We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine a world where your wallet is always full, and financial stress is a thing of the past. That’s the power of Budgeting Skills—the key ingredient to managing your money like a pro. Get ready to unlock the door to financial freedom and say hello to a life where every penny is not just spent but smartly invested. So, are you set to bid farewell to fiscal frets and embrace a life where you are the boss of your bucks? Let’s begin this savvy saving spree together!

Table of Contents

1) What is Budget?

2) What are Budgeting Skills?

3) Budget Management Skills

4) How to Improve Budgeting Skills?

5) Conclusion

What is Budget?

A budget is a plan that outlines how money will be spent and saved. It helps manage finances by tracking income and expenses, ensuring overspending is avoided and saving for future goals is possible. Budgets can be used by individuals, families, businesses, and governments to make informed financial decisions. Creating and following a budget can lead to financial stability and the achievement of long-term results.

What are Budgeting Skills?

Budgeting Skills cover the competencies needed to effectively manage and oversee a company’s financial expenditures. These skills are essential in various financial contexts, from overseeing a company’s fiscal health to managing the budget of a specific project. They enable team leaders, managers, and professionals to ensure a business remains profitable by carefully planning future spending and judiciously distributing resources. Effective budgeting is key to maintaining financial control and achieving long-term financial goals.

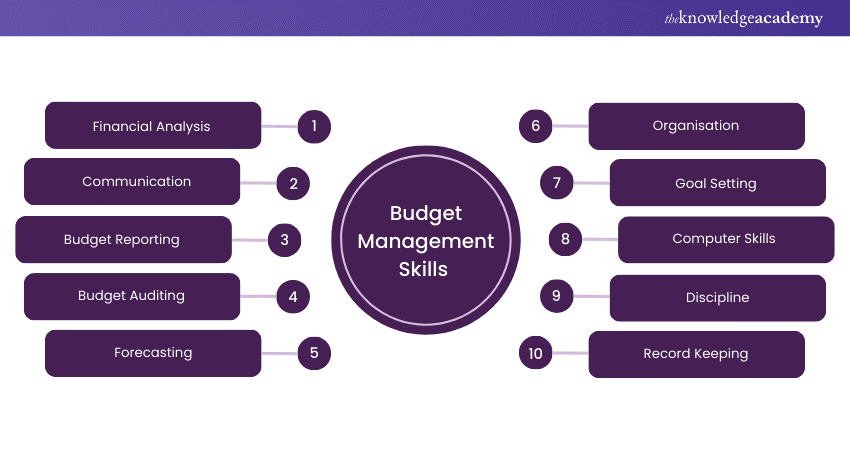

Budget Management Skills

Budget Management Skills play a key role in making sure the financial health and success of a business. Here are some of the skills mentioned below:

1) Financial Analysis

This skill is the backbone of budget management. It involves a deep dive into financial statements to extract meaningful insights that guide budget planning and strategic decision-making. This analysis helps identify areas for growth, enabling investments in new hires, technology, and other resources that drive business expansion.

2) Communication

Effective budget management isn’t a solo endeavour; it requires ongoing discussion with stakeholders. Communication skills are essential for articulating financial trends, explaining budget reports, and sharing forecasts. When stakeholders are well-informed, they can make decisions that align with the budget and contribute to achieving organisational goals.

3) Budget Reporting

Creating detailed budget reports is a critical skill that helps track financial performance against goals. These reports serve as a roadmap for future financial planning, allowing businesses to adjust strategies and set realistic targets for subsequent periods.

4) Budget Auditing

Regular audits ensure that a budget is functioning as intended and adhering to financial regulations. Auditing skills are necessary for identifying discrepancies, understanding fund allocation, and ensuring that every dollar spent contributes to the company’s profitability.

5) Forecasting

This predictive skill is about estimating future financial results based on past and current data. Forecasting helps businesses prepare for upcoming expenses, allocate funds for essential projects, and manage resources effectively throughout the fiscal year.

Learn the ability to prioritise tasks and manage time with our Motivation and Goal Setting Training – join today!

6) Organisation

A well-organised budget is easier to manage and track. Organisational skills help maintain a clear view of financial accounts, expenses, and income sources, facilitating smooth audits and accurate financial reporting.

7) Goal Setting

Defining financial objectives is crucial for guiding a company’s budgetary practices. Goals based on historical financial data help businesses focus their spending and ensure there are enough funds for necessary operations.

