We may not have the course you’re looking for. If you enquire or give us a call on 01344203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Unlock the savvy spender’s playbook with Zero-based Budgeting (ZBB)—a method where every rupee counts, and every expense is planned. In this approach, you align your earnings with your expenditures so precisely that nothing is left to chance. ZBB is not just about keeping tabs on your money; it is about giving each rupee a purpose, whether it is boosting your savings, reducing debts, or indulging in life’s little luxuries. It is not about cutting corners; it is about spending smart.

The ultimate aim is to balance your budget so that your income minus your spending equals zero, ensuring every rupee works for you. In this blog, we discuss how adopting ZBB can lead to smarter financial decisions and create a more adaptable organisation ready to thrive in today’s business environment. Read on to learn more!

Table of Contents

1) What is Zero-based Budgeting?

2) Steps to create Zero-based Budget

3) Advantages of Zero-based Budgeting

4) Disadvantages of Zero-based Budgeting

5) Difference between Zero-based Budgeting and Traditional Budgeting

6) Conclusion

What is Zero-based Budgeting?

Zero-based Budgeting (ZBB) refers to the financial planning method where each new budget period starts from a "zero base." This means every expense must be justified and approved rather than simply adjusting previous budgets. All expenditures are analysed, and only those necessary for the company's operations and goals are approved. This approach ensures resources are allocated efficiently, promoting cost-effective decision-making and eliminating unnecessary expenses.

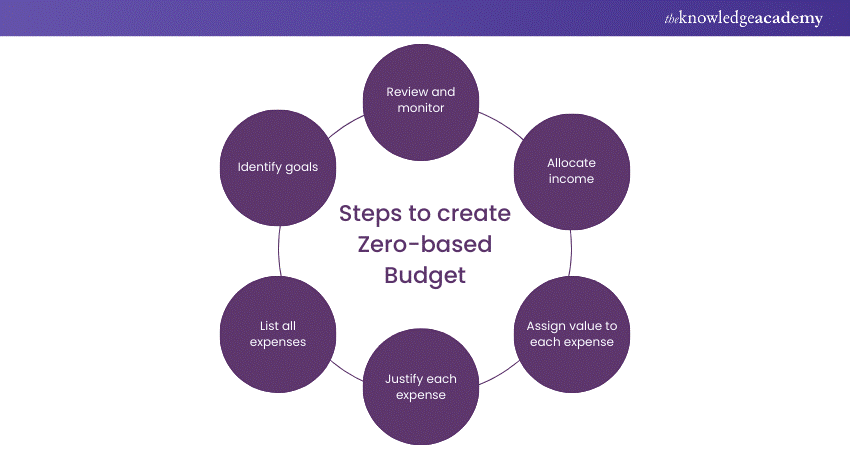

Steps to create Zero-based Budget

Creating a Zero-based Budget helps you manage your money better by making sure every expense is needed. Follow these steps to make a budget that matches your financial goals and controls your spending.

a) Identify goals: Set clear financial goals for the budget period. This helps you understand what you want to achieve and guides your budgeting decisions. Having goals keeps you focused and motivated.

b) List all expenses: Make a list of all your expected expenses, including both regular (fixed) and changing (variable) costs. This gives a complete view of your spending needs. Listing expenses ensures nothing is overlooked.

c) Justify each expense: Review each expense to ensure it is necessary and aligns with your financial goals. This helps eliminate unnecessary costs and justify expenses, keeping your budget efficient.

d) Assign value to each expense: Give each justified expense a specific cost that matches the expected amount you plan to spend. This ensures accuracy in your budget and helps prevent overspending.

e) Allocate income: Distribute your total income to cover these expenses. Make sure every money you spend has a purpose. This helps you manage your money efficiently and ensures financial stability.

f) Review and monitor: Regularly check your budget and spending. Ensure they match your plan and adjust as needed to stay on track. Continuous monitoring helps you adapt to changes.

