We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

"What is Accounting Cycle?" - It's a question that holds the key to the financial health of any business. This process makes sure that all your financial numbers are structured well to make effective decisions.

Discover more about What is Accounting Cycle in Financial Management. Learn how this structured process ensures accurate records and supports informed decision-making.

Table of Contents

1) What is the Accounting Cycle?

2) Who does the Accounting Cycle?

3) Timing of Accounting Cycle

4) Steps involved in the Accounting Cycle

5) Why is the Accounting Cycle Important?

6) Conclusion

What is the Accounting Cycle?

The Accounting Cycle is a systematic process used by businesses to record, process, and report their financial transactions, which is often discussed in Accounting Interview Questions. It's a series of steps that ensure the accuracy and consistency of financial information. By meticulously recording each transaction, companies create a robust foundation for their financial records, enabling them to track the flow of money and resources accurately.

Who does the Accounting Cycle?

The responsibility for performing the Accounting Cycle typically falls on the shoulders of trained professionals known as accountants or bookkeepers. These individuals are skilled in financial record-keeping, transaction analysis, and reporting. They record all financial activities, ensuring accuracy and adherence to relevant regulations.

Expand your financial expertise with our focused Financial Management Training Course for a successful and impactful career.

Timing of the Accounting Cycle

The timing of the Accounting Cycle is a crucial aspect for any business. It operates on a recurring and well-defined schedule. This cycle typically consists of a series of steps, including recording transactions, posting entries, preparing financial statements, and conducting audits or reviews. The frequency of these activities varies but is often monthly, quarterly, and annually.

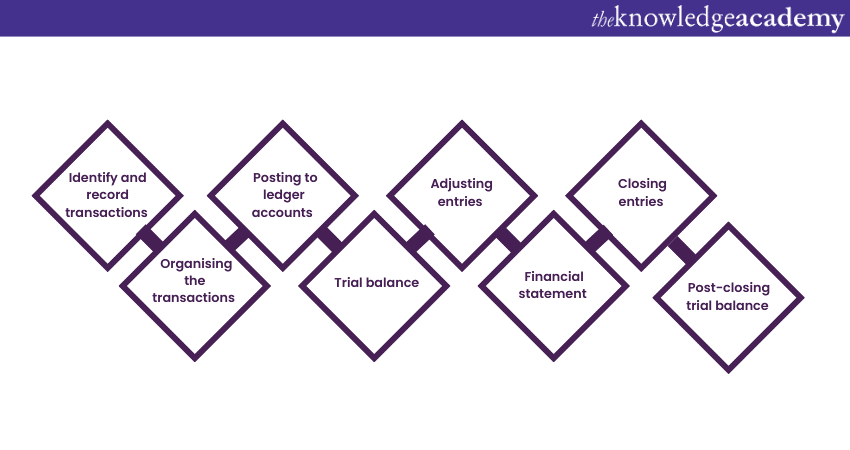

Steps involved in the Accounting Cycle

The Accounting Cycle typically consists of several essential steps, each playing a crucial role in maintaining the financial health of a business. Here's an expanded look at these steps:

Identify and record transactions

The first step in the Accounting Cycle is identifying and recording transactions related to Goods and Services. This crucial phase involves documenting every financial activity associated with the business, ensuring accurate tracking of both tangible products and intangible offerings. Understanding the distinction between Goods vs Services is essential, as it impacts how transactions are recorded, taxed, and reported in financial statements.

These transactions include a wide range of activities, from sales and purchases to expenses and payments. Each transaction is like a piece of a financial puzzle, and accurately capturing these pieces is essential to building a comprehensive and reliable picture of the company's financial health.

Once identified, these transactions are recorded in the company's books. This recording is more about creating a structured record that captures essential details. This detailed recording ensures that nothing is overlooked, and it sets the stage for accurate financial reporting and analysis.

