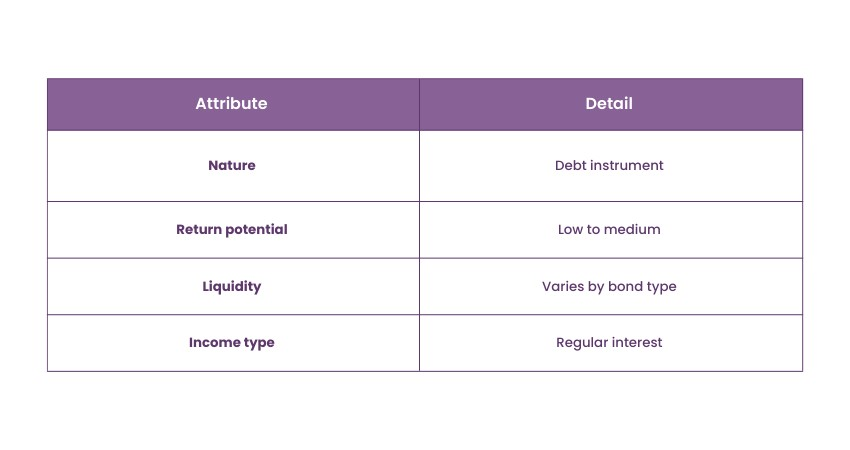

2) Bonds (fixed-income securities)

Bonds represent debt instruments where investors lend money to entities, be it corporations or governments. In return, these entities promise to pay a predetermined interest rate at specified intervals and return the principal amount at the bond's maturity.

Advantages of bonds:

Bonds are typically less volatile than stocks, offering more predictable returns. They provide regular interest income and can be a reliable source of fixed income for investors. Furthermore, they add a layer of diversification in a mixed portfolio.

Disadvantages of bonds:

Compared to stocks, bonds generally offer lower potential returns. They can also lose value if interest rates rise, making existing bonds less attractive. Additionally, there's a risk of default where the issuer might fail to make timely payments.

Who should invest in bonds?

Bonds are well-suited for conservative investors seeking steady income and capital preservation. They're also ideal for individuals nearing retirement or those who prefer to mitigate the volatility of a stock-heavy portfolio. Consider the following before investing in Bonds:

How to invest in bonds?

To invest in bonds, one can approach banks or brokerage firms or even purchase directly from the government (in the case of treasuries). Bond funds, available through mutual fund companies, provide another avenue, allowing diversification across multiple bonds with a single Investment.

Unlock the intricacies of asset allocation and portfolio strategy with the Investment Management Masterclass – dive in now!

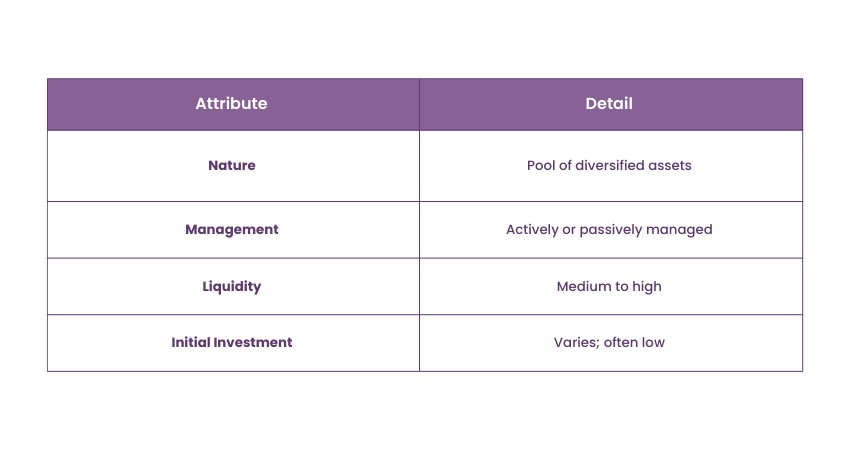

3) Mutual funds

Mutual funds involve pooling money from numerous investors to purchase a diversified collection of assets, like stocks, bonds, or other securities. These funds are managed by professional portfolio managers who make buying and selling decisions based on specific objectives.

