We may not have the course you’re looking for. If you enquire or give us a call on +357 26030221 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you at a crossroads in your financial career, wondering whether to pursue CeMAP or CII Certification? With both paths offering distinct advantages, the decision can be daunting. Choosing between CeMAP and CII Certification isn’t just about the credentials—it’s about where you see yourself thriving in the financial sector.

Have you ever considered what truly aligns with your professional interests? CeMAP or CII Certification could shape the trajectory of your career in finance. This blog explores key differences, benefits, and considerations to help you choose the right certification for your career ambitions. Ready to discover which path will lead you to success in the world of finance? Let’s delve into the details and find out.

Table of Contents

1) Overview of CeMAP and CII

2) Differences Between CII and CeMAP

3) Choosing Between CeMAP or CII

4) Benefits of Obtaining CeMAP or CII Certifications

5) Conclusion

Overview of CeMAP and CII

CeMAP

CeMAP, expanded to Certificate in Mortgage Advice and Practice, is a widely recognised certification that focuses on mortgage advice and practice. It equips individuals with the necessary skills and knowledge to provide expert mortgage advice and help clients make informed decisions about their home financing.

The CeMAP Exam is divided into three levels: CeMAP Level 1, CeMAP Level 2, and CeMAP Level 3. Each one builds upon the previous level, providing a more detailed understanding of mortgage advising. By completing the CeMAP Qualification, individuals demonstrate their competence in the mortgage industry and their ability to navigate clients through the process of obtaining a mortgage. Is CeMAP Worth It? This structured and comprehensive certification not only enhances your skills but also solidifies your credibility as a mortgage professional.

CII

The CII Certification, offered by the Chartered Insurance Institute, focuses on the insurance sector. It aims to develop professionals who possess the necessary expertise to navigate the complexities of insurance products, risk assessment, underwriting, and claims management. CII offers various certifications and qualifications covering multiple aspects of insurance, including general insurance, life and pensions, financial planning, and risk management.

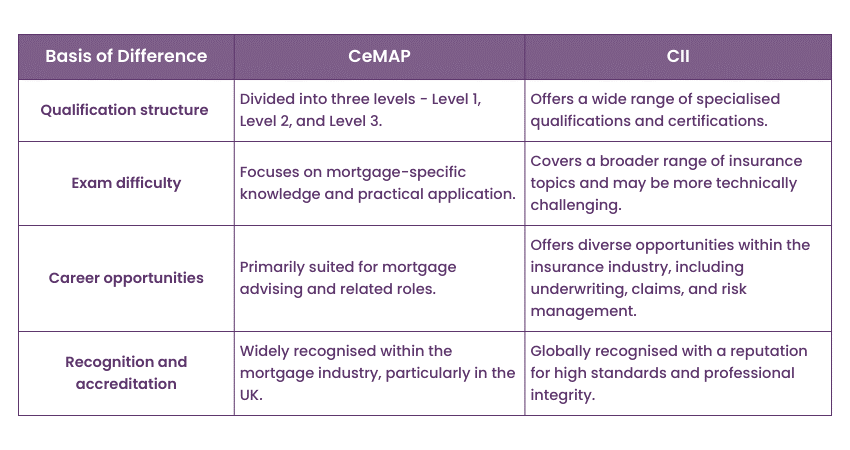

Differences Between CeMAP and CII

Understanding the differences between CeMAP and CII is crucial for individuals considering a career in mortgage advising or the insurance sector. Here are some key disparities between these certifications:

Boost your financial expertise and career prospects with our in-depth Accounting & Finance Training – sign up today!

Choosing Between CeMAP or CII

Deciding between CeMAP or CII Certifications requires careful consideration of individual career goals, interests, and the specific sector of the finance industry one wishes to pursue. Here are some factors to evaluate when making this important decision:

a) Personal Goals: Consider your personal goals within the finance industry. Are you specifically interested in the Mortgage Life Cycle and the mortgage industry? If so, CeMAP may be the more suitable option as it focuses specifically on mortgage advice and practice. Alternatively, if you have a broader interest in insurance-related roles or risk management, CII offers a wide range of specialised qualifications in these areas.

b) Industry Requirements: Research the specific industry requirements and preferences in the field you wish to enter.CeMAP is widely recognised within the Mortgage industry, particularly in the UK, and is often a standard qualification for Mortgage Advisors. If your career aspirations align closely with mortgage advising, CeMAP may be the more relevant choice. CII Certifications, on the other hand, have broader international recognition and are sought after by insurance professionals looking to advance their careers globally.

c) Time and Financial Investment: Consider CeMAP Exam Tips on the time and financial investment required for each certification. is divided into three levels, allowing individuals to progress gradually and potentially spread the investment of time and money across multiple stages. CII certifications offer a variety of qualifications, each with its own requirements. Assess the feasibility of dedicating the necessary resources for either certification and choose the option that aligns with your personal circumstances.

Embark on your journey to being a certified Mortgage Advisor with comprehensive CeMAP Courses (Level 1, 2, and 3) – sign up today!

Benefits of Obtaining CeMAP or CII Certifications

Listed below are some benefits of obtaining CeMAP or CII certifications:

a) Comprehensive knowledge

b) Industry standards

c) Wide career options

d) Enhanced employability

e) Continuous professional development

f) Trust and confidence

g) Networking opportunities

h) Personal growth and confidence

Enhance your financial expertise and prepare for a successful career with our Financial Analyst Training – sign up now!

Conclusion

Choosing between CeMAP or CII Certifications depends on your career aspirations within the financial sector. Both pathways offer distinct advantages and opportunities for growth. By exploring the unique benefits and aligning them with your ambitions, you'll make an informed decision that propels your career to new heights. Choose wisely and thrive!

Take the initial step towards a career in mortgage advising with CeMAP Training - sign up now!

Frequently Asked Questions

CII qualifications do not expire. Once you have obtained a CII qualification, it remains valid for life. However, it's important to maintain your knowledge and skills through Continuous Professional Development (CPD) to stay updated with industry changes and best practices.

CeMAP qualification can be challenging due to its comprehensive content on mortgage advice and regulations. However, with dedicated study and preparation, many candidates successfully pass and achieve certification.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various CeMAP Courses, including CeMAP Course (Level 1,2 And 3). This course caters to different skill levels, providing comprehensive insights into Become a Mortgage Advisor.

Our Business Skills Blogs cover a range of topics related to Earned Value Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Project Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 3rd Feb 2025

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 18th Aug 2025

Mon 27th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please