We may not have the course you’re looking for. If you enquire or give us a call on +852 2592 5349 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Step right up to the grand stage of number crunching, where the magic of financial Modelling turns data into gold! This blog is your gateway to understanding the secrets behind the numbers that shape businesses. Here, we spotlight the financial Modelling maestros whose savvy predictions earn them a good “Financial Modelling Salary.” If you’re eager to join the ranks of these numerical prophets or just curious about the treasure they take home, you’re in the right place. Get ready for an exciting journey through the figures that forecast fortunes and the earnings that await those who master the art of Financial Modelling!

Table of Contents

1) What is Financial Modelling?

2) Advantages of Financial Modelling

3) Financial Modelling Analyst Salary Based on Location

4) Financial Modelling Analyst Salary Based on Experience

5) Financial Modelling Analyst Salary Based on Job Roles

6) What Influences the Salary of a Financial Modelling Analyst?

7) Conclusion

What is Financial Modelling?

Financial Modelling is the process of creating a summary of a company’s expenses and earnings in spreadsheet form. This summary is used to evaluate the potential effects of future financial events or decisions on the company’s finances. Financial Analysts employ these models to systematically represent a company’s financial data, aiding in strategic business decision-making. Financial models also serve other purposes, such as enabling Analysts to assess and forecast the company’s stock market performance.

Advantages of Financial Modelling

Financial Modelling stands out as a pivotal tool in the business finance world, offering a multitude of advantages. Here are some of them:

1) Comprehensive Business Insights

Financial Modelling empowers Analysts with the analytical prowess to delve deep into a company’s operations, economic influences, and strategic decisions. This facilitates a robust understanding of the business framework, equipping Analysts to anticipate shifts in the economic landscape and devise strategies to mitigate potential impacts on business activities.

2) Regular Operational Assessments

Through the lens of financial models, Analysts conduct variance analysis, juxtaposing actual business performance against projected budgets. This regular appraisal feeds into a cycle of continuous improvement, enabling Analysts to fine-tune operations and drive profitability.

3) Funding Strategy and Analysis

Financial models are instrumental in forecasting a company’s cash flow dynamics and guiding Analysts in sourcing appropriate funding—be it through debt or equity. These models provide clarity on financial standing post-loan repayments and interest obligations, informing decisions on debt capacity and equity financing levels.

4) Valuation of Business Worth

In the context of company valuation, financial models are crucial. Analysts leverage these models to distil a company’s value by projecting free cash flow across various timeframes, a process particularly valuable during corporate restructuring or stakeholder transactions.

5) Risk Mitigation

Financial models serve as a due diligence tool, outlining the fiscal implications of specific business ventures. Analysts can pinpoint potential hazards and devise strategies to avert them, ensuring informed decision-making, especially when venturing into new markets or adjusting pricing and marketing strategies.

6) Precise Financial Forecasting and Budgeting

The data received from financial models is a cornerstone for crafting detailed budgets and forecasting the financial impact of decisions or events. This information stages structured business operations, allowing Analysts to pursue cost-saving and risk-averse budgeting and forecasting practices.

7) Catalyst for Business Expansion

Financial models identify lucrative opportunities, guide Analysts in evaluating new projects for cost-effectiveness and steer clear of overinvestment in underfunded ventures. These models illuminate pathways to enhancement and investment, unlocking avenues for heightened profitability and business expansion.

Improve skills for strategic financial planning with our Financial Management Course – join today!

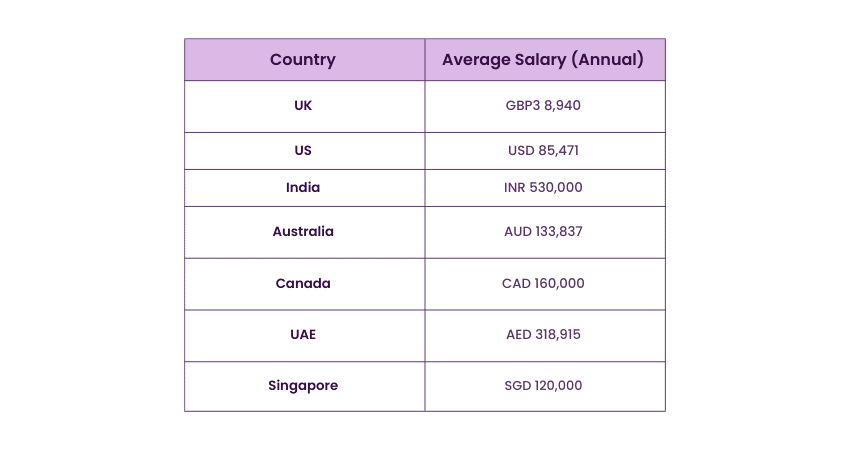

Financial Modelling Analyst Salary Based on Location

Below is a table showing the average salaries of Financial Modelling Analyst in the specified countries:

Source: Glassdoor

Note: Please remember that these figures depend on factors such as experience, location, and company size.

