We may not have the course you’re looking for. If you enquire or give us a call on +34 932716793 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Do you have a strong attention to detail and a talent for numbers and managing inventory? Then, the Inventory Accountant Job Description might be just what you’re looking for. Inventory Accountants are vital in ensuring precise inventory records and financial statements. They make sure that stock levels match up with financial information, enabling businesses to make knowledgeable choices.

Inventory Accountants enhance the overall efficiency and profitability of the business through the control of inventory costs and discrepancies. If you're prepared to assume a position that combines Accounting expertise with inventory control, the Inventory Accountant role presents a thrilling chance. Let's explore the Inventory Accountant Job Description and find out how you can make a career in it.

Table of Contents

1) Inventory Accountant Job Duties

2) Inventory Accountant Qualifications

3) Essential Skills for an Inventory Accountant

4) Inventory Accountant Salary and Career Outlook

5) Examples of Inventory Accountant Roles

6) Conclusion

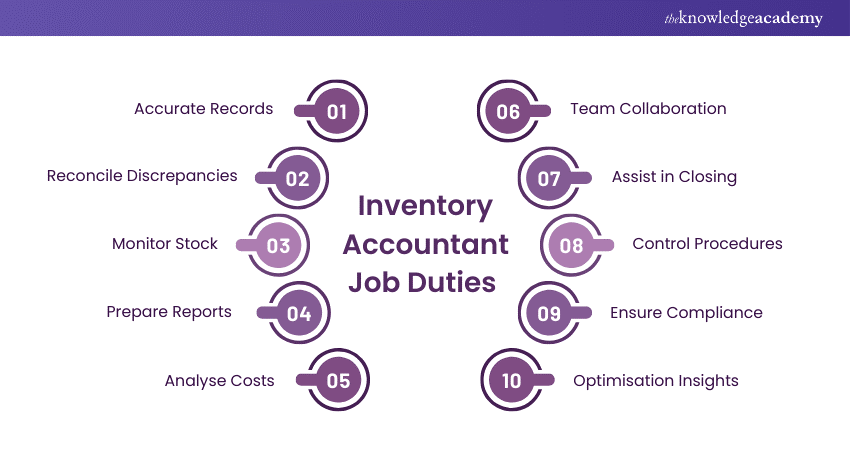

Inventory Accountant Job Duties

Inventory Accountant Job Duties involve handling and keeping accurate inventory records, ensuring data integrity, and supporting financial decision-making through efficient inventory control. Let's explore some of the essential duties of an Inventory Accountant:

a) Accurate Records: Keep inventory records precise and ensure prompt entry of data

b) Reconcile Discrepancies: Address inventory discrepancies and promptly resolve any issues

c) Monitor Stock: Monitor inventory levels and conduct routine inspections to confirm precision

d) Prepare Reports: Create thorough inventory reports to be reviewed by management

e) Analyse Costs: Examine inventory expenses and discrepancies to assist in making financial choices

f) Team Collaboration: Work together with the purchasing and warehouse teams to optimise inventory procedures

g) Assist in Closing: Help with inventory-related tasks during the monthly and yearly closing processes

h) Control Procedures: Establish and uphold Inventory Management Protocols

i) Ensure Compliance: Make sure to follow company policies and adhere to Accounting standards

j) Optimisation Insights: Offer advice and suggestions for improving inventory efficiency and lowering costs

Inventory Accountant Qualifications

To thrive as an Inventory Accountant, you need a degree in Accounting, Finance, or a related field. Qualifications related to Certifications hold significant value in the professional world.

Having strong analytical abilities, being detail-oriented, and having proficiency in Accounting software like Excel or ERP systems are crucial. Preference will be given to candidates with experience in Inventory Management, cost accounting, or similar roles. It is essential to understand inventory control procedures, and financial reporting.

Having strong communication and organisational abilities, as well as being able to handle pressure, are essential qualities. Having a good understanding of data analysis tools and following a proactive approach to problem-solving will improve performance in this position, leading to precise and efficient Inventory Management.

Revolutionise Your Career Path with our Accounting Course today!

