We may not have the course you’re looking for. If you enquire or give us a call on +852 2592 5349 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Consider this scenario: It’s a Monday morning, and instead of facing the usual rush hour, you’re eager to start your day doing work that excites you. This is the reality for many who embrace Self-employment. Have you ever thought about the freedom of being your own boss? It allows you to design your own schedule, work from any location, and steer your career in the direction you choose. But what does this path involve? How can you overcome the hurdles and enjoy the benefits?

In this blog, we will delve into the world of Self-employment, covering everything from the different types to Tax Management and achieving a work-life balance. Let's dive in and explore valuable insights to help you thrive.

Table of Contents

1) What is Self-employment?

2) How Does Self-employment Work?

3) Different Types of Self-employment

4) Tax Considerations for Self-employment

5) Advantages of Self-employment

6) Factors to Consider When Choosing Self-employed Work

7) Conclusion

What is Self-employment?

Self-employment means working for yourself instead of being employed by a specific employer. Although there are various forms of Self-employment, they typically provide more independence than traditional jobs, as you have greater control over your working hours and earnings. You might work with individual clients, a single business, or multiple clients and businesses simultaneously.

What Makes Someone Self-Employed?

Self-employed individuals operate differently from traditional employees in several key ways. They:

1) Work independently without reporting to a traditional employer

2) Have direct control over their work arrangements and client relationships

3) Can serve multiple clients or businesses simultaneously

4) Often operate in specialised fields where individual expertise is highly valued

5) Set their own rates and working conditions

6) Take full responsibility for their business success

Many career paths are particularly well-suited to Self-employment, such as:

1) Personal Trainers who can work with multiple clients and set their own schedules

2) Caterers who can manage various events and build their own client base

3) Wedding Photographers who can develop their unique style and brand

4) Consultants who can offer specialised expertise to multiple organisations

5) Freelance professionals in various fields like writing, design, or programming

How Does Self-employment Work?

Self-employment involves working for yourself rather than being employed by a company. Here are some key aspects of how it works:

Getting Started

1) Choose Your Direction

a) Identify your field of expertise and market niche

b) Decide between freelancing, consulting, or running a small business

c) Evaluate market demands and opportunities in your chosen field

d) Research competition and potential client base

e) Define your unique value proposition

2) Establish Your Business

a) Register your business entity with appropriate authorities

b) Obtain necessary licenses and permits for your industry

c) Set up dedicated business banking accounts

d) Develop a comprehensive business plan including financial projections

e) Create detailed marketing strategies to reach your target audience

f) Set up essential business systems and processes

g) Establish your pricing structure and service offerings

Operating Your Business

1) Client Acquisition and Management

a) Build and maintain a strong professional network

b) Implement targeted marketing campaigns

c) Leverage social media and online presence effectively

d) Cultivate word-of-mouth referrals through excellent service

e) Develop efficient client onboarding processes

f) Create systems for managing client relationships

g) Establish clear communication channels and expectations

2) Business Management

a) Handle day-to-day financial operations and bookkeeping

b) Track income, expenses, and profit margins

c) Manage client projects and deadlines effectively

d) Maintain consistent service quality standards

e) Handle administrative tasks and paperwork

f) Manage resources and inventory if applicable

g) Plan for business growth and expansion

Keys to Long-term Success

1) Continuous Professional Growth

a) Stay current with industry trends and developments

b) Regularly upgrade skills and knowledge

c) Adapt to changing market conditions

d) Embrace new technologies and tools

e) Attend professional development events and workshops

f) Network with other professionals in your field

g) Seek mentorship and learning opportunities

2) Work-Life Integration

a) Set clear boundaries between work and personal time

b) Establish structured work hours that suit your lifestyle

c) Maintain dedicated time for personal activities and relationships

d) Prevent professional burnout through proper scheduling

e) Create systems for managing work during busy periods

f) Plan for vacation and personal time

g) Build a support network of family, friends, and fellow entrepreneurs

Different Types of Self-employment

Self-employment provides a unique opportunity for individuals to take control of their careers and pursue their passions. Here are some different types of Self-employment:

1) Freelancer

Freelancing is the most prevalent form of Self-employment. It involves offering services based on one’s technical skills and expertise. For instance, a Copywriter can deliver professional copywriting services to companies seeking unique and engaging content for their websites.

A freelancer is not necessarily tied to a specific employer, allowing them to work on multiple projects for various clients simultaneously. However, because freelancers do not commit to a single employer, they miss out on many benefits that regular employees receive, such as health and retirement benefits.

2) Seasonal Staff

Seasonal staff provide services to businesses on a short-term basis, typically for no longer than six months each year. They fill roles where demand increases during specific periods or when a position is only temporarily required.

