We may not have the course you’re looking for. If you enquire or give us a call on +41 315281584 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Did you know that companies using advanced Revenue Management techniques can boost their profits by twofold? It might sound surprising, but the right strategies can turn your pricing and inventory into powerful tools for maximising revenue. Revenue Management is all about predicting customer behaviour and making smart adjustments to optimise your earnings.

In this blog, we'll break down what Revenue Management is, why it’s essential in today’s market, and how you can apply these strategies to see tangible results. Whether you’re just starting out or looking to sharpen your skills, this blog is all you need.

Table of Contents

1) What is Revenue Management?

2) A Brief History of Revenue Management

3) Importance of Revenue Management

4) Strategies for Effective Revenue Management

5) Revenue Management KPIs and Metrics

6) Differences Between Revenue Management and Yield Management

7) Tips for Successful Revenue Management

8) Conclusion

What is Revenue Management?

Revenue Management is the art of selling your products or services to the right customer through the proper channels at optimal prices. Here, the price is a function of the customer’s need rather than the product’s economy. You can consider Revenue Management more as addressing the ‘who, what, where, why, and how’.

The goal is to present a cost-effective solution without compromising customer satisfaction. Revenue Management System (RMS) is commonly used in industries like Hotels, Car rental, Airlines, Restaurants, and Tourism.

Given below are some parameters that help in developing an appropriate Revenue Management strategy,

a) Forecasting demand

b) Determining user behaviour

c) Comprehending user spending habits

d) Analysing competitors' strategy using Business Intelligence

e) Creating a dynamic pricing plan

By sticking to these parameters, the Revenue Manager can make the right decision while adopting the most efficient Revenue plan. This effective plan will then serve as a roadmap to your business's financial sustainability.

A Brief History of Revenue Management

The origin of Revenue Management dates back to the early 1970s when British Airways BOAC started selling early-bird booking facilities. The Airline made some adjustments in pricing when they analysed fluctuations in demand. This gave birth to the first Revenue Management Systems (RMS), where the primary focus was on predicting consumer behaviour and optimising inventory. Soon, the success of RMS was getting noticed. These adaptions help them set rates and manage reservations effectively.

By the 2000s, RMS became more sophisticated with the introduction of the Internet. Industries began to utilise a broad spectrum of data. Starting from historical data to competitor pricing, it offered a deep analytical perspective of market dynamics. This allowed industries to use a more holistic Revenue Management approach.

In 2010, RMS took a significant turn with the rise of Big Data. The system has begun using advanced algorithms, predictive analytics, and Machine Learning (ML) to analyse data. This enhanced the accuracy of decisions surrounding pricing and made forecasting of demands more precise.

At present, RMS is characterised by Machine Learning and Artificial Intelligence. The systems can automate complex decision-making and personalise rates. Industries can analyse real-time data, change pricing plans and predict future trends to satisfy their customers.

Learn user demand forecasting methods with our Revenue Management Training – Register now!

Importance of Revenue Management

Revenue Management helps businesses maximise their profits by selling their products or services to customers. Now, companies can use sophisticated pricing algorithms to maximise their capacity while minimising the cost.

By carefully assessing customer demand and monitoring historical data, businesses can make decisions about pricing and services. This will help in boosting customer satisfaction. Moreover, Revenue Management helps identify opportunities for cross-selling and upselling. Let’s understand it with the help of an example,

Can you predict when a hotel will experience a high demand? That's right, it's on weekends. For example, if a hotel charges £100 per night during the week, they will make £700 per week without Revenue Management. However, by implementing Revenue Management and charging £100 on weekdays and £300 on Friday and Saturday nights, the hotel can increase its weekly Revenue to £1,100.

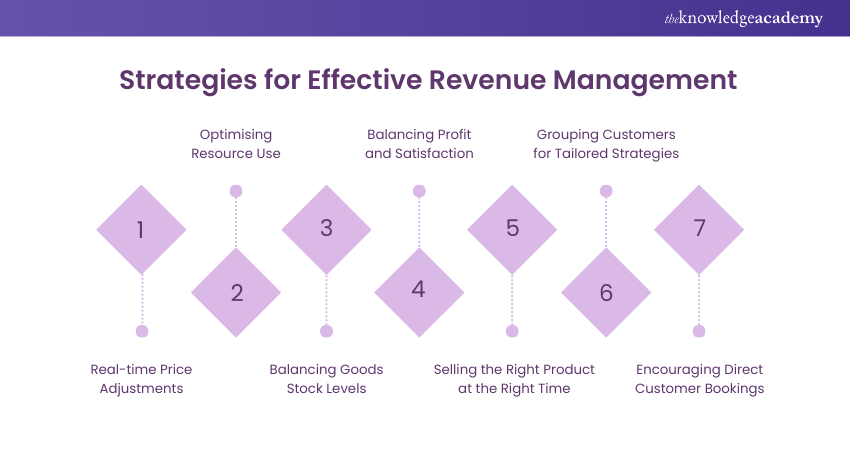

Strategies for Effective Revenue Management

Let’s explore some of the most effective Revenue Management techniques for increasing profits.