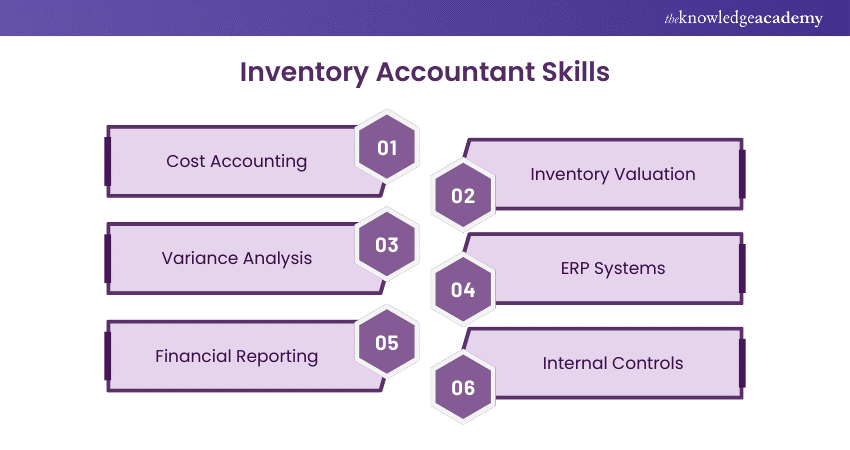

Essential Skills for an Inventory Accountant

A proficiency in Inventory Accountant Skills is crucial for efficiently overseeing stock levels and financial documentation. These abilities support efficient inventory operations and bolster a company's economic well-being.

1) Cost Accounting

Inventory Accountants are essential in examining and understanding manufacturing expenses, such as raw materials, labour, and overhead. Their skills enable them to provide precise evaluations and reports on the financial status of inventory assets, giving in-depth analysis of potential cost-cutting measures and tactics to increase profits in inventory control.

2) Inventory Valuation

Valuing and categorising inventory with attention to detail is cruicial for calculating the cost of goods sold and ending inventory balances. Inventory Accountants can influence a company's profitability and efficiency by analysing inventory levels and identifying discrepancies. They suggest improvements while ensuring financial statements are accurate and adhering to relevant accounting standards.

3) Variance Analysis

Analysing variances is essential for identifying the causes of differences in inventory costs between what was projected and what occurred. Inventory accountants can use it to find inefficiencies or errors in procurement and storage processes, which helps implement corrective actions to improve inventory levels and reduce financial losses.

4) ERP Systems

Proficiency in integrating and managing financial data is crucial in ERP systems for accurate tracking and reporting on inventory costs and valuations. It guarantees that financial statements accurately represent current inventory levels, making it easier to reconcile physical stock counts with ledger entries and improve inventory control and financial precision.

5) Financial Reporting

Accurate and detailed financial reports on inventory value, cost of goods sold, and turnover rates are crucial for informed financial decisions and maintaining financial health. Inventory Accountants offer stakeholders a transparent look into financial activities related to inventory, guaranteeing adherence to Accounting standards and regulations.

6) Internal Controls

It is crucial to implement and oversee procedures to safeguard assets and keep the precision of financial information, known as internal controls. Inventory Accountants ensure inventory records are accurate and compliant by enhancing systems for reporting, reconciling, and auditing inventory to prevent discrepancies and fraud.

Become an Inventory Accounting Pro with our Inventory Accounting and Costing Course – Register now!

