We may not have the course you’re looking for. If you enquire or give us a call on +34 932716793 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Payroll Accounting is essential to managing a company's finances and ensuring that employees are compensated accurately and promptly. As an “employee component” of the accounting process, it involves calculating and recording employee salaries, wages, bonuses, and deductions.

Many employees often raise queries about incorrect salaries, deductions, etc. It is mostly due to lax accounting and can be easily solved by leveraging technology. In this blog, you will learn about Payroll Accounting, the best Payroll Software for Accountants, and the benefits of using Accounting Software.

Table of Contents

1) What is Payroll Accounting?

a) Importance of Payroll Accounting

b) Expenses that come under Payroll Accounting

2) Best Payroll Software for accountants

a) Gusto

b) OnPay

c) Paychex Flex

d) QuickBooks Payroll

e) Paycor

f) ADP Workforce Now

3) Benefits of using Software for Payroll Accounting

a) Time-saving automation

b) Increased accuracy

c) Legal compliance

d) Seamless integration with accounting systems

e) Employee self-service portals

f) Reporting and analytics

4) Conclusion

What is Payroll Accounting?

Payroll Accounting is a specialised branch of accounting that focuses on recording, tracking, and processing financial information related to employee compensation. It involves keeping detailed records of each employee's earnings, taxes, benefits, and deductions. Accountants are crucial in ensuring employees receive accurate and timely payments while adhering to legal and tax obligations.

The key components include:

a) Employee compensation: Recording the base salaries, hourly wages, and any additional benefits or bonuses employees may receive.

b) Deductions and withholdings: Accounting for taxes, social security contributions, health insurance premiums, retirement savings, and any other deductions that impact an employee's net pay.

c) Payroll taxes: Calculating and reporting taxes to government authorities in compliance with local, state, and federal regulations.

d) Financial reporting: Preparing financial statements related to payroll expenses, taxes, and benefits for internal and external reporting purposes.

e) Recordkeeping: Maintaining accurate and organised records to ensure transparency and easy retrieval for audits or inquiries.

Master the fundamentals of Payroll Processing and learn to manage payroll with this Introduction To Payroll training.

Importance of Payroll Accounting

First and foremost, it plays a crucial role in employee satisfaction and retention. Ensuring the prompt and precise payment of salaries and wages builds trust among employees and cultivates a positive work environment.

It also plays a crucial role in compliance, helping businesses adhere to legal and regulatory requirements. By accurately calculating deductions, withholdings, and contributions, companies can avoid penalties and legal disputes that could be financially detrimental. Furthermore, accurate accounting provides valuable data for financial planning and budgeting purposes.

Businesses can make informed decisions regarding hiring, compensation adjustments, and employee benefits by analysing expenses, ensuring that budgets align with organisational goals. Payroll Accounting is also closely tied to tax reporting, with precise calculations and timely reporting reducing the risk of audits and compliance issues.

In addition to its financial implications, it offers valuable data for strategic decision-making. Companies can gain insights into labour costs, employee productivity, and workforce management by analysing Payroll Information. Furthermore, it involves overseeing employee benefits, including health insurance and retirement plans, and ensuring precise deductions and contributions.

Expenses that come under Payroll Accounting

Payroll Accounting encompasses various expenses related to employee compensation and benefits. These expenses are crucial to accurately track and record for financial and compliance purposes.

a) Salary and wages: This includes the base salary or hourly wages paid to employees for their work performed within a specific pay period.

b) Overtime pay: Additional compensation is provided to employees for hours worked beyond their regular working hours, usually at a higher rate.

c) Bonuses and incentives: Additional payments made to employees as a reward for their performance, meeting targets, or other achievements.

d) Commissions: Amounts paid to salespeople or individuals based on a percentage of sales or revenue generated.

e) Benefits: Expenses associated with employee benefits, such as health insurance premiums, retirement plan contributions, life insurance, disability insurance, and other similar benefits.

f) Taxes and deductions: Payroll Accounting includes tracking and recording various deductions from employee wages, such as income tax withholding, social security contributions, medicare taxes, state and local taxes, and other voluntary deductions like retirement savings or charitable contributions.

g) Employer contributions: Employers' contributions to employee benefit plans, such as contributions to retirement plans or health savings accounts.

h) Payroll taxes: This includes taxes that employers are responsible for paying based on employee wages, such as federal and state unemployment taxes.