8) Computer Skills

In today’s digital age, proficiency with budgeting software and computer spreadsheets is indispensable. These tools enable the analysis of financial data and support the creation of comprehensive budget plans.

9) Discipline

Discipline is essential in budget management, acting as a safeguard against overspending and financial missteps. A disciplined approach to budgeting ensures that funds are allocated wisely and that the budget is reviewed and adjusted in a timely manner, maintaining financial integrity and promoting fiscal responsibility.

10) Record Keeping

Keeping meticulous records of all transactions is fundamental for accurate budgeting. Whether it’s done manually or through software, proper record-keeping provides a clear picture of a business’s financial performance.

11) Critical Thinking

Making informed decisions about where and how to allocate funds is a key aspect of budgeting. Critical thinking allows professionals to devise effective budget strategies and manage investments to maximise profitability within the available financial resources.

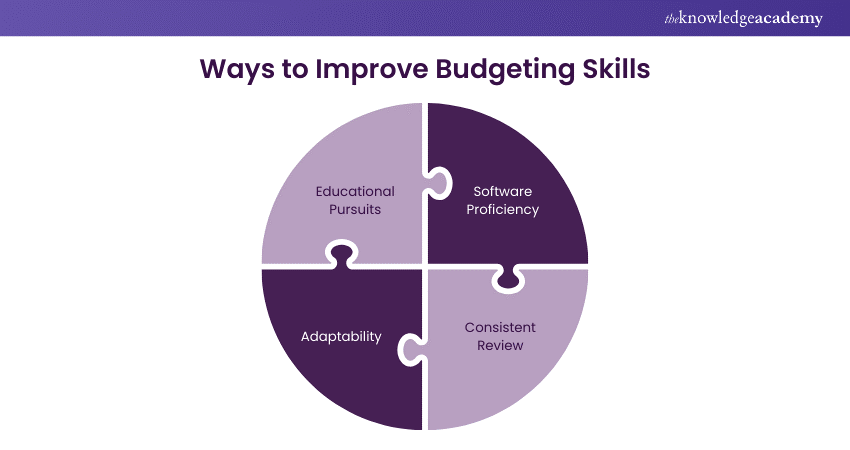

How to Improve Budgeting Skills?

Enhancing Budgeting Skills can be achieved through a few strategic steps:

a) Educational Pursuits: Join budgeting courses or attend workshops that focus on key skills like forecasting and fund allocation. These educational resources often include hands-on practice with financial analysis and budget formulation.

b) Software Proficiency: Familiarise with the latest budgeting software beyond traditional spreadsheets. These tools can enhance the financial analysis capabilities, assist in revenue prediction, and streamline the creation of budget reports.

c) Consistent Review: Conduct monthly budget reviews to refine the financial strategies. This regular assessment helps to stay on track with revenue goals, understand past performance, and plan for future success.

d) Adaptability: Maintain a flexible approach to budgeting. Be ready to adjust the budget in response to financial fluctuations throughout the year, ensuring that planning remains relevant and effective.

Find ways to identify opportunities for growth with our Strategic Thinking and Planning Course – join today!

Conclusion

Refining your Budgeting Skills is a key step towards achieving financial acumen. It’s a process that involves embracing new learning opportunities, leveraging advanced tools, and regularly assessing your financial plans. Stay adaptable and open to change, as these qualities are crucial in the ever-shifting financial terrain. With sharpened Budgeting Skills, you are equipped to guide your business to a prosperous and stable financial future.

Learn the different budgeting techniques with our Introduction to Managing Budgets Course – join today!

Frequently Asked Questions

What are the Differences Between Short-term and Long-term Budgeting Goals?

Short-term budgeting goals focus on immediate financial needs and cash flow management, typically spanning a year or less. Long-term budgeting goals involve strategic planning for future financial stability and growth, often extending over several years.

How do Budgeting Skills Impact Financial Decision-making?

Budgeting Skills are crucial for making informed financial decisions, allowing businesses to allocate resources efficiently and plan for both short-term expenses and long-term investments.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the Knowledge Pass, and How Does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Personal Development Courses, including Introduction to Managing Budgets Course, Organisational Skills Course, and Attention Management Course. These courses cater to different skill levels, providing comprehensive insights into Behaviour Management.

Our Business Skills Blogs cover a range of topics related to personal development, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Budgeting Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Introduction to Managing Budgets

Introduction to Managing Budgets

Fri 13th Jun 2025

Fri 8th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please