1) Dynamic Pricing

Dynamic pricing is also termed demand-based pricing. In this pricing technique, companies usually adjust their product pricing to compensate for real-time demand.

For example, an airline will use demand-based pricing to increase ticket prices during peak hours of demand, such as major events or holidays.

2) Capacity Management

Capacity Management is the computation of how much of a service or product a business can manufacture for selling. This is done to ensure their services and products are sufficient, which could lead to happy customers and loss of revenue.

To manage capacity effectively, businesses should have a sound understanding of their production abilities and customer demand. To create additional Revenue streams, they can identify a non-productive area and capitalise it.

3) Inventory Control

Inventory control allows businesses to have the right combination of services and products in stock to manage customer demand. This helps them minimise costs, enhance customer satisfaction, and double profits.

Inventory control is primarily seen in the hospitality industry because it deals with factors like supplier delivery schedules, customer demand, etc.

4) Pricing Optimisation

Pricing optimisation helps calculate the optimal price for a service or product. It analyses various factors like production costs, price elasticity, competitor prices, and customer demand. This strategy can be adopted by all kinds of businesses, from retail stores to restaurants.

5) Yield Management

Yield Management is another pricing strategy that is meant for businesses with time-sensitive inventory. It focuses on comparing pricing with respect to the inventory to boost Revenue.

6) Customer Segmentation

Customer segmentation divides your target audience into groups based on factors like needs, behaviour, and demographics. It allows businesses to have a better understanding of their customer so that they can create customised messages well. It also sets prices for maximum profits.

7) Incentivising Direct Bookings

Some businesses allow direct booking rather than through a third-party site. This strategy helps them save on fees and offer a good experience to their customers. Some of the ways a business incentivises direct booking include offering exclusive deals, loyalty rewards, and discounts.

Understand costing and pricing with our Costing And Pricing Training – Sign up now!

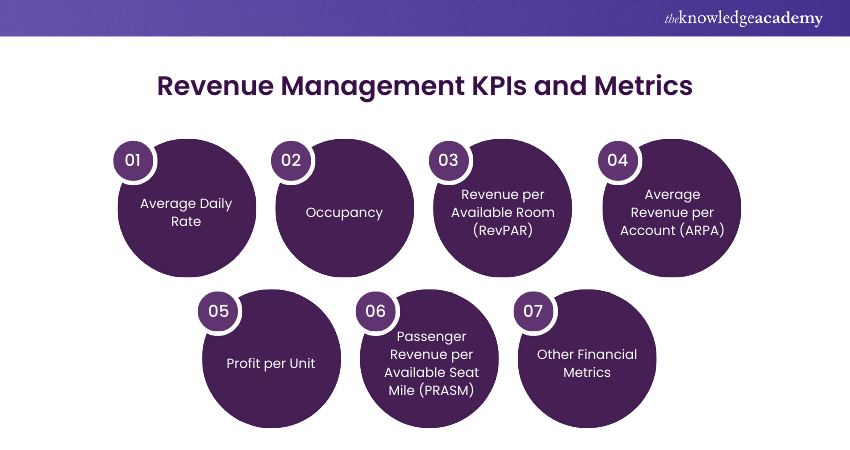

Revenue Management KPIs and Metrics

Revenue Management possesses some critical Financial Performance Indicators (KPIs) and metrics. Let’s explore them in detail,

a) Average Daily Rate: This refers to the average revenue per unit for a single day. It doesn’t include unrented periods and other income sources. It can serve as a good indicator of the pricing power of an offering.

b) Occupancy: It refers to the percentage of units rented over a given period. For example, how full a hotel is during the day or night.

c) Revenue per Available Room (RevPAR): It works in accordance with average daily rate and occupancy. Using RevPAR, hotels can find out how much each room is generating. This metric can be generalised for any rental business.

d) Average Revenue per Account (ARPA): This refers to the revenue per customer, which is calculated monthly.

e) Profit per Unit: It can take up many forms, like per vehicle, per airplane, or profit per room, depending on the industry type. For example, in the hotel industry, Gross Operating Profit Per Available Room (GOPPAR) is used.

f) Passenger Revenue per Available Seat Mile (PRASM): This KPI metric is used in the passenger airline industry. The Revenue generated from things like credit card loyalty schemes and cargo is often ignored in PRASM.

g) Other Financial Metrics: Revenue Management KPIs contain some additional metrics like EBITDA and final Revenue.

