We may not have the course you’re looking for. If you enquire or give us a call on +41 315281584 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Investing is like planting a seed for your money. Imagine each pound as a tiny seed you plant today. With the right care, that seed can grow into a big, strong tree. So, Investing is about making your money grow over time. It’s time to make your money earn for you. Before you Invest in stocks or anything else, you will need to have basic knowledge of How to Invest Money in the right way.

Just like different plants need different care, each Investment needs a different approach. Some grow fast, some slow, but they all aim to give you more money than you started with. That’s the magic of Investing – turning your savings into a bigger amount for the future. Go through this blog to have a good idea of How to Invest Money. Let's dive in!

Table of Contents

1) What are Investments?

2) Learn How to Invest Money?

a) Establish your Investment goals

b) Choose suitable Investment options

c) Determine your Investment amount

d) Align Investments with your risk appetite

e)Define your Investor profile

3) What is the ideal time to begin Investing?

4) Conclusion

What are Investments?

Investments refer to assets or items acquired with the goal of generating income or appreciating in value.

Typically, individuals opt for one of four primary Investment categories, each sharing similar features. These categories are collectively termed ‘asset classes’:

a) Shares - In this, you buy a stake in a company

b) Cash – The savings you deposit in a bank or building society account

c) Property – You invest in a physical building. This can be commercial or residential

d) Fixed interest securities (also called bonds) - They are given in return for loaning money to a business firm or government.

The various assets possessed by an Investor are called a portfolio. Generally, spreading your money between the different types of asset classes helps reduce the risk of your portfolio underperforming. There are several different ways of Investing. Many people invest through collective or ‘pooled’ funds such as unit trusts.

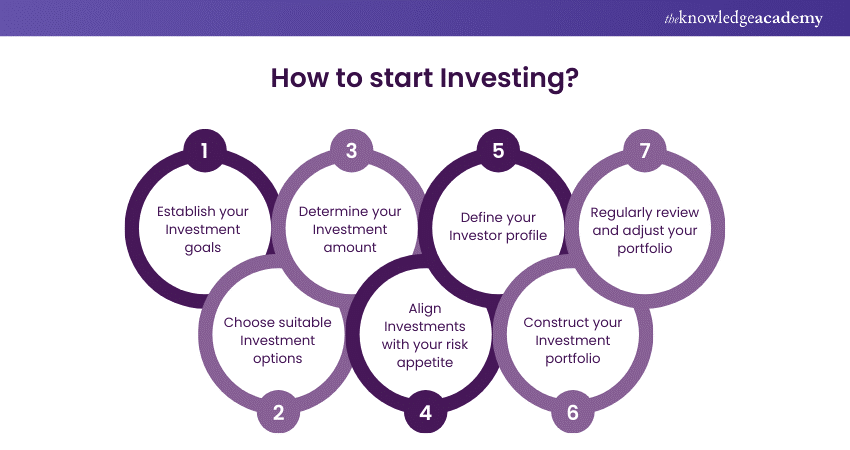

Learn How to Invest Money?

Investing involves trying to figure out where exactly you want to go on your financial journey and matching those goals to the right type of Investments that will help you get there. This implies you'll also have to understand and manage your relationship with risk over time.

If you know what you want, you simply jump in. You also make the decision to Invest by yourself or seek help from a Financial Planner. Below are some detailed key steps to help get you started with investing.

1) Establish your Investment goals

Consider your goals. Before you open an account, you should probably have in mind just what it is that you want, and then, from there, you would start looking through your Investment options. Please ask yourself questions such as, "Am I looking to Invest in the long term, or do I want a portfolio to generate income?

Asking these questions will help you narrow down the very few options available in front of you, which would make your Investment process simple. It will also help you to decide what amount of risk you can take after you identify your goals and the timelines in which you should have achieved them. Furthermore, it will help you decide which Investing accounts should be given priority.

For example, suppose you're planning to invest for your retirement. In that case, you'll likely want to explore tax-advantaged accounts such as an Individual Savings Account (ISA) or a pension scheme, like a Self-Invested Personal Pension (SIPP) or a workplace pension, if available through your employer.

