We may not have the course you’re looking for. If you enquire or give us a call on 800600725 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In today's digital age, Forex Trading Software has revolutionised how traders operate in the global currency market. Whether you are a beginner taking your first steps or an experienced trader looking for advanced tools, understanding the Forex Trading platform and Software is vital.

According to Glassdoor, the mean annual income of a Forex trader in the United Kingdom is £49,426. Forex Trading platforms and software are vital tools for Forex Traders. In this blog, we will explore how Forex Trading Software refers to computer programs and applications designed to facilitate trading activities in the FOReign EXchange (forex) market.

Table of contents

1) What is Forex Trading Software?

2) Key features of Forex Trading Software

3) Types of Forex Trading Software

4) Choosing the Right Forex Trading Software

5) Risks and benefits of using Forex Trading Software

6) The future of Forex Trading Software

7) Conclusion

What is Forex Trading Software?

Forex Trading Software refers to a set of computer programs, applications, and platforms that enable individuals and institutional traders to engage in Forex trading activities in the global currency market.

This software acts as a digital interface between traders and the forex market, facilitating the execution of trades, analysis of market data, and implementation of trading strategies. It encompasses a wide range of tools and features designed to enhance the trading experience, provide real-time market information, automate trading processes, and assist traders in making informed decisions.

Whether used by beginners or experienced professionals, Forex Trading Software plays a pivotal role in simplifying and streamlining the complexities of trading currencies on a global scale.

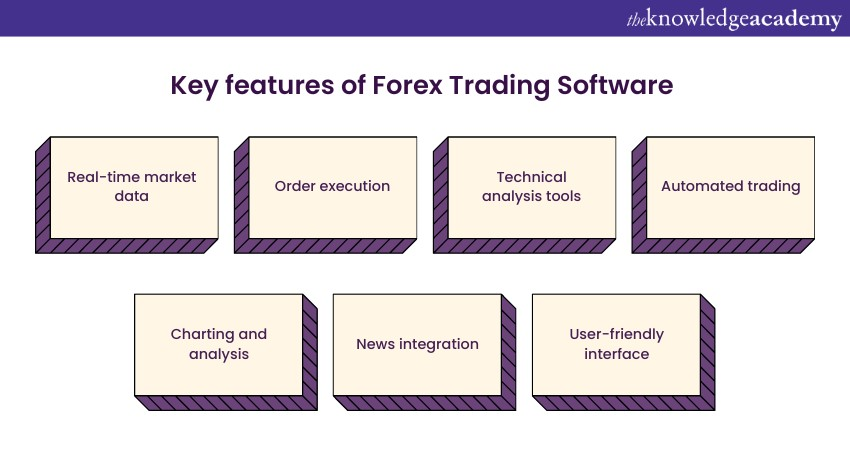

Key features of Forex Trading Software

Modern Forex Trading Software comes with a range of vital attributes that equip traders with the necessary tools for manoeuvring through the swiftly changing foreign exchange market. These attributes are crafted to amplify decision-making capabilities, simplify trading procedures, and offer a thorough understanding of market patterns. Let's delve deeply into the essential components

Real-time market data

Forex Trading Software provides access to real-time market data, including live currency prices, bid-ask spreads, trading volumes, and historical price movements. This up-to-the-moment information enables traders to make well-informed decisions based on current market conditions.

Order execution

Efficient order execution is crucial in forex trading. Trading software facilitates the placement of diverse orders like market, limit, and stop-loss orders. This ensures that trades are executed promptly at desired price levels, reducing the risk of slippage and maximising trading efficiency.

Technical analysis tools

Forex Trading Software commonly encompasses an array of technical analysis tools, including indicators and chart patterns. Traders can apply these tools to analyse historical price data, identify trends, and forecast potential price movements. This aids in making informed trading decisions and developing effective trading strategies.

Automated trading

Automation is a standout feature in modern Forex Trading Software. Traders can create or import trading algorithms known as Expert Advisors (EAs) or trading robots. These algorithms autonomously execute trades based on predetermined criteria like technical indicators or specific market conditions. Automated trading curtails emotional decision-making and facilitates continuous trading throughout the clock.

Start Your Journey to Financial Freedom! Join Our Cryptocurrency Trading Training and Learn to Navigate the World of Digital Assets with Confidence!

