We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

If you are wondering - What is Forensic Accounting? Well, Forensic Accounting is a meticulous examination of financial records, transactions, and data to uncover hidden truths. Forensic accounting meaning is nowhere close to traditional accounting bookkeeping. It combines accounting, investigation, and legal expertise to examine the details of financial transactions.

According to Allied Market Research, the Forensic Accounting market size is expected to reach £79.27 billion GBP by 2031. In this blog, we will learn What is Forensic Accounting, including the Forensic Accounting process, its importance and applications. Read more to find out!

Table of Contents

1) Understanding Forensic Accounting in detail

2) Importance of Forensic Accounting

3) Applications of Forensic Accounting

4) The Forensic Accounting Process

a) Investigation Planning

b) Data Collection and Analysis

c) Reporting and Communication

5) Conclusion

Understanding Forensic Accounting in detail

Forensic Accounting is used to detect financial fraud, prevent future fraudulent activities, resolve financial disputes, and provide litigation support. By rigorously analysing financial data and transactions, Forensic Accountants play a vital role in safeguarding the integrity of financial systems and maintaining ethical standards within businesses.

Forensic Accounting experts possess a distinctive skillset that amalgamates accounting proficiency with investigative prowess. A strong grasp of financial principles, legal regulations, analytical thinking, and attention to detail are prerequisites for these professionals.

Ordinary accounting primarily focuses on the accurate recording and reporting of financial transactions for decision-making purposes. Forensic Accounting has an investigative focus, aiming to detect financial irregularities, fraud, and discrepancies.

Importance of Forensic Accounting

Safeguarding ourselves from financial and other accounting-related frauds has become challenging in the current digital world. The risks of financial fraud and misrepresentation are threatening the stability and reputation of businesses across industries.

This is what makes Forensic Accounting very important in the recent times. Accounting is especially focused on uncovering financial irregularities, detecting fraud, and ensuring transparency among all Types of Accounting-related activities. Some of the key importance of Forensic Accounting are as follows:

a) Maintaining investor and public confidence: Forensic Accounting ensures transparency by uncovering financial irregularities, restoring faith in businesses and safeguarding their reputation.

b) Navigating regulatory complexity: Businesses often deal with a variety of regulations. Forensic Accountants navigate this complexity, ensuring compliance and ethical conduct, minimising legal risks, and maintaining the ethical integrity of businesses.

c) Unmasking complex financial transactions: Forensic Accountants excel at simplifying complex financial schemes, tracing hidden trails, and exposing fraudulent activities, ensuring financial transparency.

d) Litigation support and dispute resolution: With the increasing incidence of financial disputes, Forensic Accountants provide indispensable support. By presenting complex financial information in legal proceedings, they empower fair and informed decisions, facilitating equitable resolutions.

e) Preventing future fraud occurrences: Forensic Accounting is not only about addressing current issues; it's also about preventing future malfeasance. By identifying vulnerabilities and suggesting deterrent measures, Forensic Accountants contribute to a secure financial ecosystem.

Register for our Accounting Masterclass, and unlock your potential with skilled accounting!

Applications of Forensic Accounting

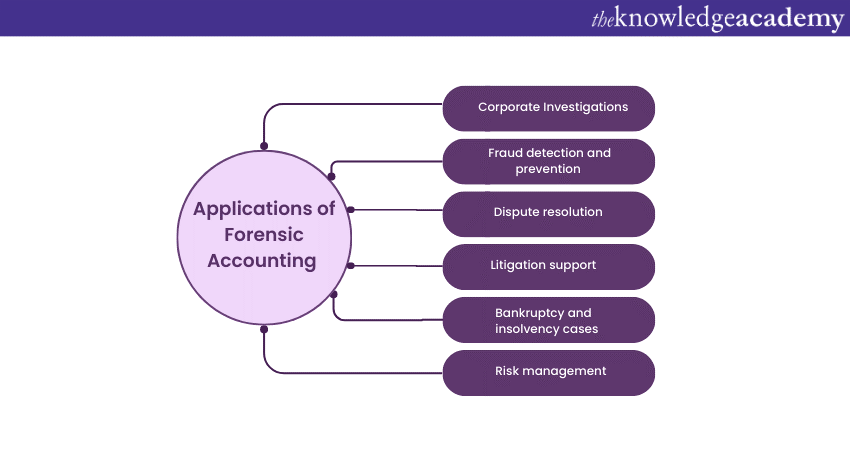

Forensic Accounting is focused on uncovering financial discrepancies and fraud. It has a variety of applications across a range of business landscapes. As a specialised branch of accounting, its role extends beyond routine number-crunching to serve as a powerful tool for fraud detection, dispute resolution, litigation support, and risk management. Some of the crucial applications of Forensic Accounting are as follows:

Corporate investigations

Accounting plays a pivotal role in corporate investigations, whether they involve allegations of financial mismanagement, embezzlement, or regulatory non-compliance. Forensic Accountants gather evidence, analyse financial transactions, and reconstruct financial data to provide a comprehensive understanding of the situation.

These findings contribute to informed decision-making, which enables businesses to determine their future actions based on the evidence presented.

Fraud detection and prevention

Perhaps one of the most crucial applications of accounting is in detecting and preventing financial fraud. Forensic Accountants carefully analyse financial records, transactions, and patterns to uncover irregularities that point to fraudulent activities.

