We may not have the course you’re looking for. If you enquire or give us a call on 0800 446148 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Decentralisation and potential for high returns have made Cryptocurrencies a popular investment avenue for investors globally. However, just like every other financial tool there are Risks of Cryptocurrency that may be overlooked at times, resulting in several challenges if not considered and analysed.

According to a 2022 Statista report, the value of Cryptocurrency – lost to cybersecurity threats – grew more than nine times since 2020, accounting for 480 billion GBP in 2021. These statistics demonstrate the vulnerability and Risks of Cryptocurrency in the cyber world.

Therefore, it’s time to understand the risks associated with it. Read this blog to learn about the Risks of Cryptocurrency and dissect the security threats, potential dangers, & vulnerabilities of investing.

Table of Contents

1) What is Cryptocurrency?

2) What are the Risks of Cryptocurrency?

a) Lack of legal protection with Cryptocurrency payments

b) Cryptocurrency payments are irreversible

c) Publicised information on transactions in Cryptocurrency

d) The government or central bank do not back Cryptocurrency

e) The constant change in the value of Cryptocurrency

3) Benefits of Cryptocurrencies

4) Conclusion

What is Cryptocurrency?

Cryptocurrency is a virtual form of currency. It is protected by cryptographic techniques, ensuring a high level of security against counterfeiting and fraudulent duplication. These digital currencies predominantly operate on decentralised networks, leveraging blockchain technology, a distributed ledger maintained by a diverse network of computers.

One standout characteristic of Cryptocurrencies is that they are generally not controlled or issued by any central authority. This provides them with a theoretical immunity against government intervention or manipulation.

What are the Risks of Cryptocurrency?

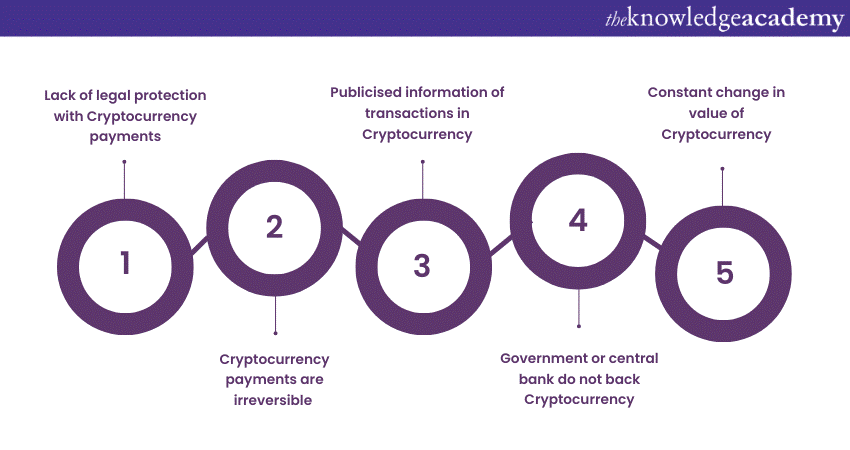

The Risks of Cryptocurrency encompass an extreme level of volatility. They can lead to potential financial loss and lack of regulation resulting in security vulnerabilities and market manipulation schemes. There also exist many technological issues related to the underlying blockchain technology. Proper research and informed decisions can help mitigate these risks.

Let's delve into the details of these risks and explore their potential harm. Here are the various Risks of Cryptocurrency, which individuals must be well aware of before investing in or being involved with any companies or agencies:

Lack of legal protection with Cryptocurrency payments

Cryptocurrency payments operate in a largely unregulated environment, which often results in a lack of legal protection for users. Unlike traditional financial systems, if your Cryptocurrency is stolen, there are no guaranteed legal provisions for recovery.

Additionally, any transactions made with Cryptocurrencies are irreversible. For example, if you were to send a payment to the wrong wallet, there's no legal recourse to get your money back. Moreover, the absence of a central authority like a bank translates to your sole responsibility for the safety of your digital assets, heightening the risk factor in case of any mishaps or discrepancies.

Cryptocurrency payments are irreversible

The primary characteristic of Cryptocurrency transactions is their irreversibility. Once a payment is made, it cannot be undone or reversed. This differs from traditional bank transactions where, in certain situations, payments can be reversed if an error occurs.

Additionally, the irreversibility of these payments means that if you accidentally send crypto to the wrong address, you have virtually no chance of getting it back unless the recipient decides to return it. This underscores the importance of extreme care when making such transactions, as a simple mistake could lead to a permanent loss of funds.

Publicised information on transactions in Cryptocurrency

Cryptocurrencies operate on Blockchain technology, a decentralised and distributed ledger system. These transactions are stored on this blockchain and are publicly available for anyone to see.

