We may not have the course you’re looking for. If you enquire or give us a call on + 1-866 272 8822 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Who doesn’t like the idea of financial freedom? And to know it's not that farfetched an idea! That’s right! Financial freedom is possible if you know how to invest in Passive Incomes! What is Passive Income? You ask, Passive Incomes are like an investment that gives your returns with little to no added effort! It's almost like free money!

If you are a student looking to support yourself, a housewife or a businessman saving up a college fund for your kids, setting up a Passive Income will help you attain the financial goals. Unlike active income earned through direct labour or services, Passive Income streams generate continuous cash flow through various means such as rental properties, dividends from investments, royalties from intellectual property (IP), or earnings from online business ventures.

If you also wish to set up stable source of Passive Income this blog would serve you well. In this blog, you will learn What is Passive Income, its types, examples and more about how to make money from it. Read ahead to learn more!

Table of Contents

1) What is Passive Income?

2) Types of Passive Income

3) Examples of Passive Income

4) How do you make money from Passive Income?

5) Does Passive Income incur taxation?

6) Conclusion

What is Passive Income?

Passive Income is often defined as earnings obtained from an enterprise in which a person is not actively involved. Unlike active income, where earnings are directly correlated with the amount of work done, Passive Income generates regular earnings from sources that do not require daily active involvement. The allure of Passive Income lies in its ability to provide financial security and freedom, as it can generate continuous income without the need for constant labour.

Types of Passive Income

Passive Income has become a cornerstone concept for those seeking financial freedom and diversification of income. Predominantly, it can be categorised into two broad types: income from creating and income from investing. Each category offers unique pathways to generate revenue with minimal ongoing effort. Let’s discuss:

1) Creating

Creating income involves providing a product or service that you may need to build on in the initial stages. Once it kicks off, you will have a cash flow every time someone avails your product or services. Here are some of the commonly used methods to create a Passive Income:

a) Digital products: This includes eBooks, online courses, stock photography, or music. Once created and uploaded to the appropriate platforms, these products can be sold repeatedly without much additional effort, providing a steady income.

b) Blogging and content creation: Successful blogs or YouTube channels can generate substantial income through ad revenue, sponsorships, and affiliate marketing. While initial efforts in content creation and audience building are intensive, these channels can provide sustainable income over time.

c) App development: Developing a mobile app requires upfront effort, but once it's in the digital marketplace, it can earn money through downloads, in-app purchases, or advertisements.

d) Licensing and royalties: Artists, musicians, and inventors can earn Passive Income by licensing their work. Every time someone uses their creation, they receive a royalty payment.

2) Investing

Investing involves putting in a large sum of money to initiate the process, and over time you build on your initial capital to multiply the investment you made. Note that there are risks involved in doing so, so be careful and mindful of your investments. Here are some of the ways you can invest:

a) Stock market investments: Investing in stocks, especially those that pay dividends, can provide a regular income stream. Dividend stocks pay out a portion of the company's earnings to shareholders, offering a Passive Income with the potential for capital appreciation.

b) Real estate investments: Buying property to rent out is a classic form of Passive Income. Investors can earn monthly rent, ideally exceeding the property's ongoing expenses. Real Estate Investment Trusts (REITs) also offer a way to invest in Real Estate without physically managing properties.

c) Peer-to-peer lending: This means lending money to individuals or businesses through online platforms. Investors earn Passive Income in interest payments, like how a bank makes interest on loans.

d) Bonds and fixed-income investments: Bonds and other fixed-income securities provide a steady income stream, typically in regular interest payments. While the returns might be lower than stocks, they are considered less risky.

Are you interested in earning Passive Income today? Register now for our Earn Passive Income Masterclass!

Examples of Passive Income

Passive Income has become increasingly popular to achieve financial freedom and stability. Individuals can diversify their revenue streams and build wealth over time by generating regular income without active involvement. Among the many forms of Passive Income, renting property, leasing equipment, and earning interest in a limited partnership stands out for their effectiveness and accessibility. Let’s explore them in detail:

1) Renting property

Owning real estate is a great way to generate Passive Income! Renting out your property gives you a great stable income that can act as a safety net, that can hold you together even if you are unemployed for quite some time. Additionally, as a passive income can help you save enough to procure more property and build capital. Here are your options when it comes to renting property:

a) Residential rentals: Owning and renting residential properties is a classic form of Passive Income. This could be single-family homes, apartments, or even vacation rentals.

