We may not have the course you’re looking for. If you enquire or give us a call on + 1-866 272 8822 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Whether it's about keeping your business compliant or recovering taxes on exports, the Goods and Services Tax (GST) Refund Process can seem like an uphill battle for business owners. But that doesn’t need to be the case. The right guidance can turn this seemingly complex process into a smooth transaction, and this blog is here to show you the way.

From submitting a refund request to that glorious moment when you receive it, this blog breaks down the process step-by-step (and tip-by-tip) to ensure you save time and hassle. So, read on, understand the ins and outs of this essential process and claim what's rightfully yours!

Table of Contents

1) What is a GST Refund?

2) Essentials of GST Refund

3) The GST Refund Process

4) What Are the Three Phases of GST Refund Status?

5) Key GST Refund Forms in India

6) When can the GST Refund be Claimed?

7) How to Track Your GST Refund Status Online?

8) Timeframe for Claiming GST Refund

9) Conclusion

What is a GST Refund?

A GST refund is the process through which registered taxpayers can claim an excess amount if they've paid more than they owe. They can file a refund using the necessary details on the GST portal. If GST refunds are delayed, working capital requirements and cash flow of producers and exporters may be adversely impacted.

Therefore, one of the goals of GST implementation is to simplify the returns process so that manufacturers and exporters don't face problems due to delays. The speedy course of the GST Refund Process makes tax administration more efficient.

Essentials of GST Refund

Here are the important points to remember regarding GST refund:

1) The refund provision in the GST law helps to reorganise and standardise the refund processes.

2) Under GST, the refund claims procedure stays uniform to avoid confusion. When the GST paid is greater than the GST liability, a situation of GST refund appeal comes up.

3) The refund procedure simplifies the trade by releasing blocked funds for different uses, such as expansion, working capital, and modernising existing businesses.

4) Once it's determined that there is a case for a GST refund, the claim must be filed using the GST Refund Form RFD 01.

5) If possible, the form can be prepared by a certified Chartered Accountant, and this claim must be made within two years of the relevant date of the GST refund application.

6) There are numerous cases under which a refund can be claimed, such as a refund for taxes paid by UN bodies or the Embassy, a tax refund to international tourists, or a refund upon finalisation of provisional assessment. It’s explored in detail later in this blog.

The GST Refund Process

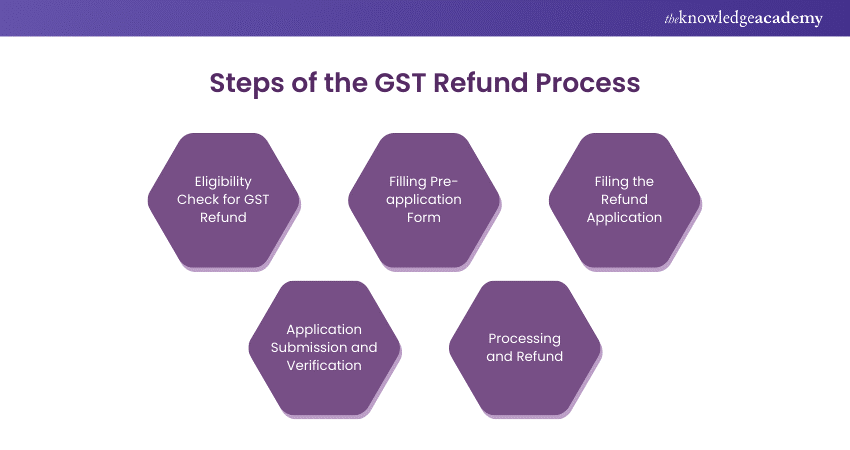

To initiate the GST Refund Process, you must visit the GSTN website and log in to the portal to complete the refund form. Here's the rest of the process:

1) In case of electronic submission, the applicant will receive an email or text message mentioning the confirmation number.

2) The cash and return book will be corrected, followed by an automatic reduction of the 'carry forward input tax credit'.

3) The authorities will process the return request, and the documents will be submitted within 30 days of the return form's submission.

4) If the application doesn't meet the requirements, the money will be returned to the Consumer Protection Fund (CPF). The CPF is like a savings account where money collected from penalties and fines imposed on businesses for unfair practices is kept.

5) A pre-examination will be conducted if someone's requested refund exceeds the predetermined refund. The GST refund will be electronically transferred to the applicant's account via RTGS, NEFT, or ECS.

