We may not have the course you’re looking for. If you enquire or give us a call on +33 805638382 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Investment Management is a vital aspect of Financial Planning and wealth growth. It involves the strategic allocation of funds into various assets with the goal of achieving optimal returns while managing risks. The process has become crucial in securing a prosperous financial future for almost all individuals today.

According to Grand View Research, the global Asset Management market was valued at £ 341.5 billion in 2023 and is expected to expand at a Compound Annual Growth Rate (CAGR) of 36.4% from 2024 to 2030. In this blog we will discuss the world of Investment Management and discuss it key principles, strategies and its importance.

Table of Contents

1) Understanding Investment Management

2) Key Tasks of Investment Management

3) Investment Management Strategies

4) Advantages and Disadvantages of Investment Management

5) How do Investment Management Firms Make Money?

6) Types of Investment Management Firms

7) Conclusion

Understanding Investment Management

Investment Management involves overseeing a portfolio or collection of assets. This includes buying and selling assets, formulating short—and long-term investment strategies, creating tax plans, and managing asset allocation. It can also encompass banking, budgeting, and other financial responsibilities.

The term primarily refers to managing and trading the assets within an investment portfolio to meet specific investment goals. It’s also known as Money, Portfolio, or Wealth Management.

Key Tasks of Investment Management

Investment Management involves a range of tasks that ensure effective management and growth of clients' assets. These tasks encompass strategic planning, Portfolio Management, market analysis, and client communication, all aimed at optimising returns while managing risks.

Here are three Key tasks of Invest Management:

a) Goal Setting and Risk Assessment

The investment journey begins with precise goal setting and identifying financial objectives like retirement, home purchase, or education. Equally crucial is assessing risk tolerance and balancing risk and reward. High-risk tolerance may lead to aggressive strategies, while risk-averse investors prefer conservative approaches, guiding their investment decisions accordingly.

b) Monitor Potential Investments

Investments range from cash deposits and government bonds to shares in emerging companies with uncertain prospects. An Investment Management firm must evaluate the potential and carefully assess the risks and returns of each option, a task handled by the investment analyst.

c) Create Investment Strategies

Every client requires a tailored investment portfolio that aligns with their goals. A diversified portfolio, spread across various assets, helps minimise risk—essentially avoiding "putting all your eggs in one basket."

This forms the core of an investment firm's business, which can take many forms. Firms may manage investment funds for multiple investors, engage in private equity, or handle essential functions like business development, marketing, IT, pricing, and accounting.

Unlock the secrets of successful wealth growth. Join our Investment Management Course today!

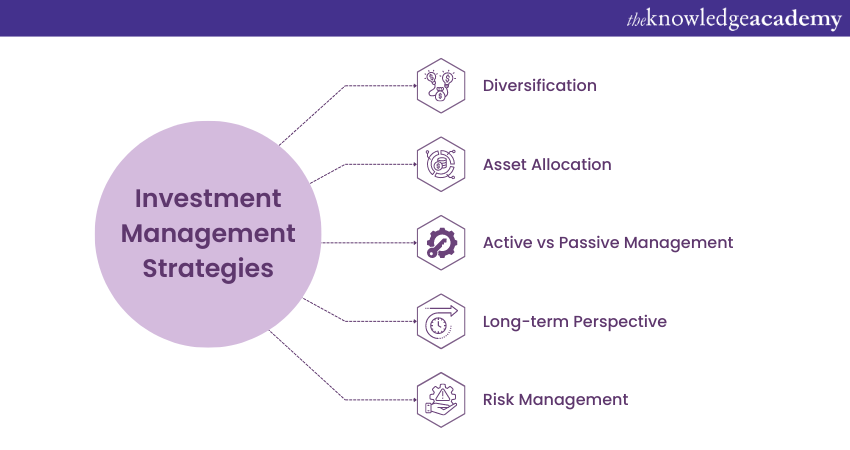

Investment Management strategies

Effective Investment Management strategies are essential tools for achieving financial goals and optimising returns in an ever-changing market landscape. These strategies guide Investors in making informed decisions about where to allocate their funds, how to diversify their portfolio, and when to buy or sell assets. By employing these strategies, Investors aim to maximise returns while managing risks. Here are some of the key Investment Management strategies that have proven successful over time:

Diversification

Diversification is an essential principle of Investment Management. It involves distributing investments across various asset classes, industries, and regions. This approach reduces the impact of poor performance in any single investment, as gains in some assets can offset losses in others, leading to more stable, long-term returns.

