We may not have the course you’re looking for. If you enquire or give us a call on +55 8000201623 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Navigating the world of Investments can be both exciting and daunting. Thankfully, a diverse range of Investment Tools exists to guide your journey towards financial success. From online brokerage platforms and robo-advisors to stock screeners and financial news aggregators – these tools empower you to make informed decisions. Thus, people willing to make great Investments and gain financial stability must learn about these Tools. So, wait no more. Explore this blog to learn about various Investment Tools and discover expert advice that can empower your Investment decisions. Keep reading to find out!

Table of Contents

1) What are Investment Tools?

2) Top 10 Investment Tools

a) Online brokerage platforms

b) Robo-advisors

c) Stock screeners

d) Financial news aggregators

e) Portfolio tracking applications

f) Investment forums and communities

g) Cryptocurrency exchanges

h) Real estate crowdfunding platforms

i) Retirement calculators

j) Tax-efficient Investment accounts

3) Conclusion

What are Investment Tools?

Investment Tools are indispensable instruments that empower individuals to navigate the complicated financial markets and make informed decisions regarding their Investments. They are a diverse range of resources, platforms, and applications designed to aid investors in various aspects of their Investment journey.

These Tools serve as bridges between investors and the intricate financial landscape, offering insights, analysis, and efficiency that traditional methods often struggle to provide. From online brokerage platforms that facilitate seamless trading of stocks, bonds, and other assets, to robo-advisors , these Tools cater to a wide spectrum of investor needs.

Today, these Tools have become the backbone of modern Wealth Management. They empower both beginners and seasoned investors to make strategic choices, optimise their portfolios, and respond effectively to market trends. Utilising these Tools not only streamlines processes but also enhances the likelihood of achieving financial goals while minimising potential risks.

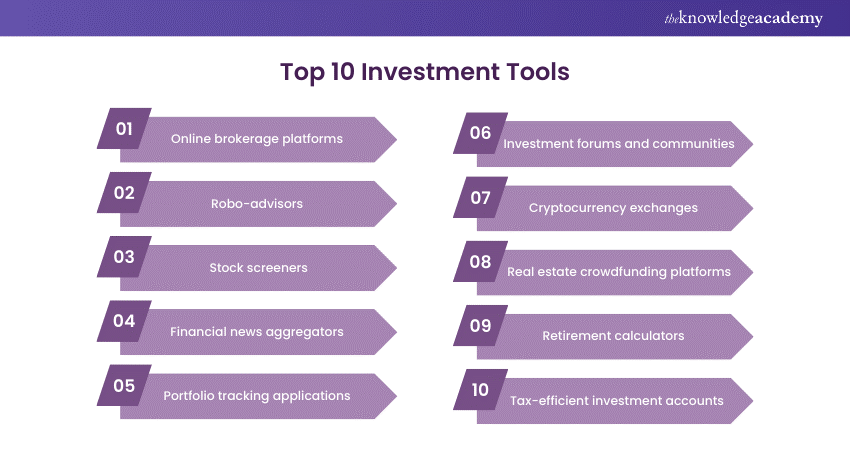

Top 10 Investment Tools

Now, let’s discuss some of the best Investment Tools you should know about before committing to any Investment:

Online brokerage platforms

Online brokerage platforms have revolutionised the way individuals invest in financial markets. These platforms offer a convenient way to buy and sell a number of financial instruments, including stocks, bonds, commodities, and more. They present investors with access to real-time market data, research tools, and educational resources that empower them to make informed decisions.

Moreover, online brokerages often offer different types of accounts, such as individual and retirement accounts, catering to various Investment goals. With their intuitive interfaces and secure transaction capabilities, online brokerage platforms have democratised investing, enabling individuals to take control of their financial future.

Robo-advisors

Robo-advisors are a boon for investors seeking a hands-off approach to portfolio management. These automated platforms use algorithms and advanced data analysis to create a diversified Investment portfolio tailored to your risk tolerance and financial goals.

Robo-advisors continuously monitor the market, automatically rebalance your portfolio, and make adjustments based on changing market conditions. This not only saves time but also ensures that your Investments align with your strategy. Robo-advisors have democratised professional portfolio management, making it accessible to investors with varying levels of expertise, Moreover, they provide a cost-effective alternative to traditional financial advisors.

Stock screeners

For investors looking to handpick individual stocks, stock screeners are invaluable tools. These Investment tools allow users to filter stocks based on specific criteria, such as market capitalisation, price-to-earnings ratio, dividend yield, and more.

Stock screeners enable investors to quickly identify companies that match their Investment criteria, streamlining the research process and helping to uncover potential opportunities. By providing a customisable way to scan through thousands of stocks, stock screeners aid investors in building a portfolio that aligns with their Investment goals and risk appetite.

Financial news aggregators

Staying informed is paramount in the dynamic world of investing, and financial news aggregators play a pivotal role in this. These platforms gather news from various reliable sources, curating articles on market trends, economic indicators, company earnings, and geopolitical events that impact financial markets.