Advantages of mutual funds:

The primary allure of mutual funds is diversification, reducing the risk associated with individual securities. Investors also benefit from professional management, potentially improving returns. With mutual funds, one can access complex strategies and assets without a significant initial Investment.

Disadvantages of mutual funds:

Mutual funds come with management fees, which can erode returns over time. Performance isn't guaranteed; some funds may underperform their benchmark. Also, depending on the fund type, there might be less control over specific Investment choices and potential capital gain distributions that could have tax implications.

Who should invest in mutual funds?

Mutual funds cater to a broad spectrum of investors. Beginners find them appealing due to their inherent diversification and professional oversight. They're also beneficial for those seeking specific Investment strategies or sectors without the need to analyse individual assets. Individuals must consider the following before investing:

How to invest in mutual funds?

Investing in mutual funds is easy and simple. Most brokerage accounts offer a range of mutual fund options. After researching and selecting a fund that aligns with one's goals, an investor can purchase shares. Many funds also allow automatic periodic Investments, simplifying the process of consistent contributions.

Optimise profit potential and master pricing strategies with Revenue Management Training – Begin your journey today!

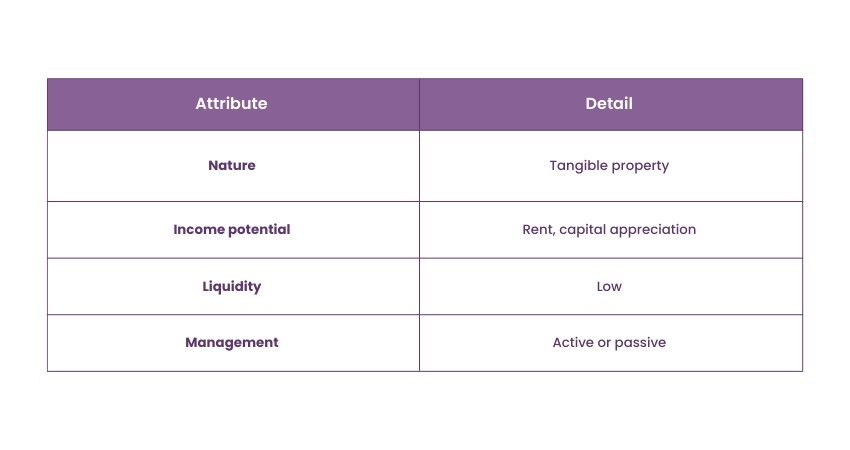

4) Real estate

Real estate refers to tangible property, often encompassing land and the structures on it. Investments can range from residential properties, like houses and apartments, to commercial spaces, such as office buildings and shopping malls. Real estate can also extend to vacant land or real estate Investment trusts (REITs).

Advantages of real estate:

Real estate Investments offer potential capital appreciation over time. Properties can generate passive rental income, serving as a steady revenue stream. Real estate often acts as a hedge against inflation since property values and rental income typically increase over time. Additionally, it offers tax advantages through deductions and credits.

Disadvantages of real estate:

Real estate requires substantial initial capital. It's not as liquid as stocks or bonds, meaning converting property to cash might take time. Managing real estate, especially rental properties, demands effort and can incur additional expenses. Market fluctuations and property location can also influence the Investment's profitability.

Who should invest in real estate?

Real estate suits those with significant capital and a willingness to commit long-term. Investors seeking passive income, capital appreciation, and tax benefits might find it attractive. It's also for those comfortable with managing physical assets or hiring property management services. Individuals must take the following into consideration before investing in real estate:

How to invest in real estate?

One can invest directly by purchasing property or indirectly through REITs, which are traded like stocks. For direct Investments, scouting locations, securing financing, and understanding local property markets are crucial steps. For an indirect approach, brokerage accounts can be used to invest in REITs, offering a taste of real estate without hands-on management.

Transform your real estate career and master the market dynamics with the our Real Estate Agent Masterclass – take the leap now!

