We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Have you ever wondered how to pay for your coffee using your smartphone, invest in stocks with a few clicks, or borrow money from a peer-to-peer platform? These are all examples of Fintech. It's a world where Finance meets innovative technology to ensure money moves faster than ever, loans are approved, or investments are managed from your pocket devices.

From transforming how we bank to reshaping industries with Blockchain and AI, fintech is revolutionising the way we handle money. This blog explores What is Fintech Company, delving into its importance, inner workings, types and more. So read on and digitise your financial future with ease!

Table of Content

1) What is Fintech

2) Importance of Fintech

3) How does Fintech Work?

4) Types of Fintech Companies

5) Fintech Trends

6) How Does Fintech Contribute to Financial Services?

7) What Skills are Required to Work in Fintech?

8) How do Fintech Companies Differ From Traditional Banks?

9) Is Coding Necessary to Work in the Fintech Industry?`

10) Conclusion

What is Fintech?

Financial Technology, or Fintech, is all about using technology to create, deliver, or improve financial products and services. It spans both the front-end and back-end of the financial industry, including the infrastructure and platforms that support it.

Fintech can be broadly categorised into two types:

1) Enabling Fintech: This includes technologies that support and enhance the existing financial system, such as:

a) Cloud Computing

b) Big Data

c) Artificial Intelligence

2) Disruptive Fintech: This involves technologies that challenge and compete with traditional financial institutions and intermediaries, such as:

a) Peer-to-peer lending

b) Crowdfunding

c) Robo-advisors

By understanding these categories, you can better grasp how Fintech Knowledge is transforming the financial landscape.

What is a Fintech Company?

A Fintech company is any business that provides financial services or applications that are significantly dependent on technology. Fintech firms frequently act as disruptors in the industry by harnessing technology to transform the way consumers engage with the financial sector. This typically involves:

1) Broadening access to financial services.

2) Reducing charges.

3) Offering quicker and more tailored assistance.

Importance of Fintech

Fintech is important because it can benefit consumers, businesses, and society. Some of the benefits of Fintech are:

a) Convenience:

Fintech can make financial services more accessible, convenient, and user-friendly. For example, it allows people to:

a) Make payments

b) Transfer money

c) Access financial information anytime and anywhere using their smartphones or other devices

b) Efficiency:

Fintech can reduce costs, time, and complexity of financial transactions and processes. For example, Fintech can:

a) Automate manual tasks

b) Eliminate intermediaries

c) Optimise operations

d) This results in faster, cheaper, and more reliable services

c) Inclusion:

Fintech helps in expanding the reach and availability of financial services to underserved or unbanked populations. For instance, Fintech can provide alternative or customised solutions for people who lack access to traditional financial institutions, such as:

a) Credit scoring

b) Microfinance

c) Mobile banking

d) Innovation:

Fintech can foster innovation and competition in the financial sector, creating new products, services, and markets. For example, Fintech can enable new forms of value creation, exchange, and distribution, such as:

a) Crowdfunding

b) Cryptocurrencies

c) Robo-advisors

Find top FinOps Interview Questions and Answers to ensure you're ready for your next interview!

How Does Fintech Work?

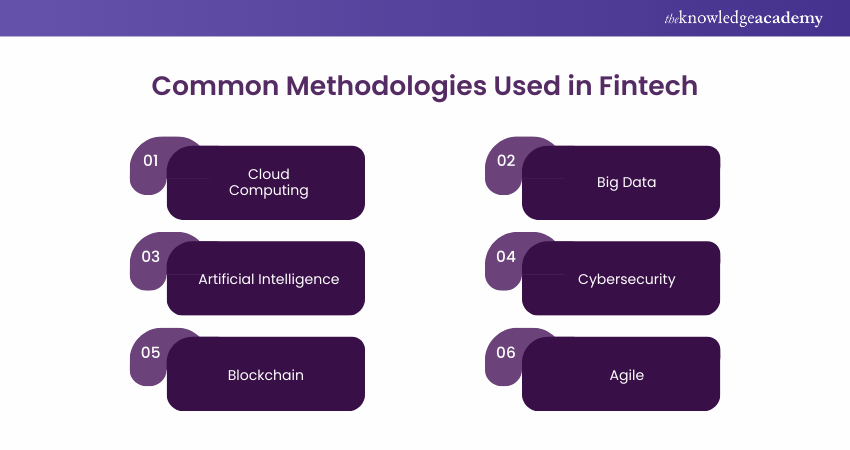

Fintech works by applying various technologies and methodologies to different domains and functions of the financial industry. Among these innovations, Neobanks and Fintech are particularly transforming the way financial services are delivered. Some of the common technologies and methodologies used in Fintech are:

Cloud Computing

Cloud Computing involves providing the following computing resources through the internet:

a) Servers

b) Storage

c) Databases

d) Networking

e) Software

f) Analytics and intelligence

Big Data

Big Data is the collection, processing, analysis, and visualisation of large and complex datasets generated from various sources, such as

a) Social Media

b) Transactions

c) Sensors

d) Devices

Big Data enables Fintech companies to gain insights and patterns from the data, as well as to make data-driven decisions and predictions.

