We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

If you have a small-scale or large-scale business and want to learn how to practice financial management, you need to learn What is Xero. It has an innovative design and user-friendly interface, which has revolutionised how businesses handle their accounting needs. So, whether you are a new entrepreneur of a growing business or an accountant looking to enhance your client's financial processes, learning about Xero can help you in the long run. In this blog, you will learn in detail about 'What is Xero?', its key features, benefits, and how it works for you to use it for your business.

Table of Contents

1) What is Xero Accounting Software?

2) How Does Xero Work?

3) Key Features of Xero

4) Benefits of Using Xero

5) Who Can Use XERO?

6) Tips to Use Xero Software

7) Alternatives for Xero Software

8) Xero Pricing

9) Is Xero Linked to your Bank Account?

10) How Safe is Xero?

11) Conclusion

What is Xero Accounting Software?

Xero Accounting Software is an innovative Cloud-based Software for small to medium-sized businesses and accountants. It offers several features for streamlining various financial processes. These include easy invoicing, automatic bank and credit card account feeds, Payroll processing, expense tracking, and detailed financial reporting.

Moreover, its intuitive user interface (UI) and real-time data access promote efficient financial decision-making. The software can easily integrate with numerous third-party apps. This boosts its functionality, making it a versatile tool for business financial tasks.

How Does Xero Work?

Xero works to manage a wide range of business finances. Here are some key points on its key working principles:

1) Automates Routine Tasks: Xero can easily automate plenty of routine tasks, such as importing bank transactions, categorising them, and reconciling accounts. This pursuit reduces manual effort and elevates efficiency.

2) Invoicing and Expense Tracking: You can easily create and send invoices, track expenses, manage payroll, and generate detailed financial reports. These features help make financial management more streamlined and efficient.

3) Real-Time Financial Overview: Its dashboard offers a real-time overview of financial health. These include Cash Flow, outstanding invoices, and upcoming bills.

4) Universal Access: Being a Cloud-based solution, Xero allows universal access for its users and enables real-time collaboration with team members and accountants. This makes sure everyone remains on the same page, regardless of their location.

5) Third-Party Integrations: Xero can integrate easily with various third-party applications, which further extends its capabilities to suit different business needs. This includes tools for Inventory Management and Customer Relationship Management (CRM).

Interested in learning about Payroll- Kickstart our Introduction to Payroll Course now!

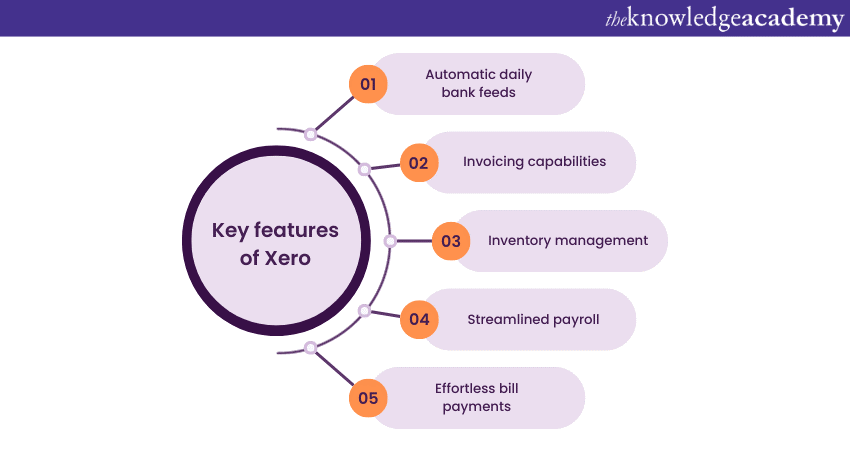

Key Features of Xero

Xero offers a range of powerful tools that simplify financial management for businesses. To learn more about it, here are some of the key features of Xero:

1) Automatic Daily Bank Feeds

Automatic daily bank feeds in Xero optimise financial tracking by automatically importing transactions from bank and credit card accounts into the software each day. This feature eliminates the entry of manual data to ensure that financial records are consistently up-to-date and accurate. In addition, it simplifies the reconciliation process by allowing users to quickly match transactions with their accounting records.

2) Invoicing Capabilities

Xero’s invoicing capabilities feature allows the swift addition of items, services, and terms and includes automatic reminders and online payment facilitation options. The invoicing system also tracks invoice status, helping businesses monitor payments and manage cash flow effectively. This results in streamlining the billing and payment collection process.

3) Inventory Management

Xero's Inventory Management feature helps businesses track and manage stock levels quickly. Users can easily monitor Inventory movement, update item details, and view the impact on financials.