It should be noted that the Payroll Accounting excludes expenses like office supplies, rent, utilities or any other inventory expenses. It also doesn’t consider taxes like sales or company income tax apart from Payroll Taxes.

Learn how to maintain Financial Records and create professional invoices for your customers with the Xero Introduction Training.

Best Software for Payroll Accountants

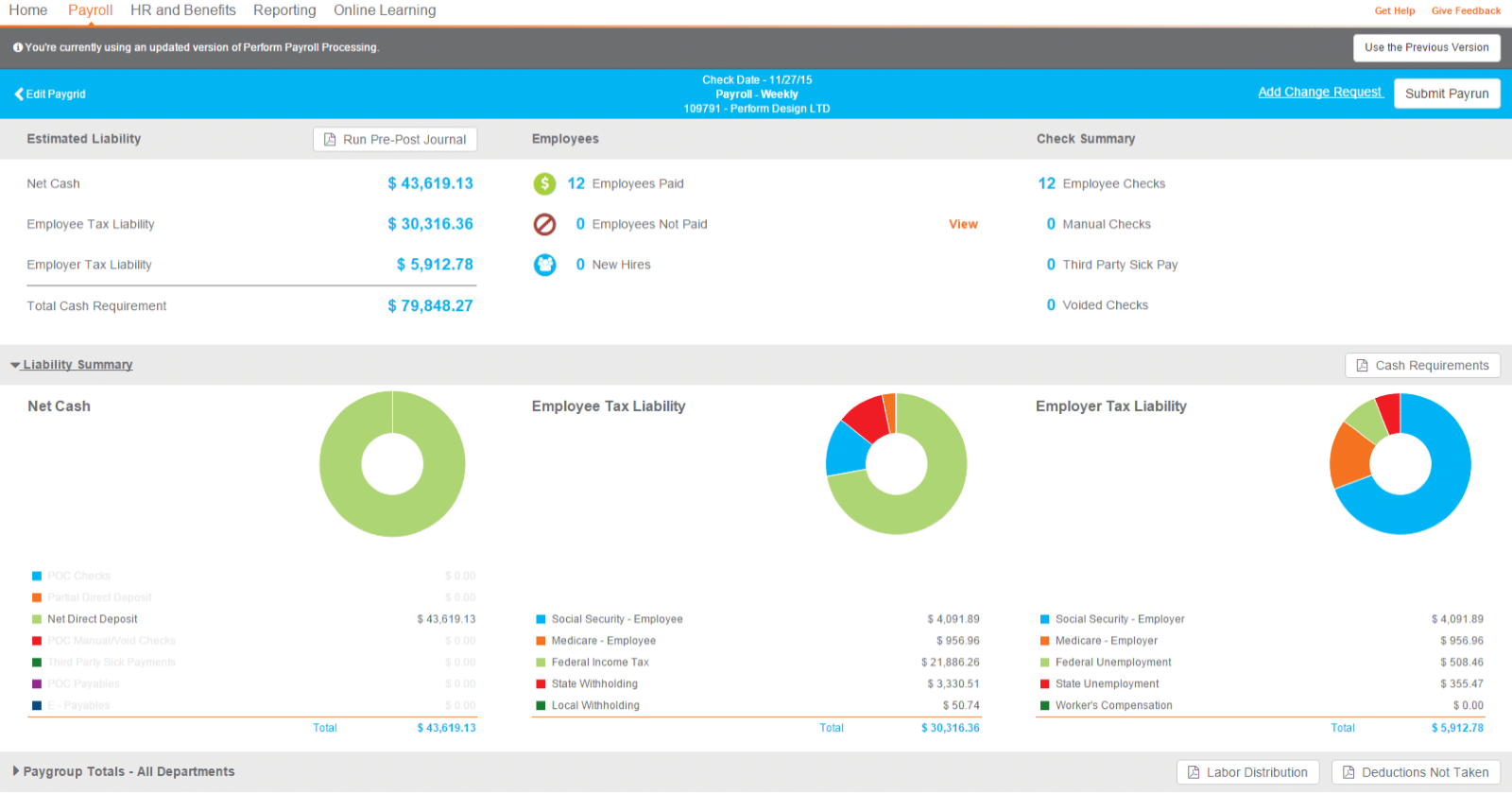

As Payroll Accounting processes become more complex, Accountants can benefit from leveraging software solutions that streamline and automate the Payroll Management Process. Here are some of the best Payroll Software options available for Accountants.