6) Individuals can submit their refund request for any period, monthly, quarterly, half-yearly, or annually. However, the person will not be eligible if the refund amount is less than INR 1000.

What Are the Three Phases of GST Refund Status?

The GST Refund Process goes through three phases starting with submission of the refund request, followed by processing of the application to finally confirmation of the refund. The three phases are elaborated on below

1) Submitting a Refund Request

The GST Refund Process begins when a taxpayer submits a refund request. This can be done electronically via the GST portal. The application must include every relevant information, including the amount of the refund, the tax year pertaining to the refund, and all necessary supporting documents.

2) Processing the Refund Application

In the second stage of the process, the GST authorities process the refund request and additional materials sent by the taxpayer. Authorities may contact the taxpayer if they need clarification on anything. The refund amount is transferred to the taxpayer's bank account after processing and approving the refund.

3) Refund Confirmation

The third and final stage of the process involves approval of the refund by the GST authorities. Now, the authorities will issue an order confirming repayment of the claimed amount. The money is then transferred to the taxpayer's bank account, and taxpayers can track the progress of the refund application at every point by logging into the GST portal. The portal regularly updates the refund status.

Want to gain deeper insight into the implications of GST on business operations? Sign up for our comprehensive GST Course now!

Key GST Refund Forms in India

There are numerous GST forms that play different roles in the GST Refund Process. There are 10 main forms that you must know about if you are planning to apply for the refund. They are explored in detail below:

1) Form GST RFD 01

Most GST-registered entities must use this refund application to claim excess tax paid from the tax authorities. Under current GST rules, the RFD 01 form must be filed online via the GST portal and enables taxpayers to claim refunds in various cases, including the following:

a) Excess tax payments

b) Refund for excess balances in electronic cash ledger

c) Accumulated Input Tax Credit (ITC) from extra payments

d) Refund from appeal or provisional assessments

This form also requires individuals to include personal details and supporting documents and must be certified by a chartered accountant before submission.

2) Form GST RFD 02

GST RFD 02 is the second GST refund form one encounters after applying for a refund. This form is auto-generated and acknowledges that your RFD 01 form has been submitted successfully.

3) Form GST RFD 03

The GST portal generates Form GST RFD 03 following RFD 02 only if there's an error or deficiency in the submitted RFD 01 refund claim. Based on the errors outlined in RFD 03, the applicant can make the required corrections and resubmit RFD 01.

4) Form GST RFD 04

The fourth form is a provisional refund sanction order that specifies the amount of refund that will be provided to the applicant on a provisional basis. Generally, RFD 04 is generated within seven days of the issue of RFD 02, and the provisional refund amount stands at 90% of the GST refund amount claimed in the RFD 01 form.

5) Form GST RFD 05

The Form RFD 05 is generated as payment advice, containing key details including:

a) Inadmissible refund amount (along with reason)

b) Amount of GST refund claimed

c) Net GST refund amount

d) Deductions based on outstanding demand amount

e) Bank account details of the refund applicant

6) Form GST RFD 06

The RFD 06, commonly known as the final refund order, is issued by the assessing officer in response to the acceptance or rejection of the claim made using RFD 01. It contains the final amount being issued as GST refund and the details of any deductions made on outstanding demands by tax authorities.

7) Form GST RFD 07

This form is only issued when the tax authorities withhold the refund. RFD 07 contains two parts:

a) Part A contains details of the refund claimed, balance GST refund amount, adjustments, etc.

b) Part B contains details of the grounds on which the tax authorities withhold the refund.

8) Form GST RFD 08

Form GST RFD 08 is issued by a tax official and provides payment advice or a notice form regarding a taxpayer’s refunds.

9) Form GST RFD 09

This form is issued in cases of a delayed refund on the tax official’s end. It allows taxpayers to submit an order for interest form to receive compensation for late payments.

10) Form GST RFD 10

Finally, Form GST RFD 10 is used only for refund applications by international organisations or embassies seeking GST refunds.

When can the GST Refund be Claimed?

Taxpayers can claim their GST refund in the following scenarios:

1) When additional tax is paid due to errors or defects

2) In case of accumulated ITC due to exports of goods or services

3) IGST paid on service export (with payment of tax)

4) For purchases made by UN embassies or agencies

5) There is an Input Tax Credit (ITC) accumulation because the output tax is lower than the inward tax (i.e. tax paid for procurement of raw materials)

6) On finalisation of the provisional assessment or appeal or any other order where the amount was deposited

7) International tourists can claim a tax refund when leaving the country

Navigate the intricacies of tax filing processes and regulations in our Tax Filing Course – Register now!