This integration into the accounting workflow allows the users to perform accurate cost tracking, better order management, and timely reordering. Furthermore, the system's insights into Inventory trends aid in making informed purchasing and sales decisions, enhancing overall efficiency.

Get know the alternate accounting softwares available, refer to our bog on Xero Alternatives.

4) Streamlined Payroll

Xero's streamlined payroll system simplifies employee payment processes. It allows businesses to efficiently manage pay runs, calculate taxes, and handle deductions. The feature can easily integrate payroll with accounting to ensure precise financial records and compliance with tax laws.

Additionally, employees can access pay slips and submit timesheets online in a timely manner to enhance transparency and efficiency. This automation further reduces manual effort and potential errors, making Payroll Management more effective and reliable.

5) Effortless Bill Payments

Xero simplifies bill payments by allowing users to schedule and make payments efficiently directly through the platform. It also enables tracking bills due, organising expenses, and prioritising payments. This feature helps maintain a clear view of cash flow and upcoming financial commitments.

6) Seamless Integrations

Xero's seamless integration capabilities improve its functionality by connecting with a wide variety of third-party applications. These include Customer Relationship Management (CRM), e-commerce platforms, time tracking, and Inventory Management.

This feature allows businesses to create a customised accounting ecosystem tailored to their specific needs. Furthermore, enabling automatic data syncing across multiple platforms reduces manual input, minimises errors, and provides a cohesive workflow.

Gear up to perform Credit assessments- Sign up now for our Introduction to Credit Control Course now!

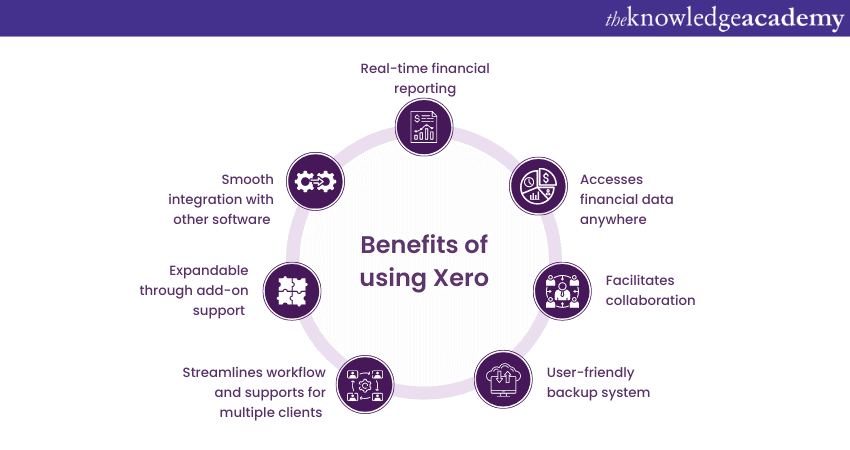

Benefits of Using Xero

Using Xero can transform the way on how you manage your business finances by offering a wide range of practical advantages. If you plan to utilise Xero for your business, you should also be familiar with its benefits. Here are some of the key benefits of Xero:

1) Real-time Financial Reporting

Real-time financial reporting in Xero is a significant benefit for the users that offers instant access to the business financial data. This feature also provides up-to-date insights into financial performance. These include profit and loss, balance sheets, and cash flow statements.

2) Access Financial Data Anywhere

Accessing financial data anywhere is a key advantage of using Xero. It is a Cloud-based Accounting Solution that enables you to view and manage financial information from any location with an internet connection. This accessibility is particularly useful for business owners and accountants who wants to stay updated on financial matters wherever they are.

3) Facilitates Collaboration

Xero greatly promotes collaboration in Financial Management. Its Cloud-based nature allows multiple users to access and work on the same financial data in real-time, regardless of location. This feature particularly benefits teams, such as business owners, accountants, and financial advisors. It enables them to collaborate efficiently on financial tasks like bookkeeping, budgeting, and reporting.

Unlock the full potential of Xero Accounting Software by refering to our blog on Xero Tips and Tricks.

4) User-friendly Backup System

Xero's user-friendly backup system offers a robust solution for safeguarding financial data. The software automatically backs up all financial information stored in the Cloud. It also protects critical business data against loss due to hardware failure, accidental deletions, or other unforeseen events.

This automatic backup process occurs without user intervention, providing peace of mind and eliminating the need for manual backups. You can quickly restore data if needed, maintaining business continuity. The secure, Cloud-based storage also means that data is accessible from anywhere, adding convenience and reliability to managing financial records.