The income generated from tenants can cover mortgage payments and property maintenance and still yield a profit. The key to success in this area often lies in choosing the right location, maintaining the property well, and managing tenant relationships effectively.

b) Commercial real estate: Investing in commercial properties, such as office spaces, retail units, or warehouses, can also be lucrative. These often come with longer lease terms and can be more stable than residential rentals.

c) Short-term rentals: Platforms like Airbnb have popularised the concept of short-term rentals. These can offer higher returns than traditional leasing, though they may require more active management and marketing efforts.

2) Leasing equipment

More often than not, people take up passion projects that would require certain equipment to follow through with. Buying all new equipment may seem a little ridiculous and not to mention expensive! However, they can choose to lease the equipment which would be the smarter choice to make. This is one of the many ways leasing equipment can prove to be a great source of Passive Income.

a) Industrial equipment: Leasing out machinery or industrial equipment can be a profitable Passive Income stream. Businesses often prefer leasing to reduce capital expenditures, creating a market for leased equipment.

b) Vehicles: Fleet leasing and renting vehicles out to businesses or individuals can generate steady income. This includes everything from cars and trucks to more specialised vehicles.

c) Technology equipment: As technology rapidly evolves, many businesses lease equipment like servers, computers, or other tech hardware instead of purchasing them outright.

d) Specialised equipment: According to your field of interest you can also have a specialised set of equipment that you can lease, like wedding or event-based equipment, Filmmaking equipment such as cameras, mics and tripods, etc.

3) Interest in a limited partnership

You don’t always have to go into an investment alone, if you and your business peers see eye to eye on an opportunity, a limited partnership may prove to be fruitful. Here are some ways you can collaborate on a Passive Income with your friends or peers.

a) Real estate investments: Limited partnerships in real estate allow investors to earn Passive Income without managing the properties themselves. These can include residential, commercial, or even large-scale developments.

b) Business ventures: Investing as a limited partner in a business can yield returns if the enterprise is profitable. This form of investment is typically more hands-off compared to direct business ownership.

c) Energy sector investments: Limited partnerships in sectors like oil, gas, or renewable energy projects can be another source of Passive Income. These often come with tax benefits but may also carry a higher risk.

Royalties

If you are a creative and innovative person, and wish to capitalise on it, you can do that too with royalties. All it will take is some paperwork! You can register your original intellectual property, and when allow people to use it with a fee, or if someone has used it already, then you can claim royalties. Here is a list of things you can register royalties for:

1) Artwork

2) Music

3) Sound effects

4) Coding

5) Stock videos

6) Photographs

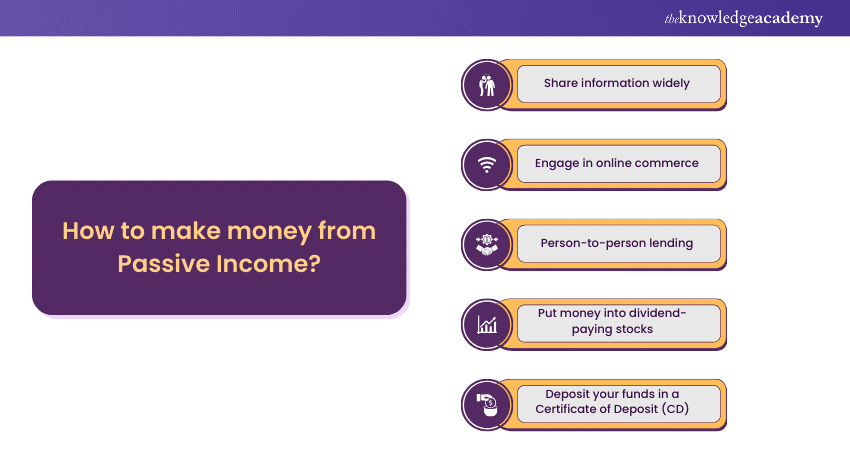

How do you make money from Passive Income?

Now that you know what Passive incomes are, it's time to explore how you can make money from Passive Incomes. Here are some effective strategies for you to be able to generate a Passive income:

1) Share information widely

a) Digital products: Creating and selling digital products like e-books, online courses, or webinars is a fantastic way to share knowledge and expertise. Once created, these products can be sold multiple times without additional cost.

b) Blogging and vlogging: Starting a blog or YouTube channel can become a significant income source. Through ad revenues, affiliate marketing, and sponsorships, Content Creators can earn substantial amounts. The key is to produce engaging, high-quality content and grow a dedicated audience.

c) Podcasting: Similarly, podcasting has emerged as a favoured medium. A podcast can be monetised through sponsorships, ads, and even premium subscription content.