Charting and analysis

Advanced charting features provide traders with customisable charts, timeframes, and technical indicators. This empowers traders to perform in-depth technical analysis, identify entry and exit points, and visualise price patterns for more accurate predictions.

News integration

Many forex trading platforms integrate real-time news feeds and economic calendars. Staying informed about economic events, geopolitical news, and central bank decisions is crucial in Forex Trading. Integration of news updates allows traders to adapt to market-moving events quickly.

User-friendly interface

Forex Trading Software offers user-friendly interfaces with intuitive navigation. This is particularly beneficial for beginners who are just entering the forex market. Clear layouts, accessible tools, and easy order placement contribute to a seamless trading experience.

Master the Forex Markets: Join Now for Comprehensive Foreign Exchange Training!

Types of Forex Trading Software

Forex Trading platform and software come in various forms, each catering to different trading styles, preferences, and levels of expertise. These software types offer a range of functionalities, from basic order execution to advanced technical analysis and automation. Here are some of the best Forex Trading Software:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

MetaTrader platforms, including MT4 and MT5, have gained immense popularity for their user-friendly interfaces and comprehensive features. MT4 offers a range of technical indicators and charting tools for automated trading. MT5, its successor, builds upon this foundation and adds more asset classes beyond forex, including stocks and commodities. Traders can access historical data real-time quotes, and execute trades, making MetaTrader a versatile choice for both beginners and experienced traders.

cTrader

cTrader is renowned for its user-friendly interface, allowing traders to navigate the platform effortlessly. It provides advanced charting features, including more than 70 technical indicators and various timeframes. cTrader's Direct Market Access (DMA) feature allows traders to place orders directly into the interbank forex market, potentially leading to faster execution and reduced spreads. The platform also supports algorithmic trading with cAlgo, enabling traders to develop custom indicators and automated strategies.

NinjaTrader

NinjaTrader appeals to traders seeking advanced technical analysis capabilities and customisation options. With a vast selection of indicators and drawing tools, traders can perform in-depth analysis. NinjaTrader's Market Analyser feature allows traders to monitor multiple instruments and apply complex conditions to identify trading opportunities. The platform supports third-party indicator integration and features an easy-to-use strategy development interface, making it a favourite among algorithmic traders.

TradingView

TradingView stands out for its vibrant community and social trading features. Traders can share ideas, charts, and analyses with others, creating a collaborative environment. The platform provides an array of technical indicators and drawing tools, along with advanced charting options. TradingView's cloud-based accessibility and compatibility with multiple devices make it convenient for traders to access their accounts and charts from anywhere.

Automated Trading Robots/Expert Advisors (EAs)

Automated trading robots, or EAs, offer traders the ability to trade without constant manual supervision. Traders can develop EAs using programming languages like MQL4 or MQL5 for MetaTrader platforms. EAs can execute trades based on specific conditions, such as technical indicators or predefined algorithms. While EAs offer the advantage of removing emotions from trading, they require thorough testing and monitoring to ensure they perform as intended.

Signal Generators

Signal generators are tools within Forex Trading Software that offer trading suggestions based on predetermined algorithms or expert analysis. These signals indicate potential entry and exit points for trades. Traders can subscribe to signal services or use software that generates signals automatically. Signal generators can be particularly useful for traders who are learning, as they provide insights into trades, though they should always be used in conjunction with personal analysis.

