We may not have the course you’re looking for. If you enquire or give us a call on +34 932716793 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Home ownership - It's the ultimate dream. The key to your home is more than just a piece of metal; it's the gateway to personal stability that unlocks a haven for your safety, protection, and lifelong memories. Embarking on the journey of home ownership is a thrilling adventure whose many twists and turns along the way are guided by the Mortgage Life Cycle. From securing a loan to making that final payment, this cycle is a roadmap to achieving your dream home.

Interestingly, for more than a decade, the mortgage rates in the UK were on a downward trend that improved the affordability of housing loans. However, according to Statista, most homeowners are expected to face a monthly increase in repayments of less than £99 This blog delves into what the Mortgage Life Cycle entails, encompassing everything from the pre-application stage to the repayment stage and will help you understand the homeownership process better.

Table of Contents

1) Pre-application stage

2) Application and approval stage

3) Closing stage

4) Repayment stage

5) Conclusion

Pre-application Stage

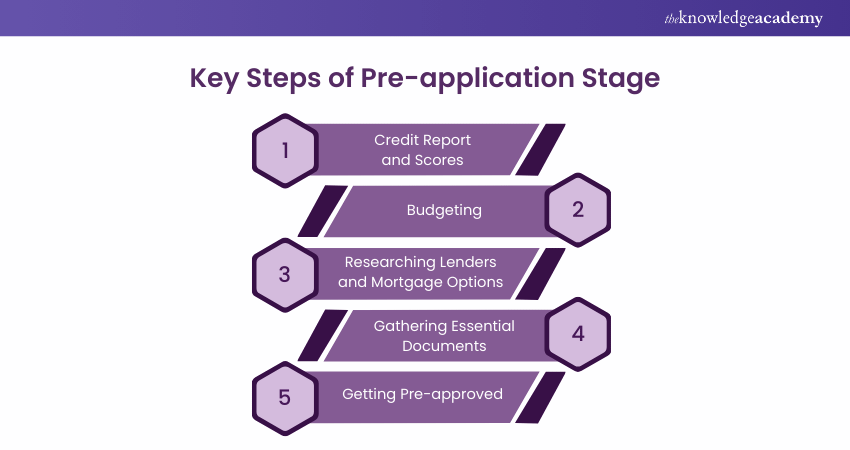

The pre-application stage marks the beginning of the Mortgage Life Cycle and is a crucial phase for prospective borrowers. During this stage, individuals or couples assess their financial situation, research lenders, and evaluate Mortgage options. It involves understanding personal finances, budgeting, and determining creditworthiness. Here are some key steps involved with this stage:

a) Credit Report and Scores: One of the first steps in the pre-application stage is obtaining a credit report and reviewing credit scores. This allows potential borrowers to assess their creditworthiness and identify any areas that need improvement. Addressing any issues, such as paying off outstanding debts or correcting errors on the credit report, can help improve the chances of obtaining a favourable Mortgage offer.

b) Budgeting: Budgeting is another important aspect of the Mortgage Life Cycle’s pre-application stage Prospective borrowers should carefully evaluate their income, expenses, and savings to determine how much they can comfortably afford to borrow. This involves considering not only the monthly Mortgage payment but also identify the difference between mortgage vs loan other homeownership costs, such as property taxes, insurance, and maintenance expenses.

c) Researching Lenders and Mortgage Options: Researching lenders and Mortgage options is a critical part of the pre-application stage. Different lenders offer varying Mortgage products with different interest rates, loan terms, and eligibility requirements. By comparing options and obtaining quotes from multiple lenders, borrowers can find the best Mortgage deal that suits their needs and financial situation.

d) Gathering Essential Documents: Additionally, gathering essential documents is crucial during this stage. Lenders typically require income statements, bank statements, tax returns, and other financial documents to assess the borrower's financial stability and ability to repay the loan. Collecting these documents in advance can expedite the application process.

e) Getting Pre-approved: Lastly, it is advisable to get pre-approved for a Mortgage during the pre-application stage of the life cycle. Pre-approval provides an estimate of the loan amount for which borrowers may qualify, giving them a clearer understanding of their budget and enhancing their credibility as serious buyers. This pre-approval letter can also be advantageous when making an offer on a property, as it demonstrates financial readiness to sellers.