By having all the relevant news in one place, investors can swiftly grasp the factors driving market movements and adjust their strategies accordingly. Financial news aggregators are particularly valuable for traders who need to respond swiftly to breaking news that can trigger volatility.

Portfolio tracking applications

In the pursuit of building a successful Investment portfolio, diligent monitoring is essential. Portfolio tracking applications offer investors an insightful overview of their holdings' performance. They allow users to consolidate all their Investments in one place, irrespective of asset class.

These apps offer features like real-time price tracking, performance analytics, and asset allocation breakdowns. This enables investors to make data-driven decisions, rebalance portfolios, and maximise returns. Portfolio tracking applications provide a comprehensive snapshot of an investor's financial position and aid in identifying areas that may require adjustments to align with Investment goals.

Ready to master the art of Investment? Explore our Investment and Trading Training Courses!

Investment forums and communities

"knowledge is power" holds true in the world of investing. Investment forums and online communities provide a platform for investors to share experiences, insights, and strategies. Engaging in discussions with fellow investors can expose individuals to diverse perspectives and new Investment ideas.

These platforms foster a collaborative learning environment where beginners can seek advice from experts, and experienced investors can refine their strategies through healthy debates. While it's important to critically evaluate information found in such forums, they offer a valuable opportunity for investors to tap into collective wisdom and stay attuned to market trends.

Cryptocurrency exchanges

Cryptocurrency exchanges serve as the gateway to the world of digital assets. These platforms facilitate the buying, selling, and trading of Cryptocurrencies like Bitcoin, Ethereum, and other altcoins. They provide users with a secure and accessible way to enter the cryptocurrency market.

Cryptocurrency exchanges present a variety of trading pairs and market analysis tools, and often feature advanced trading options. However, due diligence is crucial when choosing an exchange, as security and regulatory compliance vary. Cryptocurrency exchanges are essential for investors interested in diversifying their portfolios with this emerging asset class.

Real estate crowdfunding platforms

Real estate has historically been a lucrative Investment, but direct ownership often requires substantial capital. Real estate crowdfunding platforms address this barrier by allowing investors to pool their funds to invest in property projects. These platforms provide access to a range of real estate opportunities, from residential developments to commercial properties.

Investors can contribute a relatively small amount and expose themselves to the real estate market with the exception of the responsibilities of property management. Real estate crowdfunding combines convenience and diversification, making it an attractive option for those looking to participate in the real estate market without the traditional barriers to entry.

Retirement calculators

Planning for retirement is a critical financial objective, and retirement calculators simplify the process of determining how much you need to save. These tools consider factors like current savings, expected annual contributions, desired retirement age, and estimated lifespan to calculate the required savings amount.

Retirement calculators help individuals set realistic retirement goals and design Investment strategies to achieve them. By adjusting variables, users can visualise the impact of different scenarios on their retirement funds. These calculators provide a clearer roadmap for financial planning and aid in making informed decisions to secure a comfortable retirement.

Tax-efficient Investment accounts

When considering Investment strategies, it's essential to take into account the tax implications of your decisions. Tax-efficient Investment accounts are tools designed to minimise the tax impact on your returns. These accounts, often offered by governments to encourage long-term savings and Investment, come with specific tax advantages that can enhance your overall gains.

One common example of a tax-efficient Investment account is the Individual Savings Account (ISA) in the UK. ISAs allow individuals to invest up to a certain annual limit without paying income tax or capital gains tax on the returns generated within the account. This can significantly boost your growth over time.

These accounts can be especially advantageous for individuals in higher tax brackets, as they provide a means to shield a portion of your returns from taxation. Thus, they allow you to compound your gains more effectively over the long term.

Learn more about Investments with our Investment Management Masterclass – register now!

Conclusion

Leveraging these Investment Tools can elevate your financial journey. By harnessing the convenience, insights, and efficiency they offer, you position yourself for smarter Investment decisions. From tailored portfolios to real-time tracking and collaborative learning through forums, these tools redefine how we approach wealth-building.

Ready to master foreign exchange trading? Explore our comprehensive Foreign Exchange Training today!

Frequently Asked Questions

Investment Tools contribute to risk management by diversifying portfolios, analysing market trends, and tracking asset performance. These Tools also enhance performance by providing insights which is necessary for decision-making, know good business opportunities, and optimise how the assets are allocated effectively.

Mobile apps are one of the most important Investment Tools as they are easy to use and offer easy access so that people can participate more in Investments. Some of these tools have made it easy for the people residing in Uk to invest in financial markets. Some of these apps are – AvaTrade, Hargreaves Lansdown, eToro, Trading 212, etc.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy offers various Investment and Trading Training, including Cryptocurrency Trading Training, Investment Management Masterclass, and Day Trading Course. These courses cater to different skill levels, providing comprehensive insights into Investment methodologies.

Our Business skills blogs covers a range of topics related to Investment, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Trading skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please