We may not have the course you’re looking for. If you enquire or give us a call on +08000201623 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In an era where e-commerce and online shopping are how people shop and do business, ensuring the security and privacy of customer data is paramount. One way to achieve this is by adhering to the standard of Payment Card Industry Data Security Standard (PCI DSS). Understanding Why PCI DSS is importance cannot be stressed enough, as many consumers and businesses often fall prey to data breaches and financial breaches.

According to Statista, the e-commerce loss due to online payment fraud was 32.19 billion GBP in 2022 globally. This shows the importance of compliance with this standard. In this blog, you will learn Why PCI DSS is important of PCI DSS and learn Why compliance with the standard is essential for businesses to build trust.

Table of Contents

1) What is PCI DSS?

2) 12 requirements for PCI DSS compliance

3) Importance of PCI DSS and its benefits

4) Consequences of non-compliance with PCI DSS

5) Conclusion

What is PCI DSS?

The Payment Card Industry Data Security Standard (PCI DSS) is a comprehensive set of security standards established by major credit card companies to safeguard sensitive cardholder data. PCI DSS provides guidelines and best practices for organisations that process or store payment card information. It ensures businesses maintain a secure environment to protect against data breaches and unauthorised access.

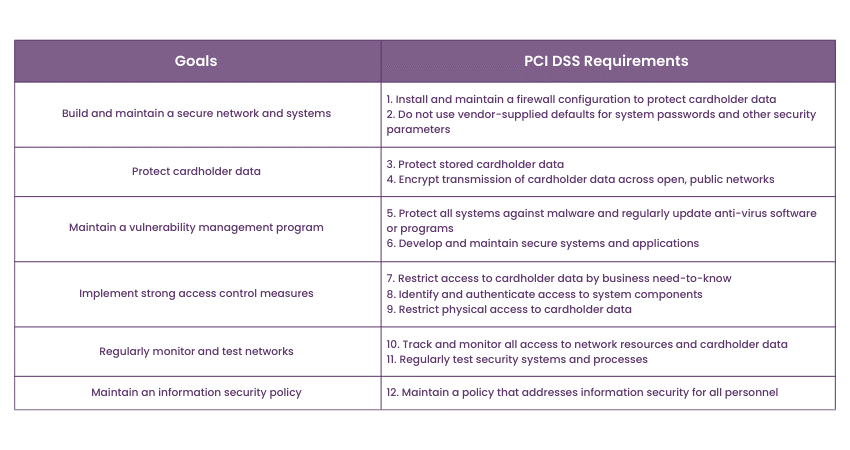

12 requirements for PCI DSS compliance

PCI DSS compliance consists of 12 specific requirements that businesses must fulfil to ensure cardholder data security. These requirements cover various aspects of data protection and security measures.

Let's take a closer look at each requirement.

1) Install and maintain a firewall: Businesses must have a secure network perimeter and employ firewalls to protect cardholder data.

2) Change default passwords: Default passwords on system components and software must be modified to reduce the risk of unauthorised access.

3) Protect cardholder data: Encryption should be implemented to protect sensitive information during transmission and storage.

4) Use strong access control measures: Access to cardholder data should be restricted based on the principle of "need-to-know" to minimise exposure and prevent unauthorised access.

5) Regularly monitor and test networks: Ongoing monitoring and periodic testing of security systems help identify and address vulnerabilities.

6) Implement robust security policies: Organisations must establish and maintain comprehensive security policies and procedures to guide their security practices.

7) Restrict access to cardholder data: Access to cardholder data should be granted only to authorised personnel and on a need-to-know basis.

8) Assign unique IDs to users: Each individual with computer access should have a unique identification to track and monitor system activity.

9) Restrict physical access: Measures should be in place to restrict physical access to cardholder data, such as video surveillance and access control systems.

10) Regularly update antivirus software: Antivirus software must be implemented and regularly updated to protect against malware and other malicious threats.

11) Implement strong authentication measures: Multi-factor authentication should be used to access secure systems remotely.

