We may not have the course you’re looking for. If you enquire or give us a call on +852 2592 5349 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The real estate market has long been plagued by issues like delays, complexities, and a lack of transparency, leaving many buyers feeling uneasy. To address these challenges and create a more regulated environment, the Indian government introduced the Real Estate Regulatory Authority (RERA).

RERA is a game-changer, designed to protect both consumers and developers, ensuring fairness and integrity in the real estate world.

In this blog, we'll chat about what RERA is, how it works, its goals, the penalties it imposes, and the benefits it has brought to the industry. By the end, you'll have a clear picture of RERA's vital role and its transformative impact on India's real estate scene.

Table of Contents

1) What is the RERA Act?

2) Functions of the RERA

3) Objectives of the RERA

4) Applicable Penalties Under RERA

5) Effects of the RERA Act

6) Benefits of RERA

7) Conclusion

What is the RERA Act?

RERA, also known as Real Estate Regulatory Authority, was formed under the Real Estate (Regulation and Development) Act of 2016 to bring accountability to the real estate segment and to listen to home buyers’ problems. Its objectives include:

a) Protecting the interests of allottees and ensuring their accountability

b) Maintaining transparency and reducing fraud

c) Implementing Pan-India standardisation and promoting professionalism

d) Enhancing the flow of accurate information between home buyers and sellers

e) Imposing greater responsibilities on builders and investors

f) Increasing the sector’s reliability and boosting investor confidence

Historically, home buyers have felt that real estate transactions were skewed in favor of developers. In India, RERA and the government’s model code aim to create fairer transactions between property sellers and buyers, especially in the primary market.

Real Estate Regulatory Authority (RERA) will bring the first regulator for the Indian real estate sector, as under the Real Estate Act, every state and union territory would be required to set up its own regulator and the rules therefore cannot be uniform across each state.

Functions of the RERA

The Real Estate Regulatory Authority (RERA) Act has several key functions, and these functions help RERA maintain transparency, accountability, and fairness in the real estate sector.

a) Regulation and Registration: It has the authority to register and regulate real estate brokers and various real estate projects.

b) Record Keeping and Dissemination: It is responsible for issuing and maintaining project records, making them available for public review.

c) Advertisements and Disclosures: RERA is also responsible for regulating the advertisements and promotional materials posted by developers and agents and discouraging false information.

d) Consumer Grievance Redressal: It creates an institutionalised consumer relations framework whereby consumers can report developers for violations and wrongdoing while offering legal means of resolving the disputes.

e) Promoter Data Storage: It maintains a database of all projects, including proof and images of promoters or enterprises whose licenses were canceled.

f) Compliance with Obligations: It also makes certain that all conditions prescribed on builders, property allottees, and estate agents are complied with.

g) Order Compliance: It ensures that all its rules and regulations are followed.

h) Tracking Real Estate Agents: It keeps track of all real estate agents and maintains details and photos of agents whose licenses have been revoked or suspended.

Objectives of the RERA

The Real Estate Regulatory Authority Act has several key objectives:

a) Consumer Protection: In terms of benefit, RERA seeks to protect the interests of homebuyers to ensure certain standards of fairness are followed, timely disclosures made, and risk management of disputes between buyers and developers taken care of.

b) Promoting Transparency: Its strategies aim to celebrate transparency in various facets of the real estate market particularly the undertakings by developers of the project in terms of timelines, legal requirements as well as finances necessary for the development and completion of a project the information that buyers need before entering into agreements are made available.

c) Standardisation and Accountability: RERA also put regulations and measures to follow quality standards, construction norms and timely delivery systemic control for the developers. It ensures that any Chiefs / Managers / Superintendents / Developers are held to any terms and conditions agreed on.

d) Establishment of a Regulatory Authority: It establishes an independent governmental organisation for the administration of the real estate business, for the application of legal measures consultations, and for ensuring that litigation is expeditious and satisfactory to the complainants.