For example, during tax season, companies actively seek tax consultants, accountants, and tax specialists to assist with their paperwork and tax compliance. If you have expertise in this area, you can apply for a temporary position until the end of the tax season.

Discover the strategies to achieve your goals - sign up for our Personal Development Courses now!

3) Temporary Work

Temporary staff provide services for a specified period, giving them control over when they work throughout the year. As a temporary employee, you can find jobs in various fields and for different durations, ranging from a few weeks or months to a year.

Working on a non-permanent basis means your schedule is quite flexible, allowing you to earn money while managing other commitments.

4) Flexible Schedules

Unlike other working schedules, flexible schedules allow you to control your hours by choosing when you want to work. For instance, you might opt to work at weekends or from Monday to Friday between 4 p.m. and 6 p.m.

Your choice depends on your daily commitments and responsibilities. Sometimes, flexible schedules can be entirely free from restrictions, enabling you to work whenever you wish.

5) Independent Contractor

An independent contractor offers services to or carries out work for a business or organisation (the payer) as a non-employee. The contract might be either long-term or short-term, with the payer only having control over the final outcome of the work.

If you are comfortable with the idea of working under the terms of a contract, you might consider becoming an independent contractor.

6) Alternative Schedule Professional

As a professional with an alternative schedule, you work outside regular business hours. Examples include working on Saturdays and Sundays or during the night. Alternative working schedules free up your weekday daytime hours for other activities such as school or caregiving.

This makes it an excellent choice for working parents, students, and those seeking supplemental income jobs.

7) Independent Business Owner

An independent business owner is someone who establishes and manages a successful business or company with the aim of expanding it in the future. Running an independent business allows you to make your own decisions and have greater control over daily operations.

Depending on the scale of your venture, you may choose to hire additional staff as you grow.

Tax Considerations for Self-employment

As your own boss, you’re responsible for both income and Self-employment taxes. Keeping detailed records and knowing which expenses are deductible can help you save money. Here are some important tax considerations for Self-employment:

1) Self-employment Tax

When you’re self-employed, you are responsible for paying your own state and federal taxes. This includes both income tax and a Self-employment tax, which combines Social Security and Medicare.

As you are not employed by a company that automatically deducts these taxes from your payroll, it is crucial to manage your own income and Self-employment taxes. You can pay these taxes either quarterly or as part of your annual tax return.

Discover techniques to enhance your listening abilities – sign up for our Active Listening Training now!

2) Deductions for the Self-Employed

You may be able to deduct certain business expenses from your income. This can comprise costs such as rent or mortgage payments for the portion of your home used exclusively as a home office, as well as business equipment and supplies.

You can also deduct business travel expenses like plane tickets and vehicle fuel. Additionally, there are special startup tax deductions for expenses incurred while starting your business.

Any deductions you claim as a self-employed individual must be for items used exclusively for business purposes. For instance, you can claim vehicle mileage for driving to and from a business meeting, but you cannot claim mileage for personal travel.

Sign up for our Attention Management Training and take control of your time.

3) Health Insurance Deductions for Self-Employed Individuals

You can also deduct the expenses of health insurance premiums from your Self-employment income for tax purposes, including both individual and family policies.

4) Retirement Contributions for Self-Employed Workers

Additionally, you can contribute to a retirement account such as an IRA or SEP IRA. These contributions are deductible against the income you’ve earned while running your business, allowing you to save for retirement on your own terms. This can also help reduce your tax burden.

Advantages of Self-employment

In this section, we will explore the benefits of Self-employment:

1) Flexible Lifestyle & Enhanced Work-Life Balance

Self-employment offers unparalleled flexibility in managing your professional life. As your own boss, you can:

a) Design your ideal work schedule

b) Choose your preferred work environment

c) Accommodate personal commitments seamlessly

d) Plan around family responsibilities

e) Take time off when needed without requesting permission

This flexibility helps prevent burnout and promotes better mental and physical well-being, as you can create a schedule that aligns with your natural productivity patterns and personal needs.

2) Accelerated Personal & Professional Growth

Self-employment serves as a powerful catalyst for development through:

a) Hands-on experience in multiple business aspects

b) Continuous skill acquisition across various domains

c) Direct exposure to business challenges and solutions

e) Development of crucial abilities like strategic planning and Financial management

Each challenge becomes a learning opportunity, fostering resilience and adaptability in an ever-changing market.

