We may not have the course you’re looking for. If you enquire or give us a call on +41 315281584 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine having the power to turn the dream of homeownership into reality. As a certified Mortgage Advisor, you become the expert who guides individuals through one of the most significant financial decisions of their lives. This exciting journey starts with understanding What is CeMAP.

The Certificate in Mortgage Advice and Practice (CeMAP) is the golden ticket for those aspiring to excel in the mortgage industry. Endorsed by the Financial Conduct Authority (FCA) in the UK, CeMAP equips you with comprehensive knowledge of mortgage laws, policies, and practical applications. Ready to unlock your potential and explore the world of mortgage advising? Let’s delve into the significance of CeMAP and how it can elevate your career.

Table of Contents

1) What is CeMAP?

2) How much does CeMAP cost?

3) CeMAP exams

4) Benefits of obtaining CeMAP Certification

5) Career opportunities with CeMAP

6) Conclusion

What is CeMAP?

CeMAP stands as a beacon for those venturing into the world of Mortgage Advisory, symbolising a deep comprehension of the market’s intricacies, regulations, and ethical standards. Governed by the FCA, this qualification is a testament to an individual’s prowess and dedication to delivering top-notch Mortgage counse. This credential affirms your understanding and paves the way for many prospects in the ever-evolving Mortgage Advisory landscape.

CeMAP’s mission is to equip Mortgage Advisors with the essential know-how and abilities to offer sound advice on Mortgage. It delves into various subjects, from Mortgage offerings and application procedures to interest rate dynamics and moral guidelines. Ultimately, CeMAP’s primary purpose is to uphold exemplary standards in the Mortgage Advisory domain, ensuring consumer protection and trust.

How much does CeMAP Certification cost?

The CeMAP Certification is a highly regarded qualification for those looking to become Mortgage Advisors. The cost of obtaining the full CeMAP qualification is currently £645. This fee includes all the necessary study materials and the first exam attempt for each module.

CeMAP is divided into three modules, which cover the UK’s financial regulations, Mortgages, and an assessment of Mortgage advice knowledge. The qualification is registered with Ofqual in the Regulated Qualifications Framework (RQF). The exam costs £190 per module if you need to retake it or if it’s not included in your study package.

CeMAP exams

There are three CeMAP Exams: CeMAP 1, CeMAP 2, and CeMAP 3. Each exam can be broken down into the following modules:

CeMAP 1

CeMAP 1 is the first level of the qualification and focuses on providing a comprehensive understanding of Mortgage advice principles, regulations, and ethics. Let's break down the modules covered in CeMAP 1:

Level 1: UK Financial Regulations

Unit 1: Introduction to Financial Services Environment and Products

a) Module 1: Introducing the Industry, Regulations and Economics

b) Module 2: Tax, HMRC and Benefits

c) Module 3: Investment

d) Module 4: Products, Wrappers and Pensions

e) Module 5: Insurance and Assurance

Unit 2: UK Financial Services and Regulation

f) Module 6: Lending Types

g) Module 7: Customers, Concepts and Advising

h) Module 8: Customers, Concepts and Advising

CeMAP 2

CeMAP 2 is the second level of the qualification and focuses on expanding candidates' knowledge of Mortgage products and their applications. This level delves deeper into the technical aspects of Mortgages, repayment methods, and calculations. Let's break down the modules covered in CeMAP 2:

Level 2: Mortgages

Unit 3: Mortgage Law, Policy, Practice and Markets

a) Module 1: Introductions to Mortgages, Types of Repayment and Clients

Unit 4: Mortgage Applications

a) Module 2: Property Process and Regulations

b) Module 3: Assessment of Suitability: Regulation and the Buying Process

c) Module 4: Lending and Property

Unit 5: Mortgage Payment Methods and Products

a) Module 5: Financial Planning, Protection and Advice

Unit 6: Mortgage Arrears and Post Completion Issues

CeMAP 3

CeMAP 3 is the final level of the CeMAP qualification and focuses on applying Mortgage advice principles and ethical considerations practically. This level challenges candidates to apply their knowledge to real-life client scenarios and develop the skills to provide appropriate Mortgage advice. Let's break down the modules covered in CeMAP 3:

Level 3: Assessment of Mortgage Advice Knowledge

Unit 7: ASSM

Some module names overlap across exam levels because they expand on or continue the same module.

Take the next step in your Mortgage career - Sign up now for a comprehensive CeMAP Level 1, 2, And 3 Training!

Benefits of obtaining CeMAP Certification

Several advantages come after getting the CeMAP Certification, especially for people who want to pursue their career as Mortgage Advisors. Let’s look at some of them below:

a) Regulatory Compliance: CeMAP is endorsed by the FCA, which is one of the main reasons why this certification is so important among aspiring Mortgage Advisors. With this certification, Mortgage Advisors can legally practice their trade in the UK.

b) Industry recognition: This certification is one of the most popular, especially in the financial sector. Receiving this certification helps Mortgage Advisors in the UK receive industry recognition, which propels their professional careers further and helps them attract clients.

c) Comprehensive knowledge: CeMAP Certification covers various topics, including financial regulations, Mortgage law, and other practical skills. These skills help the candidates increase their financial advising skills.

d) Career opportunities: After completing this certification, many are open to candidates. Some of these opportunities are as follows: Mortgage Advisor, Financial Planner, and even Mortgage Loan Officer. Candidates can choose different career opportunities from various fields.

e) Client trust: Being a certified CeMAP professional automatically increases your client’s trust. This certification shows your credibility as a professional and increases your chances of being referred to a broader clientele.

f) Increased earnings potential: It also shows that professional Mortgage consultants usually earn more than non-certified consultants. Certification may result in promotion to a better job ranking, a change in remunerations to higher scales, and other incentives based on performance.

g) Professional development: CeMAP helps to enhance a professional's learning and growth since there is a detailed procedure for gaining a CeMAP Certification. It also acquaints you with new standards that are bounced around in the industry, recent developments, and practices that would otherwise make you lag in the field.

h) Networking opportunities: Becoming a CeMAP certified professional means that you have peers, and you can especially look forward to gaining advice from leaders in the field. This can also help you build your professional network and shape your career.

i) Flexibility in learning: CeMAP training has different modes, including online and in-person training. This means you are free to learn according to your own schedule and fit your studying in between other responsibilities.

j) Enhanced job satisfaction: Gaining CeMAP Certification can be satisfying as you become more competent in offering the best Mortgage advice that results in positive transformations within clients’ financial lives.