While specific user identities are protected through cryptography, the transaction details, including the amount and the addresses involved, are fully transparent. This level of public visibility is a unique aspect of Cryptocurrency transactions. It differs from traditional banking, where transaction details are only available to the parties involved and the bank. This transparency can help maintain accountability but may also raise privacy concerns for some users.

The government or central bank do not back Cryptocurrency

One of the hazardous Risks of Cryptocurrency is that it operates in a decentralised system, free from government or central bank interference. This means they are not issued or regulated by any state authority or financial institution. Unlike traditional currencies, where the government guarantees its value and central banks can intervene to maintain stability, no such safety nets exist for Cryptocurrencies.

In the case of a crash or sudden depreciation, there's no central authority to step in to manage the situation. This aspect is what makes Cryptocurrencies inherently risky and unpredictable. However, it's also the factor that attracts many users due to the potential for high returns and freedom from governmental control.

Attain a solid understanding of how to trade Cryptocurrency by signing up for the Cryptocurrency Trading Training now!

The constant change in value of Cryptocurrency

Cryptocurrencies are infamous for their rapid and significant fluctuations in value, a characteristic known as volatility. The value of a Cryptocurrency like Bitcoin can swing dramatically within a single day, driven by a variety of factors ranging from technological updates, regulatory news, market sentiment, or even social media influence.

These constant changes can present lucrative opportunities for traders willing to embrace risk. However, for those seeking stability, the unpredictability can be a significant deterrent. This high volatility makes Cryptocurrencies a speculative investment, where the potential for large gains coexists with the risk of substantial losses.

Benefits of Cryptocurrencies

From ease of access to independence, Cryptocurrencies offer many advantages over traditional forms of money like fiat currencies or gold. Let's explore some of them below:

1) Independence: Cryptocurrencies are decentralised and not controlled by any single authority, such as a government or a central bank. Users have full access and ownership of their coins, but they also need to protect them from theft or loss.

2) Accessibility: Cryptocurrencies are available to anyone, and all you need is an internet connection and a Crypto wallet. Factors like physical location or financial status do not matter, and anyone can access it. They can be used to send and receive payments across borders without intermediaries or restrictions.

3) Lower fees and faster time: Cryptocurrencies can have significantly lower transaction costs and faster processing times than some conventional banking methods. For instance, Cryptocurrency can avoid the high fees associated with international wire transfers and be confirmed within minutes, unlike the typical 24-to-48-hour delay of bank wires. However, some everyday banking services, such as depositing checks or withdrawing cash, are still faster and free of charge.

4) Transparency: Cryptocurrencies operate on blockchain technology, which is a public and immutable ledger of all transactions. This means that every transaction is visible and verifiable by anyone and cannot be altered, tampered with, or erased.

5) Mainstream support: Cryptocurrencies have gained popularity and recognition from many mainstream financial institutions and businesses, which have started to offer and/or accept Cryptocurrencies as a form of payment or investment. However, Cryptocurrencies are still in the early stages of development, and their future is uncertain compared to traditional finance.

6) High return potential: Cryptocurrencies are highly volatile in nature. So, their prices can fluctuate significantly in a short time period. This can result in high returns for investors who buy low and sell high, but it also entails high risks and losses for those who buy high and sell low. Therefore, it is important to understand that past Cryptocurrency Trends do not assure or indicate future results.

Discover the world of Blockchain technology with our Blockchain Training – Sign up now!

Conclusion

We hope that you have now understood the various Risks of Cryptocurrency and the vitality of the knowledge before investing in any currency. Their volatility, lack of regulation, potential for loss and privacy concerns make them a high-risk asset. However, with thorough research and informed decision-making, these risks can be managed, offering potential high rewards amidst the uncertainties.

Learn about how bitcoins work and their applications by signing up for our Bitcoin and Cryptocurrency Course now!

Frequently Asked Questions

Yes, understanding Cryptocurrency risks can enhance your overall Risk Management in various investments. It helps foster a better understanding of market dynamics and risk mitigation strategies.

The Cryptocurrency market offers promising long-term prospects with the potential for significant growth. However, it's important to remember that the market is highly volatile, and various factors like adoption, regulations, and technological advancements influence future outcomes.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, blogs, videos, webinars, and interview questions. By tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Courses, including Cryptocurrency Trading, Stock Trading, Real Estate and Investment Banking courses. These courses cater to different skill levels, providing comprehensive insights into Investment and Trading methodologies.

Whether you are starting your journey or aiming to elevate your Investment and Trading expertise, immerse yourself in our Business Skills blogs to discover more insights!

Upcoming Advanced Technology Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 6th Dec 2024

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please