Asset Allocation

Asset allocation involves determining the proportion of an investment portfolio to allocate across various asset classes, such as stocks, bonds, real estate, and cash. This strategy is guided by risk tolerance, investment goals, and market conditions, ensuring the portfolio aligns with the investor's objectives.

Active vs Passive Management

Investors must choose between active and passive management strategies. Active management involves professionals selecting securities to outperform the market, while passive management aims to replicate market index performance using index funds or ETFs. The choice depends on the investor's risk tolerance, time commitment, and belief in achieving market outperformance.

Long-term Perspective

Successful Investment Management requires a long-term approach. Attempting to time the market or chase short-term gains often leads to higher risk and subpar outcomes. Patience allows investments to compound, leveraging the power of compounding to build wealth steadily over time.

Risk management

Every Investment carries some level of risk. Effective Investment Management involves assessing an Investor's risk tolerance and aligning their portfolio accordingly. Strategies to manage risk can include the following:

a) Using protective options strategies

b) Investing in less volatile assets

b) Setting stop-loss orders to limit potential losses

Elevate your business success with our comprehensive Revenue Management Training – Unlock profitable opportunities today!

Advantages and Disadvantages of Investment Management

While the Investment Management industry can yield substantial returns, operating such a firm comes with significant challenges. Here is a table explaining the key Advantages and Disadvantages of Invest Management:

How do Investment Management Firms Make Money?

Investment Management firms generate revenue primarily by charging fees for their services, which vary based on the client's needs and the firm's structure. The most common fee model is a percentage of the client's assets under management (AUM), typically ranging from 0.5% to 2% annually. This fee structure aligns the manager's interests with the client's investment growth.

Additionally, some firms charge a performance-based fee, taking a percentage of the portfolio's profits, often ranging from 10% to 20%. Others may impose a fixed annual fee, providing predictable revenue regardless of portfolio performance. For clients seeking one-time investment advice or planning, firms may offer a flat fee for consultation. These diverse fee structures allow firms to cater to various client preferences and needs.

Types of Investment Management Firms

Investment Management firms come in various types, each catering to different client needs and investment strategies. These firms vary in size, specialisation, and services, ranging from global giants to niche experts.

a) Large Investment Management Firms: These firms, such as BlackRock, manage assets worth trillions of dollars, offering a wide range of investment options and benefiting from economies of scale.

b) Boutique Firms: Smaller in size, boutique firms emphasise personalised service and quality, often focusing on delivering tailored investment strategies with a personal touch.

c) Specialist Firms: These firms concentrate on specific investment areas, such as private equity, real estate, or art. Larger firms may employ them for their specialised expertise.

d) Investment Banks: Major investment banks, like Goldman Sachs, have extensive Asset Management divisions, providing comprehensive investment services to institutional and high-net-worth clients.

Unlock the secrets of successful stock trading. Register for our Stock Trading Course today and start building your wealth!

Conclusion

When it comes to personal finance, Investment Management stands as a cornerstone of building a strong financial foundation. It empowers individuals to grow their wealth, mitigate risks, and realise their long-term financial aspirations. By understanding and embracing its strategies, Investors can navigate the complex landscape of finance and work towards a brighter financial future.

Elevate your financial expertise with our comprehensive Investment and Trading Training.

Frequently Asked Questions

Professional Investment Management can enhance your business's financial growth by providing expert analysis, Strategic Portfolio Management, and risk mitigation. It ensures your investments are aligned with your goals, optimising returns while safeguarding assets against market volatility and economic uncertainties.

Investment Management can help you grow your wealth by providing expert guidance, tailored investment strategies, and Risk Management. It ensures your portfolio is diversified and aligned with your financial goals, maximising returns while minimising potential losses in changing market conditions.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Trainings, including Stock Trading, Real Estate and Investment Banking courses. These courses cater to different skill levels, providing comprehensive insights into Revenue Management.

Our Business Skills Blogs cover a range of topics related to Investment Skills, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Revenue Management Training

Revenue Management Training

Fri 7th Mar 2025

Fri 2nd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 7th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please