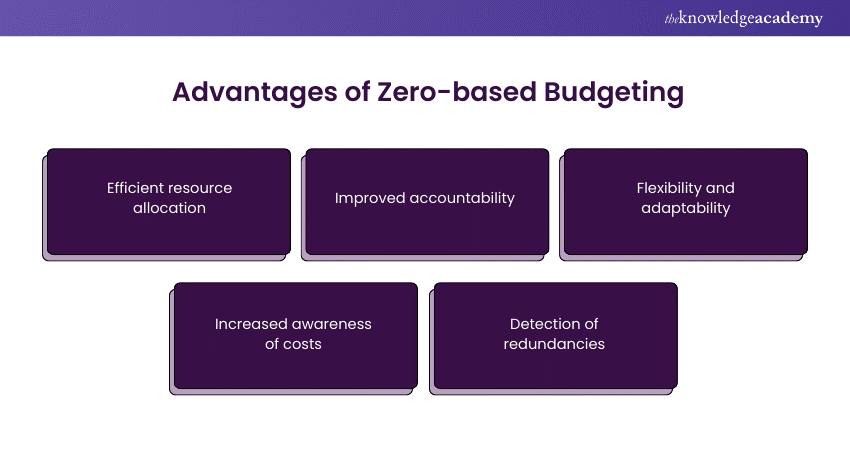

Advantages of Zero-based Budgeting

Zero-based Budgeting offers several key advantages for organisations:

a) Efficient resource allocation: Zero-based Budgeting ensures that all spending is necessary by starting from zero and justifying every expense. This helps avoid unnecessary spending. It also makes sure that resources are directed to the areas that need them most, matching current goals.

b) Improved accountability: Managers must justify all budget requests under Zero-based Budgeting, which increases accountability. This transparency helps ensure that all spending is necessary and justified. It also encourages responsible financial management.

c) Flexibility and adaptability: It allows organisations to adapt to changes. By reallocating resources to the most critical areas, companies can respond more effectively to new opportunities or challenges. This flexibility supports better decision-making.

d) Increased awareness of costs: Regularly reviewing and justifying all expenses heightens cost awareness across the organisation. This awareness encourages everyone to make more prudent financial decisions. It fosters a culture of cost-consciousness.

e) Detection of redundancies: Zero-based Budgeting helps identify and eliminate redundant or non-value-adding activities. By scrutinising every expense, organisations can streamline operations and improve efficiency. This leads to more effective use of resources.

Refine your planning abilities with our Strategic Thinking and Planning Course – join today!

Disadvantages of Zero-based Budgeting

While Zero-based Budgeting offers many benefits, it also comes with several significant drawbacks. Let's find out:

a) Time-consuming process: Zero-based Budgeting requires a detailed review of all expenses from scratch. This can be very time-consuming, as every cost needs thorough justification. It requires significant time and effort from managers and employees.

b) Complexity: The process can be complex, involving a lot of data collection and analysis. It requires a deep understanding of all business activities. This complexity can be overwhelming for organisations, especially those with limited resources.

c) Resistance to change: Employees and managers may resist the Zero-based Budgeting process due to its demanding nature. A shift in mindset from traditional budgeting methods is needed. This resistance can hinder successful implementation and create friction within the organisation.

d) Resource intensive: Implementing Zero-based Budgeting can require additional resources, such as training for staff and investment in budgeting tools. This can be a burden, particularly for small organisations. The increased resource demands might outweigh the benefits for some companies.

e) Short-term focus: It may lead to a focus on short-term gains rather than long-term goals. Managers might prioritise immediate cost savings over investments that provide long-term value. This short-term focus can impact future growth and development.

f) Potential for bias: The process relies heavily on the judgment of managers who prepare the budget proposals. This can introduce bias, as managers might favour their departments or projects. It can lead to imbalanced resource allocation if not managed carefully.

