We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

A Mortgage is a crucial financial tool in the real estate industry, enabling individuals to achieve their dream of owning a home. So, what is a Mortgage? It is a loan specifically designed for purchasing property, where the property itself serves as collateral for the loan. Understanding mortagage life cycle is essential to make informed decisions about this significant financial commitment.

In this blog, we'll explore what is a Mortgage, explain key terms, cover different types, and guide you through the process. We'll discuss mortgage applications, pre-approval, finding the right lender, payments, interest rates, expenses, repayment, equity, and refinancing. By the end of this blog, you'll have a solid understanding to make informed decisions on your homeownership journey.

Table of Contents

1) What is a Mortgage?

2) How does mortgage work?

3) Types of mortgages

4) Why do people need mortgages?

5) Mortgage payments and interest

6) The repayment process and considerations

7) Conclusion

What is a Mortgage?

The mortgage is simply the financial planning tool meant for purchasing or holding an asset such as the home or land. At its core, it is a type of loan, in which you are required to pay back the lender some money every month - split between the principal (the amount that you initially borrow) and the interest that you will pay.

The property you're buying is the security that the loan against it is attached to. In case you're no longer able to make the payments, the mortgagee can then take the property back to recover their money.

Getting a mortgage consists of selecting a lender and satisfying certain conditions, including having credit score and making at least a down payment. On applying, the mortgage enters a process called underwriting where the lender investigates everything to verify whether you can handle the loan payment or not.

Mortgages are offered in different kinds including the conventional, fixed-rate and adjustable-rate mortgage. The overall payable amount of your mortgage depends on the type of loan, its length of coverage (such as 30 years), and the interest rate. It is essential to know the different alternatives and agree to good general conditions, though the rates can much differ in accordance with the product and your personal characteristics.

How does a mortgage work?

Navigating the Mortgage process involves clearing essential steps like application filing, pre-approval, and finding the right lender. This section will guide you through each stage, ensuring a smooth path to securing your dream home.

Mortgage application

On the Mortgage application, you have to put all your financial information and fill out the loan application form. Make certain that all the required documents are available before filling the application form, such as bank statements, tax returns and proof of income. These documents will give the creditor a clear understanding of your financial standing and enable them to figure out how much you can borrow. The preparation process may not only shorten the application process for you but also make it smoother and easier.

A) Mortgage pre-approval

Getting a mortgage pre-approval is a smart move before you start house hunting. It involves sending your financial details to a lender who evaluates how much you can responsibly borrow. With pre-approval, you come across as a serious buyer and it clarifies how much you can spend, sharpening your house search. This not only makes your hunt more precise but also more efficient, as you know exactly what you can afford.

B) Finding the right m5ortgage lender

Finding the right mortgage lender is key to a smooth mortgage process. It's important to look at factors like interest rates, fees, customer service, and the lender's reputation. Take the time to compare different loan options and get several quotes. This helps you make a well-informed decision. Ideally, you'll want to choose a lender who really understands your financial goals and can offer mortgage products that suit your needs.

C) The mortgage underwriting process

The underwriting stage begins when the lender reviews your information about finances thoroughly and assesses risks associated with providing you with a loan. This requires the lender to validate not only your employment history, income, assets, and credit history, but also the value of residential property in question. The process of underwriting fulfills requirements, and guidelines of the lender. At this stage, it is also important to quickly meet the requirements of documentation or information you are requested to submit.

The underwriting phase is where the lender verifies if you are qualified to secure a loan, and looks at your creditworthiness, debt-to-income ratio, and overall financial stability. Another important role is to make sure the appraisal amount of the property conforms with the loan profile. This could require the impounding of boats which could lead to a delay in taking out the loan while the lender may ask for further clarifications or documents.

After underwriting has been done to confirm that you qualify for the loan, you will receive an approval letter also known as the mortgage commitment letter. This letter from the lender will be proof that your loan application has been accepted. This creditor’s letter provisions of the processes for the granting of mortgage are one of the most significant turning points of this process before the final works.

