We may not have the course you’re looking for. If you enquire or give us a call on +08000201623 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Accounting software plays a pivotal role in modern business operations, streamlining financial tasks and ensuring financial management accuracy. Among the myriad options available, Sage Accounting Software is a prominent choice for businesses seeking efficient and reliable solutions.

Sage Accounting Software has emerged as a reliable solution for businesses of all sizes, offering a range of tools and features designed to simplify financial processes. This comprehensive blog delves into the Different Types of Sage Accounting Software available, their features and their pros and cons for your business needs.

Table of Contents

1) What is Sage Accounting Software?

2) Different Types of Sage Accounting Software

a) Sage 50 clouds

b) Sage Intacct

c) Sage X3

d) Sage Business Cloud Accounting

e) Sage Payroll

f) Sage CRM

g) Sage Contactor

h) Safe Fixed Assets

3) Conclusion

What is Sage Accounting Software?

Sage Accounting Software is a suite of applications designed to aid businesses in managing their financial activities. These tools offer functionalities such as tracking income and expenses, invoicing, payroll processing, reporting, and more. Sage software solutions cater to the diverse needs of businesses across industries, providing both desktop and cloud-based options.

Different Types of Sage Accounting Software

Sage offers a diverse range of accounting software solutions, each tailored to meet the specific needs of different businesses, from small startups to multinational corporations. Let's explore the distinct features and benefits of each type of Sage Accounting Software:

1) Sage 50cloud

Sage 50cloud, formerly known as Peachtree Accounting, is a widely recognised accounting software solution that is specifically tailored to meet the financial management needs of small and medium-sized businesses (SMBs). With its exclusive range of features, user-friendly interface, and cloud-based capabilities, Sage 50cloud empowers businesses to streamline their accounting processes and make wise financial decisions. Here are the key features of Sage 50cloud:

a) Invoicing and billing: Sage 50cloud allows businesses to create professional invoices, customise them with company branding, and send them to clients or customers. The system also tracks invoice statuses, helping businesses keep on top of payments and outstanding invoices.

b) Expense tracking: Managing expenses is essential for maintaining a healthy cash flow. Sage 50cloud enables users to record and categorise expenses, ensuring accurate financial records. This feature helps businesses monitor spending patterns and control costs effectively.

c) Financial reporting: Having access to timely and precise financial reports is vital for making well-informed business decisions. Sage 50cloud provides a range of predefined reports such as profit and loss statements, balance sheets, and cash flow statements. Customisable reporting options allow users to tailor reports to their specific needs.

d) Inventory management: For businesses that deal with physical products, inventory management is important. Sage 50cloud helps manage inventory levels, track stock movements, and optimise supply chain processes. This feature aids in preventing stockouts and overstock situations.

e) Bank reconciliation: Reconciling bank accounts is made easier with Sage 50cloud. Users can match bank transactions with their accounting records, ensuring that financial statements accurately reflect the company's financial position.

f) Cloud accessibility: With cloud-based capabilities, Sage 50cloud offers remote access to financial data. This is particularly beneficial for businesses with remote teams or individuals who require access to their financial details while away from their usual workspace.

2) Sage Intacct

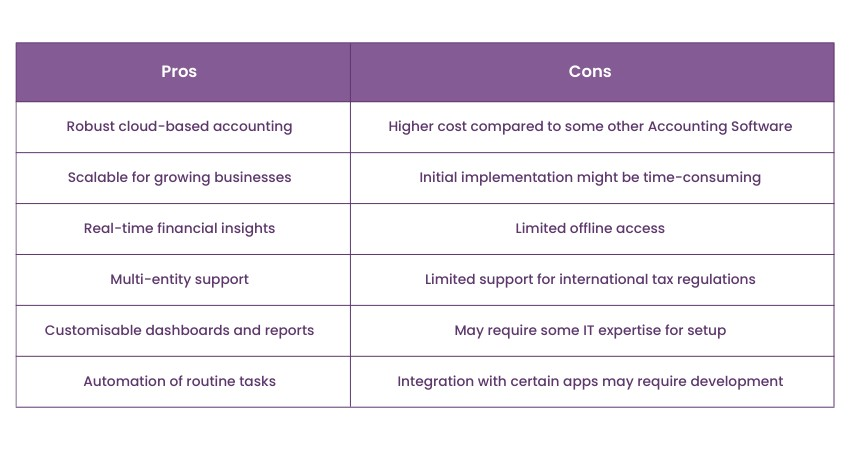

Sage Intacct stands out as a powerful cloud-based financial management and accounting solution specifically designed to cater to the needs of growing businesses and enterprises. With its advanced features and capabilities, Sage Intacct empowers organisations to effectively manage complex financial processes, get deeper insights into their financial data, and make strategic decisions.