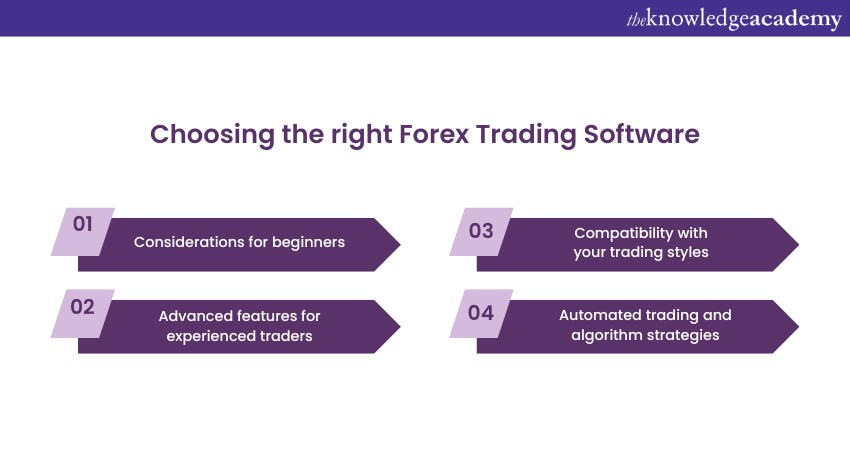

Choosing the right Forex Trading Software

Selecting the appropriate Forex Trading platform and Software is an important decision that significantly impacts your trading journey. With several options available in the market, each offering unique features and capabilities, it is essential to carefully evaluate your needs, experience level, and trading goals. Here are some tips to help you make an informed choice when choosing the right Forex Trading Software:

Considerations for beginners

For those new to forex trading, opt for trading software that offers a user-friendly interface with intuitive navigation. MT4 and MT5 are renowned for their beginner-friendly interfaces, comprehensive educational resources, and the ability to start with demo accounts. These platforms provide access to a range of technical indicators, making them ideal for beginners who want to learn and practice technical analysis.

Advanced features for experienced traders

Experienced traders often require more advanced features to support their trading strategies. If you are well-versed in technical analysis and algorithmic trading, platforms like NinjaTrader and cTrader might be more suitable. These platforms offer a broader selection of technical indicators, customisable charting, and the ability to integrate third-party indicators and trading algorithms. Advanced traders can benefit from the advanced tools these platforms provide to refine and execute complex trading strategies.

Compatibility with your trading styles

Your trading style plays a crucial role in selecting the right software. If you prefer short-term trading like scalping, a platform with low latency and fast execution times is essential. On the other hand, if you're a swing trader who relies heavily on technical analysis, platforms with comprehensive charting tools and indicator libraries are more suitable. Consider how the software aligns with your preferred trading style to ensure a seamless and efficient trading experience.

Automated trading and algorithm strategies

If you are interested in automated trading or algorithmic strategies, prioritise platforms that support Expert Advisors (EAs) or automated trading robots. MetaTrader platforms (MT4 and MT5) are renowned for their robust EA capabilities, allowing you to develop, backtest, and deploy automated strategies. Ensure that the software's programming language aligns with your expertise or willingness to learn, as coding EAs requires a degree of technical proficiency.

Unlock the Secrets of Successful Stock Trading – Join Our Stock Trading Masterclass Today!

Risks and benefits of using Forex Trading Software

Let us explore in more detail the risks and benefits associated with each of the Forex Trading Software mentioned earlier:

Risks and benefits of using MT4 and MT5

Here are some benefits and risks of using MT4 and MT5:

1) Benefits

MetaTrader platforms, including MT4 and MT5, have gained immense popularity for several compelling reasons:

a) User-friendly interface: Both MT4 and MT5 offer user-friendly interfaces that cater to traders of all levels. Beginners find these platforms easy to navigate, while experienced traders appreciate the advanced features that enhance their trading strategies.

b) Technical analysis tools: Both platforms provide a wide range of technical indicators, charting tools, and customisable templates. These features empower traders to perform in-depth analysis and make informed trading decisions.

c) Automated trading: MT4 and MT5 are renowned for their Expert Advisor (EA) functionality. Traders can create, back test, and deploy automated trading strategies using their preferred technical indicators and trading rules.

d) Community and education: The MetaTrader community is a valuable software for both beginners and experienced traders. The availability of trading signals, forums, educational materials, and expert insights fosters a collaborative environment for learning and idea-sharing.

2) Risks

While MT4 and MT5 have numerous benefits, they also come with certain risks:

a) Limited asset classes (MT4): MT4 is primarily designed for forex trading. If your trading strategy involves other asset classes like stocks, commodities, or cryptocurrencies, you might find MT5 more suitable due to its expanded asset coverage.

b) Learning curve for advanced features: Mastering the more advanced features, such as custom indicators or script programming, might require time and effort, particularly for less experienced traders.