Keep your lender closely updated during the whole process of your loan approval. Fastly resolve their queries, address any arising concerns or questions and also help them navigate through the steps to be followed. Mortgage Interview Questions often emphasize that effective communication at the right time can help secure mortgage approval in a faster and easier way.

Note that, every mortgage application is distinctive and will take a different number of days based on different factors like complexity of your finances and how many other people have applied for mortgage right now, for example. Working hand in hand with your lender and being eager and a little a bit patient will ensure that the process is fast and the chances of your approval for the mortgage are high.

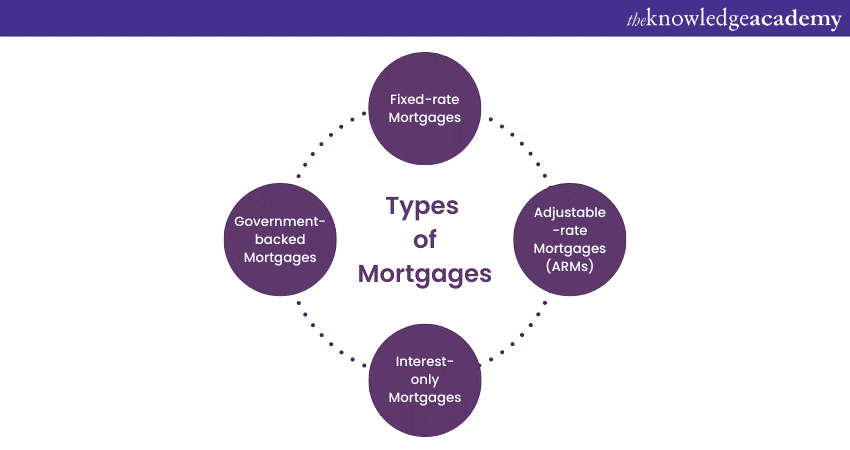

Types of Mortgages

There are different types of Mortgages available to suit different financial situations and preferences. Here are some common types:

a) Fixed-rate mortgages: The fixed-rate mortgage keeps the initial interest rate unchanged over the whole lending course, and therefore, the payments are fixed, predictable, and stable.

b) Adjustable-rate Mortgages (ARMs): The ARM Mortgages, in contrast to the fixed-rate mortgages, have floating rates levels which sometimes change time to sometime during the initially fixed period. It varies depending on what the rates are for now in the market.

c) Interest-only Mortgages: In the case of interest-only mortgage, no principal is paid from the first day till a certain period (usually five to ten years). Then interest on the outstanding amount as well as principal contributions are made after the moratium period.

d) Government-backed mortgages: These Homeowner Mortgages are funded or insured by government-sponsored institutions like the Federal Housing Administration (FHA), and the Veterans Administration (VA). They might be more fastidious on their application requirements but offer lower down payment ways.

Unlock a rewarding career in Mortgage advice, acquire essential industry knowledge, and become a certified Mortgage professional with our comprehensive CeMAP Training courses.

Why do people need Mortgages?

People often need Mortgages for several reasons, some of them can be listed as follows:

1) Home ownership: One of the primary reasons people take out mortgages is to buy a home. Houses can be quite expensive, and most individuals or families don't have the full purchase price readily available. A mortgage allows them to spread the cost over many years, making homeownership more affordable.

2) Investment: Some people buy property as an investment. They may purchase a property only to rent it out to generate rental income, or hold onto it with the hope that its value will appreciate over time. Mortgages can help them finance these investments.

3) Lack of savings: A lot of the people and family do not have a year starting money to buy a home upfront. In a sense mortgages represents the escape route for people who don’t have handy sums for an initial outlay in the property market.

4) Financial planning: Home ownership can be considered as a form of long-term financial enterprising. When a homeowner elects to take out a mortgage with a fixed interest rate, he or she secures the interest charge on the property for a length of time. This means that the cost of housing stays at a certain level which makes the budgeting exercise very predictable.

