We may not have the course you’re looking for. If you enquire or give us a call on +36 18508731 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Payrolling Benefits involve integrating employee benefits into their regular Payroll, ensuring transparency, and complying with legal regulations. By incorporating benefits into Payroll, employers provide a comprehensive view of employee compensation and simplify Benefits Management.

Payrolling Benefits refer to the practice of including employee benefits as part of their regular salary or wages. In this blog, you will learn what Payrolling Benefits is, the requirements for meeting deadlines, and some of its examples.

Table of Contents

1) What is Payrolling Benefits?

2) How to register for Payrolling Benefits?

3) How to meet deadline for Payrolling Benefits?

4) Payrolling Benefits in Kind

5) Examples of Payrolling Benefits

6) Conclusion

What is Payrolling Benefits?

Payrolling Benefits are a fundamental aspect of managing employee compensation and benefits. It involves incorporating employee benefits into their regular Payroll, simplifying the administration process and ensuring compliance with legal and tax regulations. Moreover, it streamlines employee benefits management, enhancing efficiency and compliance. Here's how it works:

a) Integration into Payroll: It involves integrating employee benefits into regular Payroll and simplifying administrative tasks.

b) Transparency and clarity: It gives employees a clear view of their total compensation package.

c) Compliance with regulations: Compliance with legal and tax regulations is ensured by accurately calculating and reporting benefit values.

d) Common Payrolled Benefits: These include pension contributions, company cars, health insurance, childcare vouchers, and gym memberships.

How to register for Payrolling Benefits?

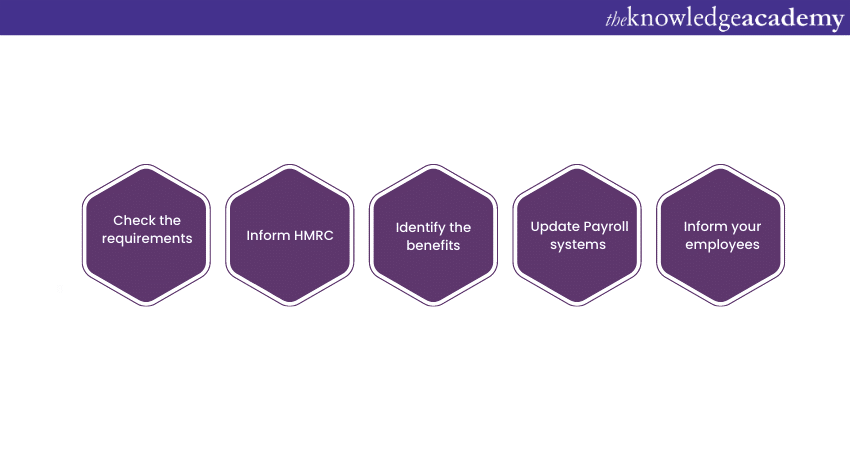

You must follow the below steps to register for Payrolling Benefits:

a) Determine eligibility: Check the eligibility requirements set by the relevant authorities before registering.

b) Notify HM Revenue Customs (HMRC): Inform HMRC about your intention to start Payrolling Benefits. This can be done through the HMRC online portal or by contacting them directly.

c) Review benefits eligibility: Identify the benefits that can be included in Payrolling. Understand the specific rules and restrictions regarding eligible benefits.

d) Update Payroll systems: Adjust your Payroll systems to incorporate these benefits. Ensure accurate deductions and reflect benefits in employee pay.

e) Communicate with employees: Inform your employees about the change in the benefits administration and how it will affect their pay. Clear communication is vital to avoid confusion or concerns.

You can follow these steps to successfully register for Payrolling Benefits and provide a more efficient and integrated approach to employee compensation.

Unlock the power of financial knowledge! Join our Finance for Non-Financial Managers course and gain the skills you need to understand and interpret financial information.

How to meet deadline for Payrolling Benefits?

Meeting specific requirements and deadlines is crucial when it comes to Payrolling Benefits. Here are important considerations:

a) Submission deadlines: Employers must submit accurate and timely reports to HMRC regarding Payrolling Benefits. Failure to meet submission deadlines can result in penalties or other consequences.

b) Employee notifications: Employers must notify their employees within a specific timeframe about including benefits in their pay. This ensures transparency and keeps employees informed.

c) Tax year-end reporting: At the end of each tax year, employers are required to report the Payrolled benefits for each employee to HMRC. This information is essential for accurate tax calculations and compliance.

d) Compliance with regulatory authorities: Employers must adhere to the regulations and guidelines set by the relevant authorities governing these benefits. Staying updated on any changes or updates is crucial to maintaining compliance.

By understanding and fulfilling these requirements for deadlines, employers can effectively manage these benefits, meet legal obligations, and ensure a smooth Payroll Process for both the organisation and employees.

Take charge of your organisation's financial stability! Join our Introduction to Credit Control course and gain essential skills to effectively manage credit and ensure timely payments.