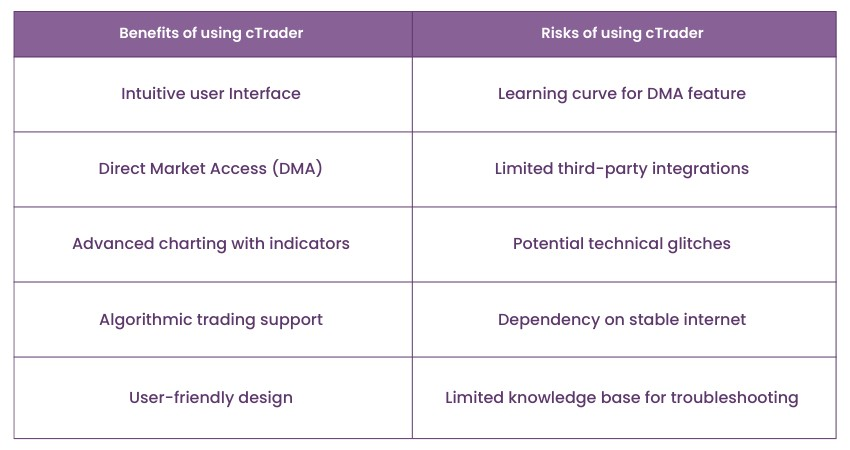

Risks and benefits of using cTrader

Here are some benefits and risks of using cTrader:

1) Benefits

cTrader distinguishes itself with its unique offerings that cater to traders seeking efficiency and innovation:

a) Intuitive design: cTrader's user-friendly interface and intuitive design make it an attractive choice, especially for traders who prioritise a seamless trading experience.

b) Direct market access (DMA): The DMA feature sets cTrader apart by allowing traders to interact directly with interbank liquidity. This potentially leads to tighter spreads and faster order execution.

c) Algorithmic trading: For traders interested in algorithmic trading, cTrader supports cAlgo, which enables the creation and deployment of automated strategies based on technical indicators and custom scripts.

d) Advanced charting: cTrader offers a rich collection of technical indicators and charting tools, empowering traders to perform thorough technical analysis.

2) Risks

However, cTrader also comes with certain considerations:

a) Learning curve for dMA: While DMA provides advantages, it requires traders to have an understanding of the market depth and how liquidity dynamics can impact trades.

b) Limited third-party integrations: While cTrader supports algorithmic trading, its selection of third-party indicators and tools may be more limited compared to other platforms.

Risks and benefits of using NinjaTrader

Here are some benefits and risks of using NinjaTrader:

1) Benefits

NinjaTrader appeals to traders who seek advanced technical analysis capabilities and customisation options:

a) Technical analysis powerhouse: NinjaTrader is known for its robust technical analysis tools. It offers an extensive range of indicators and drawing tools to cater to various trading strategies.

b) Market analyser: The Market Analyser feature allows traders to monitor multiple instruments and conditions simultaneously, facilitating efficient decision-making.

c) Third-party integration: NinjaTrader provides a supportive ecosystem for third-party indicator and strategy integration, allowing traders to tailor their platform to their specific needs.

d) Strategy development: The platform boasts an intuitive interface for strategy development, enabling traders to create, backtest, and deploy custom trading strategies.

2) Risks

However, there are some considerations to keep in mind:

a) Steeper learning curve: Due to its comprehensive set of features, NinjaTrader might have a steeper learning curve, especially for traders who are relatively new to the world of forex trading.

b) Fees for some data feeds: While NinjaTrader offers a range of data feeds, access to certain advanced data feeds or features might come with additional costs.

Risks and benefits of using TradingView

Here are some benefits and risks of using TradingView

1) Benefits

TradingView stands out for its unique community-driven approach and emphasis on technical analysis:

a) Social trading community: TradingView's social features create a sense of community among traders, allowing them to share ideas, analyses, and strategies with a vibrant user base.

b) Advanced charting and customisation: The platform offers advanced charting tools and extensive customisation options. This is particularly beneficial for traders who rely heavily on technical analysis.

c) User-friendly interface: TradingView's intuitive interface caters to traders of all experience levels, providing easy navigation and efficient access to features.

Cloud-based accessibility: The platform's cloud-based nature allows traders to access their charts and trading ideas from any device with an internet connection.

2) Risks

However, TradingView also has certain limitations:

a) Limited automation: While TradingView offers a multitude of charting and analysis tools, it has a limited built-in automation capability compared to platforms specifically designed for algorithmic trading.

