We may not have the course you’re looking for. If you enquire or give us a call on +1800812339 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Have you ever asked yourself, "What is Forex Trading?" Forex Trading is all about understanding the purchase of the currency and selling in a global marketplace. It is like swapping your allowance with a friend in a whole new way!

According to Glassdoor report, the average salary of a Forex Trader in London, UK, is £152,163. Well, if you are curious about how money from one country can be exchanged for another country’s money from another country, you are in the right place to find out. In this blog, we will talk about What is Forex Trading? Keep reading to discover the world of exciting adventures where currencies meet exchange rates along with mechanics, factors, etc.

Table of Contents

1) Understanding What is Forex Trading

2) How does Forex Trading work?

3) The Mechanics of Forex Trading

4) Ways to trade Forex

5) Factors influencing exchange rates

6) Getting started in Forex Trading

7) Analysing the Forex Market

8) Risks of Forex Trading

9) Pros and Cons of Forex Trading

10) Conclusion

Understanding What is Forex Trading

Forex Trading might sound complex, but at its core, it is an exchange of one currency of one country for another. This global marketplace (also known as the Foreign Exchange Market or Forex Market) allows people and businesses to invest in currencies trading with the goal of attaining profit.

For example, if an individual or a business wants to buy Euros, they would need to buy Euros with their local currency, such as British Pounds. This transaction would be priced based on the exchange rates of the currencies.

What is Forex?

Forex Trading might sound complex, but at its core, it is an exchange of one currency of one country for another. This global marketplace (also known as the Foreign Exchange Market or Forex Market) allows people and businesses to invest in currencies trading with the goal of attaining profit.

For example, if an individual or a business wants to buy Euros, they would need to buy Euros with their local currency, such as British Pounds. This transaction would be priced based on the exchange rates of the currencies.

How does Forex Trading work?

Forex Trading, or Foreign Exchange Trading, involves the exchange of currency and is a popular way to speculate on the currency movements. Here are the key points to understand how it works:

1) Currency Pairs: Forex trading always involves pair trading, such as EUR/USD (Euro/US Dollar). This means that you’re buying one currency while selling another at the same time.

2) Betting on Currency Strength: When you buy a currencies pair, you are essentially betting that the first currency in a pair will strengthen against the second currency over time.

3) Trading Example: If you believe the Euro (EUR) will strengthen in US Dollar (USD) comparison, you might buy a pair of EUR/USD currency. This means you are buying Euros and selling Dollars.

4) Making a Profit: If you have the correct prediction and the Euro strengthens against the Dollar, you can sell the Euros back for more Dollars than you initially spent, thus making a profit.

Key Participants in the Forex Market

The Forex Market is made up of various participants, each with their own motivations and roles:

a) Banks and Financial Institutions: They trade for their client’s currencies and portfolio management.

b) Corporations: Banks and Financial Institutions: They trade for their client’s currencies and portfolio management.

c) Governments: National governments intervene in the Forex Market to stabilise their own currency or influence in terms of the economy.

d) Investors and Traders: Individuals and institutions trade currencies to profit from price movements.

Major currency pairs

Not all currencies are Forex Market equal. Some currencies are more widely used and traded than other currencies in tandem. The most traded currencies are the major currency pairs, which involve the most global influential economies. These pairs include:

a) EUR/USD: Euro/US Dollar

b) USD/JPY: US Dollar/Japanese Yen

c) GBP/USD: British Pound/US Dollar

d) USD/CHF: US Dollar/Swiss Franc

The reason these pairs are so popular is because they have high liquidity—meaning they are actively traded.

Unlock the secrets of successful Investment and Trading – Join in our Investment and Trading Training today!

The Mechanics of Forex Trading

Understanding these fundamental aspects will equip you with the navigating the world knowledge of Forex Trading. This will help you effectively trade and make informed decisions.

1) Bid and Ask prices

Within the Forex Market, each currency pair presents two prices:

a) The Bid price signifies the value at which the base currency (the first in the pair) can be sold.

b) The Ask price denotes its purchase value. The spread, the gap between these prices, acts as a transaction fee.

2) Spread and PIPs

Spread is commonly assessed in PIPs (Percentage in Point" or "Price Interest Point). A PIP signifies the tiniest price shift in a currency pair and denotes a value change of one unit in the final decimal price point. For instance, the EUR/USD pair might shift from 1.1500 to 1.1501. This becomes a One-PIP change.