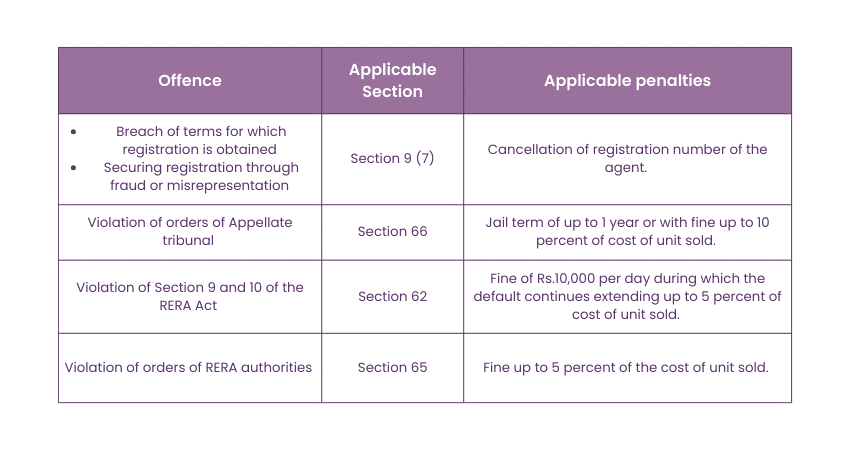

Applicable Penalties Under RERA

The Real Estate (Regulation and Development) Act of 2016 Real Estate Regulatory Authority (RERA) prescribes some offences for which penalties are to be levied. The following are the certain offences for which penalties are imposed under applicable sections:

How to Submit a Complaint?

Section 31 of RERA allows complaints to be filed against promoters, buyers or agents. Here are the steps to follow when filing a complaint:

a) Find a RERA Lawyer: Engage a lawyer who specialises in RERA cases and file a complaint under the appropriate jurisdiction.

b) Fill Out the Complaint: Complete the complaint form according to the rules prescribed by the state where the project is located.

c) Include Necessary Details:

1) Information about the applicant and the respondent

2) Address and registration number of the project

3) A brief statement of the facts and grounds of the claim

4) Details of any relief sought, including interim reliefs if applicable

5) Pay the Fee: The fee varies by state. For example, it is Rs. 5,000 in Maharashtra and Rs. 1,000 in Karnataka.

6) File Online: Alternatively, you can file a complaint online through your state’s RERA website.

7) Appeal if Necessary: If dissatisfied with RERA’s decision, you can file an appeal with the RERA Appellate Tribunal within 60 days.

8) Further Appeal: If still unsatisfied, you can approach the High Court within 60 days of the Appellate Tribunal’s decision.

Steps to Register Projects with RERA

The following are the Steps to Register Projects with RERA:

a) Prepare a Checklist: Gather all the necessary documents for registration.

b) Bank Account Number: Obtain the bank account number as required by Section 4 (2) (I) (D) of the Act.

c) Form A: Complete and submit Form A, the application form for registration.

d) Form B: Complete and submit Form B, a declaration by the promoter in accordance with Section 4 of RERA.

e) Form G: Complete and submit Form G, the draft agreement for the allotment or sale of the project.

f) Affidavit for Form G: Submit an affidavit confirming that the details in Form G comply with RERA rules.

g) Affidavit for Booking Amount: Submit an affidavit confirming that no booking amount has been taken from prospective buyers, in accordance with Section 3 of the Act.

h) Registration Fees: Pay the registration fees, which vary by state.

i) Dispatch Documents: Send a duly signed hard copy of all documents by registered post to the relevant RERA authority.

j) Form C: Complete and submit Form C to obtain the registration certificate.

Tax Benefits Under the RERA Act

Tax Benefits Under the RERA Act

1) Section 80C:

a) Tax deductions can be claimed for the principal component of home loan EMIs under Section 80C of the Income Tax Act, 1961.

b) This benefit applies only to self-occupied properties.

c) The maximum tax deduction available is Rs. 1.50 lakh per financial year.

