We may not have the course you’re looking for. If you enquire or give us a call on +1800812339 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Some people think that numbers are boring, but not you, if you love to dive into data, crunch the figures, and uncover the stories behind them. If you have a knack for finding patterns, trends, and insights that can help businesses and investors make smart decisions, becoming a Financial Analyst is the answer. But Who is a Financial Analyst? Prospective job seekers often ask this question.

According to Glassdoor, a Financial Analyst's average salary in London is £54,621/yr. You see, with the increasing importance of these professionals, salaries are soaring. So, if you are a prospective analyst, it’s time to invest in this career. In this blog, we will explore Who is a Financial Analyst, their role and responsibilities. Let's dive in to learn more!

Table of contents

1) Understanding Who is a Financial Analyst

2) Types of Financial Analysts

3) Responsibilities of a Financial Analyst

4) Skills required to become a Financial Analyst

5) Conclusion

Understanding Who is a Financial Analyst

A Financial Analyst conducts various research activities to guide investment strategy and decision-making for their company or clients. They assess financial data, monitor current and market events, review financial statements, and build financial models to forecast future performance.

They can either track macroeconomic trends or focus on specific sectors and industries. They need strong mathematical and analytical skills to handle large amounts of data. They can work for various large organisations, such as investment banks, insurance companies, mutual funds, hedge funds, pension funds, securities firms, and others, that value their role.

Types of Financial Analysts

The role of a Financial Analyst is not a single entity; instead, it is a spectrum encompassing various specialisations that cater to distinct facets of the financial landscape. Let's explore these diverse roles of Financial Analysts in detail:

Buy-side Analysts

Most Financial Analysts are on the buy-side, helping their employers decide how to invest their money. They can invest in stocks and other securities for an internal fund, buy income properties for a real estate firm, or allocate marketing funds. Some Analysts work for a third-party company that offers financial and revenue analysis to its clients. This shows how valuable Financial Analysts are; there is a whole industry around them.

Buy-side Financial Analysts usually don't make the final decisions on how their employers or clients invest their money. However, their findings and predictions are very useful in decision-making. With global financial markets changing fast and regulations shifting often, it makes sense that the need for skilled buy-side Financial Analysts will only grow in the future.

Sell-side Analysts

At a sell-side firm, Analysts measure and compare the quality of securities in a certain sector or industry. They write research reports with recommendations like "buy," "sell," "strong buy," "strong sell," or "hold."

They also monitor the stocks in a fund's portfolio to see when/if the fund should sell its position in that stock. Their recommendations have a lot of influence in the investment industry, even for people who work at buy-side firms.

The most prestigious (and best-paid) Financial Analyst job is a sell-side analyst for a big investment bank. These Analysts help banks set the prices of their own investment products and sell them to the market. They gather data on the bank's stocks and bonds and use quantitative analysis to predict how they will do in the market. They make buy and sell recommendations to the bank's clients, guiding them to certain securities from the bank's products.

Corporate Finance Analysts

Corporate Finance Analysts function as financial architects within organisations. They are pivotal in strategic financial planning, managing budgets, and evaluating investment opportunities for the company's growth. From determining a new project's financial feasibility, assessing an expansion's Return on Investment (ROI), or analysing potential acquisitions, their insights guide the company's financial destiny.

Risk Analysts

In the world of Finance, risks are inevitable companions. Risk Analysts are the key players guarding against potential pitfalls. By assessing and quantifying financial risks, they enable businesses to make informed decisions that minimise potential losses. Their work spans market risk, credit risk, operational risk, and more, providing a crucial foundation for prudent decision-making.

Quantitative Analysts (Quants)

Quantitative Analysts, or Quants, are the technologically adept mathematicians of the financial world. They develop complex mathematical models and algorithms to analyse financial markets, predict trends, and guide trading strategies. Their work is at the intersection of Finance and advanced mathematics, leveraging computational power to gain an edge in the competitive financial landscape.

Explore the world of Financial Management and elevate your skills; sign up for our Financial Management Courses now!

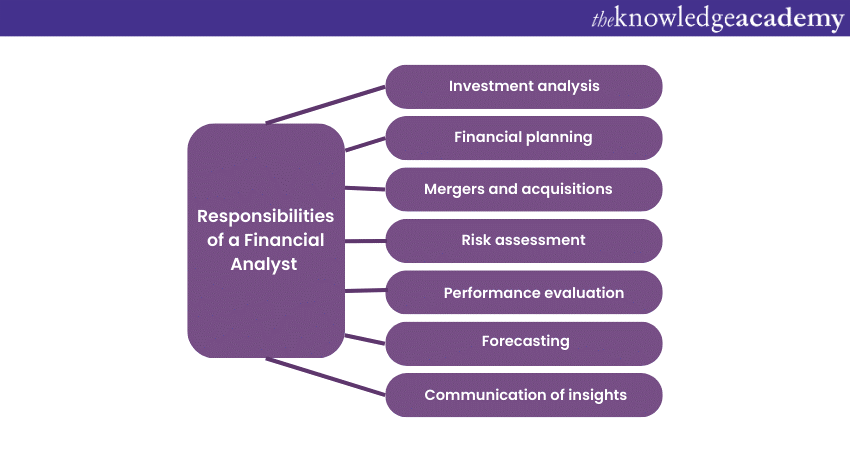

Responsibilities of a Financial Analyst

The canvas of a Financial Analyst's responsibilities is expansive, painting a portrait of their indispensability in various spheres. Let's have a detailed look at these spheres:

a) Investment analysis: Financial Analysts scrutinise investment opportunities, considering potential risks and returns. They conduct thorough research to recommend stocks, bonds, or other securities that align with investors' objectives.

b) Financial planning: Organisations rely on analysts to assist in crafting strategic financial plans. These professionals chart the course for allocating resources, managing budgets, and projecting future financial performance.

c) Mergers and acquisitions: Financial Analysts play a pivotal role in mergers and acquisitions in corporates. Their expertise helps determine the financial feasibility of such endeavours, assess potential synergies, and predict post-merger financial outcomes.

d) Risk assessment: Navigating financial markets involves inherent risks. Analysts are tasked with identifying and quantifying these risks, enabling stakeholders to make informed decisions safeguarding investments.

e) Performance evaluation: By comparing a company's financial performance against industry benchmarks and historical data, Financial Analysts offer insights that enable management to gauge their achievements and strategies for improvement.

f) Forecasting: Forecasting is a cornerstone of Financial Analysis. Analysts utilise historical data and market trends to predict future financial outcomes, assisting businesses in preparing for various scenarios.

g) Communication of insights: Beyond crunching numbers, Financial Analysts excel in conveying their findings to non-financial stakeholders. Their ability to transform complex financial jargon into comprehensible insights aids decision-makers across the organisation.

Skills required to become a Financial Analyst

Financial Analysis demands a unique blend of skills and qualifications to harmonise numerical complexities with strategic insight and effective communication. So, let’s look at the essential skills that empower Financial Analysts to excel in their multifaceted roles:

Analytical skills

An effective Financial Analyst has the ability to forecast, plan, prioritise, rank and identify financial problems. These skills enable a Financial Analyst to evaluate and solve problems using strategic planning and analysis of financial resources, markets and products. They help their company make sound financial decisions.

Financial knowledge

Another essential soft skill for a Financial Analyst is financial literacy, which is the ability to understand financial situations. A Financial Analyst can use their knowledge of the current investment market, interest rates, and other financial events to perform their duties better.

Communication skills

Communication skills are also important for Financial Analysts, as they affect interpersonal skills. A Financial Analyst can communicate effectively by being direct in emails, phone messages, and conversations with investors. They can also use nonverbal communication to navigate professional and working relationships.

Attention to detail

A Financial Analyst has to be detail-oriented to notice market trends and make accurate predictions. They pay attention to detail to draw insightful conclusions from the changes in the market.

Problem-solving abilities

Financial Analysts are often faced with intricate financial puzzles that require innovative problem-solving. Their ability to think critically and propose creative solutions is invaluable, from devising strategies to mitigate risks to optimising investment portfolios.

Technological proficiency

In today's digital age, proficiency with financial software, data analysis tools, and modelling software is a necessity. Financial Analysts must know how to leverage these tools to organise, analyse, and visualise complex data, aiding in decision-making and strategic planning.

Enhance your career with comprehensive Accounting and Finance training, sign up for our Accounting & Finance Training now!

Conclusion

We hope that after reading this blog, you have learned Who is a Financial Analysts. Financial Analysts guide investments, manage risks, and steer businesses toward success. Their analytical skills, strategic insights, and mastery of tools form a powerful orchestra, transforming data into decisions that shape economic destinies in an ever-evolving financial landscape.

Understand the impact of debt; sign up for our Introduction To Credit Control Course now!

Frequently Asked Questions

A Financial Analyst is a good job for someone who enjoys working with numbers, data, and markets. A Financial Analyst can help companies make sound financial decisions, have diverse opportunities, and earn a high salary. However, a Financial Analyst may also face stress, competition, and continuous education.

Financial Analysts make good money compared to many other professions. The average salary for a Financial Analyst was £54,621/yr. Depending on the job, the firm, location, and experience, the salary can be much higher. Financial Analysts also have other financial incentives, such as bonuses and benefits.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Courses, including Payroll Course, Finance for Non-Financial Managers, Financial Management Course and more. These courses cater to different skill levels, providing comprehensive insights into What is Credit Risk.

Our Business Skills Blogs cover a range of topics related to Fintech, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting & Finance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Financial Management Course

Financial Management Course

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please