We may not have the course you’re looking for. If you enquire or give us a call on +420 210012971 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The endgame of any business operation is the desired financial triumph; That’s what every organisational level culminates into. In that respect, think of the Chief Financial Officer (CFO) as an organisation’s financial virtuoso who orchestrates budgets, forecasts, and financial strategies with masterful precision and ensures monetary harmony. Navigating the complex world of finance, they oversee the company’s fiscal well-being and steer it towards sustainable growth.

If you are envisioning a future in this role, you will need detailed guidance on How to Become a CFO and this blog aims to do just that. Keeping in focus the sharp eye for detail and strategic mindset that CFOs wield in achieving fiscal brilliance, this blog details the steps for becoming a CFO.

Table of Contents

1) What is a CFO?

2) Steps to Becoming a CFO

3) Requirements for a Chief Financial Officer (CFO)

4) Key Responsibilities of a CFO

5) CFO Salaries and Career Outlook

6) Conclusion

What is a CFO?

A Chief Financial Officer (CFO) is an executive responsible for managing a company’s financial actions. CFO is a top-level position that involves working alongside the CEO and other executives to ensure a successful trajectory for the company.

Traditionally, a CFO would supervise the finance and accounting departments, ensuring accurate and timely financial reports, successful Cash Flow Management, and regulatory compliance. They used to provide a "tick box" response to management decisions.

However, the role is far more proactive today as a CFO drives the organisation's direction and success by leveraging financial data to inform and shape operational strategy.

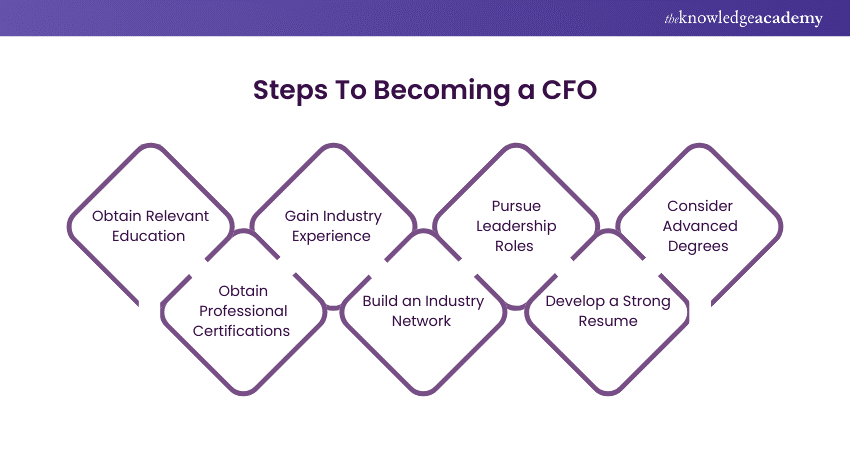

Steps to Becoming a CFO

CFOs are required to have a specific skill set and years of relevant professional experience. Consider this list as your ultimate steppingstones on How to Become a CFO:

1) Obtain Relevant Education

The educational path to becoming a CFO is quite flexible. Most employers require candidates to hold at least a Bachelor’s Degree in a finance-related field. A popular choice for aspiring CFOs is a Bachelor of Science in Finance or Accounting, though degrees in economics or other business fields can also help.

To further hone your skills as you gain experience, consider taking short online courses in:

a) Business Risk Management

b) Compliance Management

c) Import and Export Management

d) Strategic Business Management

These courses can provide a deeper understanding of analysis, budgeting, compliance, and risk management.

2) Gain Industry Experience

While you can start gaining experience during your undergraduate studies, it’s also crucial to build your industry expertise after graduation. Consider an internship in Accounting or Finance to observe processes and practice tasks you may have to handle in the future as a CFO.

After finishing your education, look for entry-level positions that provide professional growth opportunities or help you develop a strong skill set. Consider roles such as:

a) Accounting Assistant

b) Financial Analyst

c) Staff Accountant

d) Tax Preparer

3) Pursue Leadership Roles

Given how a CFO holds a position of high authority, developing leadership skills is essential for aspiring CFOs. You can start in entry-level roles and gradually transition to managerial and leadership positions to sharpen your people management abilities.

Roles within accounting or treasury departments to consider include:

a) Internal Audit Manager

b) Finance Manager

c) Controller

d) Director of Finance

4) Consider Advanced Degrees

As you gain professional leadership experience, consider pursuing advanced higher education, like a Master's Degree in Finance or Accounting or Master of Business Administration (MBA). Depending on your college, these programs typically take one to three years to complete.

Pursuing an advanced degree can elevate your skills in Business Administration and Finance Management. It provides opportunities to work on projects and case studies, enabling you to incorporate theoretical knowledge in practical scenarios. This can pave the way to securing your future as a CFO.

5) Obtain Professional Certifications

While professional certifications are often optional for CFOs, many earn specialty credentials to expand their expertise and impress employers. The following credentials can help in help in developing practical knowledge of Accounting and Finance:

1) SAP Financial Accounting

2) Accounting and Financial Statement Analysis

These certifications will teach you Financial Analysis, Investment Analysis and Portfolio Management and showcase your dedication to professional development and high-level qualifications to employers.