Organising the transactions

Journal entries play a vital role in the Accounting Cycle, serving as the mechanism for organising the transactions identified in the previous step. This step is like the filing system of a library, where each transaction is assigned a specific category or account, creating a structured repository of financial data.

Each transaction captured during the identification phase is carefully separated and classified based on its nature. For instance, a sale made to a customer will be recorded in the sales account, a payment to a supplier in the accounts payable account, and an investment in the asset account. This ensures that similar transactions are grouped together, making it easier to track and analyse financial activities.

Posting to ledger accounts

This involves transferring the information from the journal entries to the respective ledger accounts. It creates a detailed and organised record of the company's financial transactions for each account category.

Consider ledger accounts as individual chapters in a book, each dedicated to a specific aspect of the company's financial activities. For example, there will be separate ledger accounts for cash, accounts receivable, accounts payable, etc., depending on the nature of the business.

Each entry includes the date of the transaction, a description, and the monetary value. This comprehensive data enables businesses to analyse trends, identify areas of strength or concern, and make informed decisions about the company's future.

Unlock the power of Financial Modelling and Forecasting. Join Financial Modelling And Forecasting Training Course now!

Trial balance

It comes after the transactions have been identified, recorded in the journal, and posted to the respective ledger accounts. The trial balance is structured in a simple format, with columns for the account names, the debit amounts, and the credit amounts. This clear layout allows accountants to visually assess whether the totals on both sides match.

If the trial balance is balanced, it indicates that the total debits equal the total credits, suggesting that the company's books are clear. However, if the trial balance is not balanced, it signals the presence of errors that need to be identified and rectified. Common errors might include a transposition of digits, a missing entry, or an incorrect account classification.

Adjusting entries

These entries are important to ensure that the financial statements reflect the company's financial position and performance, considering items that may not have been recorded during the earlier stages of the accounting process.

They help capture transactions and events that take place during the accounting period, which may not have been initially recorded. These adjustments are essential because they enable companies to report their financial activities in a way that matches the economic reality, even if the cash hasn't changed hands yet.

Accuracy and attention to detail are crucial when making adjusting entries. These adjustments ensure that the financial statements truly reflect the company's financial health. Any errors at this stage can affect the overall picture presented in the income statement, balance sheet, and cash flow statement.

Financial statement

Financial statements are the culmination of the Accounting Cycle, presenting a comprehensive overview of a company's financial performance, position, and cash flows over a specific period. These statements are vital tools for stakeholders. It provides essential insights into the company's health and helping in decision-making.

The primary financial statements typically prepared by businesses are the Income Statement, the Balance Sheet, and the Cash Flow Statement. These financial statements collectively offer a comprehensive view of a company's financial performance, position, and the efficiency of its operations.

Closing entries

Closing entries are the final steps in the Accounting Cycle, occurring at the end of the accounting period. They play a critical role in ensuring the accuracy of financial records and preparing for the next period. These entries are like the bookend that completes the accounting process and make the books ready for the new accounting period.

The aim of closing entries is to reset the temporary accounts, specifically the revenue and expense accounts, to zero. These temporary accounts capture transactions that occur during the accounting period, and their balances need to be cleared to start the new period with a clean slate.

Post-closing trial balance

The post-closing trial balance is the ultimate step in the Accounting Cycle, coming after the closing entries have been made and the temporary accounts have been reset to zero. The primary objective of the post-closing trial balance is to confirm that the accounting equation still holds true: Total Assets = Total Liabilities + Total Equity.

The post-closing trial balance provides a fresh starting point for the new accounting period. Temporary accounts are empty, and the focus is on the permanent accounts, which represent the company's long-term financial status. This separation ensures that each accounting period's activities are distinct, making it easier to track financial trends over time.

For Business & Finance Professionals! Understand the Difference Between Cost Accounting and Financial Accounting.