Gusto

Gusto is a cloud-based payroll and HR software that helps small businesses with numerous aspects of employee management, from onboarding to benefits and payroll. Gusto is known for its ease of use, affordable pricing, and excellent customer support.

Gusto can automatically calculate and file your Payroll Taxes and generate pay stubs and W-2s for your employees. It also has a comprehensive suite of HR tools like onboarding, benefits administration, time tracking, and performance reviews.

Gusto integrates with other business apps, including accounting software, CRMs, and project management tools. It is a great option for small businesses looking for affordable payroll and HR software.

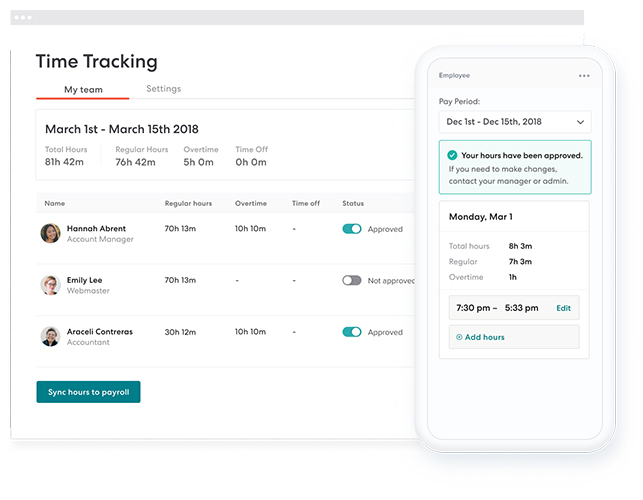

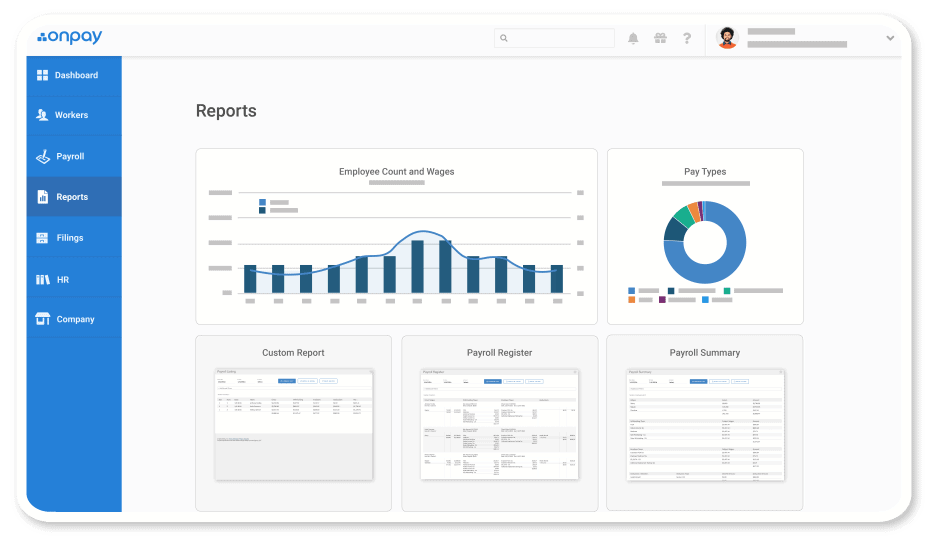

OnPay

OnPay is a cloud-based payroll software that caters to small and medium-sized businesses. It has a simple and intuitive interface for managing Payroll Processing, tax filings, benefits administration, and time tracking. OnPay also offers integrates with popular accounting systems and provides customisable reports.