Take Control of Your Financial Future – Sign Up for Our Cryptocurrency Trading Training!

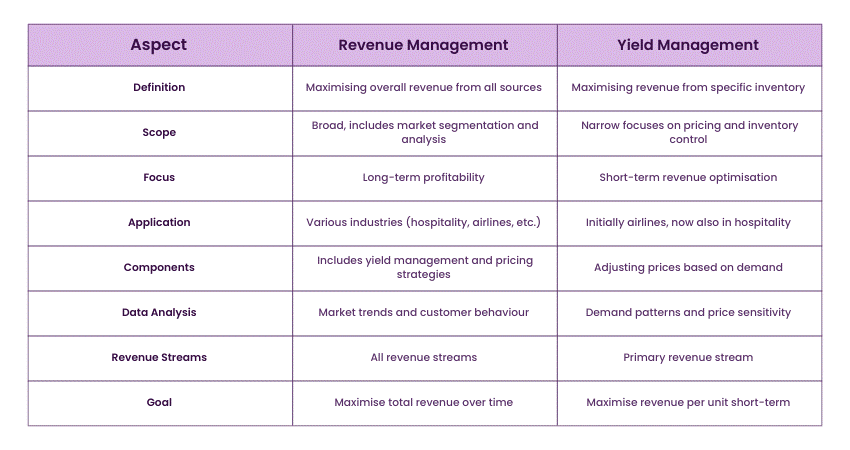

Differences Between Revenue Management and Yield Management

Yield Management and Revenue Management are two widely discussed approaches when it comes to maximising Revenue. However, both aim to boost the profitability of a business. Let’s understand both one by one via an example of a hotel,

Understanding Yield Management

Yield Management emphasises boosting revenue by selling rooms to the right customers at a reasonable price. The yield management system will assess internal data like demand levels, room segments, pricing, and historical data. Using this data, the system will make decisions on pricing and grab revenue opportunities. Since the system depends on a rule-based model, it has limited adaptability to market dynamics.

Understanding Revenue Management

On the other hand, Revenue Management utilises systems to maximise Revenue instead of getting into internal data analysis. It will integrate real-time data from the external market to calculate accurate prices that align with supply/demand fluctuations. In general, RMS uses Artificial Intelligence algorithms to gather, assess, and process market data about local events, demand, pricing, etc. After careful consideration, RMS will offer precise pricing advice.

Tips for Successful Revenue Management

Let’s explore some of the tips to succeed in Revenue Management and thrive in your industry.

a) Flex Room Rates: Practice dynamic pricing to increase the price when the demand is high and decrease the rates when the demand is low. This can boost the occupancy rates and overall Revenue.

b) Limit Stay Restrictions: Optimise your inventory management and tighten the stay restrictions when the demand is high. Similarly, the stay restrictions should be loosened when the market is low.

c) Diversify: Don’t rely on specific types of guests. Try to have a balanced mix by targeting different customers.

d) Manage Booking Channels: To achieve high occupancy levels, manage multiple booking channels like bed banks, social media sites, Wholesalers, websites, and metasearch engines.

e) Use Management Technology: A Revenue Management system will help businesses save time, grab Revenue opportunities, and improve decision-making. It can gather and sort real-time data.

Conclusion

Revenue Management is one of the rapidly growing fields that offers multiple opportunities to businesses of all kinds. By understanding the principles of pricing and revenue optimisation, a company can make informed decisions and boost its profits. For long-term success, use a Revenue Management tool that helps you forecast customer demand and automate business operations.

Learn data visualisation techniques with our Data To Insights Training today!

Frequently Asked Questions

The most common example of this is the hotel industry. The hotel has different revenue sources, such as room rates, advance bookings, etc.

Revenue Manager implements their financial knowledge to evaluate the impact of evolving market conditions on a company’s Revenue. They apply pricing strategies to enhance the performance of a business.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Training, including the Revenue Management Training, Real Estate Financial Modelling Training, and Bookkeeping Course. These courses cater to different skill levels, providing comprehensive insights into What is Financial Modelling.

Our Business Skills Blogs cover a range of topics related to Finance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Revenue Management Training

Revenue Management Training

Fri 3rd Jan 2025

Fri 7th Mar 2025

Fri 2nd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 7th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please