We may not have the course you’re looking for. If you enquire or give us a call on +55 8000201623 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you confused about the Difference Between Cost Accounting and Management Accounting? While both are vital to Financial Management, they serve unique purposes. Cost Accounting zeroes in on tracking and analysing costs to boost operational efficiency. On the other hand, Management Accounting provides insights for strategic decision-making.

Grasping these differences can elevate your financial strategies, optimise resource allocation, and lead to more informed business decisions. Read on to discover the key Difference between Cost Accounting and Management Accounting and how each can benefit your business.

Table of Contents

1) What is Cost Accounting?

a) Functions of Cost Accounting

b) Advantages of Cost Accounting

c) Disadvantage of Cost Accounting

2) What is Management Accounting?

3) Difference Between Cost Accounting and Management Accounting

4) Conclusion

What is Cost Accounting?

Cost Accounting focuses on recording, analysing, and summarising the costs associated with a company's processes, services, and products. It helps businesses calculate and control expenses, plan strategies, and make informed decisions about cost improvements.

Unlike Financial Accounting, which is reported annually, Cost Accounting provides continuous insights into production costs, including raw materials, labour, and overhead costs. This enables organisations to assess costs at each production stage and their impact on overall operations.

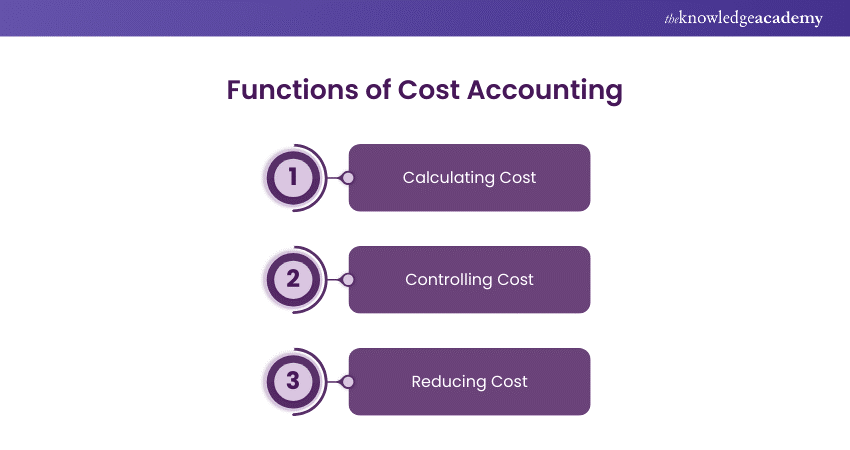

Functions of Cost Accounting

Cost Accounting plays an important role in managing and optimising a company's financial performance. By providing detailed insights into the cost structure of products and services, it supports strategic decision-making and financial control. Here are the key functions of Cost Accounting:

a) Calculating Cost

Cost Accounting determines the per-unit cost of each product, serving as the foundation for other cost-related functions. This method accurately figures out production costs, allowing firms to assess and manage their expenses effectively.

b) Controlling Cost

It identifies areas where operational costs can be controlled, assisting companies in staying within budget constraints. This function optimises resource allocation and enhances overall efficiency by limiting unnecessary expenses.

c) Reducing Cost

Cost Accounting helps pinpoint unwarranted expenses and develop strategies to mitigate them. By addressing these costs, it plays a crucial role in maximising profit margins and improving the company's financial health.

Advantages of Cost Accounting

Cost Accounting offers several benefits that enhance a company's Financial Management and operational efficiency. They are:

a) Informed Decision-making: Cost Accounting provides detailed insights into the costs associated with products and services. This help businesses to make informed decisions regarding pricing, budgeting, and financial planning.

b) Enhanced Cost Control: By identifying cost variances and inefficiencies, Cost Accounting helps organisations control and reduce expenses, leading to better resource allocation and increased profitability.

c) Profitability Analysis: It assists in determining the profitability of individual products or services, allowing companies to focus on high-margin items and discontinue or improve less profitable ones.

d) Budgeting and Forecasting: Accurate cost data aids in creating realistic budgets and financial forecasts, enhancing strategic planning and financial stability.

e) Performance Evaluation: Cost Accounting enables businesses to evaluate performance at various levels of production and management, facilitating performance improvement and operational efficiency.

Disadvantages of Cost Accounting

While Cost Accounting provides valuable insights, it also has limitations that can impact its effectiveness.

a) Complexity and Cost: Implementing a comprehensive Cost Accounting system can be complex and costly. This requires significant resources and expertise to manage and maintain.

b) Limited Scope: While effective for internal cost analysis, Cost Accounting does not always capture the broader financial context or external factors influencing profitability, potentially leading to incomplete financial insights.

c) Focus on Historical Data: Cost Accounting often relies on historical data, which may not always reflect current market conditions or future trends, potentially affecting the relevance of cost analysis.

d) Potential for Misinterpretation: Misinterpretation of cost data can occur if not analysed correctly, leading to misguided decisions and strategies that may not address underlying issues.

e) Resource-intensive: The detailed tracking and analysis required can be resource-intensive, potentially diverting focus from other critical areas of business management.

Learn the foundational skills in Financial Management with our Accounting Courses – Register today!

What is Management Accounting?

Management Accounting, also known as Managerial Accounting. It is an accounting system designed to collect, analyse, and interpret financial, qualitative, and statistical data. This system supports management in making informed decisions about business operations. Essentially, Management Accounting focuses on delivering insights tailored to the needs of specific managers and departments.

