We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Forex Trading, or Foreign Exchange Trading, is the decentralised global market where currencies are traded. This massive liquidity provides ample trading opportunities for Traders of all levels. Traders can prefer to trade with the biggest Forex Broker in the world, IC Markets, which records 14.84 billion GBP in average trading volume every day, or with a smaller, more niche broker.

To engage in Forex Trading, you need a Forex Broker to provide you with a platform, tools, and access to the market. With many options available, finding the best Forex Broker that aligns with your trading style and preferences can be daunting. This blog will provide you with a list of the top Forex Brokers and teach you how to choose the best Forex Brokers for your trading needs. Don’t miss this opportunity to become a better trader!

Table of Contents

1) What are Forex Brokers?

2) Best Forex Brokers in the UK

3) How to evaluate a Forex Broker?

4) How to choose the best Forex Broker?

5) Conclusion

What are Forex Brokers?

Forex Brokers are financial firms or individuals that facilitate Forex Trading for Retail Traders by providing them with a platform to access the Foreign Exchange Market. These Brokers play a crucial role in executing trades on behalf of Traders and offering various services such as leverage, trading tools, and analysis. Since Forex Trading occurs 24/7 across the globe, Brokers enable Traders to participate in the market at any time.

Best Forex Brokers in the UK

A reliable Broker should offer a secure and user-friendly trading platform, competitive spreads, various currency pairs, and excellent customer support. Let's take an in-depth look at some of the most prominent Forex Brokers, each bringing unique features to the table.

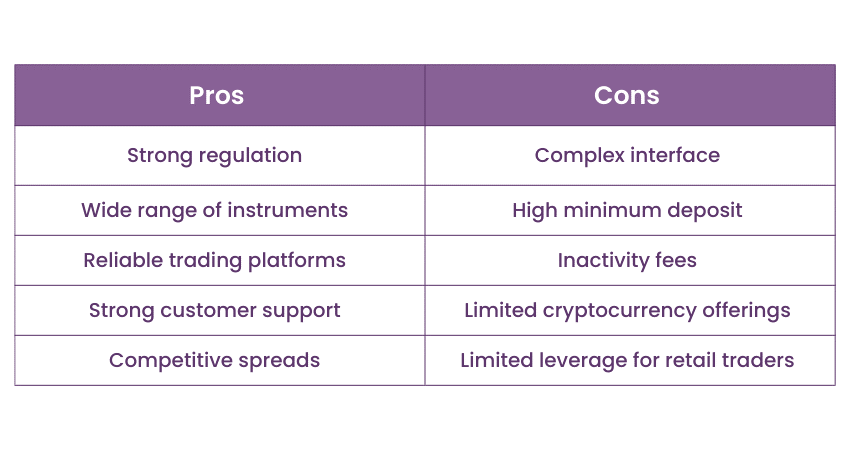

1) IG Group

IG is a well-regulated and publicly traded Forex Broker that has been at the forefront of the industry for over 40 years. Founded in 1974 as IG Markets, IG has evolved into one of the world’s best online trading platforms, offering Traders innovative products and services that enhance their trading experience. IG is regulated by the UK's Financial Conduct Authority (FCA), providing Traders with a high level of security and transparency.

IG has a strong UK base and a global reach, holding dozens of regulatory licenses from major authorities around the world. IG has also been recognised as one of the most trusted Brokers in the industry, winning the top ranking for the Trust Score category for the ForexBrokers.com 2023 Annual Awards. The key features are:

a) Platform innovation: The Broker offers its proprietary platform, IG Trading, alongside the popular MetaTrader 4 (MT4) platform. These platforms are equipped with cutting-edge tools and features.

b) Massive asset range: IG provides access to an extensive range of tradable assets, including Forex pairs, indices, commodities, cryptocurrencies, and more.

c) Research and analysis: Traders can benefit from IG's rich research and analysis resources, including real-time news feeds, technical analysis tools, and economic calendars.

2) Interactive Brokers

Interactive Brokers is a well-capitalised and publicly traded (NASDAQ: IBKR) Brokerage firm that offers Traders access to diverse and competitive markets around the world. Founded in 1977 and regulated in nine Tier-1 jurisdictions, Interactive Brokers has become one of the industry’s pioneers, known for its technological innovation and advanced trading solutions. Interactive Brokers UK Limited is authorised and regulated by the FCA, ensuring compliance with strict regulatory standards.