Let's delve into the key aspects that make Sage Intacct a preferred choice for businesses on the path to expansion:

a) Multi-dimensional reporting: One of the standout features of Sage Intacct is its ability to generate multi-dimensional reports. This means that financial data can be analysed from various perspectives, allowing for deeper insights into the company's financial health. This level of reporting is especially useful for organisations dealing with complex operations and diverse revenue streams.

b) Project accounting: For businesses involved in projects or client work, Sage Intacct offers project accounting functionality. This allows you to track expenses, allocate resources, and monitor project profitability. By maintaining a clear overview of project-related finances, you can ensure that projects remain on budget and contribute positively to the bottom line.

c) Revenue recognition: Accounting standards often dictate when and how revenue should be recognised in financial statements. Sage Intacct includes automated revenue recognition features, helping businesses adhere to these standards and avoid potential compliance issues. This feature is particularly important for industries with complex revenue recognition processes, such as subscription-based services.

d) Integration capabilities: In today's interconnected business landscape, seamless integration between different software systems is essential. Sage Intacct offers robust integration capabilities, allowing it to integrate with other critical business applications, such as CRM systems, payroll software, and e-commerce platforms. This ensures data consistency and reduces manual data entry.

e) Scalability: As businesses grow, their financial needs become more complex. Sage Intacct is designed with scalability in mind, accommodating increased transaction volumes, expanding business operations, and evolving reporting requirements. This means that organisations can continue using Sage Intacct as their financial needs become more sophisticated.

f) Cloud accessibility: Being a cloud-based solution, Sage Intacct offers the advantage of access at any time and anywhere. This is particularly beneficial in today's remote work environment, allowing authorised personnel to access financial data and reports from various devices and locations. Cloud accessibility promotes collaboration and facilitates timely decision-making.

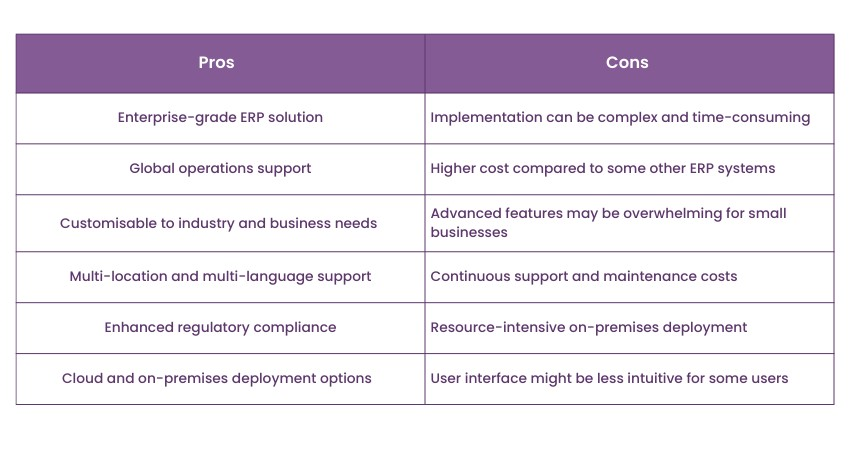

3) Sage X3

Sage X3, formerly known as Sage Enterprise Management, stands as a robust Enterprise Resource Planning (ERP) solution designed to address the intricate financial and operational needs of larger enterprises and multinational corporations. Going beyond traditional accounting software, Sage X3 encompasses a comprehensive suite of tools that assist businesses in seamlessly managing various aspects of their operations. Here are the key features of Sage X3:

a) ERP functionality: Sage X3 goes beyond standard accounting functionalities by offering a comprehensive suite of ERP tools. These tools cover areas such as inventory management, manufacturing, distribution, procurement, project management, and more. This integrated method allows organisations to manage their operations holistically, improving efficiency and collaboration across departments.

