We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Have you ever wondered how investors determine the true value of a company in the vast world of stock markets? What is Market Capitalisation, and why does it matter so much when evaluating investment opportunities? This simple yet powerful metric provides a snapshot of a company's total worth, helping investors make informed decisions.

As you delve deeper into the world of finance, you’ll quickly realise that Market Capitalisation is more than a number. It’s a tool that helps investors assess risk, forecast trends, and determine where to allocate their capital. So, What is Market Capitalisation truly telling you about a company’s position in the market? Let’s explore this essential concept in detail and uncover how it shapes the investment landscape.

Table of Contents

1) What is Market Capitalisation?

2) Calculating Market Capitalisation

3) Importance of Market Capitalisation

4) Types of Companies Based on Market Capitalisation

5) How to Consider Market Cap When Investing?

6) What is a Market Capitalisation-Weighted Index?

7) How Do Stock Splits Affect Market Cap?

8) Conclusion

What is Market Capitalisation?

Market Capitalisation represents a company's total value in the stock market, calculated by multiplying its current share price by the total number of outstanding shares. For example, a $30 stock with one million shares equals a $30 million market cap.

While the share count typically stays stable, changes occur with new stock issuances, employee options, or buybacks. However, stock prices fluctuate constantly during trading, driving market cap changes. Investors use this metric, along with understanding various Capital Market Instruments, to categorize companies into groups like large-cap, mid-cap, and small-cap, helping them assess investment opportunities and risks.

Calculating Market Capitalisation

Calculating Market Capitalisation involves a straightforward formula: multiply the current Market price of a company's stock by the total number of its outstanding shares.

The Market Capitalisation formula is:

Market Capitalisation = Current stock price × Total number of outstanding shares

For example, if a company has 1 million shares outstanding and the current stock price is £39.87, its Market cap would be £39.87 million. This calculation provides a snapshot of the company's total Market value, reflecting how much it would cost to buy all its shares at the current Market price. Market cap is a dynamic figure, fluctuating with changes in the stock price and the number of shares issued. It's a fundamental measure investors use to assess a company's size and Market standing.

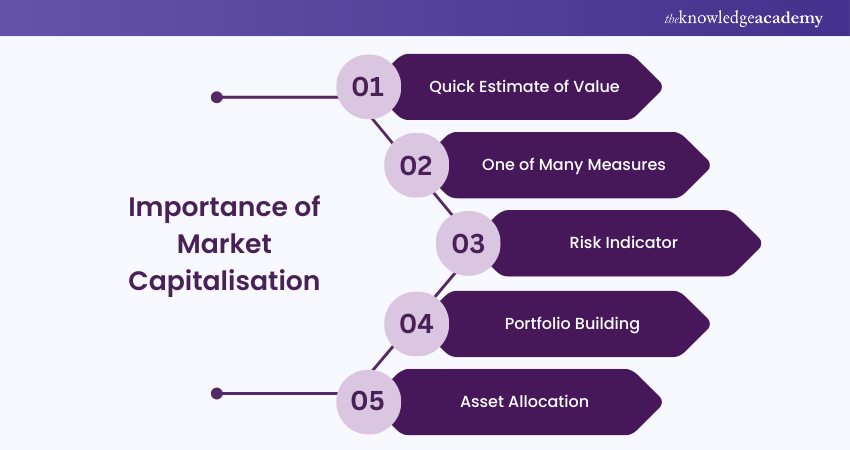

Importance of Market Capitalisation

Here are some points which will show you the importance of Market Capitalisation:

1) Quick Estimate of Value:

Market cap offers a simple way to estimate a company's value in monetary terms.

2) One of Many Measures:

It’s just one way of measuring company size, similar to how you might measure a country by its economy, population, or land area.

3) Risk Indicator:

Stocks of bigger companies are typically more stable, while smaller companies may be more volatile but could experience faster growth.

4) Portfolio Building:

Market cap helps determine how a stock fits into your asset allocation based on your risk tolerance.

5) Asset Allocation:

It can assist in making decisions on how much to invest in different-sized companies within your portfolio for balanced risk.