2) Section 24:

a) Interest on the home loan for properties that are being used for letting out or for the business is exempted under Section 24.

b) The maximum deduction permitted is Rs. 2 lakh per financial year.

c) This benefit is also applicable only to self-occupied properties.

d) To claim these benefits, the house construction must be completed. If construction takes more than five years, the maximum deduction is reduced to Rs. 30,000.

Start and learn how to manage risk in real estate with our Real Estate Risk Management Training Register today!

Completion Requirements

Tax benefits under Sections 80C and 24 can only be availed by borrowers once the construction of an under-construction property is complete or for ready-to-move-in properties.

Enhance the art of real estate with our Real Estate Financial Modelling Training - Sign up now!

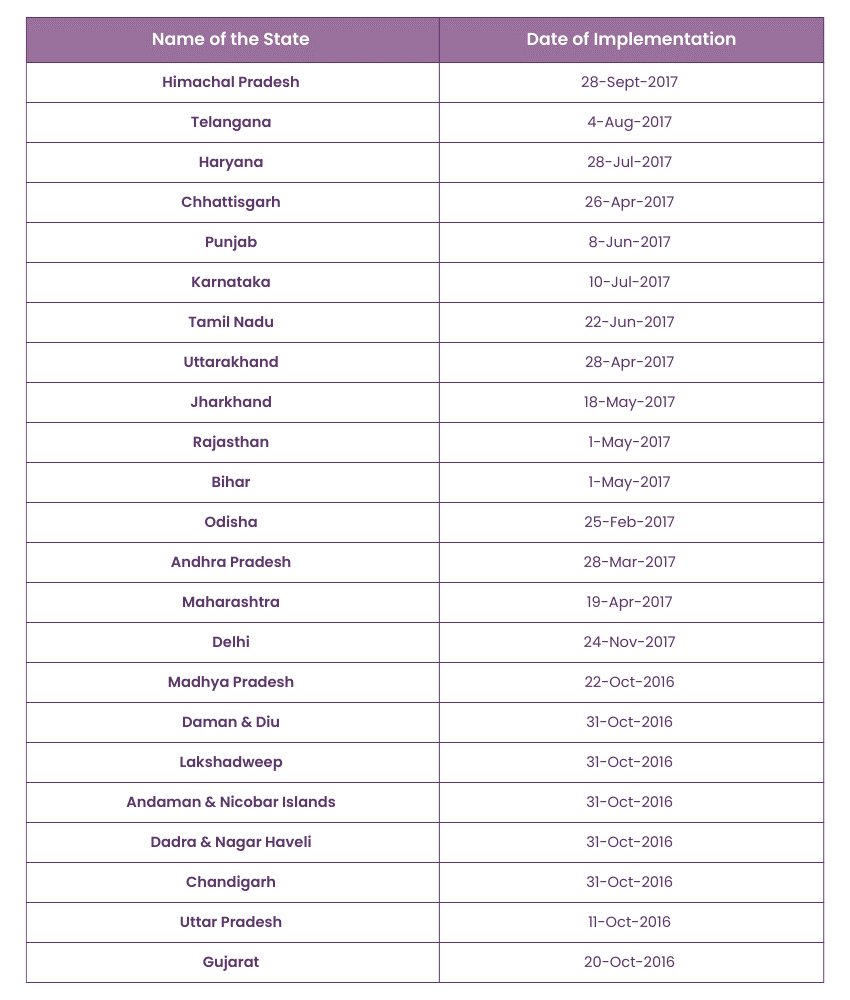

States That Have Implemented the RERA Act

This is the list of states that have enforced RERA Act:

Required Documents for Project Registration with RERA

To register a project under RERA, ensure you have the following documents ready:

a) Income Tax Returns: ITR of the promoter for the last 3 years.

b) Financial Statements: Audited balance sheet, profit and loss account, and auditor’s report of the promoter.

c) Identification Documents: Promoter’s PAN card and Aadhaar card. If there are multiple promoters, provide PAN and Aadhaar card copies for all.