b) Customisation: Every business operates differently, and Sage X3 recognises this by providing extensive customisation capabilities. This means that the software can be tailored to match specific industry requirements, business processes, and unique workflows. Customisation ensures that the ERP solution aligns closely with the organisation's operational needs.

c) Advanced reporting: Sage X3 empowers businesses with advanced reporting and analytics capabilities. Generate detailed financial reports, dashboards, and analytics that offer insights into various aspects of the business, helping decision-makers make informed choices and identify growth opportunities.

d) Global capabilities: For multinational corporations, managing operations across different regions, languages, currencies, and regulatory environments can be a challenge. Sage X3 is equipped to handle global complexities, allowing businesses to maintain consistency in their financial and operational processes while complying with various regulatory requirements.

e) Scalability: Large enterprises experience fluctuating demands and ever-evolving operational requirements. Sage X3's scalability allows organisations to adapt to changes in transaction volumes, operational complexity, and business growth. As the company expands, Sage X3 can accommodate the increased demands placed on financial and operational systems.

f) Integration capabilities: Just as businesses require integration capabilities in today's interconnected world, Sage X3 provides the means to seamlessly integrate with other business systems and tools. This integration streamlines processes, reduces manual data entry, and ensures data consistency across different departments.

g) Collaboration and efficiency: With centralised data and streamlined processes, Sage X3 encourages collaboration among teams. Information flows seamlessly between departments, reducing duplication of efforts and enhancing overall operational efficiency.

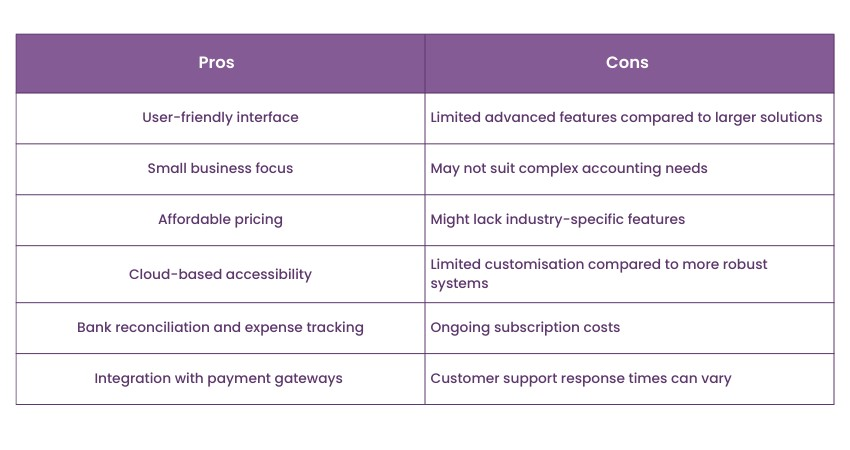

4) Sage Business Cloud Accounting

Sage Business Cloud Accounting, previously known as Sage One, is a user-friendly accounting software solution particularly designed to cater to the distinct needs of startups, small businesses, freelancers, and sole proprietors. This software offers essential accounting tools and features that enable individuals and small teams to manage their finances efficiently without being overwhelmed by complex functionalities.

a) Invoicing: Sage Business Cloud Accounting makes invoicing a breeze. Users can easily create professional invoices, customise them with their brand elements, and send them to clients. Timely and accurate invoicing helps businesses get paid faster and maintains a positive cash flow.

b) Expense tracking: Keeping track of expenses is very important for maintaining accurate financial records and preparing for tax obligations. This software allows users to categorise expenses, attach receipts, and monitor spending, providing a clear overview of where funds are allocated.

c) Bank reconciliation: Reconciling bank accounts is simplified with Sage Business Cloud Accounting. The software automatically matches bank transactions with accounting records, ensuring that financial statements remain accurate and up to date.

d) User-friendly interface: Recognising that many users may not have extensive accounting knowledge, Sage Business Cloud Accounting offers an intuitive and user-friendly interface. This reduces the learning curve, enabling users to navigate the software effortlessly and perform accounting tasks without stress.

e) Cloud accessibility: Being a cloud-based solution, Sage Business Cloud Accounting allows users to access their accounting data from anywhere with an internet connection. This feature is especially valuable in today's remote work environment, promoting collaboration and flexibility.