Your dream of ascending to the C-Suite is just a click away. Sign up for our CMI Level 7 Award in Strategic Management and Leadership Practice Training now!

6) Build an Industry Network

As you gain experience and become a company leader, consider expanding your professional network. Joining professional organisations and networking at industry events will enhance connection with fellow professionals and industry leaders.

This step can open doors to new professional development opportunities, career prospects, and mentorship, all of which can elevate your career growth.

7) Develop a Strong Resume

As you create your resume, highlight the most recent relevant experiences. Remember these points:

a) Many employers demand at least eight to 10 years of professional experience in finance or accounting to become a CFO.

b) Some employers often prioritise previous departmental leadership experience.

c) Highlight your highest level of education and the quantifiable results you have achieved throughout your career.

d) Add a ‘Skills’ section that showcases your top qualifications.

e) Include a ‘References’ section to encourage employers to seek feedback from your network about your impact and success.

Requirements for a Chief Financial Officer (CFO)

While the extra education and certifications go a long way, they aren’t a necessity to becoming a CFO. In fact, Chief Financial Officer requirements will vary from company to company.

Of course, there are specific expectations a company will have about a candidate applying for this role. You will need to craft a resume that breaks down your personal skills, relevant education, and the relevant amount of work experience.

Here are some requirements to keep in mind for any aspiring CFO:

Personal Skills

There is no substitute for people skills and CFOs will be expected to communicate with shareholders, fellow executives, boards, and employees at every organisational level. The required personal skills include the following:

a) Leadership: CFOs are expected to possess leadership qualities as they will be managing teams, providing directives, and casting vision that gets people from every department on board. Thus, developing leadership skills can be just as valuable as math and accounting for a CFO.

b) Time Management: Time Management is a crucial part of providing financial leadership at a company. It aids in managing staff alongside self-management.

c) Accounting Knowledge: CFOs need acquire a significant body of knowledge revolving around accounting. From daily tasks to ongoing projects, they will be responsible for managing everything .

d) Technology Prowess and Data Analytics: Accounting and Finances are currently managed by different software platforms. Data analytics enables CFOs to not only see the broader picture but focus on areas and identify outliers as well. A modern CFO needs to be able to access and analyse data while being able to utilise and oversee the use of financial tech.

e) Financial Strategy Vision: A CFO oversees the high-level strategies and vision that drive a company’s financial planning and operations. The ability to craft and communicate both the broader vision and task-related execution is often part of a CFO’s job.

Diversify your workforce and amplify your organisation’s productivity through our CMI Level 7 Award In Strategic Approaches To Equality, Diversity And Inclusion Course. Sign up now!

Professional Qualifications for a CFO

Work qualifications are crucial for securing the CFO position. Although these requirements are not set in stone, a lot of companies expect a CFO with significant experience.

Typically, candidates will have 8-10 years of experience in a senior role within a company before being promoted to CFO. This extensive experience is usually necessary to demonstrate that you have the essential skills and knowledge required for the job.

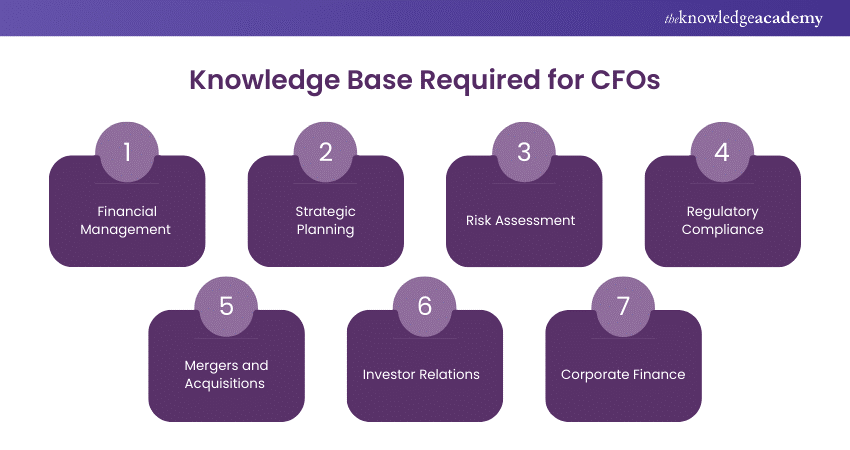

During these years, aspiring CFOs should aim to acquire a deep understanding of:

a) Financial Management

b) Strategic Planning

c) Risk Assessment

d) Regulatory Compliance

e) Mergers and acquisitions

f) Investor relations

g) Corporate Finance

Educational Background for Becoming a CFO

To become a CFO, you will need at least a Bachelor’s Degree in a related field. These fields may include:

a) Finance: A Finance Degree includes courses in Corporate Finance, Investment Analysis, Cost Accounting, Financial Modeling, Portfolio Management, and more.

b) Accounting: An Accounting track covers courses in Business Tax Accounting, Financial Accounting, Managerial Accounting, Auditing, and theory courses.

c) Economics: Economics degrees offer a range of topics, including Government, Labor Economics, Economic Theory, Economic Development, and Banking.

d) Business Administration: Business Administration Degrees (often leading to an MBA), include courses in Business Ethics, Resource Management, Organisational Leadership, Strategic Planning, and Financial Management.

