We may not have the course you’re looking for. If you enquire or give us a call on +1800812339 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The invention of Bitcoin and Cryptocurrency left a huge and permanent imprint on the financial markets and, by extension, on the economies of the countries. With each passing day, the world of digital currencies is expanding. With over 4,000 unique Types of Cryptocurrency, it can be challenging to understand their diversity, functionality, and potential.

According to Binance Feed, the investments in Cryptocurrencies surged by 127% in November 2022 to £110 million (the highest values recorded since June 2022). Thus, you see, Cryptocurrencies have created a parallel economic ecosystem that offers new methods of transactions, contracts, and data sharing.

So, it’s time to understand the various Types of Cryptocurrencies if you want to achieve heights in the technology-driven share market. Want to know how? Read this blog to discover its various types and explore how to choose the right type and where to buy them.

Table of Contents

1) What is a Cryptocurrency?

2) What are the Various Types of Cryptocurrency?

3) Why are There So Many Types of Cryptocurrency?

4) How to Choose the Right Type of Cryptocurrency and Where to buy Them?

5) Conclusion

What is a Cryptocurrency?

Cryptocurrency, a central topic in the Solana vs Ethereum discussion, is a type of money that exists solely in the digital world. It does not depend on any central authority, such as banks or governments, to validate or process transactions. Instead, it uses a network of computers, called Peers, that communicate and cooperate with each other. Anyone can send and receive Cryptocurrency payments, regardless of their location or identity.

Cryptocurrency transactions are recorded and verified by a shared database, called a Ledger, which has played a significant role in the History of Cryptocurrency by being open and transparent to everyone. Cryptocurrency is kept in secure software programs called wallets that allow users to manage their funds.

What are the Various Types of Cryptocurrency?

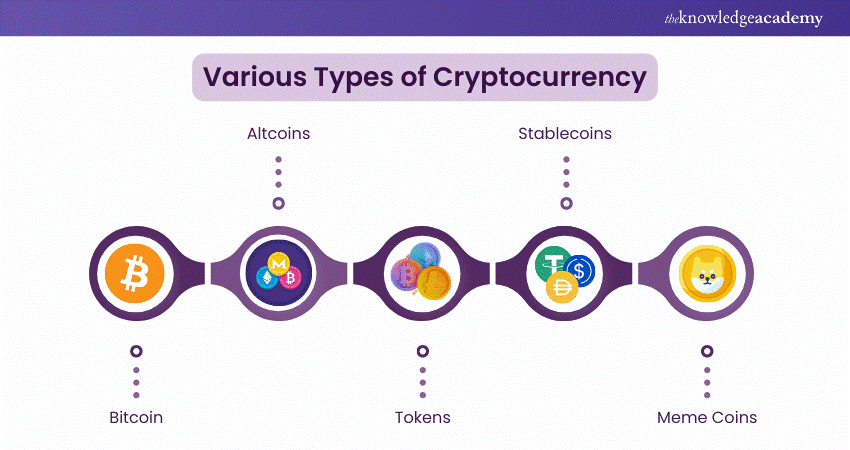

With over 4,000 unique Cryptocurrencies in existence, the Crypto ecosystem is diverse and multifaceted. The three primary categories of Cryptocurrencies are Bitcoin, Altcoins, and Tokens. These categories are again further divided into different types of Cryptocurrencies. So, let’s have a detailed look at each one of them:

a) Bitcoin

The first and most influential Cryptocurrency, Bitcoin, was introduced to the world by an anonymous entity named Satoshi Nakamoto in 2009. Bitcoin operates on Blockchain Technology and is one of the most valued Crypto today. It also often serves as a benchmark for all other Cryptocurrencies. Its primary use is as a Digital Currency and store of value.

There have been several offshoots or 'types' of Bitcoins, often referred to as Forks. These are not different types of Bitcoins per se but rather separate Cryptocurrencies that have been created by modifying the original Bitcoin software. Some of the notable ones include the following :

1) Bitcoin Cash (BCH): Created in 2017, Bitcoin Cash was designed to address some scalability issues faced by Bitcoin. It increases the block size limit. This also allows for more transactions to be processed in each block. Hence, it leads to an increase in the overall transaction speed.

2) Bitcoin Satoshi’s Vision (BSV): This is a Fork of Bitcoin Cash. Created in 2018, its goal is to stay true to the original belief of Satoshi Nakamoto for Bitcoin. It does this by expanding the block size to accommodate more transactions. Hence, it theoretically improves scalability and speed.

3) Bitcoin Gold (BTG): Bitcoin Gold was created in 2017 to revert to the decentralised nature of Bitcoin. It aims to do so by changing Bitcoin's mining algorithm to resist the development of powerful specialised machines used for Bitcoin mining.