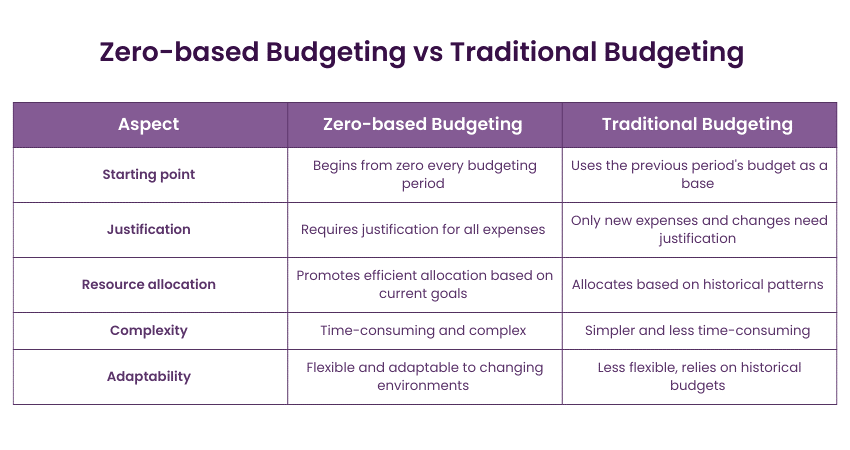

Difference between Zero-based Budgeting and Traditional Budgeting

Zero-based Budgeting and Traditional Budgeting are two distinct approaches to financial planning. They differ in how they start the budgeting process, justify expenses and allocate resources. Let's explore this in detail.

1) Starting point

Zero-based Budgeting begins at zero in every budgeting period. Each expense must be built up from scratch. In contrast, Traditional Budgeting uses the previous period's budget as a base, making adjustments for new needs and goals.

2) Justification

Zero-based Budgeting involves reviewing all costs and justifying each, giving every expense a context of need. On the other hand, in Traditional Budgeting, only new expenditures and adjustments from the last budget have to be justified while others go on without review.

3) Resource allocation

Zero-based Budgeting works toward the achievement of goals and the effective management of organisational resources. It involves the justification of spending for the current needs of the organisation. On the other hand, Traditional Budgeting can cause resources to be allocated based on past trends, and this may not always be very relevant for the current requirements.

4) Complexity

Zero-based Budgeting is complicated since it covers the evaluation and justification of all costs starting from scratch. On the other hand, the Traditional Budgeting process is easy and less time-consuming since it involves continuation from the previous budget. It focuses on the least scrutiny of the current costs.

5) Adaptability

Zero-based Budgeting is more flexible and responsive to the ever-shifting business environments because it reviews all costs periodically. On the other hand, Traditional Budgeting is relatively rigid since it covers fixed and historical budgets, which sometimes may not capture certain changes and new trends appropriately.

Develop the ability to prioritise tasks and manage time with our Motivation and Goal Setting Training – join today!

Conclusion

Zero-based Budgeting is a thorough and effective approach that ensures every expense is necessary and aligned with current goals. While it offers benefits like efficient resource allocation and adaptability, it is also time-consuming and complex. This method requires significant effort to justify all expenses from scratch. Despite these challenges, Zero-based Budgeting can lead to better financial management and more strategic use of resources, making it a valuable tool for many businesses.

Learn about different budgeting techniques with our Introduction to Managing Budgets Course – join today!

Frequently Asked Questions

Is Zero-based Budgeting easy?

Zero-based Budgeting is not easy because it requires justifying every expense from scratch, which can be time-consuming and complex. However, it can lead to more efficient and effective use of resources.

For which costs can Zero-based Budgeting be implemented?

Zero-based Budgeting can be implemented for all types of costs, including operational expenses, capital expenditures, and departmental budgets.

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various Personal Development Courses, including Introduction to Managing Budgets Course, Organisational Skills Course, and Attention Management Course. These courses cater to different skill levels, providing comprehensive insights into Behaviour Management.

Our Business Skills Blogs cover a range of topics related to personal development, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your budgeting skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Introduction to Managing Budgets

Introduction to Managing Budgets

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 8th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please