We may not have the course you’re looking for. If you enquire or give us a call on +34 932716793 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you considering a career in mortgage advising and wondering, “Is CeMAP Worth it?” This question is crucial for anyone looking to enter the financial industry. CeMAP, the abbreviation for Certificate in Mortgage Advice and Practice, is a widely recognised qualification that can open numerous doors. But is it the right choice for you? In this blog, we will explore the value of CeMAP Certification and whether it justifies the investment of your time and resources.

We will also talk about how it sets you apart in a competitive job market. Read on to identify whether pursuing CeMAP is a worthwhile endeavour for your professional journey. So, let’s dive in and answer the burning question: “Is CeMAP Worth it?”

Table of Contents

1) Understanding CeMAP Certification

2) Is CeMAP Worth it?

3) How Much Does CeMAP Cost?

4) Jobs to Pursue With CeMAP

5) Conclusion

Understanding CeMAP Certification

Certificate in Mortgage Advice and Practice (CeMAP) is a recognised qualification for professionals working in the mortgage industry. To get CeMAP certification, you need to score a minimum of 70% on the CeMAP Exam. In the United Kingdom, it falls under the regulation of the Financial Conduct Authority (FCA). Through rigorous training and examinations, CeMAP equips professionals with the skills and knowledge to navigate the complex world of mortgages. Additionally, it provides a comprehensive understanding of Mortgage Life Cycle ethical practices, mortgage products, and assessment procedures. It further ensures that Mortgage Advisors have a solid foundation in mortgage advice, enabling them to provide expert guidance to clients, maintain regulatory compliance, and contribute to a thriving and trustworthy mortgage industry.

Is CeMAP Worth it?

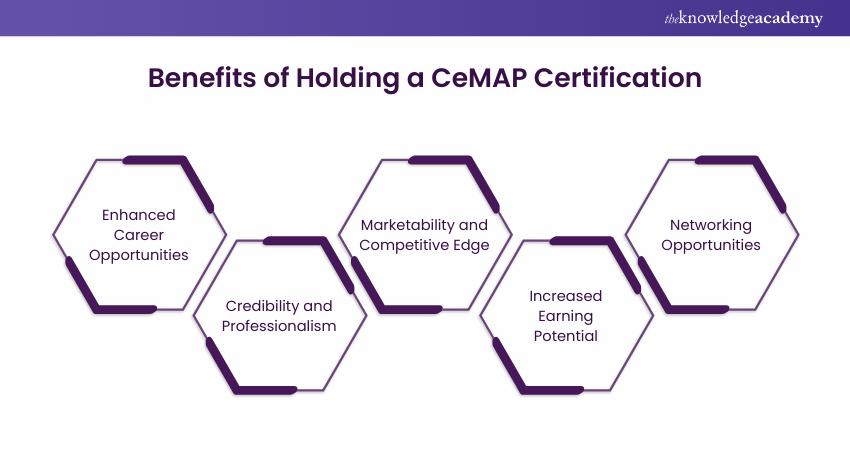

Listed below are some key benefits of holding a CeMAP Certification:

a) CeMAP Certification is often required by banks, building societies, and mortgage brokerages, making you a desirable candidate for Mortgage Advisor roles.

b) CeMAP establishes your professionalism and expertise, builds trust with clients and employers, and differentiates you from competitors.

c) In a competitive job market, CeMAP sets you apart, highlighting your dedication to professional development and high-quality mortgage advice.

d) CeMAP can lead to a financially rewarding career with a base salary and commission-based earnings because of your expertise in mortgage advice.

e) CeMAP offers opportunities to connect with industry professionals, mentors, and potential employers, leading to valuable insights and career prospects.

Complete our CeMAP Course 1, 2, and 3 to gain the expertise and credentials needed to stand out in the financial industry.

How Much Does CeMAP Cost?

CeMAP Certification requires a fee. Participants typically pay separately for both training and exams. The cost of CeMAP can vary based on the institution and the mode of training, with online options generally being more affordable than in-person courses. CeMAP Exam fees are approximately £202 per module, or you can pay £606 upfront for all three modules. If you need to retake an exam, it will cost an additional £170 each time.

Take the first step towards becoming a more persuasive communicator - register for our Communication Skills Course today!

Jobs to Pursue With CeMAP

Earning a CeMAP Certification opens up various career opportunities in the financial sector. This qualification equips you with the required skills and knowledge to excel in roles associated with mortgages and financial advice. Here are some potential career paths for CeMAP Certificate holders:

1) Banking Assistant

A Banking Assistant, also known as a bank teller, interacts directly with customers. They update banking information, check accounts, investigate requests, collect and deposit money, and educate customers on banking fees. With a CeMAP Certification, they can also assist mortgage customers by explaining mortgage policies and requirements.

2) Relationship Support Representative

A Relationship Support Representative manages portfolios for individual or business clients, ensuring a positive customer experience. They handle customer requests, assist in financial statement analysis, produce mortgage or loan reports, and help customers prepare documentation for mortgage applications.

3) Protection Advisor

A Protection Advisor collaborates with sales representatives to generate referrals and provide advice to potential buyers and customers. They discuss financial solutions, explain mortgage requirements, and help customers select appropriate insurance tools. They may offer general financial and insurance advice or specialise in areas like life insurance or mortgages.

Learn strategies to enhance your professional relationships and drive business success – join our B2B Communications Training now!

4) Wealth Management Advisor

A Wealth Management Advisor works with high-profile individuals and businesses to manage their assets. They evaluate clients’ financial situations and provide advice on tax and investment strategies. They may specialise in areas such as pension plans, insurance, or securities.

5) Business Owner

With a CeMAP qualification, you can gain experience as a Mortgage Advisor and eventually start your own business. As a Mortgage Advice Agency Owner, you can maximise your earning potential and train other advisers. Success in this role requires expert knowledge of financial regulations and strong business skills, which can be developed through self-learning and practice.

Conclusion

In conclusion, the question “Is CeMAP Worth It?” hinges on your career aspirations and commitment to professional growth. With its potential to enhance job prospects, credibility, and earning potential, CeMAP can be a game-changer in the Mortgage Advisory field.

Achieve professional success with CeMAP Courses – sign up for our comprehensive Training today!

Frequently Asked Questions

Yes, the CeMAP qualification offers self-employment and entrepreneurship opportunities. Qualified Mortgage Advisors can start their own practice, offering tailored mortgage advice and services, capitalising on the growing demand for professional financial guidance.

Self-employed Mortgage Advisors can earn between £30,000 to £70,000 annually, depending on experience, client base, and success in securing deals. Earnings can significantly increase with a well-established reputation and client referrals.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers CeMAP Courses, including the CeMAP Course (Level 1,2 and 3). These courses cater to different skill levels, providing comprehensive insights into Mortgage Life Cycle.

Our Business Skills Blogs cover a range of topics related to CeMAP career, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please