d) Photographs: Passport-size photograph of the promoter. For firms or companies, include photos of all members, including the director and chairman.

e) Legal Title Deed: The legal title deed and any authenticated documents reflecting the promoter’s legal rights over the land. If unavailable, provide a non-encumbrance certificate from a revenue authority not below the rank of a Tehsildar.

f) Collaboration Agreement: If the promoter is not the landowner, include a copy of the collaboration agreement and the owner’s consent.

g) Project Plans: The layout plan and sanctioned plan of the project.

h) Location Details: Comprehensive location details, including the project’s boundaries, latitude, and longitude.

i) Property Details: Details of carpet area, number of apartments, area of open terraces; area of balconet, if any.

j) Professional Details: Names and addresses of structural engineers, architects, contractors, and others involved in the project’s development.

k) Form B Declaration: A declaration under Form B stating that the promoter or authorised person will not discriminate during the project’s allotment.

Effects of the RERA Act

The RERA Act has brought significant changes to India’s real estate sector and These changes have made the real estate sector more reliable and buyer friendly.

a) Transparency: Mandatory project disclosures on state portals ensure buyers receive accurate information, reducing misleading practices.

b) Timely Delivery: Developers face penalties for delays, leading to better planning and timely project completion.

c) Developer Accountability: Developers must register projects and follow instructions, ensuring quality and responsibility.

d) Reduced Fraud: By requiring project registration and full disclosure, RERA helps minimise fraudulent activities.

e) Grievance Redressal: A structured system allows for quicker resolution of buyer complaints.

Benefits of RERA

RERA has certain advantages for the buyer, promoter, and the real estate agent. These include:

a) Standardisation of Carpet Area: Before RERA the way of how a builder quantified the cost of a project was undefined. In contrast, RERA has provided a format which gives a single formula to calculate carpet area. In this way, promoters cannot afford more carpet area for higher tariffs, artificially.

b) Less Chances of Builders Getting Insolvent: Most of the promoters and developers develop more than one project at a time. Earlier, promoters were allowed to alienate funds to another project which really created problems.

But under RERA, out of this, at least 70% should be deposited in one bank account only. The funds can only be withdrawn on production of a certificate from engineers, chartered accountants, and architects.

c) Advance Payment: According to the rules they are not allowed to charge above 10 percent of the cost of the project from the buyer as advance or as application fees. This relieves the buyer of pressure to look for the funds quickly and also do so within a short time and part with so much cash.

d) Rights to The Buyer in Case of Any Defects: The builder is also required to remedy any structural defects or problems in quality within 30 days of being notified by the buyer if the vacant possession has been taken over for not more than 5 years.

e) Interest to be Paid in Case of Default: This meant that before RERA was passed if the promoter delayed possession of the property, he had to pay less interest to the buyer than the buyer would have to pay to the promoter if the buyer delayed on payment.

Conclusion

So, what’s the verdict on RERA? Well, the Real Estate Regulatory Authority has been a real game-changer for the Indian real estate market. By tackling those pesky issues like delays, complexities, and lack of transparency, RERA has made things a lot smoother and fairer for everyone involved. Buyers and developers alike can now breathe a little easier knowing there's a system in place to keep things in check.

Unlock real estate success with our RERA Training Course - Register today!

Frequently Asked Questions

RERA registration is mandatory to protect buyers and ensure accountability in real estate. It requires developers to disclose project details, adhere to timelines, and meet quality standards. This transparency builds trust, reduces fraud, and provides a legal framework for resolving disputes, making real estate safer for all.

Buying property without RERA approval is risky. RERA ensures transparency, timely delivery, and protects buyers from fraud. Without RERA, there's less accountability, making it harder to resolve disputes or ensure project completion. For a safer investment, choose properties with RERA registration and compliance.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Training, including the Real Estate Financial Modelling Training, RERA Training and the Real Estate Agent Course. These courses cater to different skill levels, providing comprehensive insights into Real Estate Investment.

Our Business Skill Blogs cover a range of topics related to Real Estate Investment, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Investment Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please