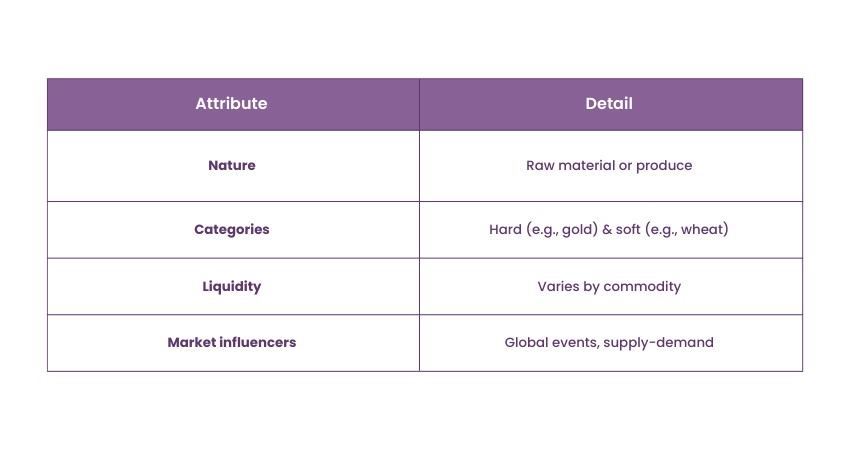

5) Commodities

Commodities are raw materials or primary agricultural products that can be bought or sold. They are typically standardised and interchangeable with other goods of the same type. Commodities are broadly categorised into two: hard (like gold and oil) and soft (such as wheat and coffee).

Advantages of commodities:

Commodities offer a hedge against inflation and currency fluctuations. They provide diversification, as their performance can be uncorrelated with traditional assets like stocks. In certain scenarios, commodities can offer significant returns, especially during supply shortages or increased demand.

Disadvantages of commodities:

They can be highly volatile, influenced by global events, weather patterns, and geopolitical tensions. Investing in commodities requires specialised knowledge to predict market dynamics accurately. Physical storage for some commodities, like metals, can be challenging and expensive.

Who should invest in commodities?

Investors looking to diversify beyond traditional assets might consider commodities. They're suitable for those who understand the unique factors influencing commodity prices and are comfortable with potential volatility. Speculators, aiming to capitalise on price fluctuations, also delve into commodities. However, it is better to consider the following factors before investing in any commodity:

How to invest in commodities?

There are various avenues: directly buying the physical good, investing in futures contracts, or through commodity-focused Exchange-Traded Funds (ETFs) and mutual funds. Online brokerage platforms often provide access to these Investment vehicles. For direct purchases, it's crucial to consider storage, insurance, and other logistical aspects.

Navigate the world of foreign exchange and amplify your trading prowess with our Forex Trading Masterclass – join today!

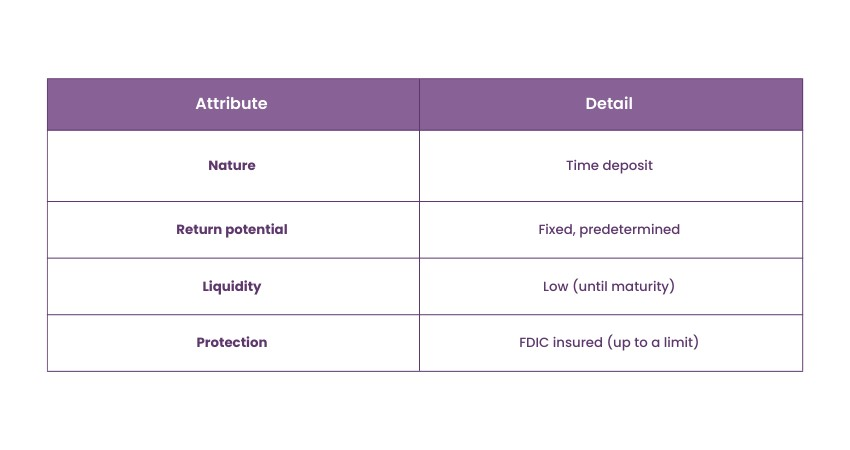

6) Certificates of Deposit (CDs)

Certificates of Deposit, commonly known as CDs, are time deposits held at financial institutions. They offer a fixed interest rate over a specified term, after which the initial Investment (principal) is returned along with accrued interest.