Learn the strategies used by top traders through our Foreign Exchange Training - sign up now to take control of your financial future!

b) Altcoins

The term “Altcoin” is short for "Alternative Coin". It is used to describe all Cryptocurrencies that aren't Bitcoin. Since Bitcoin's creation, many other Cryptocurrencies, or Altcoins, have been developed.

These developments are unique in their individual functionalities and purposes. They are often designed to address the perceived limitations of Bitcoin. They also provide different uses and applications. Some of the most significant types of Altcoins include the following:

1) Ethereum (ETH): Ethereum, introduced in 2015 by Vitalik Buterin, isn't just a Cryptocurrency but also a Blockchain platform. It is used to develop Decentralised Applications (dApps) and smart contracts. Its native currency is Ether (ETH). This platform has paved the way for the Initial Coin Offerings (ICO) industry. It has also been integral to the recent rise of Decentralised Finance (DeFi) and Non-Fungible Tokens (NFTs).

2) Litecoin (LTC): Launched in 2011, Litecoin is often considered the silver to Bitcoin's gold. Created by former Google Engineer Charlie Lee. It's based on the Bitcoin protocol but differs based on the hashing algorithm used, hard cap, block transaction times, and other factors. It was designed to have faster block generation times and a larger maximum supply of coins.

3) Ripple (XRP): Ripple, created in 2012, is both a digital payment protocol and a Cryptocurrency. It enables fast and low-cost international money transfers. It is also popular with banks and other financial institutions. Ripple's native Cryptocurrency, XRP, serves as a bridge currency for transfers between different fiat currencies.

4) Cardano (ADA): Launched in 2017, Cardano aims to be the world's financial operating system by establishing decentralised financial products in the same way that Ethereum has for dApps. Cardano's ADA token allows owners to participate in the network's operation, including voting on network software changes.

5) Polkadot (DOT): Polkadot is a multi-chain platform that allows different Blockchains to interoperate in a shared security model. By allowing for cross-Blockchain transfers, Polkadot aims to make the process easier for developers to create useful dApps in a secure and scalable environment.

Understand the world of Cryptocurrencies- register now for our Bitcoin and Cryptocurrency Course

c) Tokens

Tokens represent a unique category within the Cryptocurrency world. Unlike standalone Cryptocurrencies like Bitcoin or Altcoins, Tokens are issued on existing Blockchain platforms. Tokens typically represent a specific value or utility within a Blockchain project's ecosystem. Let's have a look at the types of Tokens available in the market today:

1) Utility Tokens: Utility Tokens, also known as app coins or User Tokens. It provides holders with future access to a product or service. They can be likened to a store gift card or a software license. They are not created to be an investment but rather to facilitate future use of a project's product or services. For example, Filecoin is a Utility Token that allows users to access and use a decentralised cloud storage platform.

2) Security Tokens: They are digital assets that derive their value from an external and tradable asset. They are subject to federal securities and regulations. They grant ownership rights in the underlying asset or company. Essentially, owning a security token is similar to owning shares in a company or having ownership of a real-world asset like real estate. They provide a range of financial rights to the holder, such as equity, dividends, voting rights, and more.

3) Non-Fungible Tokens (NFTs): These Tokens are unique and cannot be replaced with something else. They represent ownership of unique items or pieces of content and are typically used in the art and gaming industry. The famous Cryptokitties and the artwork sold by digital artist Beeple are examples of NFTs.

Want to start your own cryptocurrency business? Grab the Cryptocurrency Business Plan PDF and build a solid foundation with expert strategies and insights.

d) Stablecoins

A stablecoin is a type of cryptocurrency designed to have a stable value by being linked to the price of another asset, typically a fiat currency like the U.S. dollar. Ideally, a stablecoin that is pegged to the dollar should maintain a constant value of $1. There are two primary types of stablecoins, which are explained below:

a) Collateralised Stablecoins: Collateralised stablecoins are backed by a reserve of assets, ensuring that there is an equivalent value held in reserve for each stablecoin in circulation. This method is used by Tether (USDT), a well-known stablecoin tied to the U.S. dollar, though its reserve holdings have been subject to scrutiny.

b) Algorithmic Stablecoins: Algorithmic stablecoins, such as TerraUSD (UST), rely on a system of algorithms that adjust the supply of the stablecoin—and a related cryptocurrency, in this case, Luna—to maintain the peg to the dollar. This is achieved by minting or burning the sister cryptocurrency in response to the stablecoin’s market transactions.

Sign up for our Forex Trading Course and master the art of Currency Trading – book your spot now!

e) Meme Coins

Meme coins are a specialised niche in the Future of Cryptocurrency Market, emerging from the world of internet humour, viral memes, and cultural trends. Recognised for their significant price fluctuations, these digital currencies often ride the waves of social media fads and the endorsements of celebrities.