f) Basic financial reporting: While not as robust as the reporting capabilities of more advanced accounting software, Sage Business Cloud Accounting offers basic financial reporting functionalities. Users can generate essential reports, including profit and loss statements and balance sheets, to gauge their financial health.

g) Tax calculation: Accurate tax calculations are vital for businesses to meet their tax obligations. Sage Business Cloud Accounting assists users by calculating taxes based on the transactions recorded, simplifying tax preparation.

h) Affordability: Small businesses and sole proprietors often operate with limited budgets. Sage Business Cloud Accounting offers an affordable solution that provides essential accounting features without straining financial resources.

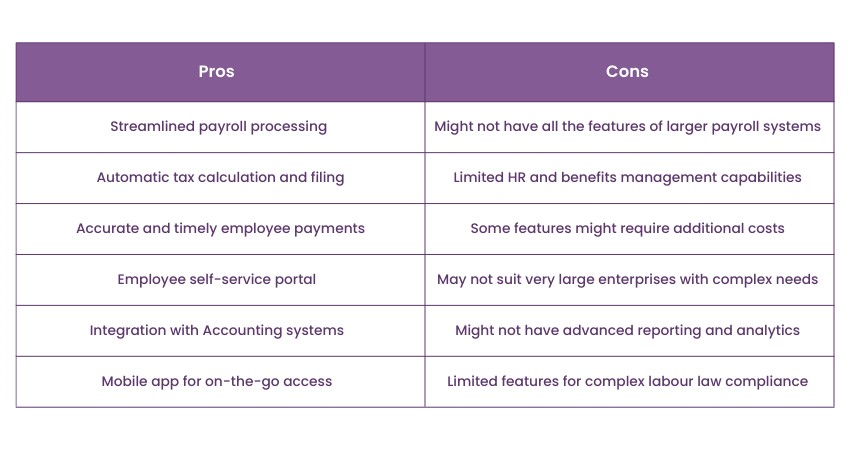

5) Sage payroll

Payroll management is a crucial part of any business, ensuring that employees are accurately compensated and compliant with tax regulations. Sage Payroll is a specialised software solution designed to simplify and streamline the often-intricate process of payroll processing. This section delves deeper into the key features of Sage Payroll and how it benefits businesses of all sizes.

a) Automated payroll processing: Sage Payroll eliminates the need for manual calculations by automating payroll processing. It accurately calculates employee wages, salaries, overtime, and deductions, minimising the risk of errors and ensuring that employees are paid on time.

b) Tax compliance: Maintaining compliance with tax regulations is a complex task. Sage Payroll stays up to date with changing tax laws, automating the calculation and deduction of taxes, social security contributions, and other statutory deductions. This ensures that your business remains in line with legal requirements.

c) Employee self-service portal: Sage Payroll often includes an employee self-service portal where employees/users can access their pay stubs, tax documents, and other important payroll-related information. This feature minimises the administrative burden on HR departments and empowers employees to manage their own payroll details.

d) Direct deposit: Sage Payroll facilitates direct deposit, allowing employees to conveniently receive their pay directly in their bank accounts. This saves time and minimises the risk associated with lost or stolen paper checks.

e) Time and attendance integration: Integration with time and attendance systems allows Sage Payroll to automatically factor in employee work hours, shifts, and overtime. This integration ensures that employee pay is accurately based on their actual working hours.

Take your accounting expertise to new heights with our world-class Accounting Masterclass. Register now for comprehensive learning and professional growth!