Advantages of CDs:

CDs provide a guaranteed return, making them a low-risk Investment option. They often yield higher interest rates than regular savings accounts. The predictability of returns and the FDIC insurance (in the U.S.) up to certain limits offer added security.

Disadvantages of CDs:

The returns on CDs might be lower compared to other Investment vehicles. Liquidity can be an issue, as withdrawing before maturity often incurs penalties. Additionally, if interest rates rise in the broader market, locked-in CD rates might seem less attractive.

Who should invest in CDs?

CDs are ideal for risk-averse individuals seeking a safe place for their money over a specified period. They're also suitable for those targeting specific financial goals with a fixed timeline, ensuring the principal remains intact. Consider the following factors before investing:

How to invest in CDs?

Investing in CDs is straightforward. Banks, credit unions, and some brokerage firms offer CDs with varying terms and interest rates. After selecting a suitable term and rate, investors deposit their money, leaving it to maturity. It's crucial to understand the terms, especially concerning early withdrawal penalties, before committing.

Empower your financial decision-making and grasp core principles with the Financial Management Training – start your transformation now!

7) Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of traditional banking systems. Bitcoin, the pioneer, has been followed by a plethora of others like Ethereum, Ripple, and Litecoin. These decentralised assets are stored and transacted over blockchain technology.

Advantages of cryptocurrencies:

Cryptocurrencies offer the potential for substantial returns, given their nascent stage and volatility. Transactions are usually swift, borderless, and sometimes anonymous. They provide an alternative to traditional banking, especially in areas with limited banking infrastructure. Furthermore, blockchain, the underlying technology, offers transparency and security.

Disadvantages of cryptocurrencies:

Cryptocurrencies are notoriously volatile, with prices subject to sharp fluctuations. They're not universally accepted and face regulatory uncertainties in many jurisdictions. Additionally, there's the risk of loss due to hacking, as several cryptocurrency exchanges have been compromised in the past.

Who should invest in cryptocurrencies?

Cryptocurrencies cater to risk-tolerant investors intrigued by new-age digital assets. Tech-savvy individuals and those wanting to diversify away from traditional assets might find them appealing. However, the Investment should be approached with caution and ideally represent only a fraction of a diversified portfolio. Take the following factors into consideration before investing in crypto:

How to invest in cryptocurrencies?

To invest, one needs a digital wallet and an account on a cryptocurrency exchange. Once registered, users can buy, sell, or hold cryptocurrencies. Given the rapidly changing landscape, staying updated on regulations, market dynamics, and technological advancements is essential. Consulting with professionals or dedicated cryptocurrency advisors can also be beneficial.

Step into the dynamic world of digital currencies and hone your trading strategies with Cryptocurrency Trading Training – Begin your crypto journey today!

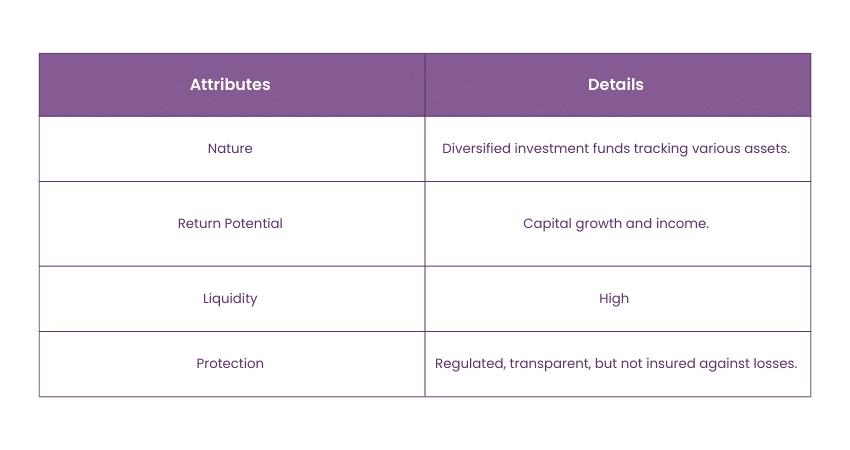

8) Exchange Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges. They typically hold assets like stocks, bonds, or commodities and provide investors with diversified exposure to a specific market index. ETFs offer the flexibility of trading throughout the day and are known for their low expense ratios and tax efficiency.

