Popular searched areas in and around Crewe include:-

- Holmes Chapel

- Chorlton

- Weston

- Audlem

- Leighton

- Madeley

- Basford

- Cranage

- Hough

- Betley

- Wistaston

- Radway Green

- Balterley

- Madeley Heath

- Sproston

Capital Accounting Course Outline

The Capital Accounting Course is designed to provide delegates with comprehensive knowledge and skills in Capital Accounting practices. This course is particularly beneficial for the following professionals:

There are no formal prerequisites for this Capital Accounting Course. However, a basic understanding of accounting principles and financial statements may be beneficial.

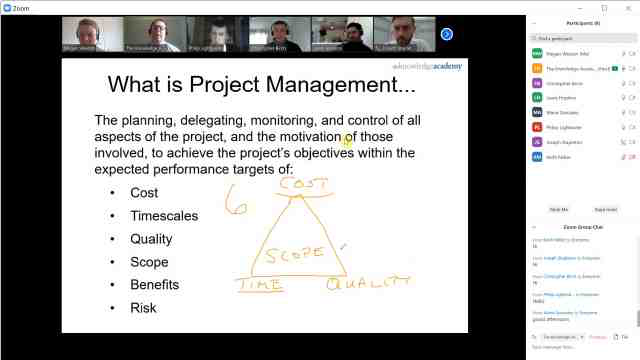

Capital Accounting is a specialised area of finance that focuses on managing and recording the acquisition, utilisation, and disposal of a company's capital assets. It plays a crucial role in ensuring that capital expenditures are accurately tracked and reported, which is vital for financial planning, compliance, and decision-making.

Proficiency in Capital Accounting is essential for Financial Analysts, Accountants, and Finance Managers. Mastering this field empowers professionals to effectively manage asset lifecycles, prepare accurate financial statements, and ensure regulatory compliance. It is crucial for those aiming to enhance their financial management capabilities and contribute to strategic business planning.

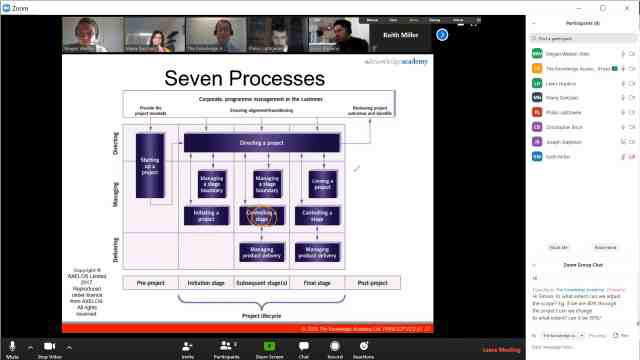

This intensive 2-days course by The Knowledge Academy equips delegates with fundamental concepts and practical skills in Capital Accounting. Through hands-on workshops and expert-led sessions, delegates will gain a comprehensive understanding of asset management, depreciation methods, capital budgeting, and reporting. Delegates will learn to apply Capital Accounting principles, prepare detailed asset reports, and manage capital investments effectively.

Upon completing this course, delegates will have acquired the knowledge and skills necessary to manage and report on capital assets effectively, making them valuable contributors to their organisations' financial health and strategic planning.

Why choose us

To make sure you’re always connected we offer completely free and easy to access wi-fi.

To keep you comfortable during your course we offer a fully air conditioned environment.

IT support is on hand to sort out any unforseen issues that may arise.

This location has full video conferencing equipment.

Popular searched areas in and around Crewe include:-

Experience live, interactive learning from home with The Knowledge Academy's Online Instructor-led Capital Accounting Course in Crewe. Engage directly with expert instructors, mirroring the classroom schedule for a comprehensive learning journey. Enjoy the convenience of virtual learning without compromising on the quality of interaction.

Unlock your potential with The Knowledge Academy's Capital Accounting Course in Crewe, accessible anytime, anywhere on any device. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers. Elevate your skills at your own pace with our Online Self-paced sessions.

Experience the most sought-after learning style with The Knowledge Academy's Capital Accounting Course in Crewe. Available in 490+ locations across 190+ countries, our hand-picked Classroom venues offer an invaluable human touch. Immerse yourself in a comprehensive, interactive experience with our expert-led Capital Accounting Course in Crewe sessions.

Boost your skills with our expert trainers, boasting 10+ years of real-world experience, ensuring an engaging and informative training experience

We only use the highest standard of learning facilities to make sure your experience is as comfortable and distraction-free as possible

Our Classroom courses with limited class sizes foster discussions and provide a personalised, interactive learning environment

Achieve certification without breaking the bank. Find a lower price elsewhere? We'll match it to guarantee you the best value

Streamline large-scale training requirements with The Knowledge Academy's In-house/Onsite at your business premises. Experience expert-led classroom learning from the comfort of your workplace and engage professional development.

Leverage benefits offered from a certification that fits your unique business or project needs

Cut unnecessary costs and focus your entire budget on what really matters, the training.

Our offers a unique chance for your team to bond and engage in discussions, enriching the learning experience beyond traditional classroom settings

The course know-how will help you track and evaluate your employees' progression and performance with relative ease

You won't find better value in the marketplace. If you do find a lower price, we will beat it.

Flexible delivery methods are available depending on your learning style.

Resources are included for a comprehensive learning experience.

"Really good course and well organised. Trainer was great with a sense of humour - his experience allowed a free flowing course, structured to help you gain as much information & relevant experience whilst helping prepare you for the exam"

Joshua Davies, Thames Water

Back to course information

Back to course information

We may not have any package deals available including this course. If you enquire or give us a call on 01344203999 and speak to our training experts, we should be able to help you with your requirements.

To help and support our clients we are providing a limited number of 250 daily discount codes. Hurry, first come, first served!

To help and support our clients we are providing a limited number of 250 daily discount codes. Hurry, first come, first served!

If you miss out, enquire to get yourself on the waiting list for the next day!

If you miss out, enquire to get yourself on the waiting list for the next day!

(344 remaining)

close

Press esc to close

close

Fill out your contact details below and our training experts will be in touch.

Back to Course Information