Application and Approval Stage

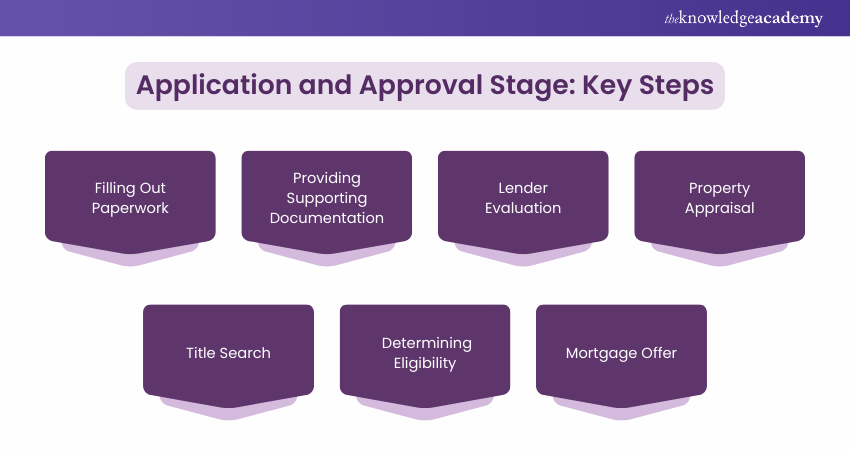

Once the pre-application stage is complete, the next crucial phase of the Mortgage Life Cycle is the application and approval stage. During this stage, prospective borrowers formalise their Mortgage application and go through the evaluation process by the lender. Here are the major steps associated with this stage:

a) Filling Out Paperwork: The borrower initiates the application by completing the necessary paperwork the lender provides. This includes financial details, personal information, employment history, and other relevant data. You must be meticulous and precise to avoid any delays or complications.

b) Providing Supporting Documentation: In this step, you must submit recent pay stubs, tax returns, bank statements, and other financial statements with your application. These documents verify your income, assets, and liabilities, helping the lender assess your financial stability and repayment ability.

c) Lender Evaluation: After submission, the lender will thoroughly review your credit history, debt-to-income ratio, employment status, and other relevant factors. They may contact employers, credit agencies and financial institutions to verify the provided information.

d) Property Appraisal: In this step, a professional appraiser assesses the property's value to ensure that it aligns with the requested loan amount. This step protects both the borrower and the lender from overvaluing the property.

e) Title Search: The lender may require a title search to confirm the property's legal ownership and identify any outstanding claims or liens against it. This step ensures that the property can serve as collateral for the mortgage.

f) Determining Eligibility: Based on the evaluation, the lender evaluates the loan's risk and determines the terms and conditions, including loan duration, interest rate, and mortgage type (e.g., fixed or adjustable rate). Additionally, they will specify the maximum loan amount for which you qualify.

g) Mortgage Offer: The final step of this stage involves the lender providing a formal mortgage offer or loan commitment letter once the evaluation is complete. This document outlines the loan's terms and conditions, including the loan amount, interest rate, monthly payment, and other relevant details. Review the offer carefully and seek clarification if needed.

Unlock your full potential in Mortgage advice, advance through all levels of expertise, and achieve your CeMAP Course (Level 1, 2, and 3) certifications with our comprehensive training.

Closing Stage

The closing stage is a significant milestone in the Mortgage Life Cycle, marking the final steps before homeownership becomes a reality. During this stage, all the necessary paperwork is completed, and the transfer of ownership takes place. This stage is detailed below:

|

Steps of the closing stage |

Timeframe |

|

Reviewing the closing disclosure |

3-7 days before the scheduled closing date |

|

Scheduling the closing date |

Typically 30-45 days from the date of contract acceptance |

|

Signing the necessary legal documents |

On the day of the closing |

|

Settling closing costs |

On the day of the closing |

|

Receiving the keys and transfer of ownership |

At the conclusion of the closing meeting |

a) Scheduling a Closing Date: The closing date is generally coordinated by the lender or a closing agent.

b) Reviewing the Closing Disclosure: Before closing, the borrower carefully reviews the closing disclosure, which outlines final loan terms, including loan amount, closing costs, interest rate, and other fees.