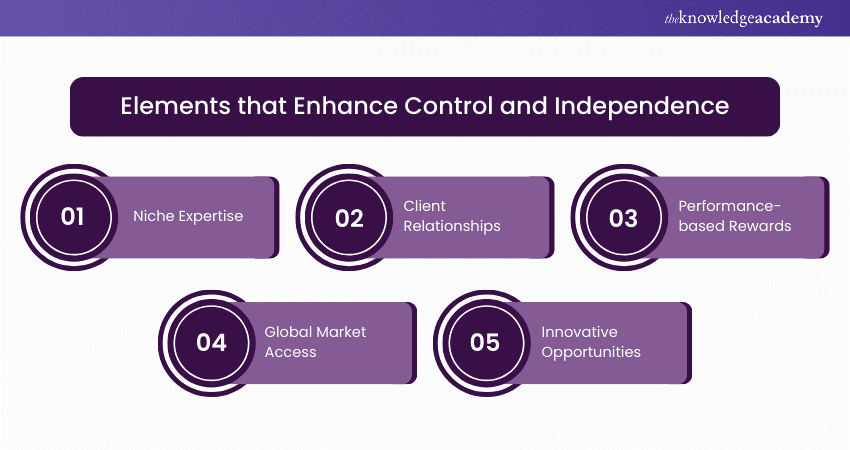

3) Complete Professional Autonomy

Self-employment grants you full control over your professional journey. They help you do the following:

a) Make independent business decisions

b) Set personalised goals and strategies

c) Choose projects that match your interests

d) Work with clients who share your values

e) Direct your business's growth path

f) Implement your own ideas and solutions

This independence allows you to build a business that truly reflects your vision and professional standards.

4) Unlimited Earning Potential

While Self-employment comes with financial responsibilities, it offers significant financial advantages:

a) Set your own rates and pricing strategies

b) Keep 100% of your business profits

c) Scale your income based on effort and efficiency

d) Create multiple revenue streams

e) Take advantage of tax benefits

f) Invest in growth opportunities as you see fit

Success and earnings directly correlate with your effort, expertise, and business acumen rather than preset salary structures.

5) Career Fulfilment Through Passion

Self-employment enables you to:

a) Transform your interests into profitable ventures

b) Build a career around your expertise

c) Create unique products or services

d) Express your creativity freely

e) Make a direct impact in your chosen field

f) Experience pride in building something of your own

This alignment of passion and profession often leads to higher job satisfaction and long-term career fulfillment.

By choosing Self-employment, you're not just selecting a different way to work – you're embracing a lifestyle that offers greater control, opportunity, and potential for personal and professional satisfaction.

Moreover, Self-employment allows you to choose the clients or projects you work with, ensuring your work aligns with your values, preferences, and long-term objectives.

Factors to Consider When Choosing Self-employed Work

Selecting the right type of Self-employment is a crucial decision that can impact your satisfaction and success. Below are some key factors to consider when choosing your ideal type of self-employed work:

1) Time Availability

Certain forms of Self-employment, such as freelancing, necessitate following up with clients for payments. This can be time-consuming and impact your finances, particularly if you have invested your savings into projects.

If you do not have the time to chase clients for payments, consider contractual Self-employment, such as becoming an independent contractor or seasonal staff.

2) Lifestyle

Self-employment can accommodate various schedules for different individuals. Some may prefer working while their children are at school, while others might choose to work only at weekends. It is important to select the type of Self-employment that suits your lifestyle and daily routine.

For instance, if you are a working parent, freelancing is an excellent option as it allows you to schedule your work around your daily commitments, such as taking the children to school.

3) Personal Preferences

Certain forms of Self-employment may align better with your preferences than others. For example, if you prefer working under the terms of a contract, you might consider becoming an independent contractor.

Conversely, if you thrive under supervision, you might be better suited to temporary work, where you can work with an employer for a short period.

Conclusion

Self-employment is a lifestyle that empowers you to shape your own destiny. By exploring the different avenues and understanding the essentials, you can craft a path that aligns with your aspirations. With the right approach, this can offer personal satisfaction, significant financial rewards and professional growth.

Take the first step towards a stress-free life - join our Time Management Training now!

Frequently Asked Questions

The basic requirements of Self-employment include having a marketable skill or service, registering your business with the appropriate authorities, maintaining proper financial records, and adhering to tax regulations. It also calls for self-discipline and the ability to manage time effectively.

The role of Self-employment is to provide individuals with autonomy, flexibility, and the potential for financial growth while contributing to economic diversity and innovation.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Personal Development Courses, including the Time Management Training, Attention Management Training, and Self-employment Training. These courses cater to different skill levels, providing comprehensive insights into How to Become Self-Employed.

Our Business Skills Blogs cover a range of topics related to Self-employment, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Contract Management Certification Training

Contract Management Certification Training

Thu 23rd Jan 2025

Thu 27th Feb 2025

Thu 27th Mar 2025

Thu 29th May 2025

Thu 3rd Jul 2025

Thu 4th Sep 2025

Thu 6th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please