Risks and benefits of using Automated Trading Robots/Expert Advisors (EAs)

Here are some benefits and risks of using Automated Trading Robots/Expert Advisors (EAs)

1) Benefits

Automated Trading Robots/EAs provide a few benefits:

a) Emotion-free trading: EAs remove the influence of emotions, ensuring that trading decisions are based solely on pre-defined rules. This helps maintain discipline and consistency in executing trading strategies.

b) 24/5 trading: EAs operate continuously, executing trades around the clock, even during non-trading hours. This allows for the capture of trading opportunities in different time zones and ensures that no potential trade setups are missed.

c) Backtesting and refinement: EAs can be backtested using historical market data to evaluate their performance under various conditions. Traders can refine and optimise their strategies based on the insights gained from backtesting, enhancing the likelihood of success in live trading.

2) Risks

Here are some risks:

a) Adaptability challenges: EAs are designed based on historical data and specific market conditions. However, they may struggle to adapt to sudden and unforeseen changes in the market, potentially leading to losses if the strategy becomes less effective.

b) Over-optimisation risk: While optimising an EA's parameters is crucial, excessive fine-tuning to fit past data perfectly can result in poor performance in live trading conditions. This phenomenon, known as over-optimisation or "curve fitting," can lead to disappointment when the EA fails to replicate past success.

c) Technical vulnerabilities: EAs depend on stable internet connections, proper platform functioning, and accurate programming. Technical glitches, connectivity issues, or programming errors can occur unexpectedly, leading to unintended consequences such as orders being executed at incorrect prices or not executed at all.

Risks and benefits of using Signal Generators

Here are some benefits and risks of using Signal Generators

1) Benefits

Signal generators provide a range of benefits for traders:

a) Guidance for novices: Signal generators offer valuable trading suggestions, which can be particularly helpful for traders who are still learning to analyse the market effectively.

b) Time-saving: Utilising signal generators can save traders time by providing pre-generated signals that indicate potential entry and exit points.

c) Diverse signals: Depending on the signal service or software used, signals can be based on technical analysis, algorithmic models, or insights from experienced traders.

3) Risks

However, there are certain risks associated with relying solely on signals:

a) Dependency on signals: Over-reliance on signals without understanding the underlying analysis can lead to poor decision-making. It is crucial to complement signals with your own analysis.

b) False signals: Like any form of analysis, signals are fallible. False signals can occur, leading to incorrect trading decisions if blindly followed.

The future of Forex Trading Software

The future of Forex Trading Software promises to be transformative, driven by technological advancements and shifting market dynamics. Key trends shaping this future include:

1) Artificial Intelligence (AI) and Machine Learning: AI and machine learning integration will revolutionise decision-making. Real-time data analysis will enable more accurate predictions and informed trading strategies.

2) Quantitative analysis and algorithmic trading: Advanced algorithms and mathematical models will fuel sophisticated algorithmic trading. This trend will lead to more precise and efficient trade execution.

3) Personalisation and customisation: Forex Trading Software will become more personalised. Traders can customise interfaces, indicators, and strategies to match their unique preferences and styles.

4) Cloud-based platforms: Cloud technology will enhance accessibility and scalability. Traders can access their accounts on various devices, irrespective of location.

5) Regulation and security: Evolving regulations will drive enhanced security and transparency in trading software.

6) Mobile trading evolution: Mobile apps will offer advanced features like real-time market analysis and order execution.

7) Social trading and collaboration: Social platforms will democratise trading knowledge, enabling real-time insights and collaboration among traders.

8) Integration of alternative assets: Trading software will accommodate cryptocurrencies and other alternative instruments.

9) User experience and interface design: User interfaces will prioritise user-friendliness, visualisation, and efficient trade execution.

Unlock Your Potential: Elevate Your Investment and Trading Skills with Our Comprehensive Investment and Trading Training. Join now!

Conclusion

Forex Trading Software has become a crucial tool for traders. From automated trading robots to advanced charting platforms, each type of software offers its benefits and risks. By understanding these tools, their features, and how they align with your goals, you can navigate the forex market with confidence and adaptability.

Unlock the secrets of successful forex trading with our comprehensive Forex Trading Masterclass – take your trading skills to the next level!

Frequently Asked Questions

Upcoming Advanced Technology Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 14th Feb 2025

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 15th Aug 2025

Fri 10th Oct 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please