Financial Modelling Analyst Salary Based on Experience

Here is a table showing the average salaries of Financial Modelling Analyst in the UK. This data shows the potential earnings for professionals in this field at different career stages.

|

Experience Level |

Average Salary |

|

Entry Level |

£27,630 |

|

Mid-Level |

£59,168 |

|

Senior Level |

£54,846 |

|

Expert Level |

£78,3210+ |

Source: Glassdoor

Financial Modelling Analyst Salary Based on Job Roles

Financial Modelling Analyst salaries can vary based on their specific job title. Below is an overview of different roles and their salary ranges to help understand Financial Modelling Analyst compensation.

|

Job Title |

Average Salary |

|

Financial Modelling Specialist |

£59,168 |

|

Corporate Finance Analyst |

£46,777 |

|

Investment Banking Analyst |

£49,064 |

|

Private Equity Analyst |

£86,000 |

|

Risk Analyst |

£40,777 |

Source: Glassdoor

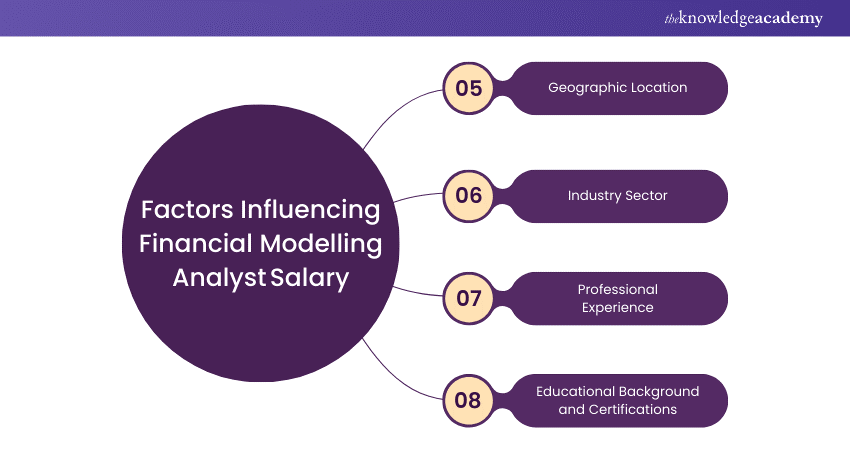

What Influences the Salary of a Financial Modelling Analyst?

The salary of a Financial Modelling Analyst is shaped by several key elements, which include:

a) Geographic Location: Salaries vary widely between cities and countries. Major urban areas often offer higher pay than smaller towns or rural regions.

b) Industry Sector: The industry sector can significantly impact on salary levels. Financial services and consulting typically provide higher compensation compared to other industries.

c) Professional Experience: More professional experience usually results in higher pay. Employers value the expertise and skills accumulated over the years in the field.

d) Educational Background and Certifications: A strong educational background and relevant certifications can enhance salary prospects. Degrees from top institutions and certifications like CFA or CPA are particularly valued.

Learn applications of the time value of money in financial analysis with our Financial Analyst Training – join today!

Conclusion

Financial Modelling Salary is what you earn for using math to predict a company’s financial future. It’s like being a fortune teller for money, helping businesses plan ahead. Your pay depends on how long you’ve been doing it, where you work, and how much you know. It’s a job that pays well because you help companies make smart money moves, which is super important for their success.

Learn how to analyse historical data for financial information with our Financial Modelling and Forecasting Training – join today!

Frequently Asked Questions

Learning Financial Modelling can vary in duration. It might take a few weeks to grasp the basics, but achieving proficiency could require several months to a year or more, depending on one’s background and dedication.

Financial Modelling should be undertaken when you need to make informed financial decisions, assess business strategies, or evaluate potential investments and their outcomes.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Training, including the Financial Modelling Course, Finance for Non-Financial Managers Course, and Financial Analyst Course. These courses cater to different skill levels, providing comprehensive insights into Financial Modeling Software.

Our Business Skills Blogs cover a range of topics related to Finance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your finance management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Financial Modelling Course

Financial Modelling Course

Fri 25th Oct 2024

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please