3) Leverage and Margin

Leverage stands as a potent instrument enabling you to manage a more prominent position with a comparably smaller capital sum. This ratio, like 50:1 or 100:1, magnifies gains and losses, necessitating careful usage.

In contrast, the margin pertains to the funds you must reserve in your trading account to initiate and uphold a trade. Serving as a safety net, it guarantees coverage for potential losses.

Unlock the world of Crypto Trading with our expert-led Cryptocurrency Trading Training!

Why do people Trade Forex?

Forex Trading is the currencies’ exchange for profit. There are three main ways for Forex Trading on a large scale:

1) Spot Market: It is the primary Forex Trading market where buying and selling of currencies are done at the current market price. These are based on the supply and demand of currency in real-time. In the spot market, transactions immediately occurred, and settlement typically takes place within two business days.

2) Forward Market: The Forward Market allows Forex traders to agree to currency amount buying and selling at a predetermined exchange rate for a future date. These contracts are customisable. This means that traders can negotiate their currency amount, the rate of exchange, and the settlement date.

3) Future Market: The futures market involves standardised contracts’ buying and seeling to exchange a specific currency amount at a fixed exchange rate at a future date. Unlike the forward market, futures contracts are standardised and regulated exchanges traded, providing more transparency and liquidity.

Factors Influencing Exchange Rates

Exchange Rates act like the Forex Trading pulse. It helps in deciding how much one currency is worth in comparison to another. To guess these rates and make clever Trading decisions, it is essential to know why they change. Let us check out the main things that push and pull exchange rates.

1) Economic Indicators

GDP, unemployment rates, inflation, other economic indicators along with the consumers' confidence, hold immense exchange rates. A strong economy often relates to a stronger currency, as it entices foreign investments and spikes the currency’s demand.

2) Interest Rates

A specific country’s central bank sets interest rates to influence the value of the currency. Higher interest rates can attract foreign investors who are looking for better investment returns. Consequently, the demand for increased currency can lead to the depreciation of value. Meanwhile, lower interest rates can lead to depreciation.

3) Political Stability And Economic Performance

Political stability and the economic performance of the country are closely intertwined. Countries that have stable governments and strong economies tend to attract foreign investment. These further boosts currency demands. On the other hand, political uncertainty or economic instability can lead to a currency value decrease due to reduced Investor confidence.

4) Market Sentiment

The psychology of Traders and Investors can significantly impact exchange rates. Positive news and a general sense of optimism can lead to high demand for a currency, causing its value to rise. Conversely, negative news or uncertainty can trigger a decrease in demand and a currency's depreciation.

Unlock the Secrets of Forex Trading: Join our Foreign Exchange Training today!

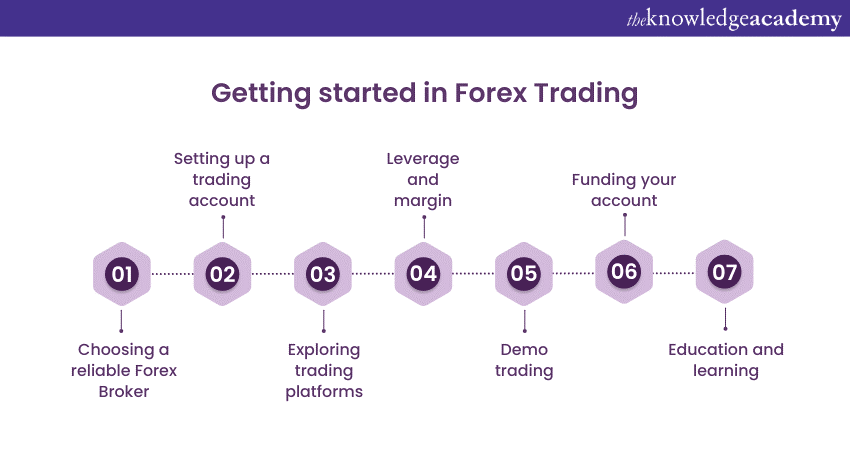

Getting Started in Forex Trading

Starting your Forex Trading adventure is exciting. However, it's more like a sturdy base building before you jump in. Here is a simple guide to help you start off on the right track.