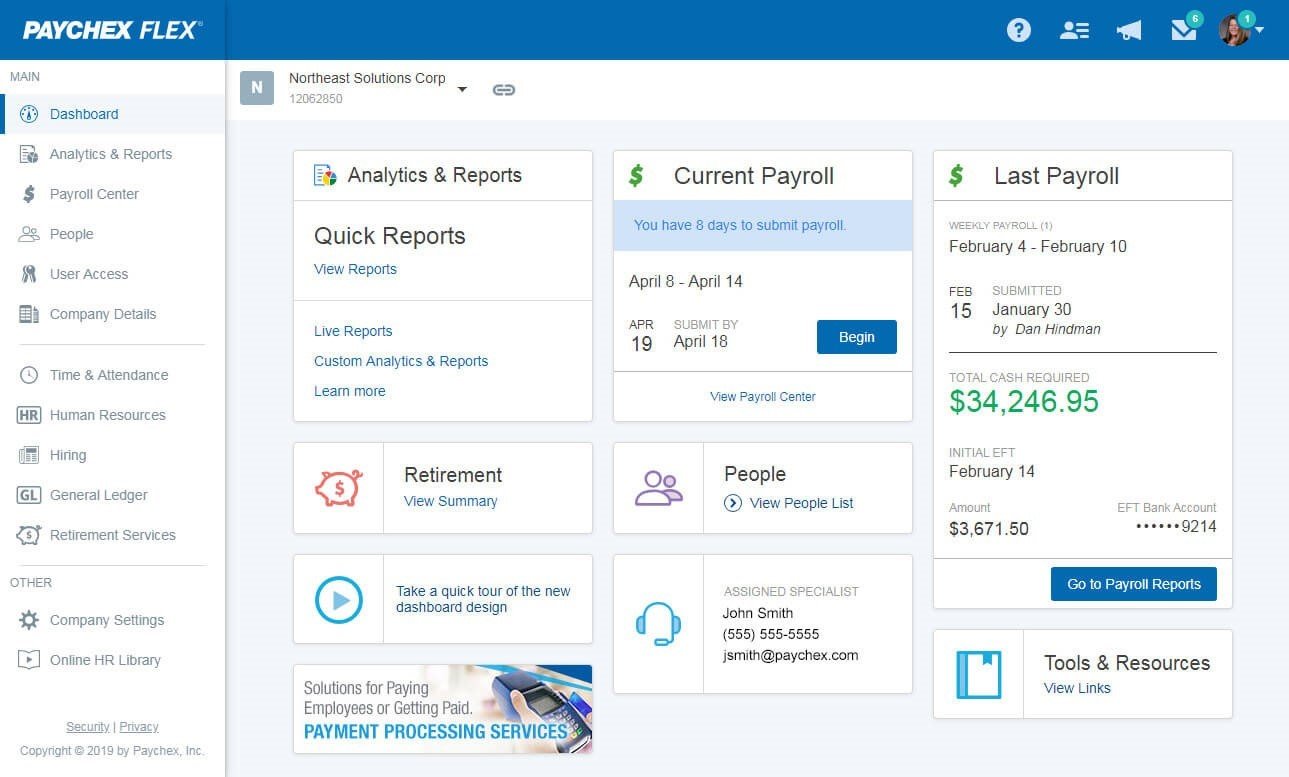

Paychex Flex

Paycheck Flex is a cloud-based Payroll Software that helps automate the process. It is easy to use, affordable, and offers many features, including Automated Payroll, tax filing, and employee self-service.

It also offers features like tax management, benefits administration, time tracking, and reporting. The software provides flexibility and customisation options to meet specific business needs. Paycheck Flex is a great option for businesses looking for simple, affordable Payroll Software.