With a strong UK base and a global reach, Interactive Brokers caters to both retail and institutional Traders who seek comprehensive and reliable trading services. Its key features are:

a) Sophisticated platforms: The Broker provides Trader WorkStation (TWS), a powerful and customisable trading platform that caters to both beginners and advanced Traders.

b) Global market access: Interactive Brokers offers access to many global markets, including Forex, stocks, options, futures, and more.

c) Low costs: The Broker is known for its competitive pricing structure, offering low spreads, commissions, and financing rates.

d) Algorithmic trading: Interactive Brokers supports algorithmic trading and provides APIs for Traders interested in automated trading strategies.

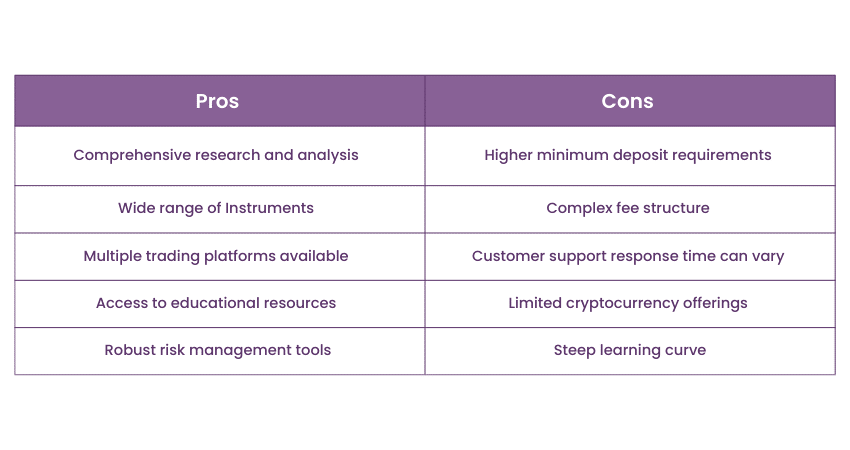

3) Saxo Bank

Saxo Bank is a premier Forex Broker that has earned its reputation as an industry leader by offering comprehensive trading experience, innovative technology, and a global reach. Saxo Bank is regulated by the FCA and adheres to high regulatory standards for client protection and operational transparency. Saxo Bank has been at the forefront of financial innovation, serving both retail and institutional clients with a wide range of trading instruments and services.

The key features of Saxo Bank are:

a) Trading platforms: The Broker offers SaxoTraderGO and SaxoTraderPRO platforms, both equipped with advanced charting, trading tools, and risk management features.

b) Market access: Saxo Bank provides access to an extensive array of asset classes, including Forex, stocks, bonds, commodities, and options.

c) Educational resources: Saxo Bank offers comprehensive educational materials, including webinars, tutorials, and market insights to enhance Traders' skills.

d) Institutional services: The Broker caters to both retail and institutional clients, offering tailored solutions for different trading needs.

4) CMC Markets

CMC Markets is a UK-based financial services company that offers online trading in shares, spread betting, Contracts for Difference (CFDs) and foreign exchange across world markets. CMC is headquartered in London, with hubs in Sydney and Singapore.

It is listed on the London Stock Exchange and regulated by the FCA in the UK, The Australian Services and Investment Commission in Australia and the Monetary Authority of Singapore (MAS) in Singapore. CMC Markets is a leader in low-cost Forex Trading, with measurably lower trading costs compared to the industry. Its key features are:

a) Next-generation platform: The Broker offers the Next Generation platform, known for its intuitive interface, advanced charting, and order execution capabilities.

b) Range of tools: Traders can access a wide range of Forex pairs, commodities, indices, and cryptocurrencies, allowing for diverse trading strategies.

c) Education and analysis: CMC Markets provides educational webinars, video tutorials, and a wealth of market analysis tools to help Traders make informed decisions.

Master Cryptocurrency trading and capitalise on digital assets – Join our Cryptocurrency Trading Training today!

5) FOREX.com

Renowned for its reliability, innovation, and extensive trading services, FOREX.com stands as a well-established Forex Broker with a strong reputation. It is regulated by the FCA in the UK, ensuring adherence to strict regulatory standards. With a global presence and a strong foothold in the UK, FOREX.com offers Trader's access to the dynamic world of Forex with a wide range of features and tools.

The key features of FOREX.com are:

a) Advanced platforms: The Broker provides the FOREXTrader platform and MetaTrader 4 (MT4), both equipped with advanced trading tools and features.

b) Competitive pricing: FOREX.com offers competitive spreads, low commissions, and no deposit or withdrawal fees, making it cost-effective for Traders.

c) Research and analysis: Traders can access market analysis, research reports, and economic calendars to stay informed about market developments.