1) Choosing a Reliable Forex Broker

A Forex Broker is like your Forex Market guide. They provide you with a reliable trading platform, offer various tools, and perform your trade execution. It is crucial to choose a trustworthy, regulated Broker that suits your Trading needs. Look for reviews, compare features, and make sure they have good customer support.

2) Setting up a Trading Account

Once you have picked a Broker, you will need to do a Trading account. This involves sharing some personal information and performing your identity verification. It is a standard procedure for fraudulent activities prevention.

3) Exploring trading Platforms

Trading platforms are like your cockpit in the Forex Market. Forex Brokers offer charts, tools, and options to execute trades. Explore the trading platform your Broker provides.

4) Leverage and Margin

One Forex Trading aspect that often requires careful understanding is Leverage. Leverage allows you to control a trading position at a larger position with a smaller amount of money. While it can amplify your profits, it can also elevate your losses.

5) Demo Trading

Before you start real money Trading, it is a smart idea to practice with a demo account. Moreover, it helps you get familiar with the platform, assess your strategy testing, and build confidence without money risk.

6) Funding Your Account

Once you have picked a Broker, you will need to do a Trading account. This involves sharing some personal information and performing your identity verification. It is a standard procedure for fraudulent activities prevention.

7) Education and Learning

Forex Trading is a learning journey. There are plenty of resources, courses, and educational materials available online to help you.

Analysing the Forex Market

To be a successful Trader, you need to understand what is happening in the market and predict where it might go next. Here is how you can become a market detective.

1) Fundamental Analysis

Fundamental analysis involves studying news, economic reports, and global events that impact economies. For instance, if the economy of the country is strong and growing, its currency tends to become more valuable. Through these factors, traders can make more informed decisions.

2) Technical Analysis

In technical analysis, traders study charts and graphs that show how a currency's price has changed over time. They look for patterns and trends that often repeat. If they spot a pattern that indicates a currency might go up, they might decide to buy.

3) Sentiment Analysis

Sentiment Analysis is all about feelings. Traders' collective feelings can influence market movements. Positive sentiment can lead to more buying, driving prices up. Negative sentiment might trigger selling, causing prices to drop.

Risks of Forex Trading

Forex Trading carries significant risks that traders should be aware of before market engaging. The higher leverage and margin make it riskier than other types of assets, as traders can control large positions with relatively small capital, increasing both potential profits and losses.

Additionally, constant price fluctuations require traders to execute large trades using leverage to make substantial profits.

Pros and Cons of Forex Trading

Forex trading comes with both sets of advantages as well as disadvantages. The forex market is highly liquid. This allows traders to easily perform currencies buying and selling without significantly affecting the market price. It operates 24 hours a day, 5 days a week, enabling participation according to geographical location and time zone.

Additionally, forex trading offers leverage at a high rate. This allows traders to open positions larger than their account balance, potentially increasing their profits. However, there are also significant drawbacks. Although forex trading online is legalised in India, it is not completely regulated, making it challenging to find trustworthy brokers and make safe investments.

Elevate your Forex Trading skills with our comprehensive Forex Trading Course - Sign up today!

Conclusion

In the Forex Trading world, grasping the basics is essential. It involves currency exchange to profit from their fluctuating values. There are various levels of strategies, such as scaling for quick profits or position trading for long-term trends, providing different approaches. Moreover, Position sizing, Stop-loss, and Take-profit, among other key tools, are crucial for safeguarding your investments. Achieving success requires continuous learning, adaptability, and disciplined execution.

Gain advanced knowledge in Investment Management with our Investment Management Course - Sign up now!

Frequently Asked Questions

Mastering Forex Trading can enhance your career prospects by opening up opportunities in various sectors, such as finance, banking, consulting, or Trading firms. You can also work as a self-employed trader and earn income from your own strategies.

Employers actively seek Trading professionals possessing strong analytical skills to assess market trends and effective risk management to protect investments. They also value discipline to stick to strategies, patience to wait for the right opportunities, and financial management skills to optimise and control trading portfolios.

The Knowledge Academy takes global learning to new heights, offering over 3000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Courses, including Day Trading Course, Stock Trading Masterclass and Revenue Management Training. These courses cater to different skill levels, providing comprehensive insights into the Steps of Investment Process.

Our Business Skills Blogs cover a range of topics related to Investments, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Investment and Trading skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please