We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Ensuring financial stability and integrity is important in global banking. Various steps, methodologies, and regulations have been implemented to protect financial institutions from economic breakdowns. One major regulation is Basel III. But What is Basel III exactly?

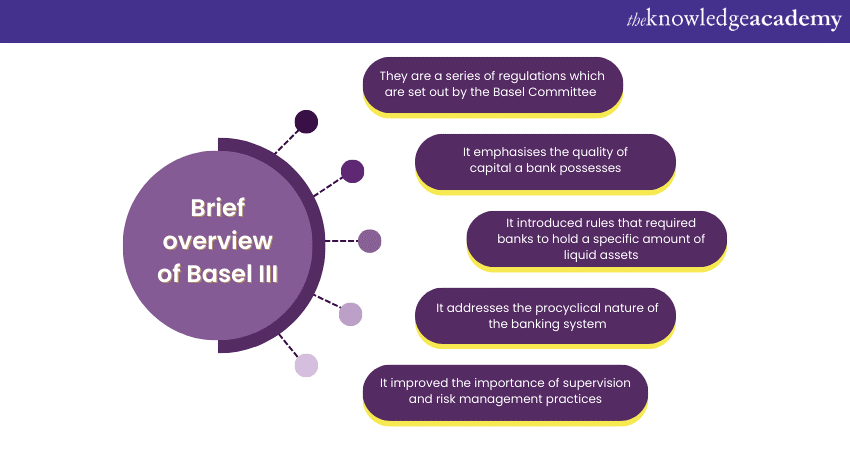

Basel III is a set of international banking regulations developed by the Basel Committee on Banking Supervision in response to the 2007-2008 financial crisis. Its primary aim is to enhance regulation, supervision, and risk management within the banking sector.

According to the Bank for International Settlements, as of the latest update, the final Basel III framework has increased the average impact on Tier 1 minimum required capital for the largest global banks to 3.2%, up from 3.0% in the first half of 2023. Read this blog to learn more about What is Basel III, its key components, impacts, and objectives.

Table of Contents

1) Understanding What is Basel III

2) The Principles of Basel III

3) What are the Objectives of Basel III?

4) Impacts and Implications for Banks Because of Basel III

5) Securing Data in Compliance with Basel III

6) Basel III to “Basel IV”: What changed?

7) Conclusion

Understanding What is Basel III?

Basel III, also recognised as the Third Basel Accord, stands as a pivotal international regulatory framework. It is established to address inherent vulnerabilities within the global banking sector. The inception of Basel III was in 2009 by the Basel Committee on Banking Supervision responded to the fallout of the 2007–2008 financial crisis. Its aim is to fortify the banking industry by instituting specific regulations.

These include enforcing leverage ratios and mandating reserve capital thresholds for banks worldwide. Despite the initially proposed implementation deadline of 2015, delays have persisted. Basel III represents an evolutionary progression from the preceding Basel I and Basel II accords.

This serves to refine risk management, transparency, and fortify individual banks' resilience. Its ultimate goal is to diminish the likelihood of systemic shocks and prevent future economic catastrophes.

The Principles of Basel III

The following are the basic principles of Basel III:

Minimum Capital Requirements

a) Common Equity Tier 1 (CET1): Basel III increased the minimum requirement from 2% under Basel II to 4.5% of risk-weighted assets.

b) Capital Conservation Buffer: An additional 2.5% buffer was introduced, bringing the total minimum CET1 requirement to 7%.

c) Tier 1 Capital: The requirement increased from 4% under Basel II to 6% under Basel III, which includes 4.5% CET1 and an additional 1.5% of other Tier 1 capital.

Leverage Ratio

Basel III introduced a non-risk-based Leverage Ratio to complement the risk-based capital requirements. Banks must maintain a Leverage Ratio of at least 3%, calculated by dividing Tier 1 capital by the bank’s average total consolidated assets.

Liquidity Requirements

a) Liquidity Coverage Ratio (LCR): Requires banks to hold high-quality liquid assets sufficient to cover net cash outflows for a 30-day stress period. The LCR was phased in starting at 60% in 2015 and reached 100% by 2019.

b) Net Stable Funding Ratio (NSFR): Requires banks to maintain a stable funding profile in relation to the composition of their assets and off-balance sheet activities. The NSFR became fully effective in 2018 and aims to ensure that banks have sufficient stable funding to meet their needs over a one-year period of extended stress.

Navigate the world of Compliance with confidence – Register now in our Compliance Training.

What are the Objectives of Basel III?

The objectives of Basel III are discussed in this section. These points will help you to understand why it is important:

1) Strengthening Bank Capital Requirements: One of the primary aims of Basel III is to bolster the quality and quantity of the capital banks must hold. By enforcing stricter capital adequacy standards, it ensures that banks are better equipped to absorb shocks arising from financial and economic distress.