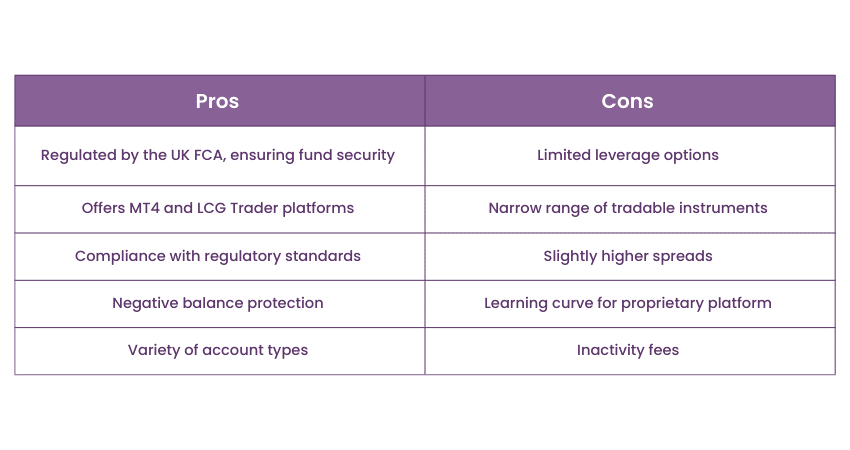

6) London Capital Group (LCG)

LCG, short for London Capital Group, is a reputable Forex Broker that has been catering to Traders' needs for many years. It is authorised and regulated by the FCA in the UK. This regulatory oversight ensures that the Broker adheres to strict industry standards and maintains a secure trading environment for its clients. With its headquarters in London, LCG is known for its commitment to transparency, diverse trading options, and comprehensive Forex trading platforms.

The key features of LCG are:

a) Trading platforms: The Broker offers the LCG Trader platform and MetaTrader 4 (MT4), both equipped with advanced charting tools, technical indicators and order execution features.

b) Market access: Traders can access a variety of asset classes, including Forex, indices, shares, commodities, and cryptocurrencies.

c) Research and analysis: LCG provides in-depth market analysis, daily market updates, and technical analysis reports to help Traders make informed decisions.

7) XTB Online Trading

XTB Online Trading, also known as X-Trade Brokers, is a well-established Forex Broker with a global presence. XTB Online Trading platform is regulated by the FCA in the UK, providing Traders with a high level of security and regulatory compliance. With its strong reputation for reliability and technological innovation, XTB has become a popular choice among Traders of varying experience levels.

The key features of XTB Online Trading are as follows:

a) Regulation: XTB Online Trading platform is regulated by the Financial Conduct Authority (FCA) in the UK, providing Traders with a high level of security and regulatory compliance.

b) xStation Platform: The Broker's proprietary xStation platform offers a user-friendly interface, advanced charting tools, and one-click trading functionality.

c) Educational resources: XTB offers educational materials, including video tutorials, trading courses, and market analysis, to support Traders' learning journey.

d) Range of instruments: Traders can access a diverse array of instruments, including Forex pairs, indices, commodities, cryptocurrencies, and more.

e) Research and analysis: XTB provides daily market analysis, economic calendar updates, and real-time news feeds to keep Traders informed.

Level up your trading skills with our expert-led Day Trading Masterclass – Sign up today!

8) Pepperstone

Pepperstone is an Australian online broker that provides CFD trading and spread betting on thousands of global markets. Pepperstone is part of the Nasdaq-listed StoneX Group and is regulated by the Australian Securities and Investments Commission (ASIC), FCA in the UK and many more authorities world-wide.

Pepperstone is a highly regulated Forex and CFD broker that offers fast and reliable trading platforms, razor-sharp spreads, industry-leading liquidity and a wide range of trading tools and instruments.

The Key features of Pepperstone are as follows:

a) Multiple platforms: The Broker offers MetaTrader 4 (MT4) and cTrader as its primary Forex trading platforms, both known for their cutting-edge features and user-friendly interfaces.

b) Razor account: Pepperstone's Razor account offers ultra-low spreads and fast execution, making it suitable for scalpers and active Traders.

c) Market access: Traders can access a wide range of Forex pairs, commodities, indices, and cryptocurrencies, allowing for diversified trading strategies.

d) Advanced trading tools: Pepperstone offers advanced trading tools like Smart Trader Tools, aiding in enhanced analysis and trading decision-making.

9) City Index

City Index is a global spread betting, FX and CFD Trading provider. City Index is part of the Nasdaq-listed StoneX Group and is regulated by the FCA in the UK, the ASIC in Australia, the Monetary Authority of Singapore (MAS) in Singapore and many more authorities world-wide.