12) Maintain information security policies: Organisations should develop and maintain policies that address information security requirements for employees and contractors.

By adhering to these requirements, businesses can establish a robust security framework, reduce the risk of data breaches, and protect cardholder information throughout the payment card transaction process. It is essential for organisations to regularly review and update their security practices to maintain ongoing compliance with these requirements.

Get compliant with PCI DSS and protect your customers' data with the PCI DSS Implementer training.

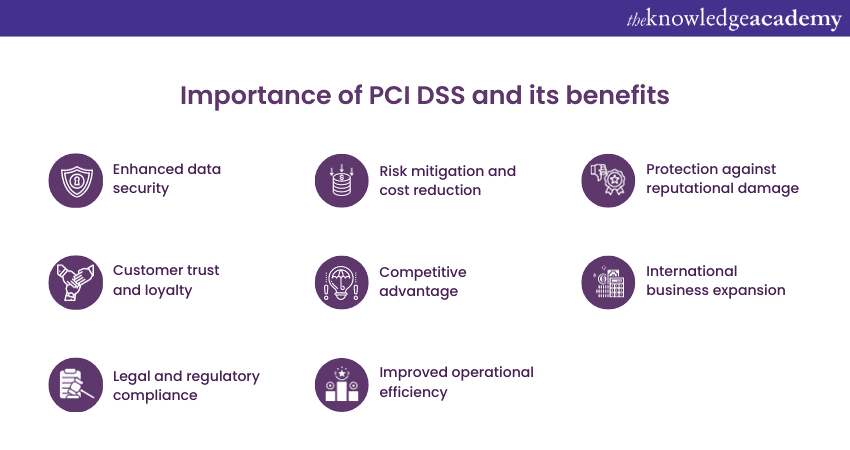

Importance of PCI DSS and its benefits

PCI DSS is a set of security standards that businesses must follow to protect cardholder data. Compliance with security standards PCI DSS is extremely important and has so many advantages for businesses. Let's explore Why PCI DSS is Important:

Enhanced data security

PCI DSS compliance ensures that businesses have a secure environment for processing, storing, and transmitting cardholder data. Compliance reduces the chances of data breaches and unauthorised access by requiring security measures such as encryption, access controls, and network monitoring.

Customer trust and loyalty

One of the main Benefits of PCI DSS Compliance is it shows customers that their privacy and data security are important to the business. Customers are more likely to share their payment information with a business that follows strict security standards. This builds trust and confidence, which leads to higher customer loyalty and satisfaction and enhances the business’s reputation.

Legal and regulatory compliance

Many laws and regulations around the world relate to data security and privacy. Compliance with PCI DSS helps businesses meet these legal requirements, avoiding non-compliance penalties and legal liabilities. Compliance also serves as a basis for meeting other data security regulations that are specific to certain industries or regions.

Learn the importance and implementation of Consumer Protection Laws with our Consumer Protection Masterclass.

Risk mitigation and cost reduction

Businesses may face hefty fines, penalties, legal fees, and remediation costs if they suffer a security breach. Compliance helps businesses avoid these costs by implementing the necessary security controls and conducting regular audits, potentially saving a lot of money in the long run.

Competitive advantage

PCI DSS compliance can give businesses an edge over their competitors. Compliance demonstrates a commitment to best practices and customer protection in industries where data security is a concern. This can attract customers who value data privacy and security and differentiate the business from others.

Improved operational efficiency

PCI DSS compliance requires businesses to have robust security processes and systems. This improves operational efficiency as businesses adopt standardised procedures, streamline access controls, and monitor and test their networks regularly. These improvements result in a more secure and organised business environment.

Protection against reputational damage

Non-compliance with PCI DSS can damage a business’s reputation. A data breach or security incident can erode customer trust, generate negative publicity, and harm the business’s image. Compliance helps businesses protect their reputation by showing a commitment to data security and maintaining the trust and loyalty of customers.