2) Improving Risk Management and Governance: Basel III introduces more rigorous risk management requirements for liquidity, leverage, and funding. This compels banks to have robust governance structures in place and ensures that they assess risks in a better manner.

3) Promoting Stability in the Banking System: By introducing countercyclical capital buffers and provisioning norms, it aims to reduce the procyclicality in the banking system. Whereas economic upswings can lead to excessive lending and downturns to sharp contractions.

4) Protecting the Economy from Systemic Risks: It identifies systemically important banks and mandates them to maintain higher capital reserves. This minimises the risk of major banks collapsing and thereby protects the broader economy.

5) Enhancing Transparency and Disclosures: With Basel III, banks are required to adopt more transparent disclosure practices, which fosters market discipline and allows stakeholders to make informed decisions.

Stay ahead in finance - Register now in our Introduction to Basel IV Training.

Impact and Implications for Banks Because of Basel III

The introduction of Basel III regulations profoundly impacted banks globally, altering their operational landscape significantly. Here's an exploration of the effects and implications for banks:

a) Capital Allocation and Enhancement: Banks had to maintain higher quality capital, leading many to raise fresh capital or retain earnings to meet the stipulated requirements. To manage risk-weighted assets more effectively, some banks reconsidered their exposure to riskier loans or assets. This approach potentially limited financing to sectors perceived as high risk.

b) Operational Cost Increase: The additional regulatory requirements called for significant investments in data management, risk modelling, and reporting infrastructure. These changes, along with enhanced compliance functions, led to higher operational costs for banks.

c) Liquidity Management: To meet the Liquidity Coverage Ratio, banks increased their holdings of government and other qualifying securities. This shift affected the return on assets, as these securities generally offer lower yields. The Net Stable Funding Ratio encouraged banks to shift towards more stable, long-term funding sources, potentially increasing their cost of funding.

d) Lending Rate and Business Model Adjustments: Some banks increased lending rates to compensate for higher capital and liquidity costs. Business models evolved, with some banks shifting from traditional lending to fee-based services or other non-interest income streams.

e) Risk Management and Governance: Enhanced focus on risk management led to the strengthening of internal risk models, governance frameworks, and risk culture. More holistic stress-testing and scenario analysis became standard practice.

Securing Data in Compliance with Basel III

Data masking protects sensitive business and personal information. This reduces the risk of non-compliance with Basel III. Banks can share masked data across departments, with third parties, and through cloud providers without increasing risk. This approach ensures compliance with Basel III and reduces the risk of a data breach.

Basel III to “Basel IV”: What changed?

In December last year, the Basel Committee on Banking Supervision (BCBS) introduced new recommendations for capital requirements. These new regulations are commonly referred to as "Basel IV" in the banking sector.

These new regulations include reforms in the standardised approach for credit risk and the Internal Ratings-Based (IRB) approach. They also address the quantification of Credit Valuation Adjustment (CVA) risk and updates to operational risk approaches.

Additionally, there are enhancements to the leverage ratio framework and the finalisation of the output floor. Deloitte has created a placemat that highlights and elaborates on the key changes from Basel III to “Basel IV.”

Conclusion

We hope you enjoyed reading this blog and understood What is Basel III. It serves as a robust regulatory framework. It strengthens the global banking sector's resilience against financial shocks. By enhancing capital requirements, risk management, and transparency, it seeks to foster a more stable, trustworthy, and sustainable financial ecosystem for the benefit of economies worldwide.

Explore the Introduction to Basel III Course and enhance your knowledge to succeed in the evolving financial world!

Frequently Asked Questions

a) Pillar 1: Minimum Capital Requirements - Ensures banks hold sufficient capital.

b) Pillar 2: Supervisory Review - Enhances oversight and risk management.

c) Pillar 3: Market Discipline - Promotes transparency through public disclosures

Basel III builds on Basel I and II by increasing minimum capital requirements, introducing liquidity ratios (LCR and NSFR), and enhancing risk coverage. Unlike its predecessors, Basel III focuses on strengthening the banking sector's ability to withstand financial stress and improve risk management practices.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Compliance Training, including the Introduction To Basel III, Introduction To Basel IV Training and PCI DSS Implementer Course. These courses cater to different skill levels, providing comprehensive insights into Compliance Framework.

Our ISO & Compliance Blogs cover a range of topics related to Basel III, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Compliance skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 28th Nov 2024

Thu 6th Feb 2025

Thu 3rd Apr 2025

Thu 5th Jun 2025

Thu 7th Aug 2025

Thu 2nd Oct 2025

Thu 4th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please