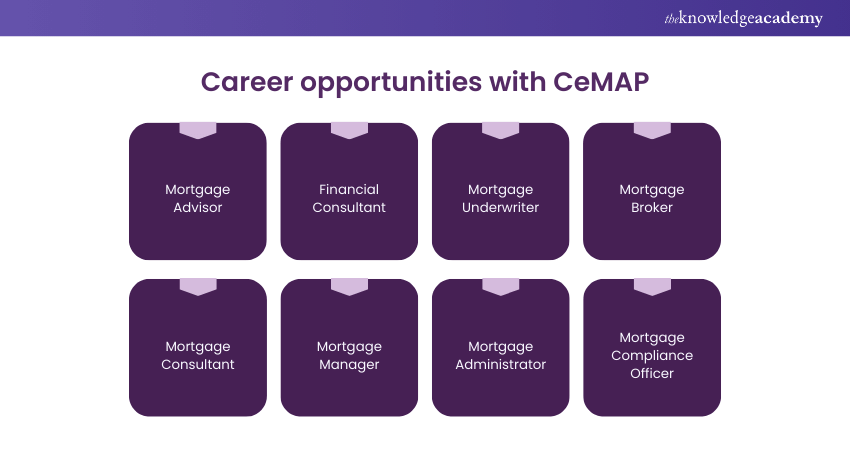

Career opportunities with CeMAP

Earning a CeMAP qualification offers diverse career prospects in the finance sector. Here is a list of some of the job positions that are available for CeMAP-qualified individuals:

a) Mortgage Advisor: CeMAP qualification enables you to work as a Mortgage Advisor who helps clients find the most suitable Mortgage product, supports them through the application process, and meets all the legal requirements.

b) Financial Consultant: The qualifications obtained through CeMAP can also help one become a Financial Consultant. With this qualification, you can advise on most matters of finance, such as Mortgages, investments, and insurance. Financial Consultants offer solutions customised to clients' financial needs, wants, and capabilities.

c) Mortgage Underwriter: Mortgage Underwriters are critical in Mortgage applications. They evaluate and approve loan requests for Mortgages, considering the stability and credit history of the applicants and the market value of the assets offered as security. This qualification prepares individuals to assess Mortgage Applications, analyse risks, and decide whether to approve a Mortgage or not.

d) Mortgage Broker: CeMAP holders can also work as independent intermediaries between the buyer and the seller to facilitate a Mortgage loan. Their main duties include assisting customers in understanding the Mortgage offering, searching for the best offer, and obtaining the most beneficial terms. As they specialise in Mortgages, they offer advice tailored to client needs, complete documentation, and assist clients while applying for a Mortgage. They can operate individually or with a brokerage house company.

e) Mortgage Consultant: A Mortgage Consultant is a professional who offers specialised services on legal matters concerning Mortgages. Having acquired CeMAP Certification, people can advise clients on Mortgage plans, remortgaging, and investment opportunities. Anyone who works as a Mortgage Consultant must ensure that they follow market trends, rates of interest and all sorts of changes in law so that they can offer reliable services to clients.

f) Mortgage Manager: Mortgage Managers are responsible for the Mortgage departments of financial institutions such as banks and other institutions. They maintain regulatory standards, oversee Mortgage portfolios, and formulate ways of attracting customers. This qualification provides individuals with the knowledge and understanding of Mortgage products and regulations to properly perform this managerial position.

g) Mortgage Administrator: Mortgage Administrators offer clerical assistance to Mortgage groups or divisions. They complete forms, manage Mortgage, deal with clients, and communicate with other firms and solicitors. People who get their CeMAP Certification can effectively perform administrative tasks related to the Mortgage sector and thus support the proper functioning of the Mortgage.

h) Mortgage Compliance Officer: Mortgage Administrators work in teams or departments and offer administrative services. They complete forms, input and sort Mortgages, communicate with clients, and deal with lenders and solicitors. CeMAP Certification enables candidates to perform administrative tasks related to the Mortgage field effectively and can support the operation of Mortgage plans.

Enhance your advisory knowledge with our CeMAP Courses – register now!

Conclusion

This blog discussed in detail about What is CeMAP and why is this certification important for any aspiring candidate to enter the domain of Mortgages and loans. It is safe to say that this certification helps in increasing the value of your professional career. We hope understanding its benefits and career opportunities can help you see the importance of getting your CeMAP Certification.

Unlock your potential in the Mortgage industry with CeMAP Training – Register now for expert guidance and comprehensive courses!

Frequently Asked Questions

Studying for CeMAP 1 typically requires around 60 to 80 hours of dedicated study.

CeMAP is not equivalent to a degree. It is a professional qualification focused specifically on Mortgage advice and practice.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various CeMAP Courses, including the CeMAP Course (Level 1,2 And 3). These courses cater to different skill levels, providing comprehensive insights into Mortgage Life Cycle.

Our Business Skills Blogs cover a range of topics related to Mortgage, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Mortgage Advisory skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 3rd Feb 2025

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 18th Aug 2025

Mon 27th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please