Payrolling Benefits in Kind

Payrolling Benefits in Kind includes non-cash benefits as a part of an employee's regular Payroll. These benefits, often referred to as "perks," can add significant value and contribute to an employee's overall compensation package. Here's what you need to know about these benefits in kind:

a) Definition of benefits in Kind: Payrolling Benefits in Kind are non-monetary benefits provided to employees by their employers. These can include company cars, housing accommodations, private healthcare, and other similar perks.

b) Inclusion in Payroll: Employers incorporate their value into the employee's regular Payroll instead of providing these benefits separately. This means that the appropriate deductions, such as tax and National Insurance contributions, are made based on the value of the benefits.

c) Tax implications: Payrolling Benefits in kind has tax implications for both employers and employees. Employers are responsible for accurately calculating and reporting the taxable value of these benefits. Employees may be subject to additional tax liabilities based on the value of the benefits they receive.

d) Regulatory requirements: Employers must comply with specific regulations and guidelines for Payrolling Benefits in Kind. These may include reporting requirements to tax authorities and ensuring accurate calculations and deductions.

e) Employee communication: Clear communication with employees is crucial for Payrolling Benefits in Kind. Employers should inform employees about the inclusion of these benefits in their Payroll and provide them with relevant information regarding tax implications or any changes in their compensation.

Employers must stay updated on the applicable laws and communicate effectively with employees to maintain transparency and compliance.

Discover the essentials of Payroll Management and take control of your organisation's financial success with our Introduction To Payroll Training – Signup today!

Examples of Payrolling Benefits

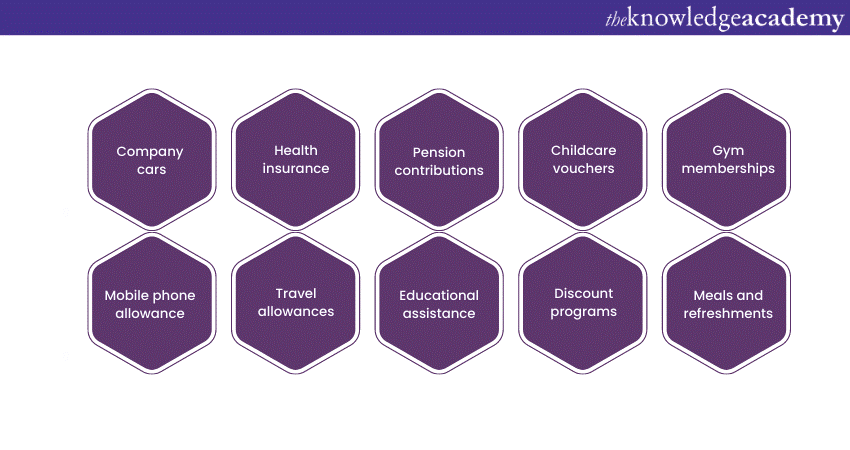

Payrolling Benefits encompass a wide range of non-monetary perks that can be included in an employee's regular Payroll. Here are some of its common examples:

a) Company cars: Employers may provide company cars for business and personal use. The value of the car and associated expenses, such as fuel, insurance, and maintenance, can be included in Payrolling.

b) Health insurance: Employers often offer health insurance coverage to employees. The cost of the premiums can be integrated into the employee's pay.

c) Pension contributions: Employers may contribute to their employees' pension plans. These contributions can be included in Payrolling, providing employees with long-term financial benefits.

d) Childcare vouchers: Employers sometimes provide childcare vouchers or subsidies to help employees cover childcare expenses. The value of these vouchers can be added to the employee's pay.

e) Gym memberships: Some employers offer gym memberships or wellness program benefits to promote employee well-being. The cost of these memberships can be integrated into Payrolling.

f) Mobile phone allowance: Companies may provide mobile phone allowances or reimbursements to employees who require mobile communication for work purposes. These allowances can be included in Payrolling.

g) Travel allowances: Employers may offer travel allowances to cover commuting costs or business-related travel expenses. These allowances can be included in Payrolling.

h) Educational assistance: Some companies support their employees' educational pursuits by providing tuition reimbursement or assistance programs. The value of these benefits can be integrated into Payrolling.

i) Discount programs: Employers may partner with vendors or retailers to offer employee discount programs. The value of these discounts can be included in Payrolling.

j) Meals and refreshments: In certain industries or work environments, employers may provide meals or refreshments to employees. The value of these benefits can be integrated into Payrolling.

By incorporating these examples of these benefits into regular Payroll, employers enhance their employees' overall compensation package and provide valuable perks that contribute to their well-being and satisfaction.

Master the art of Xero Payroll and revolutionise your Payroll Management with our specialised Xero Payroll Training – Signup now!

Conclusion

We hope you read and understood everything about Payrolling Benefits. It plays a significant role in managing employee compensation and enhancing the overall employee experience. By integrating benefits into regular Payroll, employers simplify administration, provide transparency, and ensure compliance with legal and tax regulations.

Supercharge your financial skills and elevate your career with our cutting-edge Accounting & Finance Training Courses – Sign up today!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Payroll Course

Payroll Course

Fri 24th Jan 2025

Fri 28th Feb 2025

Fri 30th May 2025

Fri 15th Aug 2025

Fri 26th Sep 2025

Fri 31st Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please