By identifying uncertainties and anomalies, they provide businesses with the insights needed to take immediate corrective actions and prevent further fraud occurrences. This application is especially vital in an era where technology has both enabled and fuelled fraudulent activities.

Dispute resolution

Business disputes, like financial transactions, contractual agreements, or business separations, often require an understanding of financial confusion. Forensic Accountants act as neutral parties, carefully examining financial records to provide an unbiased assessment of the situation. It facilitates equitable resolutions by shedding light on financial aspects that may not be apparent to the parties involved.

Litigation support

Forensic Accounting plays a crucial role in legal proceedings by providing litigation support. Forensic Accountants' expertise allows them to present complex financial information in a comprehensible manner to judges and juries. Their involvement enhances the credibility of financial evidence presented in court, aiding in the decision-making process.

Whether it is calculating economic damages, evaluating business valuations, or explaining financial intricacies, Forensic Accountants ensure that financial aspects are accurately portrayed during litigation processes.

Bankruptcy and insolvency cases

In cases of bankruptcy or insolvency, accounting provides useful insights into the financial condition of a business. It assesses the financial records, scrutinises transactions leading up to the bankruptcy, and identifies potential instances of fraudulent conveyance or preferential transfers.

The accounting analysis aids stakeholders, creditors, and the court in understanding the financial circumstances surrounding the bankruptcy and making informed decisions.

Risk management

Forensic accounting contributes to risk management by identifying vulnerabilities within financial systems and processes. It assesses the effectiveness of internal controls, scrutinises financial statements, and offers recommendations to mitigate potential risks. By proactively addressing weaknesses, businesses can enhance their resilience and safeguard against future economic challenges.

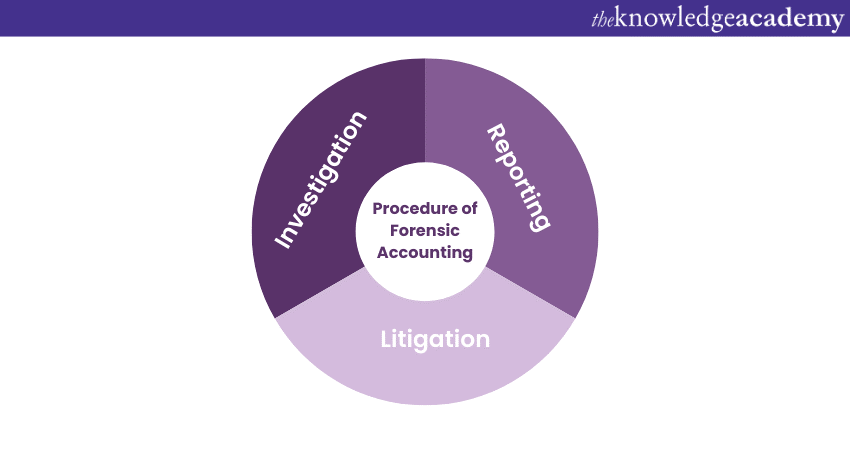

The Forensic Accounting process

The Forensic Accounting process is a meticulously orchestrated series of steps designed to uncover hidden financial truths, detect fraud, and provide an unbiased assessment of financial situations. In this article, we dive into the stages that comprise the accounting process and explore how each step contributes to unravelling complex financial mysteries.

Investigation planning

The journey of Forensic Accounting begins with careful planning. This phase involves understanding the context of the investigation, defining the scope, and identifying the key objectives. It's crucial to determine the potential areas of concern, the specific financial records to examine, and the methodologies to be employed. Clear communication with stakeholders is vital at this stage to ensure alignment on expectations and outcomes.

Data collection and analysis

Once the investigation plan is in place, Forensic Accountants move on to collecting the necessary data. This involves gathering financial records, transaction data, bank statements, invoices, and any other relevant documents. In the digital age, electronic data plays a significant role, and Forensic Accountants use specialized software to extract, organise, and analyse electronic records. The analysis phase is marked by meticulous scrutiny of the collected data. Forensic Accountants search for patterns, anomalies, and inconsistencies that might point to financial irregularities.

Quantifying economic damages

In disputes or litigation cases, quantifying economic damages becomes a critical task. Forensic Accountants apply their expertise to calculate financial losses, business valuations, and other relevant monetary aspects. This involves analysing financial data, market trends, and economic conditions to provide an accurate assessment of the financial impact.

Register for our Quantitative Finance Training, and upskill your financial knowledge!

Reporting and communication

The accounting report outlines the methodologies employed, the collection of evidence, running analysis, and drawing conclusions. It is essential for the report to be clear, objective, and free of bias, as it may be presented as evidence in legal proceedings. The report should be structured in a manner that is easily understandable to stakeholders who may not possess a financial background.

Ethical considerations

Throughout the process, adherence to ethical standards is paramount. Forensic Accountants must maintain objectivity, independence, and confidentiality. Their findings and conclusions should be based on facts and evidence, devoid of personal bias. Additionally, they must ensure that the methods employed align with legal and professional standards.

Conclusion

Forensic Accounting is a very responsible role, which helps keep businesses honest and fair and hold anything illegal accountable. We hope this blog will help you learn What is Forensic Accounting? Its application, importance and accounting processes.

Register for our Accounting & Finance Training to unlock new dimensions of your business and career.

Upcoming Business Skills Resources Batches & Dates

Date

Accounting Course

Accounting Course

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please