City Index offers traders access to over 12,000 markets across forex, indices, shares, commodities and cryptocurrencies, with competitive spreads, fast execution and award-winning platforms.

The key features of the City Index are:

a) Regulation: The City Index platform is regulated by the Financial Conduct Authority (FCA), ensuring a high level of regulatory compliance and client protection.

b) Advantage Web Platform: The Broker offers the Advantage Web platform, known for its intuitive interface, advanced charting, and technical analysis tools.

c) Range of Instruments: Traders can access a wide range of Forex pairs, indices, commodities, and cryptocurrencies, allowing for diversified trading strategies.

d) Mobile trading: This Forex trading Broker offers mobile Trading apps, enabling Traders to manage their positions and monitor the markets on the go.

10) eToro

eToro is not just a Forex Broker; it's a social trading platform that has redefined the way Traders approach the markets. Founded in 2007, eToro has gained widespread recognition for its innovative approach to trading, enabling Traders to connect, learn from, and even copy the strategies of successful investors. With its UK operations regulated by the Financial Conduct Authority (FCA), eToro provides a unique and user-friendly trading experience.

The key features are:

a) Regulation: eToro UK is regulated by the Financial Conduct Authority (FCA), ensuring compliance with regulatory standards and client fund protection.

b) Social trading: The eToro platform enables Traders to engage in social trading by following and copying the trading strategies of experienced investors.

c) Range of instruments: Traders can access Forex pairs, stocks, commodities, cryptocurrencies, and more, offering diverse investment opportunities.

d) User-friendly interface: With its user-friendly interface, the eToro platform caters to Traders of all levels, whether they're beginners or experienced Traders.

e) Copyportfolios: eToro offers thematic investment portfolios, known as CopyPortfolios, allowing Traders to invest in a diversified group of assets.

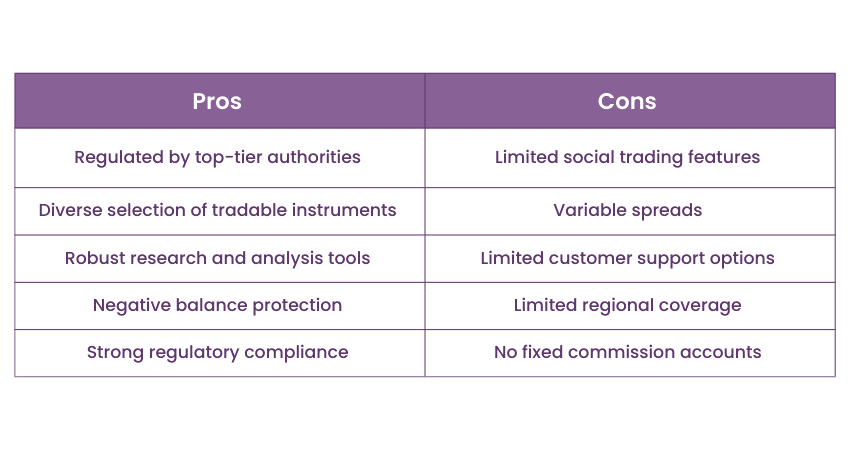

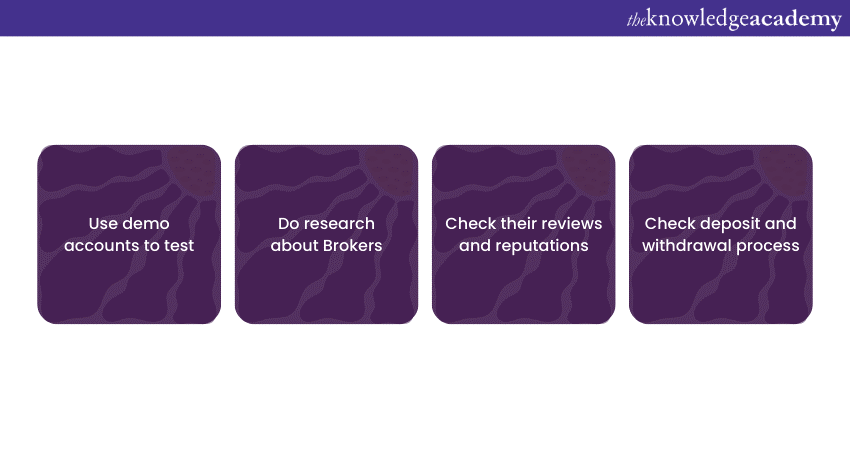

How to evaluate a Forex Broker?

