We may not have the course you’re looking for. If you enquire or give us a call on +852 2592 5349 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In the modern competitive job market, acing a Payroll interview is crucial for securing a position in Payroll Management. As companies recognise the importance of efficient Payroll processes, they are looking for people with the skills and knowledge required to handle the Payroll responsibilities accurately and effectively. Further, read this blog aims to get insights into the top 15 Payroll Interview Questions and equip yourself with well-crafted answers to impress potential employers.

Table of Contents

1) What is Payroll?

2) Why are Payroll interviews important?

3) Most asked Payroll Interview Questions and answers

4) Key Payroll interview preparation tips

5) Conclusion

What is Payroll?

Before diving into the Payroll Interview Questions, let us briefly understand what it really means. Payroll can be defined as the process of managing employee financial records, such as salaries, wages, deductions, and tax withholdings. It involves calculating employees' net pay, ensuring timely payments, and complying with legal and regulatory requirements.

Payroll primarily aims to ensure that employees are accurately and timely compensated for their work. The Payroll process involves various key components, including collecting and maintaining employee data, calculating wages and benefits, deducting taxes and other withholdings, and distributing net pay to employees.

Proper Payroll Management is vital for any organisation. Accurate and timely processing of Payroll ensures employee satisfaction, maintains legal compliance, and contributes to the smooth functioning of the company. By showcasing your expertise during an interview, you exhibit your potential to contribute to the organisation's success in efficient Payroll Management.

Why are Payroll interviews important?

Payroll interviews hold significant importance in the hiring process for positions in this domain. Employers recognise that efficient management is crucial for maintaining employee satisfaction, complying with legal regulations, and ensuring accurate financial record-keeping. Therefore, conducting thorough interviews with appropriate Payroll Interview Questions allows employers to assess candidates' understanding of processes, their ability to handle sensitive financial information, and their knowledge of relevant regulations.

One key reason why interviews are important is that they provide an opportunity for employers to evaluate a candidate's competence and suitability for the role. Specialists play a critical role in ensuring accurate and timely processing of employee wages. They are responsible for calculating wages, managing deductions, processing benefits, and maintaining records. By asking appropriate Payroll job interview questions, employers can assess a candidate's skills, experience, and qualifications to determine if they possess the necessary expertise to handle these responsibilities effectively.

Moreover, Payroll Interview Questions allow employers to gauge a candidate's knowledge of regulations and their ability to ensure compliance. Laws and regulations governing processes are subject to change, and it is crucial for professionals to stay updated with these changes. Through the Payroll related interview questions, employers can assess a candidate's familiarity with related laws, their understanding of compliance requirements, and their ability to implement proper procedures.

Sign up for our Xero Payroll Training Course today and enhance your accounting and finance skills!

Most asked Payroll Interview Questions and answers

This section of the blog will delve deeper into the top 15 most asked Payroll Interview Questions and answers.

Question 1. What is the role of a Payroll Specialist?

A Payroll Specialist is responsible for handling various tasks, such as calculating wages, managing deductions, processing benefits, and maintaining records. The role of a specialist is to oversee the Payroll process within an organisation. This includes calculating employee wages and benefits, ensuring accurate deductions, handling tax withholdings, and ensuring compliance with legal and regulatory requirements. A Specialist also maintains records, responds to employee inquiries, and generates reports related to Payroll data.

Question 2. What are the essential components of a Payroll system?

The essential components of a Payroll system include:

a) Employee data management: This component involves maintaining accurate and up-to-date employee information, including personal details, employment status, and tax withholding allowances.

b) Time and attendance tracking: Tracking employee work hours, absences, and overtime is crucial for calculating accurate wages and ensuring compliance with labour laws.

c) Payroll calculations: The system performs calculations based on employee work hours, pay rates, and any applicable overtime or bonuses. It determines gross wages before deductions.

d) Tax calculations and deductions: Payroll systems calculate and withhold taxes, such as income tax, national Insurance contributions, and pension contributions, based on the employee's tax code and earnings.

e) Payroll reporting: This component generates various reports related to Payroll, such as payslips, summaries, and tax reports. These reports provide essential financial information for record-keeping and decision-making purposes.

Question 3. How do you ensure accuracy in Payroll processing?