Advantages of ETFs

ETFs offer several advantages, including diversification, as they track various assets, providing instant exposure to entire market sectors. They are cost-effective with lower expense ratios compared to mutual funds. ETFs also offer flexibility, trading like stocks on exchanges, allowing investors to buy and sell throughout the trading day at market prices.

Disadvantages of ETFs

While ETFs offer various benefits, they also come with disadvantages. Some drawbacks include market price fluctuations, tracking errors, and the potential for lower liquidity in certain ETFs. Additionally, investors may incur brokerage commissions when buying and selling ETF shares, impacting overall returns.

Who should invest in ETFs?

ETFs suit a broad range of investors, from beginners to seasoned professionals. Individuals seeking diversified exposure to various asset classes, cost-conscious investors looking for low expense ratios, and those desiring the flexibility of intraday trading find ETFs attractive. Their simplicity makes them accessible to investors with different risk tolerances and financial goals. Consider the following factors before investing in ETFs:

How to invest in ETFs?

Investing in ETFs is straightforward and involves the following steps. First, you need to choose a brokerage account and research and select ETFs based on your investment goals. You also need to predetermine the amount you want to invest. Once these are done, you can place buy orders through your chosen brokerage platform. Post-purchase, you must constantly monitor your investments and adjust your portfolio.

Step into the dynamic world of digital currencies and hone your trading strategies with Cryptocurrency Trading Training – begin your Crypto journey today!

Investment strategies

Beyond choosing assets, how you approach Investment matters. Strategies shape your Investment journey, guiding decisions based on risk tolerance, goals, and market conditions. Here are some of them:

1) Buy-and-hold: Focuses on long-term gains. Investors believe in the growth of markets over extended periods and avoid reacting to short-term market fluctuations.

2) Active trading: Involves frequently buying and selling assets, aiming to capitalise on short-term market movements. Requires a keen understanding of market dynamics.

3) Diversification: Spreading Investments across different asset types to manage risks. This strategy is rooted in the idea that not all Investments will perform poorly at the same time.

4) Dollar-cost averaging: Investing a fixed amount regularly, regardless of market conditions. This can reduce the impact of market volatility, ensuring investors don't always buy high.

Remember, combining these strategies with a deep understanding of the various Types of Investment can pave the way for informed decision-making and optimal financial growth.

Conclusion

The financial world offers numerous Investment opportunities, each with its unique set of advantages and challenges. Understanding the different Types of Investment is crucial for crafting a strategy that aligns with individual financial goals and risk tolerance. From traditional stocks and bonds to innovative cryptocurrencies, the options are diverse. As investors, it's essential to stay informed, continuously educate ourselves, and seek expert advice when needed.

Frequently Asked Questions

Before choosing stocks, consider the company's financial health, earnings history, growth prospects, industry trends, and competitive positioning. Evaluate the management team, scrutinise the balance sheet, and assess potential risks. Diversify your portfolio to mitigate risk, stay informed about market conditions, and have a clear investment strategy aligned with your financial goals. Conduct thorough research, utilise financial ratios, and remain mindful of market trends and economic indicators for informed stock selection.

Starting an Investment with a limited budget involves the following:

a) Setting clear financial goals

b) Understanding risk tolerance

c) Creating a budget

d) Exploring low-cost Investment options like index funds or ETFs

e) Considering automated Investment platforms for fractional shares

f) Diversifying your portfolio to spread risk

g) Continuously educating yourself about investing, and gradually increase your investment as your budget allows.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy offers various Investment and Trading Courses, including Day Trading Course, Stock Trading Masterclass and Revenue Management Training. These courses cater to different skill levels, providing comprehensive insights into the Steps of Investment Process.

Our Business skills blogs cover a range of topics related to Investments, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Investment and Trading skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 17th Jan 2025

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please