While it might be tempting to put all your Investment funds into a pension due to the tax benefits, remember that you generally can't access these funds until you are 55 years old. Additionally, it's not advisable to keep your emergency fund in a brokerage account. The funds in such accounts aren't immediately accessible and are subject to market fluctuations.

If you need to access your money quickly during a market downturn, you might have to sell at a loss, which could deplete your emergency savings. Therefore, keeping your emergency fund in a readily accessible account, such as a cash ISA, ensures it's available when you need it most without the risk of market losses.

2) Choose suitable Investment options

After setting your financial goals, you'll need to choose the right Investment Vehicles sometimes referred to as Investing accounts to use. This may involve using multiple accounts to reach a single objective.

For those interested in a more active approach to building their Investment portfolio, a brokerage account is a strong option. Brokerage accounts allow you to buy and sell individual stocks, mutual funds, or ETFs (Exchange-Traded Funds). These accounts offer significant flexibility: there are no income limits for contributions, no caps on Investment amounts, and no restrictions on when you can withdraw your funds.

However, the trade-off with brokerage accounts is that they do not offer the same tax advantages as some other Investment accounts, such as ISAs or pensions. On the upside, brokerage accounts often provide the opportunity to speak directly with a human advisor for guidance, which can be reassuring and helpful. One limitation of traditional brokerages is that they can be slow to adopt new features or niche Investment options, like cryptocurrencies.

Another route you might consider within brokerage accounts is using a robo-advisor, which is ideal for individuals with straightforward Investment needs. Robo-advisors are attractive because they usually charge lower fees than human financial advisors and include automatic rebalancing of your portfolio. However, if you require more tailored Investment strategies or have complex financial needs, a robo-advisor might not be the best fit.

It’s important to remember that simply opening a brokerage account and depositing money does not equate to investing. This is a common misconception among newcomers. To actually invest, you need to make purchases within the account.

Are you interested in learning more about Content Marketing? Register now for our Content Marketing Course!

3) Determine your Investment amount

As you decide what Investment accounts you want to open, you should also decide on the amount of money that you're going to fund with each kind of account.

The amount you put in each account will depend on your Investment goal and the amount of time you have before you plan to reach that goal. Certain accounts may even limit one's Investment. Decide upon a percentage of your total income that you can Invest in making your portfolio.

As a general rule, while aiming at retirement targets, one has to make an Investment equivalent to 15% of their income on a yearly basis, but in case you have started to Invest late in your career or are aiming at having an early retirement, then a consideration of a higher percentage Investment may be considered. 15% is also accounting for any matches you get from your employer. That means you could be contributing 10% of your W2 income with an additional 5% match from your employer to reach a total of 15% to hit this benchmark.

If you are living from one check to the other, even 15% may look like a crazy amount to Invest. Do not get jitters; it is fine to start small, maybe at 1%. The more important point is that you get going, so your money has time to grow. Plan how you'd like to Invest your Money. A frequently asked question among users is whether one should invest his or her Money all at once or in equal amounts over some time. Both have their merits and demerits.

4) Align Investments with your risk appetite

Risk tolerance measures just how much risk an Investor is willing to take on for a higher return. Accordingly, it is perhaps the greatest determiner of your risk tolerance and maybe even the biggest determiner of which assets will appear in your portfolio. These are high-stakes questions because some assets turn out to be more volatile than others.

One of the measures of your risk tolerance level is filling out a risk tolerance questionnaire. These are usually a set of survey questions that will guide you in understanding your risk tolerance based on the responses you select.

For example, if someone had a more conservative risk tolerance, it might only mean a higher allocation of the percentage of the portfolio should be in bonds and cash rather than stocks. For an individual possessing an aggressive risk tolerance, it would imply that the larger percentage should be in equities. Keep in mind that while assessing your risk tolerance, it does not run parallel to your risk capacity. Your risk tolerance is your willingness to take more risk in search of higher returns.