Even though it’s not mandatory, a Master’s Degree in the following fields can increase your chances of succeeding as a CFO:

a) Master of Business Administration (MBA): This degree is achieved by taking the GMAT and completing an MBA program. It covers areas such as Finance, Economics, Accounting, Marketing, Ethics, and Management.

b) Master of Science in Accounting (MSA): This degree delves deeper into Accounting Principles and Concepts, including Auditing/Taxation, Financial Analysis, Statement Analysis, and IT.

c) Master of Public Administration (MPA): This degree provides in-depth knowledge of Communications, Organisational Theory, Institutions/Values, Human Resource Management, Public Service Leadership and More.

d) Master of Accounting for Financial Analysts: This degree focuses on theory with courses like Valuation Analysis, Quantitative Modeling, Corporate Finance and Management.

e) Master of Accounting for Financial Managers: This degree combines theoretical and practical understanding with courses such as Investment Management, Building Capital Structures, Global Economics, Corporate Finance, Maintaining Cash Flows and Quantitative Financial Reviews.

Key Responsibilities of a CFO

A CFO must be well-versed in diverse elements of Financial Management ranging from Accounting to broader Investment and Banking operations. The key responsibilities of a CFO include:

a) Lead the company’s financial planning strategies.

b) Conduct Risk Management by analysing the organisation’s liabilities and investments.

c) Formulate investment strategies by considering cash and liquidity risks.

d) Control and assess the organisation’s fundraising plans and capital structure.

e) Ensure adequate cash flow for the organisation’s operations.

f) Supervise all finance personnel including treasurers and controllers.

g) Manage relationships with vendors.

h) Prepare accurate current and forecasting reports.

i) Establish and manage the company’s finance IT system.

j) Ensure compliance with laws and company policies.

k) Lead a team of Financial Controllers and Financial Analysts.

CFO Salaries and Career Outlook

The salary and job prospects for the role of CFO are very strong. Consider these stats:

a) According to Glassdoor, a Chief Financial Officer's average yearly income in the UK is £160,077 per year. A CFO may also receive bonuses, commissions, and profit-sharing plans.

b) During the first quarter of 2024, there were approximately 1.54 million people employed in the Finance and Insurance sector in the UK, compared with 1.19 million in the first quarter of 2017.

c) According to a survey by Deloitte featuring the CFOs of 37 UK-listed companies, the combined market value of these companies surveyed was calculated to be £201 billion (or approximately 8% of the UK quoted equity market).

|

Country |

Average CFO Salary (Per Year) |

|

UK |

GBD 160K |

|

India |

INR 297K |

|

Australia |

AUD $93K |

|

USA |

USD 336K |

|

Canada |

CAD159K |

|

Singapore |

SGD 60K |

|

Dubai |

AED 77K |

Source: Glassdoor

Salaries are influenced by a candidate’s education, additional skills and certifications, and years of experience in the role. Other factors, such as company size and industry type, can also affect the salary offered. Compensation, including bonuses, varies by region and is often higher in developed countries and metropolitan areas.

Despite these figures, applicants for CFO encounter a highly competitive market, primarily due to the roles' attractive salaries. However, this does not indicate a slowdown in CFO vacancies. Since the 2020 pandemic, there has been an increased demand from business owners and management teams for timely and accurate data to identify trends, and forecast productivity.

Conclusion

The path of How to Become a CFO is challenging yet immensely rewarding. We hope this blog has provided you with the insights and inspiration needed to begin this journey with confidence. Remember, achieving CFO excellence requires a strategic blend of financial education, valuable experience, and persistent networking. Best of luck on your journey!

Looking to level up your leadership skills? Sign up for our CMI Level 7 Certificate In Leadership Coaching And Mentoring Training now!

Frequently Asked Questions

A Bachelor’s Degree in a Finance-related field such as Accounting, Economics, Public Administration, or Business Administration is good for CFO. A Master’s Degree in Business Administration is also beneficial.

Some of the biggest challenges for CFO include Controlling job costs, disconnected data, embracing new technology, compliance and governmental regulatory changes, and satisfying the demand of the business for real-time data

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers CMI Level 7 Training, including CMI Level 7 Award in Leadership Coaching and Mentoring Training Course Outline and CMI Level 7 Diploma in Strategic Management and Leadership Practice Training Course Outline. These courses cater to different skill levels, providing comprehensive insights into Financial Management.

Our ILM, CMI Leadership & Management cover a range of topics related to Financial Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming ILM, CMI Leadership & Management Resources Batches & Dates

Date

CMI Level 7 Award in Strategic Management and Leadership Practice Training Course

CMI Level 7 Award in Strategic Management and Leadership Practice Training Course

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please