5) Tax benefits: Purchases of a property will only be done if the conditions involve a tax benefit in the form of the mortgage interest payments. Through the tax benefit available to homebuyers in the form of the mortgage interest deduction of the taxable income, the homeowners' tax liability is decreased.

6) Property upgrades: People, who are looking to do some major renovations or extensions to their homes sometimes, borrow money and thus get mortgages. In this process, they can upgrade their accommodation possibly or increase the house value.

7) Retirement planning: A number of people apply for Reverse Mortgages that help them to withdraw a portion of the equity that they have in the house into cash. This can be a way to provide more money while retired or when unpredicted hackney expenses later in life one can move out.

8) Building credit: Effectively managing mortgages may help individuals create records that can be used by creditors to weigh them for credibality of future loans such as education loans or other items, which can be really helpful.

9) Family homes: There are many bankruptcies reported every year, as people are always seeking better investment opportunities. This results in individual homes being an unstable investment environment. Owning a house can help kids feel settled as well as like home and for a very family it can be a wonderful experience of being engaged and be responsible.

10) Housing demand: If these areas have a great need for houses, then you may find that the rent is higher than the mortgage credits that will be given on monthly basis to the house owners. It means that when compared to renting, being a home owner promises financial wisdom over time.

Mortgage payments and interest

Knowledge of how mortgage payments are set up and interest rates impact that mortgage is essential for successful mortgage management.

Understanding mortgage payments

Mortgage payment are what you pay per month in order to take care of your outstanding debt. They typically consist of two components: The principal amount and the interest.

a) Principal: The principal is the beginning amount that has been paid up to buy the property. All installments that you make to reduce the outstanding principal amount are accumulated in the form of equity in your property.

b) Interest: Interest is the interest rate chosen by the lender to get borrowed funds. The interest rate and balance of the remaining principal base the calculation. In the early years of a mortgage, however, a bigger chunk of the payment is directed towards interest, in such a way that it gradually shifts to the principal portion as the loan persist.

Calculating Mortgage payments

For you to be able to calculate mortgage payments properly, you can either use a mortgage calculator, or you may utilize a formula that considers elements such as loan amount, interest rate, and loan term. Additionally, it's important to mention that your monthly payment may include paying other charges related to the property taxes and insurance, which will be put into an Escrow account. If you're preparing for a role in finance or banking, reviewing Letter of Credit Interview Questions can help you better understand financial tools and concepts that may complement your expertise in mortgage calculations.

Impact of interest rates

The mortgage rate has a great influence on the average cost of your mortgage. A low interest rate helps cut down the monthly payment and may even save you tons of money in the long run of the loan. On the other hand, when interest rates go up, your monthly payments will go up which will, in turn, make you pay a higher amount for your loan in total.

Fixed-rate vs Adjustable-rate Mortgages

With Fixed-rate Mortgage, the interest rate remains same right from the beginning of the loan term up to the repayment. Such a feature contributes to the stability factor since your monthly repayment amount doesn't change, giving you peace of mind handling the expenses for homeownership.

In contrast, ARMs have rates that move up and down with time. Fixed-rate Mortgages are the first choice for them and they offer lower interest rates than Fixed-rate Mortgages. Nonetheless, the initial interest rate will be a Fixed-rate one and will be able to change at any time from the market conditions. Payment based ARMs have a possibility of becoming more costly if interest rates increase.

Additional costs: Insurance and taxes

Your mortgage payment may include additional costs, such as property insurance and property taxes, in addition to the principal and interest. Lenders often require borrowers to have homeowners, insurance to protect against property damage or loss. Property taxes are assessed by local government entities and contribute to funding public services.