By utilising financial data, Management Accounting generates detailed reports such as budget forecasts, cost analysis, and variance analysis. Although distinct from Cost Accounting and Financial Accounting, it incorporates information from both to produce periodic management reports. Notably, Cost Accounting is considered a subset of Management Accounting.

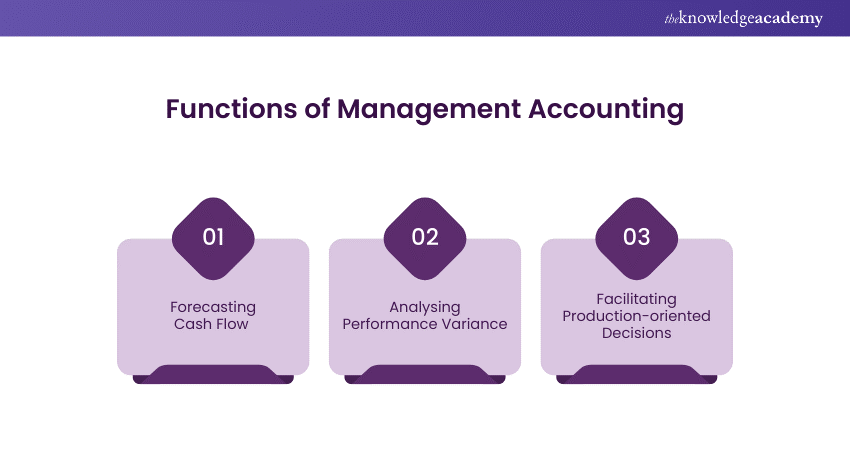

Functions of Management Accounting

Management Accounting provides essential information and data to plan and manage organisational operations effectively. It assists in organising resources, both human and non-human and analyses functions and responsibilities to improve efficiency and maximise profits. Here are the key functions of Management Accounting.

a) Forecasting Cash Flow

Management Accounting plays a crucial role in forecasting a firm’s future cash flow. Analysing financial trends and employing budgeting measures helps predict future cash flow and guide investment and production decisions.

b) Analysing Performance Variance

Management Accounting focuses on predictive analysis and addressing variances between estimated and actual costs. Through effective management accounting techniques, firms can bridge the gap between these costs.

c) Facilitating Production-Oriented Decisions

Data from Management Accounting aids business owners in evaluating the cost and profit implications of managerial decisions. This information helps determine whether to produce raw materials in-house or outsource them for cost-effective production.

Advantages of Management Accounting

Management Accounting offers several benefits that enhance decision-making and operational efficiency:

a) Informed Decision-making: It provides detailed and timely financial information tailored to specific managerial needs, enabling more accurate and informed decisions.

b) Performance Monitoring: Through various tools and techniques, such as budgetary control and variance analysis, Management Accounting helps monitor and improve organisational performance.

c) Resource Optimisation: By analysing costs and profitability, it assists in optimal resource allocation and improves the efficiency of operations.

d) Future Planning: Management Accounting aids in forecasting and budgeting, helping businesses plan for future financial needs and strategic initiatives effectively.

e) Cost Control: It identifies areas of inefficiency and suggests cost reduction strategies, which can lead to significant savings and enhanced profitability.

Disadvantages of Management Accounting

Despite its benefits, Management Accounting has some limitations:

a) Subjectivity: The information provided can be influenced by the manager’s subjective judgments, potentially leading to biased or inaccurate reports.

b) Costly Implementation: Developing and maintaining a comprehensive management accounting system can be expensive and resource-intensive.

c) Complexity: The system's complexity may require specialised skills and training, which can be a challenge for smaller organisations or those with limited resources.

d) Limited Historical Perspective: Unlike Financial Accounting, which focuses on historical data, management accounting may not always provide a full historical perspective, potentially affecting long-term strategic planning.

e) Data Overload: The extensive amount of data generated can sometimes overwhelm managers, making it difficult to focus on key performance indicators and actionable insights.

Do you want to acquire skills in budgeting, financial reporting, and effective accounting practices? Sign up with our Accounting Course now!

Understanding the Difference Between Cost Accounting and Management Accounting

Cost Accounting and Management Accounting each serve distinct functions in Financial Management. This table outlines their key differences, including their purpose, application, and impact on decision-making.

Learn the basic principle of Project Accounting with our Project Accounting Course - Join now!

Conclusion

Understanding the Difference Between Cost Accounting and Management Accounting is essential for any business aiming to thrive in today’s competitive environment. Cost Accounting helps you keep a close eye on expenses and improve operational efficiency, while Management Accounting provides the strategic insights needed for informed decision-making. By leveraging both, you can optimise resource allocation, enhance financial strategies, and drive your business towards greater success.

Become familiar with Cash Management to create and sustain a company's financial stability with our Cash Cycle Management Training – Register now!

Frequently Asked Questions

Cost Accounting is used to track, analyse, and manage costs to improve operational efficiency, control expenditures, and enhance profitability. It helps businesses identify cost-saving opportunities and make informed pricing and budgeting decisions.

Management accounting is used by internal managers, executives, and business owners. It provides them with detailed financial reports and analysis to aid in strategic planning, performance evaluation, and decision-making within the organisation.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including Accounting Course, Inventory Accounting and Costing Course and Accounting and Financial Statement Analysis Course. These courses cater to different skill levels, providing comprehensive insights into What is Corporate Finance.

Our Accounting and Finance Resources cover a range of topics related to Accounting, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Finance Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Accounting Course

Accounting Course

Fri 10th Jan 2025

Fri 14th Feb 2025

Fri 11th Apr 2025

Fri 23rd May 2025

Fri 8th Aug 2025

Fri 26th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please