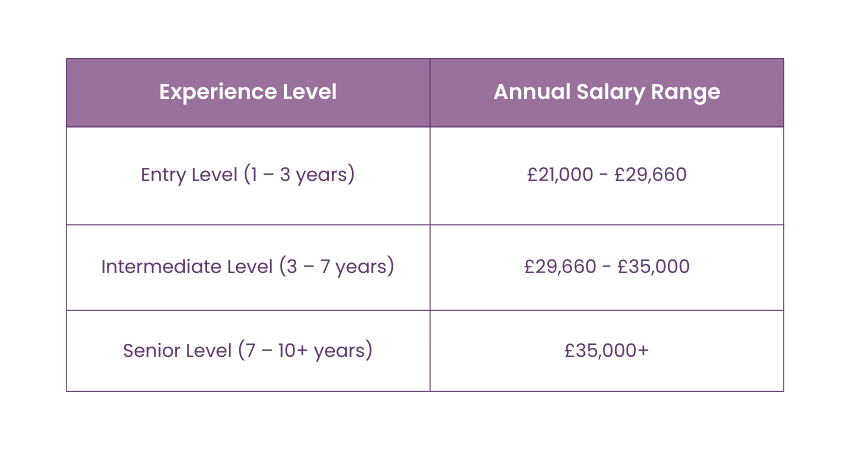

Inventory Accountant Salary and Career Outlook

An Inventory Accountant's salary is affected by factors like their level of industry experience, the complexity of the inventory systems they oversee, the size of the company, and the range of tasks they handle, such as auditing and implementing cost-saving measures. Focusing on sectors with valuable inventory can also greatly increase profits.

The future job prospects for Inventory Accountants are expected to decrease in the coming ten years, mainly because of progress in automated Accounting software and AI technologies. These advancements lessen the dependency on manual inventory monitoring and financial reporting, resulting in less demand for professionals in this field.

Source: Glassdoor

Examples of Inventory Accountant Roles

The following example showcase the Inventory Accountant Job Description:

|

Job Title: Inventory Accountant Location: [Location] Salary: [Salary Range] Summary: We're looking for an experienced Inventory Accountant to oversee and streamline inventory records for precise financial reporting. This position requires resolving differences, aiding in cost management efforts, and improving inventory procedures, which all play a crucial role in the company's financial well-being and operational effectiveness. Strong analytical skills and attention to detail are essential qualities for ideal candidates. Responsibilities: a) Maintain accurate inventory records and ensure timely data entry b) Reconcile inventory discrepancies and resolve issues promptly c) Monitor stock levels and perform regular audits to verify accuracy d) Prepare detailed inventory reports for management review e) Analyse inventory costs and variances to support financial decisions f) Collaborate with purchasing and warehouse teams to streamline processes g) Assist in month-end and year-end inventory closing activities Qualifications: a) Degree in Accounting, Finance, or a related field b) Professional certification such as ACCA or CIMA preferred c) Proficiency in Accounting software, such as Excel or ERP systems d) Strong analytical skills and attention to detail e) Excellent communication and organisational abilities Benefits: a) Competitive salary with performance-based incentives b) Professional development opportunities and certification support c) Flexible working hours and remote work options d) Health and wellness benefits, including private healthcare Send your CV along with a brief explanation of why this job appeals to you. |

Conclusion

The Inventory Accountant Job Description highlights the vital role of ensuring precise inventory records and boosting financial effectiveness within a company. This position provides a fulfilling career opportunity for those with keen eye to details, excellent analytical skills, and a drive to improve processes. You’ll significantly impact financial decisions and contribute to the company’s success.

Become a Fixed Assets Management Expert with our Fixed Assets Accounting And Management Course – Join now!

Frequently Asked Questions

Inventory is considered as a current asset in Accounting and is listed on the balance sheet. It is assessed at the lesser of cost or market value utilising techniques such as FIFO, LIFO, or weighted average. Fluctuations in inventory quantities impact the expenses of products sold and the overall financial performance.

Inventory Accounting monitors the worth of a business's inventory, assuring precise financial records and adherence to Accounting regulations. Assisting businesses in controlling expenses, maximising inventory levels, and making well-informed buying and selling choices, ultimately affecting profitability and efficiency.

Inventory Accounting ensures precise inventory evaluation, assists in financial reporting, and helps manage costs effectively. It aids in avoiding excess inventory or shortages, improves decision-making, and ensures adherence to regulations. Businesses can enhance cash flow and operational efficiency by optimising inventory levels.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including the Inventory Accounting And Costing Course, Fixed Assets Accounting And Management Course, and Accounting Course. These courses cater to different skill levels, providing comprehensive insights into Accounting Principles.

Our Accounting and Finance Blogs cover a range of topics related to Finance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Inventory Accounting and Costing Course

Inventory Accounting and Costing Course

Fri 28th Feb 2025

Fri 4th Apr 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 24th Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please