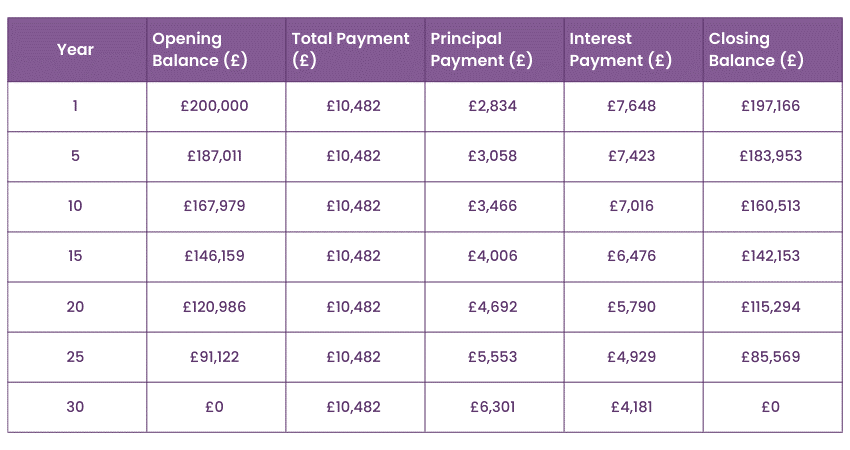

Amortisation and building equity

Amortisation refers to the process of gradually paying off your mortgage through regular payments. With each payment, a portion goes towards the principal, reducing the outstanding balance. Over time, this helps build equity in your home, which is the difference between the property's value and the remaining mortgage balance.

An amortisation schedule illustrates how mortgage payments are allocated towards the principal and interest over the course of the loan term. Here is an example of a £200,000 Mortgage with a 30-year term and a fixed interest rate of 3%:

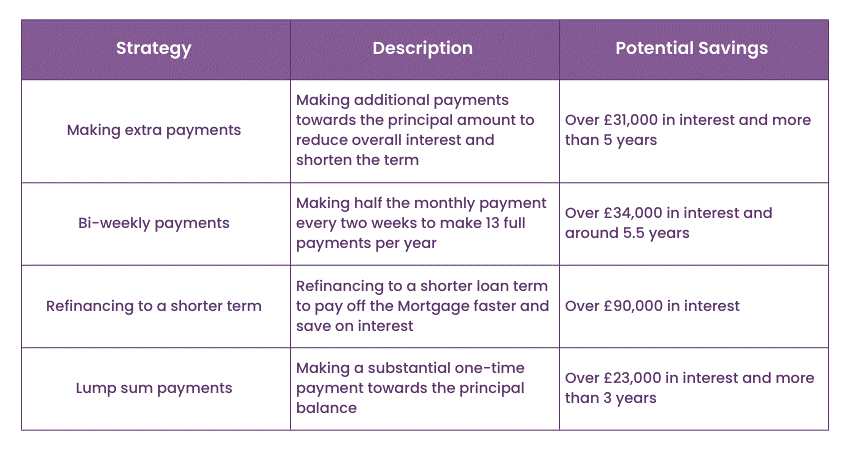

Paying off the Mortgage early

If you have the right financial means, paying off your Mortgage early can provide long-term benefits. By making extra principal payments or opting for shorter loan terms, you can save on interest payments and potentially own your home outright sooner.

Mortgage refinancing

Refinancing is the process of replacing your current Mortgage with a new one, usually to get a better interest rate or more favourable loan terms. Refinancing can help reduce monthly payments, save on interest costs, or tap into home equity for other financial goals. It's also important to understand EMI in this context, as it refers to the fixed monthly installment that includes the principal and interest. However, before opting to refinance, it's crucial to consider the associated fees and assess the long-term benefits to ensure it’s the right financial decision.

Understanding Mortgage payments, interest rates, and associated costs is crucial for managing your Mortgage effectively. In the following section, we'll explore the concept of equity and discuss considerations for paying off your Mortgage early.

The repayment process and considerations

Understanding how to repay your mortgage and exploring factors like early payoff options and equity building are essential for successful mortgage management. In this section, we'll delve into the intricacies of the repayment process and provide valuable considerations for optimising your Mortgage strategy.