5) Streamlined Workflow and Support for Multiple Clients

Xero's streamlined workflow and support for multiple clients significantly enhance accountants' and bookkeepers' productivity. The platform is designed to handle various clients efficiently, allowing professionals to switch seamlessly between different financial data sets. This multi-client support is ideal for managing a diverse portfolio of businesses, each with unique accounting needs.

6) Expandability Through Add-on Support

Xero's expandability through add-on support is a key feature that enhances its versatility. The platform offers various add-ons and integrations with third-party applications, allowing businesses to tailor the software to their needs. These add-ons include Inventory Management, time tracking, Customer Relationship Management (CRM), and e-commerce.

7) Smooth Integration With Other Software

Xero's smooth integration with other software is a standout feature to enhance its functionality and user experience (UX). It can connect seamlessly with various third-party applications and systems, such as CRM tools, e-commerce platforms, and payment processors. This integration capability allows users to automate data syncing across various business functions. It also reduces the need for manual data entry and minimises errors.

Who Can Use XERO?

Xero, being a versatile Cloud-based Software caters to a diverse range of users. Here are some key points highlighting its features and benefits:

1) Small and Medium-Sized Businesses: Xero can help manage finances, including invoicing, expense tracking, and payroll processing. Its intuitive interface makes it easy for business owners, even those with limited accounting knowledge, to use.

2) Accountants and Bookkeepers: Xero allows accountants and bookkeepers to collaborate with clients in real-time. It facilitates financial reporting and ensures compliance with tax regulations.

3) Freelancers and Sole Traders: Xero enables freelancers and sole traders to keep track of their income and expenses, simplifying tax preparation and financial management.

Tips to Use Xero Software

Xero offers a broad range of features that can significantly enhance your accounting experience. Here are the top seven tips and tricks to help you navigate Xero like a pro:

1) Customised Roles: Creating customised roles in Xero enables collaboration with team members without giving all users access to sensitive information. This allows you to control access rights and privileges effectively.

2) Xero Login Shortcut: Streamline the sign-in process by saving the login URL with your email address included. This saves time by eliminating the need to manually enter your email each time you log in.

3) Split-Screen Functionality: Use the split-screen function to run multiple instances of Xero simultaneously. This allows for faster navigation and reference without switching between tabs.

4) Invoice Reminders: Set up automatic invoice reminders to ensure timely payments from customers. Xero can send reminders based on how far an invoice is past due, reducing the need for manual follow-ups.

5) Sync with Google Sheets: Export Xero reports and budgets to Google Sheets for easy sharing and collaboration. This feature is useful for team members who need to access and edit financial documents.

Keen on choosing the best accounting software for your business, refer to ou blog on Xero vs Quickbooks.

Alternatives for Xero Software

When exploring alternatives to Xero, businesses can consider several accounting software options that cater to varying needs and preferences. Here are some key points highlighting these alternatives:

1) QuickBooks Online: This popular choice offers robust features such as invoicing, expense tracking, and tax management, making it excellent choice for small to medium-sized businesses. Its user-friendly interface and comprehensive reporting tools ensure user-friendliness while providing deep insights into financial performance.

2) FreshBooks: Excelling in time tracking and client invoicing, FreshBooks is a favorite among freelancers and service-based businesses. Its intuitive design and mobile app integration allow users to manage their finances efficiently wherever they are.

3) Wave Accounting: For businesses seeking open-source solutions, Wave Accounting presents a free alternative with essential features like invoicing, receipt scanning, and expense tracking. While it lacks some advanced tools, Wave is an excellent option for startups or sole proprietors on a budget.

4) Sage Business Cloud Accounting: Larger organisations might prefer Sage Business Cloud Accounting, which offers scalable solutions and powerful tools for managing Inventory, taxes, and payroll. This software offers distinct features and pricing models. It allows businesses to select the option that best suits their operational needs and financial goals.

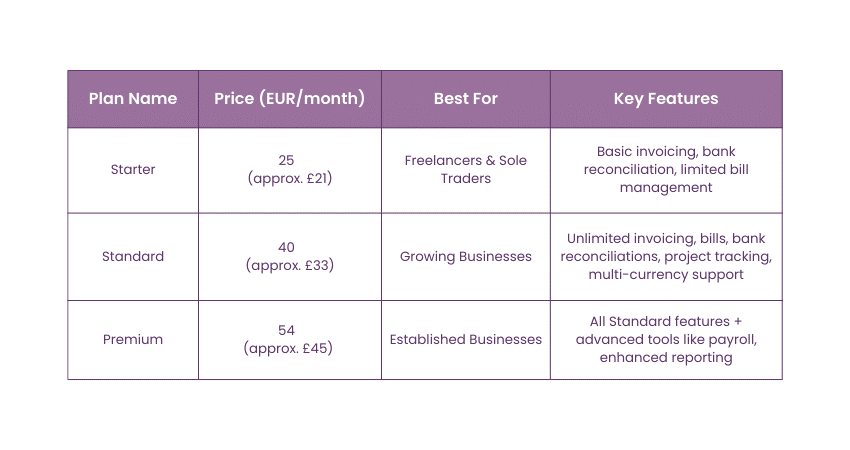

Xero Pricing

Xero offers flexible pricing plans tailored to businesses of various sizes and needs. Each plan provides a range of essential accounting tools, with increasing levels of features as you move up the tiers. Here’s an overview of Xero’s pricing options:

1) Starter Plan (€25/month): Ideal for freelancers and sole traders. Includes features like basic invoicing, bank reconciliation, and limited bill management. Suitable for smaller volumes of transactions.

2) Standard Plan (€40/month): Designed for growing businesses. Offers unlimited invoicing, bills, and bank reconciliations. Includes additional features like project tracking and multi-currency support.

3) Premium Plan (€54/month): Best for established businesses. Provides all Standard Plan features plus advanced tools like payroll and enhanced reporting capabilities for larger teams.

Is Xero Linked to your Bank Account?

Xero offers seamless integration with your bank account to enable automatic bank feeds for simplifying financial management. Here are the key points related to the Xero linkage:

1) Automatic Bank Feeds: Xero can be linked to your bank account. This allows for automatic bank feeds that streamline the finance management process.

2) Transaction Import: By connecting your bank account to Xero, transactions such as deposits, payments, and withdrawals can be automatically imported. This ensures your Xero account is updated with your latest financial activity.

3) Reduced Manual Data Entry: This integration helps reduce manual data entry and ensures that your financial records are updated in real-time.

4) Easy Reconciliation: You can also reconcile these transactions easily by matching them with your existing invoices or bills in Xero.

5) Secure and Encrypted: The process is secure and encrypted. This ensures that your financial data remains fully protected.

6) Wide Range of Supported Banks: Xero supports a wide range of banks and financial institutions. This allows most businesses to integrate their accounts seamlessly.

7) Time-Saving and Accurate: This feature saves time, reduces errors, and improves the accuracy of financial reporting. It provides you with a clearer, more accurate view of your cash flow.

How Safe is Xero?

Xero is designed with robust security measures to maximise your data protection. Here are the key points about its safety:

1) End-to-End Encryption: Xero uses end-to-end encryption to ensure that all information transmitted between your device and Xero's servers is safe and secure.

2) ISO/IEC 27001 Certification: Xero is certified under ISO/IEC 27001, an internationally recognised standard for information security management, which further assures users of its commitment to protecting data.

3) Two-Step Authentication (2FA): Xero offers two-step authentication to add an extra layer of security, preventing unauthorised account access.

4) Regular Security Audits: Xero regularly undergoes security audits and has a dedicated security team to monitor and address potential threats.

5) Regular Backups: Backups are taken regularly. This frequency ensures that your data can be recovered in the event of an incident or failure.

6) Compliance with Global Regulations: The platform complies with global data protection regulations, such as the GDPR. This ensures that your personal and financial information is handled securely and adhering to all the compliances.

Attain detailed knowledge on your financial plans' execution with our Financial Management Training- Join today!

Conclusion

We hope this blog helped you learn 'What is Xero.” Xero is a robust, Cloud-based accounting Software solution for small to medium-sized businesses. Its comprehensive features, including real-time financial reporting, seamless integrations, and a user-friendly interface, make Financial Management accessible and more efficient. Moreover, its adaptability to diverse business needs marks it as a critical tool for modern Financial Management.

Enhance your expertise in the implementation of softwares in accounting processes with Accounting Software Training!

Frequently Asked Questions

What Information Do I Need to Set Up Xero?

To set up Xero, you will need your business details (name, address, industry), tax information (VAT or GST registration number), and financial details (bank account information for linking). You may also be required to import your existing data, such as invoices, contacts, and transaction history.

Do You Need to Be an Accountant to Use Xero?

No, you don't need to be an accountant to use Xero. It's designed for business owners, bookkeepers, and managers to manage their finances. While accounting knowledge can be helpful, Xero's user-friendly interface and support tools make it accessible for anyone to manage their finances effectively.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting Software Training, including Introduction to Payroll Course, Introduction to Credit Control Course, and SWIFT Payments Operate Alliance Access and Entry Training. These courses cater to different skill levels, providing comprehensive insights into Inventory Accounting: Methods, Benefits, & How it Works.

Our Accounting and Finance Blogs cover a range of topics related to financial management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your accounting and finance skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Xero Introduction Training

Xero Introduction Training

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please