Basically, risk tolerance is an evaluation of the emotions that you would react to your losses and the volatility. Risk capacity is the level of risk taken by an entity. It considers the things that would affect your financial ability to take risks. This is going to take into consideration things like your job status or caretaking duties and how much time you need to reach that goal. These other priorities can be rather capital-intensive, and they must fit in with your ability to take on risk.

5) Define your Investor profile

There is no one-size-fits-all approach to Investing. The type of Investor you want to be is directly tied to your risk tolerance and capacity, as some strategies may require a more aggressive approach. It is also tied to your Investing goals and time horizon. There are two major categories that Investors fall into short-term Investing (also referred to as trading) and long-term Investing.

The lure of short-term Investing is the potential to replace your current income with revenue made through buying and selling your Investments. The drawback is it can be both difficult and risky to see profits consistently because of how quickly the market can move and how unexpected news and announcements can impact an Investment in the short term.

Furthermore, short-term profits from Investments are usually taxed at a higher rate than long-term Investments. The IRS describes a short-term gain or loss as an asset that was purchased and sold in one year or less. Long-term capital gains and losses happen when the asset is held for more than one year.

Do you want to learn about Search Engine Marketing? Sign up now for our Search Engine Marketing (SEM) Training!

6) Construct your Investment portfolio

Having set your goals, understood your risk tolerance, and decide on how much money you must Invest and what kind of Investor you want to be, it's finally time to build out your portfolio. Building a portfolio brings together the right combination of assets to help you meet your goals. This way of building your portfolio helps you view your Investments through the context of what you are trying to achieve. It can be a good motivator to keep going. The first step is to choose the goal type for which you want to accumulate money and open the right type of account.

7) Regularly review and adjust your portfolio

Once you’ve selected your Investments, you’ll want to monitor and rebalance your portfolio a few times per year because the original Investments that you selected will shift because of market fluctuations.

For instance, if you decide to Invest 70% of money in stocks and 30% in bonds, it could be about 80% in stocks and just 20% if the stock market expands at a rapid pace compared to bonds. This is called portfolio drift, and if you don't check it properly, you may take more risks than you thought, which could impact your returns.

Rebalancing is the strategy of reallocating those funds to match your targeted allocation. A general rule of thumb is to rebalance any time your portfolio has drifted more than 5% from its initial allocation. One advantage of robo-advisors is that this rebalancing process is done for you automatically.

You’ll also want to tread carefully when looking at your Investments following a big drop in the market. This can lead Investors to make foolish decisions and sell their assets when the stock market has a bad week, month, or year, losing money for the Investors not only on their initial Investment but also a chance to buy the stocks when they are virtually on discount.

What is the ideal time to begin Investing?

If your cash savings account holds extra money—that you have at the very least to cover for yourself three to six months—and you want it to grow over time, consider Investing some of it.

The kind of Investments or savings that are most appropriate to you will depend on several factors, such as your financial condition, capacity to take risks, and the goals you have set for the future.

Improve your skills in Digital Marketing more with our Digital Marketing Masterclass now!

Conclusion

Investing money can indeed seem daunting for beginners but understanding key aspects such as How to Invest Money, the amount to invest, and your risk tolerance level can lead to sound financial decisions that will benefit you in the long term.

Frequently Asked Questions

The decision to Invest in gold can sometimes be rational since it usually holds its value and serves as an inflationary hedge. On the other hand, it does not return capital in the way that Investment in stocks or bonds would, and over the long run, it may not be able to produce superior returns compared to other kinds of Investments.

Yes, £100 is a good amount to start with in terms of Investing. Most of the platforms allow you fractional shares or have a low minimum Investment; hence, with this amount, you could take your first step into the Investment arena and later increase it once you learn and start earning.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Digital Marketing Courses, including Social Media Marketing Course, SEO Course, and Pinterest Marketing Course. These courses cater to different skill levels, providing comprehensive insights into Content Marketing vs Digital Marketing methodologies.

Our Business Skills blogs covers a range of topics related to Digital Marketing, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Digital Marketing skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Digital Marketing Resources Batches & Dates

Date

Content Marketing Course

Content Marketing Course

Fri 26th Jul 2024

Fri 4th Oct 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please