We may not have the course you’re looking for. If you enquire or give us a call on +45 89870423 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

An extensive understanding of What is Compliance and its requirements is vital for organisations to navigate the business environment with confidence. Abiding by the protocol can them ensure ethical and responsible business operations.

A key challenge for Compliance Officers is the lack of skilled resources, which make up for more than 36 per cent of the organisational hurdles faced, according to the Thomson Reuters Cost of Compliance Report of 2022. Thus, is time to learn about what Compliance is, the distinctions between regulatory and corporate Compliance, and careers in compliance, including the chief compliance officer.

Table of Contents

1) Understanding What is Compliance

2) Exploring the different types of Compliance

3) Key components of Compliance

4) The benefits of Compliance Procedures

5) What are the various legal requirements?

6) Careers in Compliance domain

7) Conclusion

Understanding What is Compliance

Compliance refers to conforming to laws, regulations, guidelines, and standards relevant to a particular industry or sector. It entails adhering to prescribed rules and fulfilling obligations to ensure legal and ethical conduct in business operations. Additionally, it is crucial to ensure organisations operate with integrity and accountability. It is of various types, such as the following:

a) Regulatory Compliance

b) Financial Compliance

c) Data Privacy Compliance

d) Environmental Compliance

e) Internal Compliance

Exploring the different types of Compliance

After learning What is Compliance, here are the various Types of Compliance explained in further detail:

a) Regulatory Compliance: This type focuses on complying with laws and regulations set by governmental bodies or industry-specific authorities. It ensures that organisations meet standards related to safety, quality, consumer protection, financial reporting, and more.

b) Financial Compliance: This type involves following laws and regulations related to financial transactions, accounting practices, tax obligations, and reporting requirements. It guaranteestransparency, accuracy, and integrity in financial operations. Additionally, organisations must comply with regulations such as the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

c) Data privacy Compliance: This type concerns with safeguarding of personal and sensitive information collected from individuals. It involves complying with data protection laws, ensuring secure data storage, obtaining consent for data usage, and implementing privacy measures.

d) Environmental Compliance: This type emphasises Compliance with environmental laws, regulations, and standards to mitigate adverse impacts on the environment. It involves Waste Management, pollution reduction, resource conservation, and the promotion of sustainable practices.

e) Internal Compliance: This type denotes Compliance with the organisation's internal policies, procedures, and codes of conduct, respectively. It ensures that employees follow ethical guidelines, maintain professional conduct, and act in the best interests of the company.

Acquire a better understanding of Effective Compliance by signing up for the Effective Compliance Training now!

Key components of Compliance

The key components of Compliance include the following:

a) Policies and procedures: Establishing comprehensive and clear policies and procedures is vital for achieving Compliance. These documents outline rules, guidelines, and expectations. Thus, they ensure that employees adhere to consistent and transparent standards.

b) Training and education: Effective training programs enable employees to grasp organisation’s requirements and understand their roles in regulatory maintenance. Moreover, regular workshops and resources ensure employees stay current with evolving regulations.

c) Risk assessment and management: Regular risk assessments identify potential vulnerabilities. Organisations can then implement suitable controls, mitigation strategies, and monitoring processes to minimise risks by being Compliant to industry standards.

d) Monitoring and auditing: Continuous monitoring and auditing are crucial for evaluating effectiveness. Regular reviews, internal audits, and checks ensure ongoing adherence to laws, regulations, and internal policies.

e) Reporting and documentation: Accurate reporting is vital as organisations must maintain records of activities, incidents, corrective actions, and document policies and procedures.

The benefits of Compliance procedures

The key Benefits of Compliance are described as follows:

a) Legal and regulatory Compliance: Organisations can avoid legal penalties, fines, and damage to their reputation by ensuring Compliance with laws and regulations.

b) Reputation and brand protection: It contributes to building a positive reputation and protecting the brand image. It signals trustworthiness, ethical conduct, and dedication to responsible business practices.

c) Improved operational efficiency: The practices streamline processes, reduce errors, and enhance operational efficiency, resulting in cost savings and smoother operations.

d) Enhanced data security: It helps safeguard sensitive information, preventing data breaches, unauthorised access, and potential legal consequences.

e) Ethical conduct and corporate social responsibility: It also promotes ethical conduct, ensuring organisations operate with integrity and accountability. It also advances corporate social responsibility by endorsing responsible business practices and sustainability initiatives, showcasing the benefits of corporate social responsibility in fostering a positive impact.

Learn how you can be more compliant with law, regulation and company policy by signing up for our Compliance Training now!

What are the various legal requirements?

Based on the company's size and industry, various laws and guidelines become relevant. International businesses, in particular, must adhere to a certain legal frameworks of all the markets they engage in. Notably significant are the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, both incorporate provisions aimed at preventing corruption.