2) Engage in online commerce

a) E-commerce stores: Setting up an online store on platforms like Shopify or Etsy can be lucrative. Using drop-shipping models, where a third-party handles inventory and shipping, can minimise the required active involvement.

b) Affiliate marketing: Promoting products or services and earning a commission for every sale made through your referral can be a solid income stream. This works well with a strong online presence or a blog with good traffic.

c) Stock photography: If you're a photographer, selling photos to stock photography websites can provide a steady income. Every time someone downloads your photograph, you earn a fee.

3) Person-to-person lending

a) Peer-to-peer (P2P) platforms allow individuals to lend money to others directly and earn interest. It's like being a bank but on a smaller scale. The risk can be mitigated by choosing platforms that vet borrowers and spread the investment across multiple loans.

4) Put money into dividend-paying stocks

a) Dividend stocks: Investing in companies that pay regular dividends is a classic form of Passive Income. These stocks provide payouts, typically quarterly, giving you a steady income stream.

b) Dividend funds: For those who prefer a more hands-off approach, investing in mutual funds or ETFs focusing on dividend stocks can be a good strategy.

5) Deposit your funds in a Certificate of Deposit (CD) or savings account

a) Certificates of Deposit: CDs offer a fixed interest rate for a period. They are a low-risk investment, typically offering higher interest rates than traditional savings accounts.

b) High-yield savings accounts: These accounts offer higher interest rates compared to regular savings accounts. While the returns might not be as high as other forms of Passive Income, they come with virtually no risk.

Become an expert in Accounting today – Sign up now for our Accounting & Finance Training!

Does Passive Income incur taxation?

While Passive Income offers a way to earn money without active involvement, it is essential to understand that it is not exempt from taxation. How Passive Income is taxed can significantly impact its net benefit. Let's look more into this subject:

Understanding Passive Income taxation

Let’s look at some of the points to understand Passive Income taxation:

a) Rental income taxation: Rental income is taxable and must be reported on your tax return. Expenses related to the rental property, such as mortgage interest, property tax, operating expenses, depreciation, and repairs, can be deducted. However, rental income can push your total income into a higher tax bracket, impacting the tax rate.

b) Dividends and interest taxation: Dividends from stocks or interest from bonds and savings accounts are also subject to taxes. The tax rate varies based on whether dividends are qualified or non-qualified. Qualified dividends are taxed at a lower capital gains rate, while non-qualified dividends are taxed as ordinary income.

c) Capital gains on investments: If you sell an investment like stocks or real estate for more than you paid, you will incur capital gains tax. Long-term capital gains (on assets held for more than a year) are taxed at lower rates than short-term gains.

d) Royalties and licensing income: Income from royalties, whether from a book, patent, or other intellectual property, is subject to taxation. The IRS considers this part of your ordinary income, and it's taxed accordingly.

e) Taxation on P2P lending: The interest you earn from peer-to-peer lending is taxable as income. The platform you use will usually provide a 1099-INT form showing the interest earned during the year.

f) Passive Income from business activities: Income from business activities in which you're not actively involved is still taxable. For instance, if you're a silent partner in a business, your share of the profits is subject to tax.

Tax deductions and credits

These points will explain more about tax deductions and credits:

a) Rental property depreciation: One of the significant tax advantages of owning rental property is the ability to depreciate the building and offset income.

b) Expense deductions: Expenses incurred in generating Passive Income, like maintenance costs for rental properties or transaction fees for stock sales, can often be deducted.

c) Tax credits: In some cases, you may be eligible for tax credits related to your Passive Income activities, which can reduce your tax liability dollar-for-dollar.

Tax planning for Passive Income

This is how you can plan your tax for your Passive Income:

a) Professional advice: Consulting a tax professional is advisable to understand the taxes incurred by Passive Income.

b) Keeping records: Maintaining detailed records of income and expenses related to your Passive Income activities is crucial for accurate tax filing.

c) Understanding tax laws: Tax laws change frequently, and staying informed can help plan and identify potential tax-saving opportunities.

Are you interested in learning more about financial modelling and helping your business grow? Register now for our Financial Modelling Course!

Benefits of Passive Income

Well, an additional source of income by itself is a great benefit on its own, but surprise! there is more! Let’s jump right in and explore all the benefits having a Passive Income has to offer. Here is a list of benefits you can enjoy by setting up your Passive Income:

1) Enhanced financial stability: Passive Incomes provide a safety net for your finances and makes sure you never have to worry about money.