Artificial Intelligence

Artificial Intelligence mimics human intelligence and skills, including learning, reasoning, problem-solving, and decision-making, through machines and systems. It allows Fintech firms to automate and refine tasks and processes like:

a) Fraud Analytics

b) Risk Assessment

c) Customer Support

d) Portfolio Management

Cyber Security

Cyber Security is the protection of information systems, devices, networks, and data from unauthorised access, use, modification, or damage. Cyber Security enables Fintech companies to safeguard their assets and customers from cyberattacks, such as:

a) Phishing

b) Malware

c) Ransomware

d) Denial of service

Blockchain

a) Represents a decentralised ledger technology

b) Securely, transparently, and unalterably records and confirms transactions and data.

c) Blockchain enables Fintech companies to create and exchange digital assets and contracts, such as:

a) Cryptocurrencies

b) Tokens

c) Smart contracts

d) Eliminates the need for intermediaries or central authorities.

Agile

a) Emphasises collaboration, flexibility, and customer feedback.

b) Focuses on the development and delivery of products and services.

c) Agile enables Fintech companies to:

a) Adapt and respond quickly to customer needs and market expectations

b) Deliver value and quality in a timely and efficient manner

Elevate your financial expertise: Join our Financial Management Course now!

Types of Fintech Companies

Fintech companies are the entities that use technology to provide financial products and services. Fintech companies can be classified into different types based on the domain and function they operate in. Some of the common types of Fintech companies are:

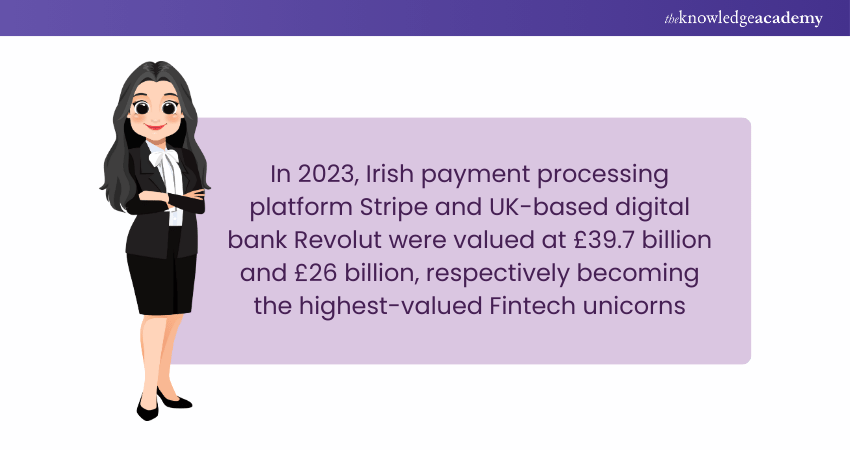

a) Payments:

Payments Fintech companies provide solutions for transferring, receiving, or processing money, such as:

a) Digital wallets

b) Payment gateways

c) Remittance services

Prominent examples of payment Fintech companies include PayPal, Stripe, and TransferWise.

b) Lending:

Lending Fintech companies provide solutions for borrowing or lending money, such as:

a) Peer-to-peer platforms

b) Online marketplaces

c) Alternative credit scoring

Examples of lending Fintech companies are:

a) LendingClub

b) Kabbage

c) ZestFinance

c) Investing:

Investing Fintech companies provide solutions for investing or managing money, such as robo-advisors, online brokers, or crowdfunding platforms. Examples of investing Fintech companies are:

a) Wealthfront

b) Robinhood

c) Kickstarter

d) Insurance:

Insurance Fintech companies provide solutions for insuring or managing risk, such as online platforms, microinsurance, or telematics. Examples of insurance Fintech companies are:

a) Lemonade

b) Oscar

c) Metromile

e) Accounting:

Accounting Fintech companies provide solutions for accounting or bookkeeping, such as online software, invoicing, or payroll. Examples of accounting Fintech companies are:

a) QuickBooks

b) FreshBooks

c) Xero

Fintech Trends

Fintech is a dynamic and evolving field constantly influenced by new technologies, regulations, consumer preferences, and market conditions. Some of the current trends in Fintech are:

Digital Wallets

Digital wallets are applications that store and manage the digital credentials and assets of the users, such as:

a) Bank accounts

b) Credit cards

c) Debit cards

d) Loyalty cards

e) Coupons

f) Tickets

g) Cryptocurrencies

Digital wallets are becoming popular and widespread, especially in developing and emerging markets, providing financial inclusion and convenience to the unbanked and underbanked populations. Examples of digital wallets are Apple Pay, Google Pay, Samsung Pay, and Alipay.