The EU Money Laundering Directives and the Money Laundering Act are important regulations that organisations must adhere to. ISO 37301 outlines the establishment of a globally standardised and certifiable Compliance Management System, inclusive of Whistleblowing Guidelines.

Moreover, EU Directive 2019/1937, effective since 2019, safeguards whistleblowers from reprisals.

Careers in Compliance domain

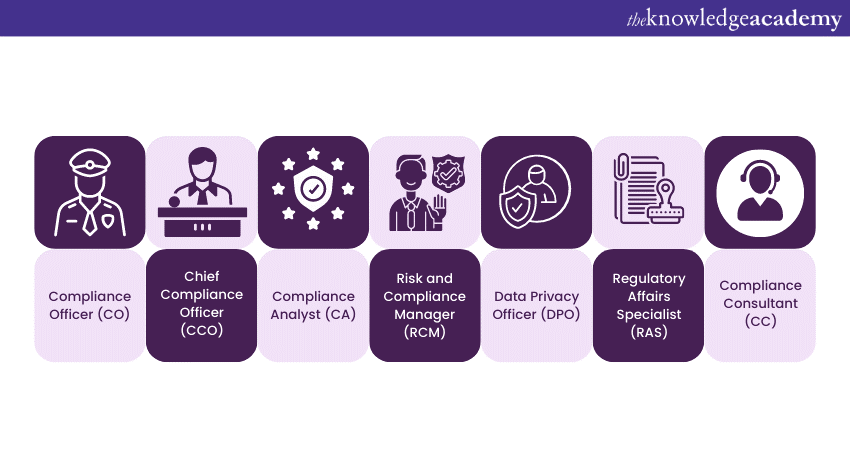

Careers in Compliance domain offer diverse opportunities for individuals seeking roles focused on ensuring ethical and legal adherence within organisations. Some key career paths include:

a) Compliance Officer (CO): Compliance officers are responsible for developing, implementing, and monitoring the corresponding programs within organisations. They ensure adherence to laws, regulations, and internal policies and help identify and mitigate risks.

b) Chief Compliance Officer (CCO): The CCO is a senior executive who oversees an organisation's entire operation. Their responsibilities involve establishing the strategic course of programs, ensuring regulatory procedure fulfilments, and reporting to senior management and board members.

c) Compliance Analyst (CA): Compliance Analysts assist in the development, implementation, and maintenance of programs. They conduct risk assessments, monitor activities, and assist in drafting policies and procedures.

d) Risk and Compliance Manager (RCM): Risk Managers focus on identifying and managing risks within organisations. They develop risk mitigation strategies, conduct audits, and ensure adherence to regulatory requirements.

e) Data Privacy Officer (DPO): Data Privacy Officers specialise in establishing Compliance with data protection laws and regulations. They assess data privacy risks, develop privacy policies and procedures, and oversee the implementation of data protection measures.

f) Regulatory Affairs Specialist (RAS): Regulatory Affairs Specialists navigate the complex regulatory landscape, ensuring products, services, or operations comply with relevant laws and regulations. They review regulatory requirements, submit necessary documentation, and liaise with regulatory authorities.

g) Compliance Consultant (CC): Compliance Consultants provide expert advice and guidance to organisations on the necessary matters. They conduct audits, develop frameworks, and help organisations address challenges.

Conclusion

Organisations should develop an excellent understanding of What is Compliance, and practice adherence to laws, regulations, and internal policies. These measures translate to the protection of their reputation, minimisation of risks, and demonstration of ethical conduct. More importantly, implementing robust programs, staying informed about evolving regulations, and fostering a culture of achieving and maintaining compliance.

Learn to improve organisational effectiveness and Compliance by signing up for our Corporate Governance: Principles and Practices Training now.

Frequently Asked Questions

Why is having a strong Compliance policy important for a company?

Ensuring robust Compliance is vital for a company as it establishes a foundation for ethical and lawful behaviour. It aids in risk mitigation, guaranteeing adherence to laws, regulations, and internal policies. Strong compliance builds trust among stakeholders, such as customers and investors, elevating the company's standing.

How can businesses effectively navigate and manage Compliance requirements amidst changing regulations?

To effectively handle Compliance amid dynamic regulations, businesses should set up a proactive Compliance framework. They can stay ahead of evolving regulations through consistent monitoring and engagement with industry updates. They must also cultivate a culture of Compliance awareness among employees through effective training and communication.

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various Compliance Trainings, including Corporate Governance Course and Security Governance and Compliance Training. These courses cater to different skill levels, providing comprehensive insights into various Compliance Frameworks.

Our Compliance blogs cover a range of topics related to ISO and Compliance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Compliance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 6th Feb 2025

Thu 3rd Apr 2025

Thu 5th Jun 2025

Thu 7th Aug 2025

Thu 2nd Oct 2025

Thu 4th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please