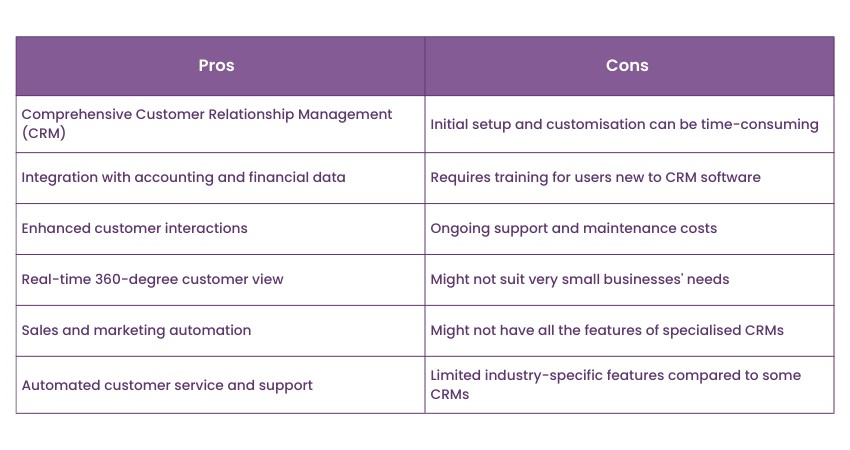

6) Sage CRM

Sage CRM is a dynamic customer relationship management software that aids businesses in managing interactions with customers and integrates seamlessly with accounting systems, providing a holistic view of the organisation's financial health. This powerful software is designed to streamline processes, improve customer interactions, and enhance overall financial insight. Here are the key features that make Sage CRM stand out:

a) 360-degree customer view: Sage CRM provides a comprehensive view of customer data, enabling businesses to understand customer preferences, purchase history, and interactions. This data integration with accounting allows for better financial decision-making based on customer behaviour.

b) Sales and marketing automation: The software automates sales and marketing processes, allowing businesses to nurture leads, track opportunities, and manage campaigns. The integration with accounting data ensures that sales and financial teams have aligned information for accurate forecasting.

c) Customisable dashboards: Sage CRM offers customisable dashboards that provide real-time insights into sales performance, customer engagement, and financial metrics. This visibility assists in identifying trends and optimising strategies.

d) Integration with accounting: Connecting Sage CRM with accounting software enables a seamless flow of information between sales, customer interactions, and financial data. This integration enhances accuracy in invoicing, order tracking, and revenue recognition.

e) Lead and opportunity management: The software facilitates lead tracking and opportunity management, ensuring that potential sales are efficiently tracked and converted. With accounting integration, financial impact is considered when pursuing opportunities.

f) Customer service and support: Sage CRM helps manage customer inquiries, complaints, and support requests. Integrated accounting data aids in providing timely responses and understanding the financial implications of customer interactions.

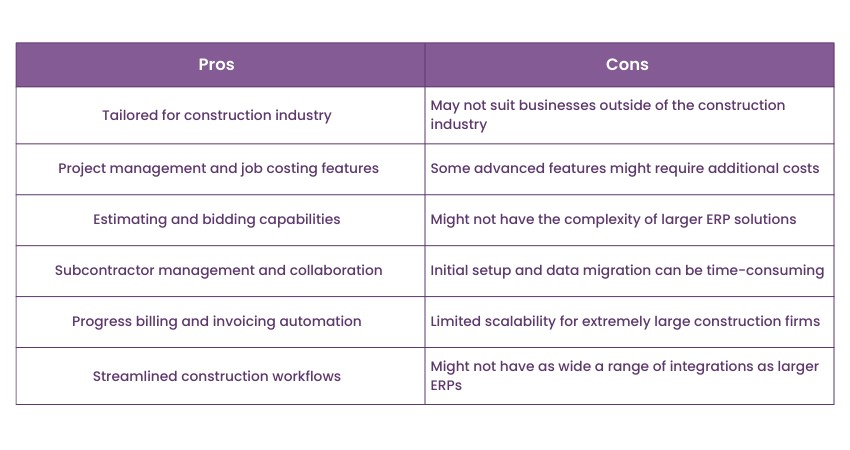

7) Sage Contractor

Sage Contractor is a specialised accounting software created to cater to the distinct needs of the construction industry. From project management to job costing and everything in between, this comprehensive solution offers construction businesses the tools they need to efficiently manage their finances and operations. Here's an in-depth look at the key features and benefits of Sage Contractor:

a) Project management and job costing: Sage Contractor enables construction firms to track every aspect of their projects, from initial estimates to project completion. Job costing features help allocate costs accurately, ensuring profitability assessment for each project phase.

b) Estimating and bidding: The software assists in creating accurate project estimates and bids by integrating cost data, labour expenses, materials, and subcontractor quotes. This leads to competitive bidding and more precise budgeting.