Despite the potential for substantial gains, meme coins come with considerable risk. The following are some key types of meme coins:

a) Dog-themed Coins: The most prominent examples include Dogecoin (DOGE) and Shiba Inu (SHIB), which are recognised for their dog-related imagery and have achieved notable Cryptocurrency Market Capitalisation and investor interest.

b) Pop Culture-themed Coins: Drawing from elements of mainstream media, these coins often reference well-known entertainment sources, like Sealana (SEAL), which takes inspiration from “South Park.”

c) Technology-themed Coins: Meme coins like WienerAI (WAI) blend tech concepts with their branding, positioning themselves as advanced and evolving digital currencies.

d) Play-to-earn (P2E) Coins: These coins merge gaming with earning potential, exemplified by PlayDoge (PLAY), which gamifies the Doge meme.

e) Algorithmic Coins: Although not directly meme-based, these coins employ algorithmic methods to stabilise their value and are often associated with meme coins due to their speculative nature.

f) Novelty Coins: Created for entertainment or as a commentary on current events, these coins are typically designed for short-term amusement and lack a serious purpose or long-term vision. They often capitalise on fleeting internet trends or jokes. Apart from these five categories and types there are several other Types of Cryptocurrencies. Let’s have a look at them:

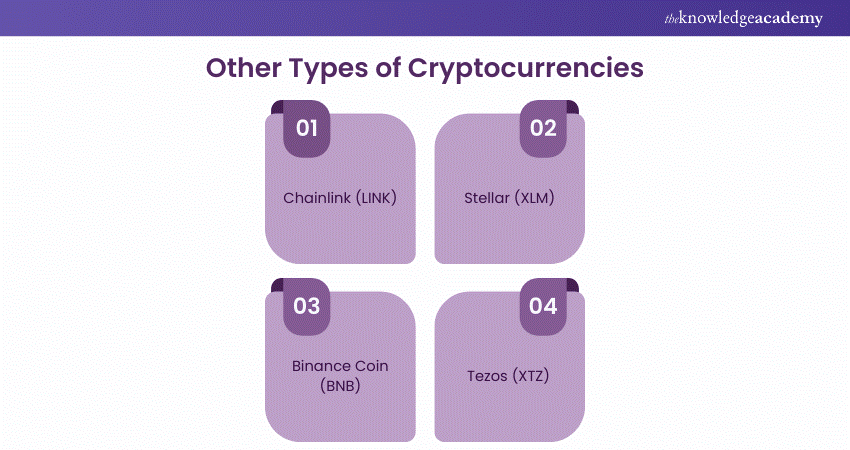

1) Chainlink is a decentralised oracle network that aims to connect smart contracts with data from the real world. Chainlink's token, LINK, is used to pay for services on the network.

2) It is a platform that connects major banks, payment systems, and people to move money quickly, reliably, and at almost no cost. Its native Cryptocurrency, Stellar Lumens (XLM), facilitates multi-currency transactions and remittances.

3) Binance Coin is the native Cryptocurrency of the Binance exchange. It is one of the largest Crypto exchanges globally. BNB is used for various transactions within the Binance platform, including paying transaction fees, participating in token sales, and more.

4) It is a Blockchain network that operates on a model of self-amendment. It allows the protocol to upgrade itself without having to split or fork the network. Tezos holders can participate in network upgrades and decision-making. Participants can also earn rewards for doing so.

Equip yourself with the tools to maximise your returns with our Investment Management Course - sign up today!

Why are There so Many Types of Cryptocurrency?

Cryptocurrencies are a form of digital currency that utilises Blockchain Technology—a modifiable and open-source software system. This flexibility has given rise to a diverse array of cryptocurrencies, each with unique characteristics and objectives. The cryptocurrency landscape has expanded rapidly, with over 10,000 different types now available, a significant increase from the approximately 1,000 that existed just a few years ago. The proliferation of cryptocurrencies can be attributed to the simplicity of creating new ones, often by modifying existing cryptocurrency codes.

For example, the Ethereum network allows for the creation of custom tokens. Additionally, a process known as a “fork” can split a cryptocurrency’s code, leading to a new currency with altered rules. How to Create a Cryptocurrency involves understanding the crypto industry’s growth, which is fueled by high demand and continuous innovation. Blockchain’s potential extends beyond monetary applications to decentralised platforms, smart contracts, and digital identities. While not all cryptocurrencies may endure, the decentralised and adaptable nature of Blockchain Technology promises a continual emergence of novel and intriguing cryptocurrencies.

Discover the key Differences between Bitcoin and Ethereum and make the right choice today.

Get a comprehensive guide to all things crypto! Download our Cryptocurrency Glossary PDF today and master the terminology in no time!

How to Choose the Right Type of Cryptocurrency and Where to buy Them?