Repayment options

When it comes to repaying your Mortgage, you have different options available. The most common repayment methods include:

a) Monthly payments: This is the standard repayment method where you make fixed monthly payments over the loan term, consisting of both principal and interest.

b) Bi-weekly or accelerated payments: Selecting this option allows you to make payments every two weeks instead of once a month. This results in 26 half-payments per year, which is equivalent to 13 full monthly payments. With this, you can pay off your Mortgage at a quicker pace and potentially reduce the interest you have to pay.

c) Lump-sum payments: You may have the flexibility to make lump-sum payments towards your Mortgage principal, which can help reduce the outstanding balance and the overall interest paid.

Considerations for early Mortgage payoff

Paying off your Mortgage early can provide several benefits, including interest savings and the freedom from monthly Mortgage payments. However, before pursuing early Mortgage payoff, consider the following factors:

a) Financial stability: Ensure you have sufficient emergency savings and are free from high-interest debt before allocating extra funds towards Mortgage repayment.

b) Prepayment penalties: Some Mortgages may have prepayment penalties, which are charges imposed by the lender for paying off the loan early. Review your Mortgage agreement to determine if any penalties apply and assess their impact on your decision.

c) Opportunity cost: Consider whether the funds used for early Mortgage repayment could be better utilised in other investments or financial goals that offer higher returns.

Building equity and home appreciation

When you pay your Mortgage, you are also increasing your equity in the home. To determine the equity of a property, subtract the current remaining Mortgage balance from its current value. Home appreciation, where the value of your property increases over time, can also contribute to building equity. Just like understanding the Pros and Cons of Letter of Credit is crucial in trade finance, building equity can provide financial security and potentially unlock opportunities for accessing additional funds through refinancing or home equity loans.

The importance of regular mortgage reviews

Regularly reviewing your mortgage is essential to ensure it aligns with your financial goals and current market conditions. Consider the following aspects during a Mortgage review:

a) Interest rates: Monitor interest rate trends and explore opportunities to refinance if rates have significantly dropped since you obtained your Mortgage.

b) Loan terms: Assess whether your current loan term still suits your financial situation or if refinancing to a shorter or longer term may be beneficial.

c) Changing circumstances: Evaluate any changes in your financial circumstances, such as increased income or decreased expenses, that could allow for higher mortgage payments or accelerated repayment.

By regularly reviewing your Mortgage and making informed decisions, you can optimise your Mortgage strategy and potentially save on interest payments.

Unlock a rewarding career in financial advice, gain comprehensive knowledge and skills, and earn your CeMAP Courses.

Conclusion

To sum it up understanding Mortgages is essential for successful homeownership. Remember, each Mortgage is unique, so seek professional advice whenever needed. With this knowledge, you're now equipped to navigate the mortgage process and achieve your homeownership goals. Best of luck on your journey!

Embark on a transformative journey in Mortgage advice, gain expertise across all levels, and become a fully qualified Mortgage professional with our comprehensive CeMAP Level 1, 2, and 3 Training.

Frequently Asked Questions

Is a Mortgage good or bad?

A mortgage can be beneficial for acquiring property and building equity but carries risks if not managed properly. It offers access to homeownership while requiring responsible financial management to avoid potential debt and foreclosure.

What are disadvantages of mortgage?

Disadvantages of Mortgages include:

a) Risk of foreclosure for missed payments

b) Accumulated interest costs over the loan duration

c) Potential financial strain from high monthly payments

d) Risk of owing more than property's value if housing prices decline

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related courses and blogs provided by The Knowledge Academy?

Knowledge Academy offers various Business Intelligence Reporting Courses, including the Microsoft Power BI Course, Tableau Desktop Training, and DAX Training. These courses cater to different skill levels, providing comprehensive insights into Incremental Refresh in Power BI.

Our Office Applications Blogs cover a range of topics related to Power BI, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Power BI skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 18th Aug 2025

Mon 27th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please