Before selecting your preferred Forex Broker, it’s important to evaluate them. Here’s how you can do it:

1) Demo accounts: Utilise demo accounts to test a Broker's platform and trading conditions without risking real money. This helps you assess if the Broker's offerings align with your trading strategy and preferences.

2) Research and education: Search for Brokers that offer educational resources such as webinars, tutorials, and market analysis. A Broker invested in its Traders' education demonstrates a commitment to their success.

3) Reviews and reputation: Research online reviews and testimonials provided by other Traders to gauge the Broker's reputation.

4) Deposit and withdrawal process: Evaluate the Broker's deposit and withdrawal methods, fees, and processing times. A seamless and transparent transaction process is essential to ensure smooth trading experiences.

How to choose the best Forex Broker?

Forex Trading is a popular and lucrative activity that attracts millions of Traders worldwide. However, choosing the best Forex Broker for your needs and preferences can be a challenging task, as there are many factors to consider. Here are some of the most important aspects to look for when selecting a Forex Broker:

a) Regulation and security: You want to trade with a Broker that is regulated by reputable authorities and offers a high level of security for your funds and personal data. Check the Broker’s license, reputation, and history of compliance with the rules and regulations of the jurisdictions where they operate.

b) Trading platforms and tools: You want to trade with a Broker that provides you with reliable and user-friendly trading platforms and tools that suit your trading style and goals. Look for platforms that offer fast execution, advanced charting, technical analysis, market news, and trading signals. Also, check the Broker’s mobile and web-based trading options, as well as the compatibility with third-party platforms such as MetaTrader and cTrader.

c) Trading costs and conditions: You want to trade with a Broker that offers you competitive and transparent trading costs and conditions, such as spreads, commissions, swaps, and slippage. Compare the Broker’s fees and charges across different account types, currency pairs, and trading instruments. Also, check the Broker’s leverage, margin requirements, minimum deposit, and withdrawal policies.

d) Customer service: You want to trade with a Broker that provides you with excellent customer service and education, such as 24/5 support, multilingual staff, live chat, phone, and email.

e) Trading products and markets: You want to trade with a Broker that offers you a wide range of trading products and markets, such as Forex, CFDs, commodities, indices, stocks, Cryptocurrencies, and more. Look for Brokers that give you access to the most liquid and popular markets, as well as the opportunity to diversify your portfolio and explore new trading opportunities.

Conclusion

Choosing the right Forex Brokers is a crucial decision for any Trader. By considering key factors like regulation, trading platform, trading conditions, and support services, you can narrow down your options and find a Brokerage that suits your needs. Successful Forex Trading requires not only a reliable Broker but also a solid trading plan, discipline, and continuous learning.

Empower your trading journey with our Foreign Exchange Training. Register now to gain a competitive edge in the Forex market!

Frequently Asked Questions

Yes, you can become a Forex Broker if you have the necessary knowledge, experience, and resources. To start a Forex Brokerage business, you need to follow these steps:

a) Choose a platform provider that offers reliable and cost-efficient solutions for trading, liquidity, risk management, and more.

b) Register your company and obtain a license from the relevant regulatory authority in your jurisdiction.

c) Open a call centre and hire and train your sales team to attract and retain clients.

d) Drive traffic to your brokerage website through various marketing channels and strategies.

Yes, Forex Brokers are regulated by various supervisory bodies around the world that set standards and guidelines for their operations. Forex Broker's regulation serves as a safeguard for traders, protecting them from fraudulent activities and unfair practices and ensuring the integrity of the financial markets. Some of the major regulatory bodies for Forex Brokers are:

a) The Financial Conduct Authority (FCA) in the UK

b) The Australian Securities and Investments Commission (ASIC) in Australia

c) The Cyprus Securities and Exchange Commission (CySEC) in Europe

d) The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the US

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

Explore Investment and Trading Courses with The Knowledge Academy, where more courses await, including Foreign Exchange Training, Cryptocurrency Trading Training, and Stock Trading Masterclass. Tailored for various skill levels, these courses offer in-depth insights into Investment and Trading methodologies.

Dive into our Business Skills blogs, a trove of resources covering Investment and Trading topics. Whether you are a beginner or aiming to enhance your Trading skills, The Knowledge Academy's diverse courses and insightful blogs are your go-to source.

Upcoming Advanced Technology Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 17th Jan 2025

Fri 21st Feb 2025

Fri 4th Apr 2025

Fri 6th Jun 2025

Fri 25th Jul 2025

Fri 7th Nov 2025

Fri 26th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please