International business expansion

PCI DSS compliance enables businesses to expand their operations internationally by meeting the data security requirements of different countries and regions. Many countries have adopted PCI DSS as a recognised security standard, making compliance a necessity for businesses that want to operate globally or partner with international entities. Compliance helps businesses overcome regulatory challenges and expand their operations with confidence.

Overall it plays a key role in protecting your business. By understanding the Roles and Responsibilities of PCI DSS, you can not only safeguard your business but also increase your business opportunities.

Take the first step towards safeguarding your business with our Compliance Training – Sign up now!

Consequences of non-compliance with PCI DSS

While it is not required by law to be compliant with PCI DSS, not being compliant can have consequences in the form of broken customer trust, increased risk for data breaches and reputational damage. Here are some consequences of non-compliance with PCI DSS.

Financial penalties and liabilities

If a data breach occurs and a business is not PCI compliant, it may be held financially responsible for the stolen funds and incur additional costs. This includes reimbursing customers and their banks, potentially facing hefty fines that can cripple or even close the business.

Reputation damage

A single data breach can severely damage a business's reputation. Customers expect their personal information to be protected, and if a breach occurs due to non-compliance, customers may lose trust and take their business elsewhere. Rebuilding a tarnished reputation can be challenging, impacting future customer loyalty and brand perception.

Legal and regulatory ramifications

Although PCI compliance is not a law, non-compliance can still have legal implications. Card brands may impose penalties, revoke services, or suspend accounts for non-compliant businesses. In the event of a data compromise, businesses may suffer financial losses, incur expenses for card issuance, and be required to invest in future detection and prevention services mandated by card associations.

Increased transaction fees

Non-compliance with PCI DSS may increase transaction fees imposed by card associations. These fees can be a consequence of breaches or as a penalty for not adhering to the required security standards. Higher transaction fees can impact profitability and financial stability.

Limited business opportunities

Many partnerships and collaborations require PCI compliance as a prerequisite. Failure to meet these compliance requirements may hinder business expansion, limit potential partnerships, and prevent access to new markets that prioritise data security.

Higher risk of data breaches

Non-compliance increases the risk of data breaches and security incidents. Not implementing the necessary security measures and controls make businesses vulnerable to cyberattacks and unauthorised access, potentially leading to significant financial and reputational damage.

Conclusion

We hope you read and understand Why PCI DSS is Important. Businesses must adhere to its requirements to protect customer data, build trust, mitigate financial risks, and ensure legal and regulatory compliance. Non-compliance can lead to devastating consequences like, financial penalties, reputational damage, and increased risk of data breaches. Maintaining PCI DSS compliance helps safeguard valuable customer information and contributes to your business's long-term success and sustainability.

Build a solid foundation in PCI DSS compliance with our PCI DSS Foundation Course – Sign up today!

Frequently Asked Questions

PCI compliance is not a universal legal requirement, but it is mandated by various laws and regulations in many regions to protect cardholder data. Non-compliance can lead to legal repercussions and penalties, making it a de facto requirement for businesses that handle payment card information.

Businesses should regularly review and update their PCI DSS compliance measures to stay ahead of evolving threats. Conducting annual assessments is a common practice, but continuous monitoring is crucial to ensure ongoing compliance and security in a dynamic cyber landscape.

PCI DSS Specialists have diverse career opportunities, including Compliance Managers, Security Analysts, and Consultants. These roles align with the growing emphasis on data security and privacy in various industries. As data breaches become more prevalent, demand for PCI DSS expertise continues to rise. By preparing for the top PCI DSS Interview Questions and Answers, you can maximise your chances of getting a job in this domain.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. By tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Compliance Courses, including PCI DSS Foundation, Consumer Protection Masterclass and many more. These courses cater to different skill levels, providing comprehensive insights into Compliance methodologies in general.

Our ISO & Compliance blogs cover a range of topics related to Compliance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Compliance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 9th Jan 2025

Thu 13th Mar 2025

Thu 12th Jun 2025

Thu 7th Aug 2025

Thu 18th Sep 2025

Thu 27th Nov 2025

Thu 18th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please