The ideal way to respond to this question might be along these lines - “To ensure accuracy in Payroll processing, I double-check all calculations and verify employee information for accuracy. I also maintain open communication with the HR department to ensure any changes in employee status or benefits are reflected correctly in the system. Regular reconciliation of records and thorough review of reports help identify and resolve any discrepancies.

Question 4. Can you explain the difference between exempt and non-exempt employees?

Exempt employees are ineligible for overtime pay and are usually salaried, while non-exempt employees are eligible for overtime pay depending on the number of hours worked beyond the standard workweek. The classification is determined by various factors, including job duties, salary level, and exemption criteria outlined in employment laws.

Question 5. How do you handle Payroll discrepancies or errors?

An appropriate response to this question might resemble the following - “When faced with Payroll discrepancies or errors, I investigate the issue promptly. I review employee records, compare them with relevant documents, and consult with HR and finance departments to identify the root cause. Once identified, I take corrective measures and ensure that the error is rectified, and preventive actions are implemented. This may involve adjusting the affected employee's pay, updating records, and communicating any necessary changes to the employee.”

Question 6. What steps do you take to ensure compliance with Payroll regulations?

The question could be answered effectively by following a format such as this - “To ensure compliance with Payroll regulations, I stay updated with the latest laws and regulations governing processes. I regularly review policies and procedures, conduct internal audits, and collaborate with legal and finance teams to ensure adherence to legal requirements. By implementing strong internal controls, maintaining accurate records, and promptly addressing any compliance issues, I ensure that the processes align with regulatory guidelines.”

Question 7. Can you describe your experience with Payroll software?

You may want to shape your answer to this question along these lines - “In my previous roles, I have worked extensively with popular Payroll software systems such as [mention specific software names if applicable]. I am proficient in performing calculations, generating reports, and managing employee data using these systems. I have experience in configuring software to meet specific requirements, troubleshooting technical issues, and maximising its functionalities to streamline processes.

Question 8. How do you handle confidential employee information?

An answer to this question could be modelled along these lines - “I understand the importance of maintaining employee confidentiality. I strictly adhere to data protection protocols, making sure that sensitive employee information is securely stored and accessible only to authorised personnel. I follow best practices, such as data encryption, password protection, and limited access rights. Additionally, I prioritise employee privacy and handle sensitive information with utmost care and professionalism.”

Question 9. What methods do you use to stay updated with Payroll-related laws and regulations?

An answer to this question might be best framed in this way - “To stay updated with Payroll-related laws and regulations, I actively participate in professional development programs, attend industry conferences, and subscribe to relevant publications. I also follow reputable online resources and join professional networks to stay informed about any changes or updates in legislation. By staying proactive in my learning, I ensure that I am well-informed and compliant with the latest regulations.”

Question 10. Can you explain the process of calculating gross pay?

Calculating gross pay involves multiplying the employee's hourly rate by the number of hours worked within a pay period. For salaried employees, gross pay is determined by dividing their salary by the number of pay periods in a year. Gross pay does not include deductions such as taxes or other withholdings.

Question 11. How do you handle Payroll for employees with multiple deductions?

This question might be best answered in the following way - “When handling Payroll for employees with multiple deductions, I ensure that each deduction is accurately calculated and deducted from the employee's gross pay. I carefully track and record each deduction to ensure proper allocation and transparency. By maintaining detailed records and staying organised, I guarantee that the correct amounts are withheld and reflect accurately in the employee's net pay.”

Question 12. What is the purpose of Payroll audits, and how do you conduct them?

A response in line with the following would be suitable for this question - “Payroll audits help ensure the accuracy, legality, and integrity of Payroll processes. During an audit, I review records, verify the accuracy of calculations, assess compliance with legal requirements, and identify any potential discrepancies or irregularities. I follow a systematic approach, documenting my findings and recommending corrective actions if necessary. Conducting regular audits allows for proactive identification and resolution of issues, ensuring the accuracy and reliability of data.”

Question 13. Can you explain the difference between net pay and gross pay?

Gross pay refers to an employee's total earnings before deductions, such as taxes, insurance premiums, and other withholdings. Net pay, on the other hand, is the amount an employee receives after deductions. It represents the employee's take-home pay, reflecting the actual amount they receive in their bank account or paycheck.

Question 14. How do you handle Payroll processing during holiday seasons?