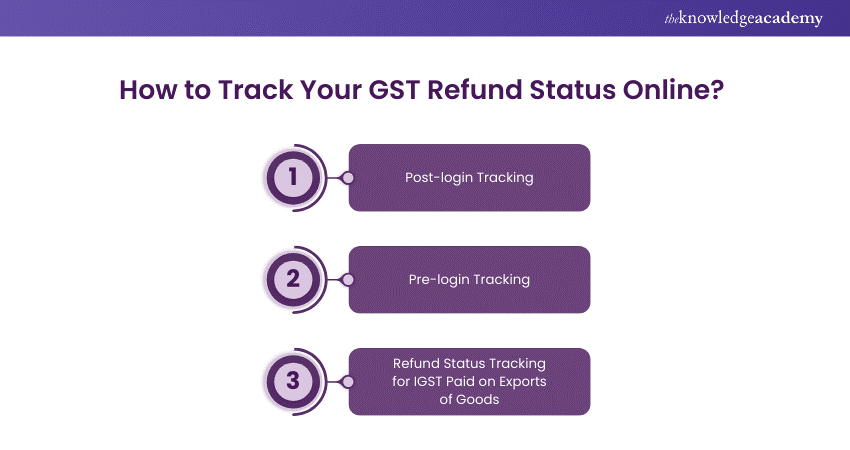

How to Track Your GST Refund Status Online?

After filing for a refund using the RFD 01 form, you can track the GST refund status online in the following ways:

1) Post-login Tracking: Here, you must check "Track Application Status" simply by logging into GST Portal and then going to the Services tab. In the services tab, you have to choose a year and confirm a bank account.

2) Pre-login Tracking: In this case, there is no need to log in to the GST portal to get tracking-related data. Instead, you can visit the GST portal, click 'Track Application Status,' and enter the ARN to receive refund status.

3) Refund Status Tracking for IGST Paid on Exports of Goods: In this section, the login process to select quarterly files and fiscal year must be completed. Following that, the invoice information must be checked and entered.

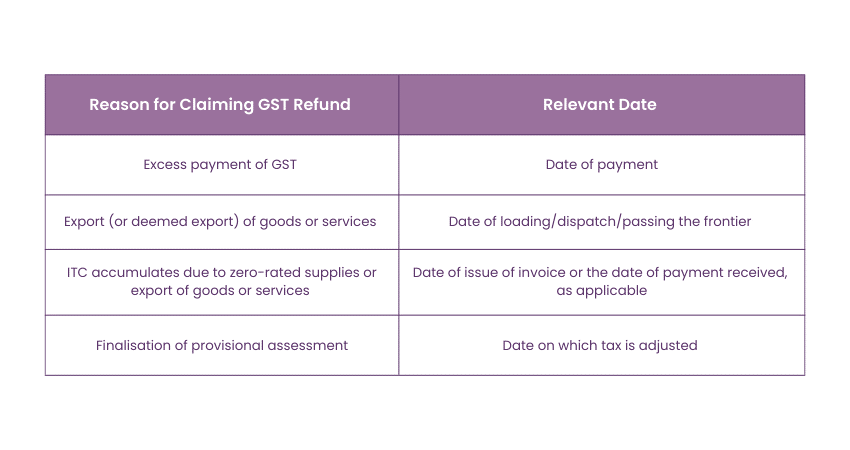

Timeframe for Claiming GST Refund

The timeframe for applying for a GST refund application is within two years from the relevant date, as summarised in the table below:

Conclusion

Navigating the GST Refund Process doesn't have to be daunting, as this blog shows. By understanding the key steps, keeping proper documentation, and staying aware of deadlines, you can reclaim your refunds with ease and keep your business finances in check. With the right approach, you can turn this task into an effortless part of your business management process.

Master the concept of VAT in your manufacturing and selling framework in our detailed VAT Training – Sign up now!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

GST Course

GST Course

Fri 1st Nov 2024

Fri 17th Jan 2025

Fri 21st Feb 2025

Fri 4th Apr 2025

Fri 6th Jun 2025

Fri 25th Jul 2025

Fri 7th Nov 2025

Fri 26th Dec 2025

Halloween sale! Upto 40% off - 95 Vouchers Left

Halloween sale! Upto 40% off - 95 Vouchers Left

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please