2) Early retirement: With Passive incomes set up you can retire early and enjoylife with complete freedom.

3) No more paycheck dependency: With passive incomes you no longer need to worry about a paycheck to support yourself.

4) Enables you the pursuit of personal passions: It allows you to follow your dreams and not have to worry about the monetary expenses, you can also make your personal passion your Passive Income to double the joy it brings you.

5) Enables you to save: Having a Passive Incomes allows you to build your savings for all the big things you want for yourself or a rainy day.

Do you want to learn about Finance? Register now for our Finance for Non-Financial Managers Course!

Myths about Passive Income

Here comes the juicy gossip! With a concept such as Passive Incomes, it is bound to have misconceptions and misinterpretations of what it is and how it’s done. Don’t you worry, this blog will bust some of the most well-known myths about Passive Incomes. Here it goes:

Myth no.1: Once you set it up, you don't have to bother about it anymore

This is not true as if you are investing your money on anything, you will need to keep track of your progress and keep an eye out for potential market risks. If you fail to do so you might end up losing money instead of making it.

Myth no.2: You can set it up in just a few days

It isn’t as easy as configuring a new phone, it will take effort and time to set up! So, don’t get disheartened if it takes more time than you thought it would. It is absolutely normal for it to take some time to set up.

Myth no.3: You only need one source of Passive Income

Have you heard the saying “Don’t put all your eggs in the same basket”? Just like that you don’t depend on just one Passive Income to secure your financial future. The more you set up the more stable you are likely to be.

Myth no.4: The safest Passive Income is real estate

Although it is the most stable, maintenance of the property will cost you a pretty penny from time to time and property values drop just like the stock market. There is no full proof safe method of setting up a Passive Income.

Myth no.5: You can build a Passive Income if you come up with a great idea

It's not as simple as it may seem the great idea will take a lot of effort into fabricating and if not done properly may also result in a loss. There will be challenges while you put in the work to set up your Passive Income, you will need to keep up your spirits and keep going till you make it possible.

Challenges in Passive Income

Hopefully you are the kind of person that loves a challenge, cause even setting up a Passive Income, comes with challenges. If that sounds scary, we got your back! If you are aware of the challenges coming your way, you will be prepared to face them. So, this blog has made a list of the most common challenges faced while setting up a Passive Income. Let’s take a look:

1) One size does not fit all: What works for someone else does not mean it will work for you. Following in the footsteps of your peers won't do it. You will have to find your own method of setting up your Passive Income and keeping track of it.

2) Fixation on ideas: An idea may seem perfect in theory but not work out as well practically. In such a situation you may start to fixate on the idea and less on the purpose of the idea. Try to keep your end goal in mind to avoid getting caught up in the process.

3) Forgetting to reinvestment: Confidence is a sneaky poison, if you get overconfident on your returns, you may forget that to keep the cycle going you should ideally reinvest. This can prevent you from accomplishing your full potential with Passive Incomes.

4) Ignoring the figures: with an abundance of financial return, you need to remember to keep track of your progress the number and the legal liabilities that may come with it.

Conclusion

Passive Income offers a pathway to financial freedom and security. We hope that from this blog, you have understood What is Passive Income and its role in achieving financial freedom. It requires upfront effort, investment, or both but can lead to a steady income stream without actively working on it consistently. While setting yourself up for financial freedom, don't forget to keep in mind the myths and challenges you may face and try to plan. Proper planning and an understanding of the tax implications can make Passive Income a valuable component of a balanced financial strategy. You are now ready to take the first step towards your financial freedom and build your own Empire.

Learn how to predict and stay ahead of your competitors with our Earn Passive Income Masterclass– Join now!

Frequently Asked Questions

Any source of income that provides regular earnings and does not require consistent oversight is considered a Passive Income. Remember it doesn’t require consistent oversight, however it does require oversight from time to time.

Active or earned income that requires you to consistently put in the work every day is a non-passive income. It typically involves trading your time and skills to receive a paycheck at the end of the month.

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Marketing Training including Passive Income Training, Strategic Marketing Training and Video Marketing Training. These courses cater to different skill levels, providing comprehensive insights into Importance of a Marketing Budget.

Our Digital Marketing Blogs cover a range of topics offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business Improvement skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Digital Marketing Resources Batches & Dates

Date

Passive Income Course

Passive Income Course

Fri 14th Feb 2025

Fri 11th Apr 2025

Fri 13th Jun 2025

Fri 8th Aug 2025

Fri 26th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please