To address this question effectively, you might want to respond like this - “During holiday seasons, I ensure that Payroll processing is planned and scheduled well in advance to accommodate any adjustments due to public holidays. I work closely with the HR team to gather accurate time and attendance data, factor in any holiday pay or bonuses, and ensure timely payment to employees. By proactively preparing for holiday processing, I minimise disruptions and ensure employees are paid accurately and on time.

Question 15. Can you discuss any challenges you've faced while processing Payroll and how you resolved them?

Consider providing a response similar to this for this question - “One challenge I faced in the past was managing Payroll for a rapidly growing organisation with a large number of employees. To overcome this challenge, I implemented automated systems, streamlined processes, and established clear communication channels with other departments involved in the process. These measures significantly improved efficiency and accuracy in processing. Additionally, I closely monitored data, conducted regular audits, and addressed any discrepancies promptly to ensure the accuracy of employee payments and compliance with legal requirements.”

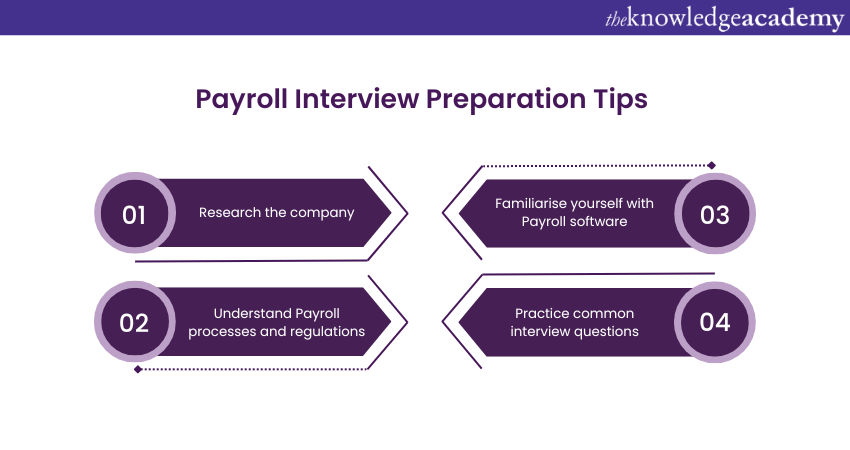

Key Payroll interview preparation tips

Now that we have expanded on the top 15 Payroll Interview Questions and answers, here are some essential tips to help you prepare effectively for your upcoming interview:

1) Research the company: Thoroughly research the company you're interviewing with. Familiarise yourself with their industry, size, and any recent developments. This demonstrates your interest and shows that you've taken the initiative to understand the company's specific requirements.

2) Understand Payroll processes and regulations: Develop a solid understanding of Payroll processes, including calculations, tax obligations, and compliance with employment laws. Stay updated with any recent changes in regulations to demonstrate your knowledge and adaptability.

3) Familiarise yourself with Payroll software: Many organisations use Payroll software to streamline their processes. Familiarise yourself with common Payroll software systems and their functionalities. Highlight any experience you have with these systems during the interview.

4) Practice common interview questions: To enhance your confidence, practice answering common interview questions. Prepare concise yet comprehensive responses to the questions that highlight your skills, experience, and ability to handle challenging situations.

Conclusion

In conclusion, excelling in a Payroll interview requires thorough preparation for common questions, a solid understanding of Payroll processes and regulations, and the ability to showcase your expertise confidently. By preparing for the aforementioned top 15 Payroll Interview Questions and crafting well-thought-out answers, you can demonstrate your suitability for the role and increase your chances of securing a position.

Take your accounting and finance knowledge to new heights – explore our comprehensive Accounting & Finance Training Courses today!

Frequently Asked Questions

What is the Biggest Challenge in Payroll?

The biggest challenge in payroll is ensuring accuracy and compliance with tax regulations and labour laws. Errors in Payroll can lead to financial penalties and employee dissatisfaction.

What Excel Skills are Needed for Payroll?

For Payroll, you need skills in Excel such as using formulas, creating pivot tables, and managing data with functions like VLOOKUP and SUMIF. These skills help in organising, calculating, and analysing payroll data efficiently.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting & Finance Training, including the Payroll Course, Bookkeeping Course, and Financial Management Course. These courses cater to different skill levels, providing comprehensive insights into Financial Modelling.

Our Business Skills Blogs cover a range of topics related to Finance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Payroll Course

Payroll Course

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 18th Jul 2025

Fri 12th Sep 2025

Fri 14th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please