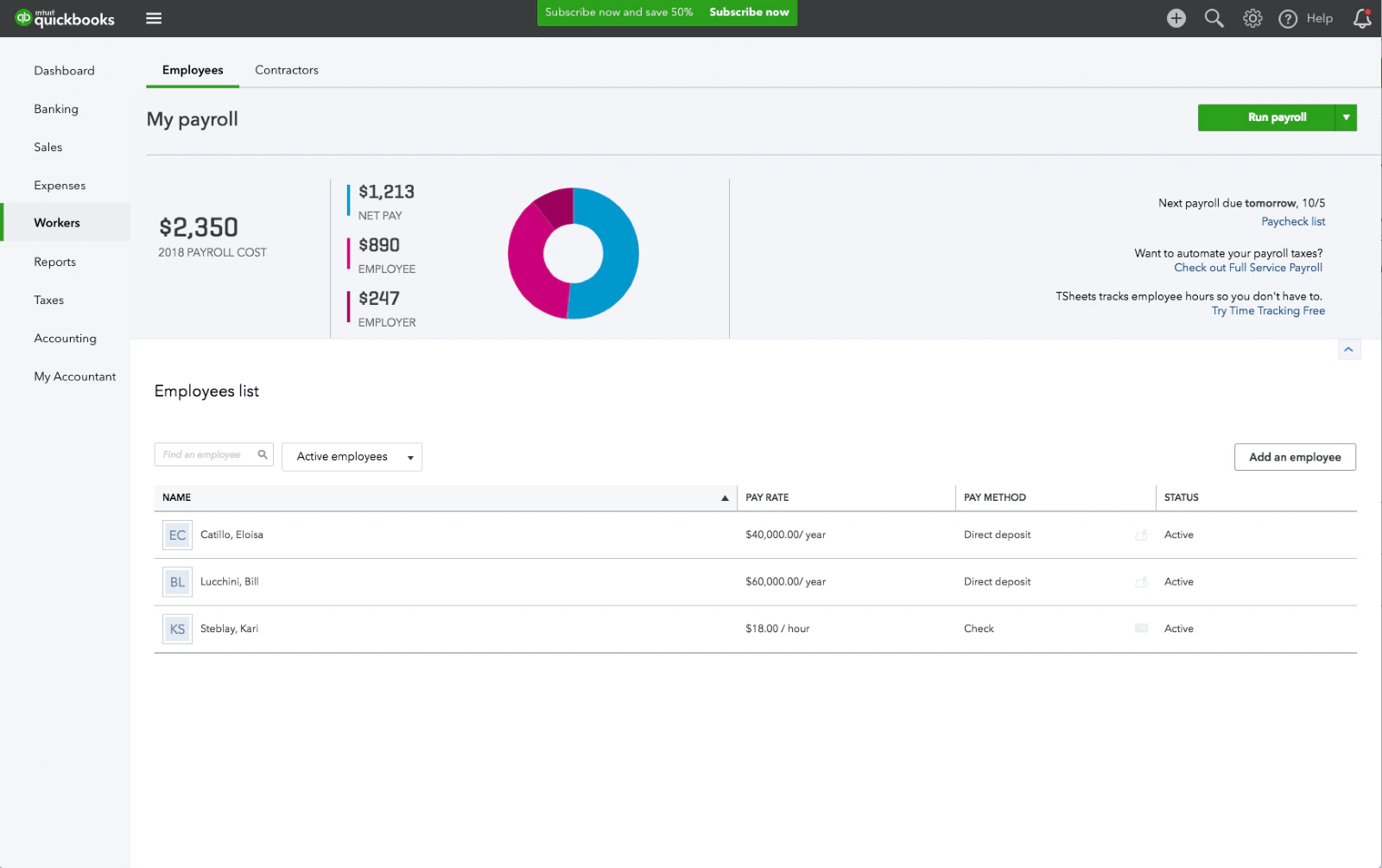

QuickBooks Payroll

QuickBooks Payroll is a popular choice for businesses already using QuickBooks accounting software. It simplifies management by seamlessly integrating payroll processing with the accounting system. With QuickBooks Payroll, accountants can efficiently track employee compensation, calculate taxes, generate pay stubs, and automate tax filings. Pricing for QuickBooks Payroll varies based on the plan selected and the number of employees.

Learn the essentials of QuickBooks and understand how to use it effectively for Payroll Accounting with the QuickBooks Masterclass.