Types of Companies Based on Market Capitalisation

Here are some major types of companies that are based on Market Capitalisation:

1) Large-Cap (£10B - £200B)

These are the market giants – think of them as the established, well-known brands you encounter daily. They're like large, sturdy ships that can weather market storms better than smaller companies. They typically grow slowly but steadily and often share profits with investors through dividends. If you're looking for a safer investment, these companies are usually your best bet.

2) Mid-Cap (£2B - £10B)

These are the rising stars of the market. While not as stable as large companies, they often grow faster. Take Reddit's story: when it went public in March 2024, it was worth £9.84B, but by year-end, it had grown so much that it joined the large-cap club. These companies are like teenagers – still growing but with more stability than smaller firms.

3) Small-Cap (£300M - £2B)

Think of these as promising startups that have already shown some success. While they're riskier investments than larger companies, they might grow significantly if things go well. However, their stock prices tend to bounce up and down more dramatically. Many are young companies with fresh ideas, though some are older businesses that have shrunk over time.

4) Micro-Cap (£50M - £300M)

These are the smallest public companies, often selling penny stocks. Many are very young businesses working on cutting-edge ideas like new medicines or AI technology. They're the riskiest investment type – like betting on a racehorse that could either win big or not finish the race. Careful research is crucial before investing in these companies.

Explore Investment and Trading Training to enhance your financial knowledge today!

How to Consider Market Cap When Investing?

With a solid understanding of Market Capitalisation, here are some ways to use it in your investment research and portfolio construction.

1) Choose an Appropriate Asset Allocation

Successful investing begins with a well-considered plan. Whether you conduct your own research, use an online tool, or work with a financial advisor, it’s essential to develop a strategy that suits your needs and circumstances. Key factors such as risk tolerance, risk capacity, and time horizon should guide your decision-making process to create a portfolio that aligns with your goals.

2) Evaluate Diversification Strategies

In your portfolio's stock component, consider diversifying across large-cap, mid-cap, and small-cap companies. The performance of these categories can vary, and diversification helps to balance risk. At times, one market-cap segment may outperform others, so spreading your investments across different sizes can help reduce risk.

3) Consider Simplicity with ETFs and Mutual Funds

If you're building a portfolio yourself, selecting individual companies and ensuring a diversified mix of stocks can be time-consuming. Exchange-traded Funds (ETFs) and mutual funds can simplify this process. They allow you to achieve your target asset allocation, including the desired balance among market-cap segments. This approach eliminates the need to research hundreds of companies individually.

Enhance your financial understanding with our Accounting and Finance Policies Course – sign up now!

What is a Market Capitalisation-Weighted Index?

The S&P 500 is one of many stock indexes that are weighted by Market Capitalisation. This means that stocks with larger Market Capitalisations make up a larger portion of the index.

How Do Stock Splits Affect Market Cap?

A stock split increases the number of shares while proportionally reducing each share’s price, leaving the total Market Capitalisation unchanged. It makes shares more affordable without altering the company’s value.

Advance your financial knowledge with our professional Accounting Courses – Join today!

Conclusion

Understanding What is Market Capitalisation is crucial for investors. It helps gauge a company's size, stability, and growth potential, enabling informed investment decisions. Recognizing the difference between Money Market and Capital Market is key in determining where to invest based on your financial goals and risk tolerance. So, next time you invest, remember to consider market cap—it's your compass in the world of stocks.]

Enhance your investment strategies with our Capital Market Course – sign up today!

Frequently Asked Questions

What is the Difference Between Market Value and Market Capitalisation?

Market value is the term that refers to the current price at which a company or asset can be bought or sold. Market Capitalisation, on the other hand, is the total value of a company, calculated by multiplying its share price by the total number of outstanding shares.

What Company has the Largest Market Cap?

Apple is the largest company in the world, with a market cap of £3.59 trillion. Its dominant position in technology and innovation contributes to its impressive market value.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting Courses, including Capital Market Course, Accounting Course, Accounting and Finance Policies Course and Inventory Accounting And Costing Course. These courses cater to different skill levels, providing comprehensive insights into Inventory Accountant Job Description.

Our Accounting and Finance Blogs cover a range of topics related to Capital Market, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Finance skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Capital Market Course

Capital Market Course

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please