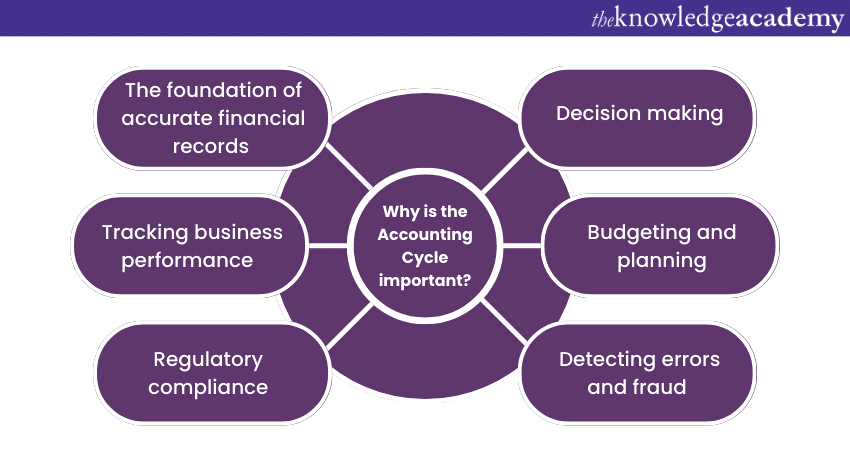

Why is the Accounting Cycle important?

The Accounting Cycle is a fundamental process in the world of finance and business. It involves a series of steps that organisations follow to record, analyse, and report their financial transactions. This cycle plays a pivotal role in maintaining accurate financial records and providing crucial insights for making informed business decisions.

Here we discuss why it is important in a business perspective:

Maintaining accurate financial records

At the heart of any successful business is accurate financial record-keeping. The Accounting Cycle ensures that every financial transaction, whether it's a sale, purchase, or expense, is properly recorded in the books. This meticulous recording provides a clear picture of the company's financial health, helping stakeholders understand its performance and make strategic choices.

Tracking business performance

The Accounting Cycle enables businesses to track their performance over specific periods, usually monthly, quarterly, and annually. By analysing financial statements, organisations can identify trends, evaluate profitability, and assess the effectiveness of their strategies. This insight allows them to make necessary adjustments to stay competitive and achieve long-term growth.

Regulatory compliance

In the complex world of finance, there are numerous regulations and standards that businesses must adhere to. The Accounting Cycle ensures that all financial transactions are recorded according to these regulations, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Compliance with these standards not only maintains the organisation's credibility but also helps prevent legal issues.

Optimise your finances with our Cash Cycle Management Training Course Sign up now for strategic insights!

Effective decision-making

Effective decision-making is a cornerstone of successful businesses. The Accounting Cycle provides essential data that executives and managers use to make informed choices. Whether it's expanding into new markets or assessing the viability of a project, having accurate and up-to-date financial information is crucial. The Accounting Cycle delivers this information in a structured and timely manner.

Budgeting and planning

Budgeting is a critical aspect of managing any organisation. The Accounting Cycle ensures that companies have the data they need to create realistic budgets and financial forecasts. It allows them to allocate resources efficiently, set achievable goals, and monitor progress. This strategic planning helps businesses remain financially stable and adaptable to changing market conditions.

Detecting errors and fraud

Errors in financial records can have serious consequences for a business. Additionally, fraud is a constant concern in the business world. The Accounting Cycle includes steps for reconciliation, internal audits, and checks and balances that help detect irregularities. By identifying and addressing these issues early, organisations can mitigate risks and maintain trust.

Conclusion

The Accounting Cycle is a fundamental tool that businesses rely on to stay financially healthy. It ensures that financial records are accurate, helps us understand how well a company is doing, and guides us in making wise financial choices. Hope you have got an overview on What is Accounting Cycle.

Explore our comprehensive Accounting and Finance Training Courses to enhance your financial skills and boost your career!

Upcoming Accounting and Finance Resources Batches & Dates

Date

Accounting Course

Accounting Course

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please