Paycor

Paycor is a comprehensive HR software solution that offers a range of functionalities, including Payroll Processing, tax management, and time and attendance tracking. It offers seamless integration with various accounting software, enabling accountants to synchronise Payroll Data with their financial records effortlessly. Pricing for Paycor is tailored to each organisation's specific needs and size.

ADP Workforce Now

ADP Workforce Now is a comprehensive Payroll Software suitable for businesses of all sizes. It offers many features like Payroll Processing, tax compliance, benefits administration, and HR management. The software integrates well with accounting software, facilitating seamless data transfer between payroll and financial systems. Pricing for ADP Workforce Now varies based on the organisation's size and specific requirements.

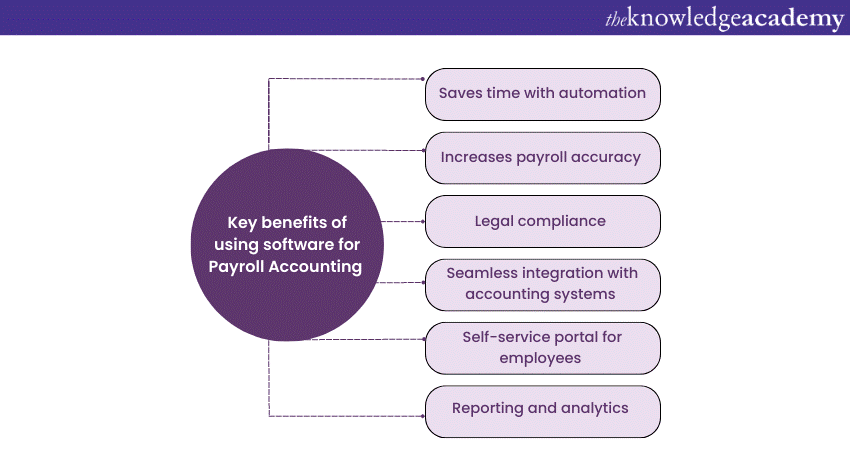

Benefits of using software for Payroll Accounting

Here are some key benefits of using software:

Saves time with automation

Payroll Software automates repetitive tasks, such as calculating employee wages, tax deductions, and generating pay stubs. This automation reduces the time and effort required for manual calculations, allowing accountants to focus on more strategic financial management tasks.

Increased accuracy

Payroll Software minimises the risk of human error by automating calculations and applying up-to-date tax rates and regulations. This accuracy reduces the chances of discrepancies, ensuring employees are paid correctly and reducing the need for time-consuming corrections.

Legal compliance

Payroll Software incorporates tax tables and regulatory updates to ensure compliance with ever-changing tax laws and labour regulations. It helps accountants stay updated with tax requirements, avoiding penalties and legal issues related to inaccurate tax calculations or reporting.

Seamless integration with accounting systems

Payroll Software often integrates smoothly with accounting software, enabling seamless data transfer between payroll and general ledger systems. This integration streamlines the recording of transactions, eliminates duplicate entries, and ensures accurate financial reporting.

Employee self-service portals

Many Payroll Software solutions offer self-service portals where employees can access their relevant information and documents like pay stubs, tax forms, etc. This reduces administrative burdens for accountants and empowers employees to manage their own Payroll Information, such as updating personal details or accessing past pay statements.

Reporting and analytics

Payroll Software provides robust reporting and analytics features, allowing accountants to generate detailed reports on labour costs, tax liabilities, and other payroll-related metrics. These insights aid in financial planning, budgeting, and making data-driven decisions related to workforce management.

Conclusion

To summarise, Payroll Accounting is about maintaining a proper record of employees’ salaries and compensation. This can be significantly optimised through the utilisation of software solutions. By embracing payroll software, employers can streamline their account processes, save time, and improve accuracy. By leveraging appropriate software solutions, organisations can maximise the benefits of accurate and efficient payroll management.

Master the fundamentals of bookkeeping and improve your financial management skills with the Book Keeping Training.

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Payroll Course

Payroll Course

Fri 27th Dec 2024

Fri 24th Jan 2025

Fri 28th Feb 2025

Fri 30th May 2025

Fri 15th Aug 2025

Fri 26th Sep 2025

Fri 31st Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please