Embedded Finance

Embedded Finance is integrating and delivering financial products and services within the context and experience of non-financial platforms and ecosystems, such as e-commerce, Social Media, Transportation, and Healthcare. Embedded finance enables users to access and use financial services seamlessly and conveniently without leaving the platform or ecosystem they are engaged with.

Embedded Finance also enables non-financial platforms and ecosystems to enhance their value proposition and customer loyalty and generate new revenue streams and opportunities.

Examples of embedded Finance are:

1) Amazon Pay

2) Uber Money

3) Facebook Pay

4) Shopify Payments

Blockchain in Fintech

Blockchain in Fintech is the application and adoption of Blockchain technology in the Fintech industry to create and exchange digital assets and contracts, such as cryptocurrencies, tokens, and smart contracts. Blockchain also helps to improve and transform various aspects of the financial sector, such as payments, investing, lending, insurance, and banking.

Blockchain in Fintech offers many advantages over the traditional financial system and intermediaries, such as:

a) Security

b) Transparency

c) Immutability

d) Decentralisation

e) Efficiency

Blockchain in Fintech also enables the creation and emergence of innovative and new financial products and services, such as:

a) Decentralised Finance (DeFi)

b) Non-Fungible Tokens (NFTs)

c) Central Bank Digital Currencies (CBDCs)

Examples of Blockchain in Fintech are:

a) Bitcoin

b) Ethereum

c) Ripple

d) Libra

Transform your financial career with top-tier Finance Training – Join now!

How Does Fintech Contribute to Financial Services?

Fintech contributes to the financial services sector by offering new and improved solutions that complement or compete with traditional financial institutions, such as Insurers, Banks, or Asset Managers. Fintech can contribute to the financial services sector by:

a) Enhancing Customer Experience (CX):

Fintech can offer customer-centric, convenient, and personalised services that meet the needs and expectations of the modern consumer. Fintech can also improve customer satisfaction, retention, and loyalty by providing value-added features like rewards, gamification, or social interaction.

b) Increasing Operational Efficiency:

Fintech can reduce financial services' operational costs, risks, and errors by automating, streamlining, or optimising processes, such as:

a) Data collection

b) Data verification

c) Data analysis

d) Data reporting

Fintech can also increase financial services' speed, accuracy, and reliability by using advanced technologies, such as AI, Cloud, or Blockchain.

c) Expanding Market Reach:

Fintech can extend the market potential and penetration of financial services by reaching new or underserved segments, such as:

a) Millennials

b) Women

c) Rural populations

Fintech can create new or niche markets by offering innovative or customised solutions, such as Microfinance, robo-advisory, or peer-to-peer lending.

Unlock your financial future: Join our cutting-edge Fintech Course today!

What Skills are Required to Work in Fintech?

Working in Fintech requires a blend of technical, analytical, and soft skills. Key skills include:

1) Familiarity with Blockchain, Cyber Security, and Data Analysis

2) Financial knowledge

3) Experience in data analysis tools and statistical software

4) Ability to detect issues and create innovative solutions

5) Customer-centric mindset

How do Fintech Companies Differ From Traditional Banks?

Fintech Innovations have enabled firms to leverage cutting-edge technology to deliver financial services, focusing on specific areas such as payments, lending, or investment platforms. In contrast, traditional banks provide a wider range of services like loans, checking and savings accounts, and mortgages, highlighting the difference between the two sectors.

Is Coding Necessary to Work in the Fintech Industry?

A career in Fintech requires coding, but it's not the only skill needed. While coding is essential for technical roles, non-technical roles like business development or marketing may not require coding expertise.

Prepare for your next job with the best Fintech Interview Questions. Get insights to boost your confidence and land your dream role in the fintech industry!

Conclusion

In conclusion, Fintech is a game-changer that is reshaping the financial landscape. Blending technology with Finance has unlocked faster, smarter, and more accessible solutions for individuals and businesses. As Fintech innovation continues, it promises to drive greater efficiency and possibilities, making it the most exciting force to revolutionize how we manage and move money.

Learn to implement cutting-edge fintech solutions in our comprehensive Digital Transformation in Financial Services Course - Sign up now!

Frequently Asked Questions

Is PayPal Considered a Fintech Company?

Yes, PayPal is a Fintech company that provides customers with services for sending and receiving money online without needing credit cards or bank accounts.

Can Fintech Replace Traditional Banks in the Future?

Fintech completely replacing traditional banks is unlikely anytime soon due to banks' essential role in regulatory compliance, trust, and a broader range of financial services.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Fintech Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Finance Courses, including the Financial Management Course and the Financial Modelling Course . These courses cater to different skill levels, providing comprehensive insights into How to Improve Cash Flow.

Our Accounting and Finance Blogs cover a range of topics related to Fintech, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting & Finance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

FinTech Course

FinTech Course

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 15th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please