c) Closing Day Meeting: The borrower and seller (if applicable) meet at a designated location, such as attorney's office or a title company. The borrower must bring a government-issued ID and any required funds, like the down payment and closing costs.

d) Signing Legal Documents: During the closing, both parties sign necessary legal documents, including the Mortgage Note (borrower's commitment to repay the loan) and the Mortgage or Deed of Trust (grants lender security interest in the property). This step ensures that the seller transfers the property's title to the buyer.

e) Settling Closing Costs: Closing costs, including appraisal fees, attorney fees and title insurance are settled. The borrower should review the closing statement (HUD-1 Settlement Statement or Closing Disclosure) for a detailed breakdown of all costs and address any questions with the attorney or closing agent.

f) Providing Necessary Funds: In this step, the borrower provides the necessary funds, usually via cashier's check, to cover the down payment and closing costs. The lender funds the loan by transferring the mortgage proceeds to the closing agent or attorney.

g) Receiving Property Keys: Once the closing is completed, the borrower receives the keys to the property, officially becoming the homeowner. The borrower should arrange for homeowner's insurance coverage prior to closing to protect the investment.

Embark on a rewarding career in financial advice, gain comprehensive knowledge and skills, and earn your Diploma for Financial Advisers (DipFA) through our specialised Diploma For Financial Advisers DipFA Training.

Repayment Stage

After the closing stage, borrowers enter the repayment stage of the Mortgage Life Cycle. This stage spans the entire duration of the Mortgage loan and involves making regular monthly payments to the lender. Each Mortgage payment consists of two components: Principal and interest. The principal is the amount borrowed and is gradually paid down over time. The interest is the cost of borrowing the money and is calculated based on the outstanding principal balance and the interest rate. These are the points to remember about this stage:

a) Timely Payments: The repayment stage of the Mortgage Life Cycle requires borrowers to make timely payments to the lender. It’s essential to establish a system to ensure payments are made on time, such as setting up automatic payments or creating reminders. Late payments can result in penalties and may negatively impact credit scores.

b) Amortisation Schedule: The proportion of principal and interest in each payment changes over time. In the early years of the Mortgage, a larger portion of the payment goes towards interest, while in the later years, a larger portion goes towards reducing the principal. This is known as an amortisation schedule.

c) Options for Borrowers: During the repayment stage, borrowers should be aware of their options. Some borrowers choose to make additional principal payments to pay off the Mortgage early and save on interest costs. This can be done by making extra payments or increasing the monthly payment amount.

d) Refinancing Considerations: Another option is refinancing the Mortgage. Refinancing involves replacing the current Mortgage with a new one, typically with more favourable terms such as a lower interest rate. This can help borrowers reduce their monthly payments or shorten the loan term. However, it is important to carefully consider the costs and benefits of refinancing before deciding.

e) Monitoring Mortgage Account: Throughout the repayment stage, borrowers should stay informed about their Mortgage account. This includes regularly reviewing statements, verifying the accuracy of payments applied, and contacting the lender if any discrepancies or concerns arise.

f) Financial Management: Additionally, borrowers should be proactive in managing their finances to ensure the ability to make Mortgage payments. This involves budgeting, maintaining an emergency fund, and being mindful of other financial obligations to avoid any financial strain that may impact Mortgage repayment.

Conclusion

The Mortgage Life Cycle encompasses multiple stages from pre-application to repayment, shaping the homeowner's financial journey. Understanding each stage is necessary for borrowers to make informed decisions, navigate challenges and optimise the homeowners’ mortgage experience. We hope this blog helps you streamline your decisions and ultimately achieve long-term homeownership success.

Enhance your financial management skills with our CeMAP Training. Sign up now!

Frequently Asked Questions

In the UK, the average time taken for approval of mortgage is typically between 2 to 6 weeks. Even though in some cases, it can be approved as fast as 24 hours, this is typically very rare.

Many things can go wrong including having a bad credit score, inadequate income, inadequate deposit for the home, incomplete application and considerable debt.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various CeMAP Courses, including the CeMAP Level 1, 2, and 3 Course. These courses cater to different skill levels, providing comprehensive insights into Mortgage.

Our Business Skills Blogs cover a range of topics related to Mortage, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your understanding of Mortgages, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 3rd Feb 2025

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 18th Aug 2025

Mon 27th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please