c) Subcontractor management: Sage Contractor allows businesses to manage subcontractor agreements, track work performed, and ensure timely payments. This reduces administrative overhead and enhances collaboration with subcontractors.

d) Change order management: Construction projects often involve changes to the original scope. The software facilitates tracking and managing change orders, ensuring transparency and accountability in budget adjustments.

e) Progress billing: Sage Contractor automates progress billing based on project milestones, ensuring that invoices are generated accurately and promptly. This enhances cash flow and financial planning.

f) Payroll and labour tracking: The software includes payroll functionality tailored to the construction industry, considering factors such as prevailing wages and union rules. Labour tracking features help monitor workforce efficiency.

g) Equipment and inventory management: Construction businesses can track equipment usage, maintenance, and depreciation. Inventory management features assist in monitoring materials and supplies for projects.

Master the essentials of payroll management with our comprehensive Introduction to Payroll Training. Sign up now to elevate your financial skillset!

Advance your accounting skills with Sage 50 Accounts Training. Register now and master efficient financial management!

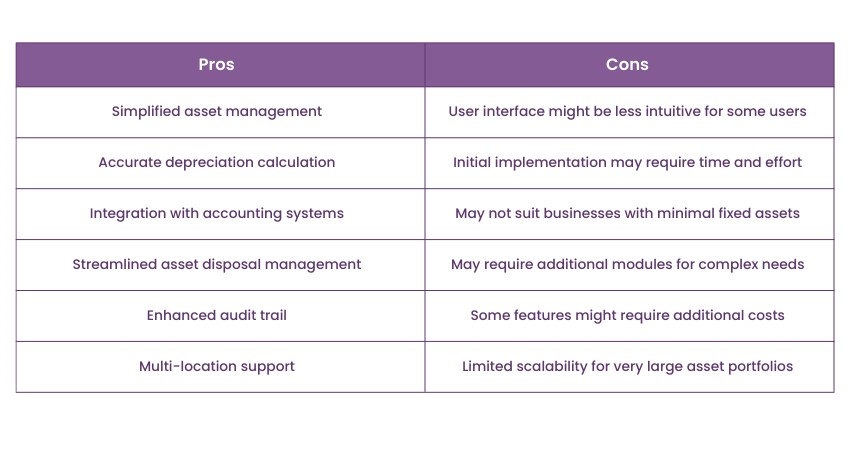

8) Sage Fixed Assets

Sage Fixed Assets is a robust software solution designed to simplify the complicated process of managing and tracking tangible assets throughout their lifecycle. Whether it's equipment, vehicles, machinery, or property, businesses across various industries benefit from Sage Fixed Assets' capabilities in optimising asset management, ensuring compliance, and maximising return on investment.

a) Depreciation calculation: Sage Fixed Assets automates the calculation of depreciation, considering various methods such as straight-line, declining balance, and custom methods. This ensures accuracy and compliance with accounting standards.

b) Asset tracking: The software enables businesses to maintain a comprehensive record of asset details, including acquisition date, cost, location, and maintenance history. This aids in optimising asset utilisation and reducing the risk of loss or theft.

c) Regulatory compliance: Businesses are subject to regulatory requirements related to asset reporting, tax compliance, and financial statement disclosures. Sage Fixed Assets helps ensure adherence to these regulations, reducing the risk of penalties and errors.

d) Tax planning: The software assists in tax planning by providing insights into the tax implications of asset acquisitions, disposals, and depreciation methods. This helps businesses make informed decisions that optimise their tax liability.

e) Customised reporting: Sage Fixed Assets offers a range of customisable reports that provide insights into asset depreciation, valuations, and historical data. These reports aid in financial planning, budgeting, and decision-making.

Conclusion

Sage Accounting Software presents a range of options tailored to businesses' unique financial needs. By understanding the Different Types of Sage Accounting Software, the features, and the suitability of each version, businesses can make a well-informed decision to level up their financial management practices and drive business growth.

Expand your financial horizons with a diverse range of expert led Accounting and Finance Courses. Register today and advance your career!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Sage 50 Accounts Training

Sage 50 Accounts Training

Fri 17th Jan 2025

Fri 21st Feb 2025

Fri 4th Apr 2025

Fri 6th Jun 2025

Fri 29th Aug 2025

Fri 24th Oct 2025

Fri 26th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please