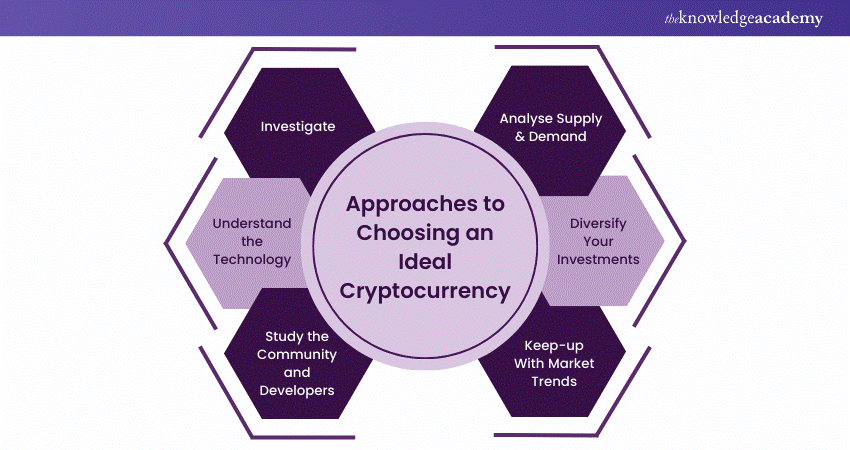

Choosing the right Crypto involves careful thought and consideration. Here are some key steps to follow:

1) Before investing in any Type of Cryptocurrency, make sure to do thorough research. Understand what Crypto does, who its developers are, what problem it solves, and its long-term potential. Also, check its Market Capitalisation and historical performance.

2) It's important to grasp the technology behind Crypto. Ask, if it's based on Blockchain, how secure is it? Does it offer unique technological advantages? For instance, Ethereum's smart contract functionality has made it a popular choice.

3) Strong support from a community and an active team of developers can indicate the potential for a Cryptocurrency's success. Moreover, regular updates and active communication from the team can be good signs.

4) The value of a Crypto often depends on supply and demand. Cryptocurrencies with a limited supply, like Bitcoin, can have a higher value if demand increases.

5) Just like with any investment, it's advisable not to put all your eggs in one basket. Diversification can help mitigate the risks that come with investing in Cryptocurrencies.

6) The Crypto market is very dynamic and can change rapidly. Stay updated with market news, global economic events, regulatory developments, and other factors that can influence the market.

Once you've chosen a Cryptocurrency to invest in, the next step is to decide where to buy it. Here are some options:

1) Cryptocurrency Exchanges: Cryptocurrency exchanges like Binance, Coinbase, and Kraken allow users to buy, sell, and store different Types of Cryptocurrencies. So, always choose a reputable exchange with strong security measures.

2) Peer-to-peer Trading: Some investors prefer buying Cryptocurrencies directly from others using peer-to-peer platforms. This method offers more privacy but can also carry more risk.

3) Bitcoin ATMs: Bitcoin ATMs work like regular ATMs, but instead of withdrawing money from your bank account, you can buy and sometimes sell Bitcoin against fiat currencies.

4) Decentralised Exchanges (DEXs): For those interested in DeFi, DEXs like Uniswap or Sushiswap allow buying and trading tokens directly from your own private wallet.

Learn key strategies for success in crypto with the Cryptocurrency Trading PDF!

Conclusion

Understanding different Types of Cryptocurrency is important for anyone interested in joining this digital revolution. Among these, Mining Dogecoin offers a unique way to participate in the cryptocurrency ecosystem. These digital currencies are not just a trend; they are the keystones of a new economic landscape. Embrace the future by exploring the Future of Cryptocurrency and consider how these varied cryptocurrency types can redefine your digital transactions and investments.

Stay informed about Bitcoin and its potential! Download the Bitcoin PDF today and start mastering the world of digital currencies.

Master the art of decentralised application development- register now for our Ethereum Developer Training .

Frequently Asked Questions

What Risks are Associated With Investing in Certain Types of Cryptocurrency?

Investing in Cryptocurrencies can involve risks such as market volatility, regulatory changes, technological vulnerabilities, and the potential for fraud or hacking. Different Cryptocurrencies may have varying levels of risk based on their technology, market position, and community support.

Is Cryptocurrency a Good Investment Option?

Whether Cryptocurrency is a good investment depends on individual risk tolerance, investment goals, and market knowledge. Cryptocurrencies can offer high returns but come with high risks and volatility. It's essential to conduct proper research and consider financial advice before investing.

What are the Other Resources Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and how Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Investment and Trading Courses, including Cryptocurrency Trading, Stock Trading, Real Estate and Investment Banking courses. These courses cater to different skill levels, providing comprehensive insights into Investment and Trading methodologies.

Whether you are starting your journey or aiming to elevate your Investment and Trading expertise, immerse yourself in our Business Skills Blogs to discover more insights!

Upcoming Advanced Technology Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please