We may not have the course you’re looking for. If you enquire or give us a call on +36 18508731 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The landscape of business is an ever-shifting one and is populated with constantly evolving risks waiting to fumble you up. But thanks to the broad range of cutting-edge Risk Management Software at your disposal, you can now anticipate threats, dodge disasters, and stay ahead of the curve easily. These powerful tools enable organisations to proactively spot, assess, and mitigate risks before they escalate.

If you are feeling burdened with these software options, this blog will help you narrow out the right choice for your business. Dive in, explore the 21 best Risk Management Software and turn risk management from a challenge into a strategic advantage!

Table of contents

1) Why is Risk Management Software Important?

2) Key features of Risk Management Software

3) Top Risk Management Software

4) How to Select the Right Software for Risk Management?

5) Conclusion

Why is Risk Management Software Important?

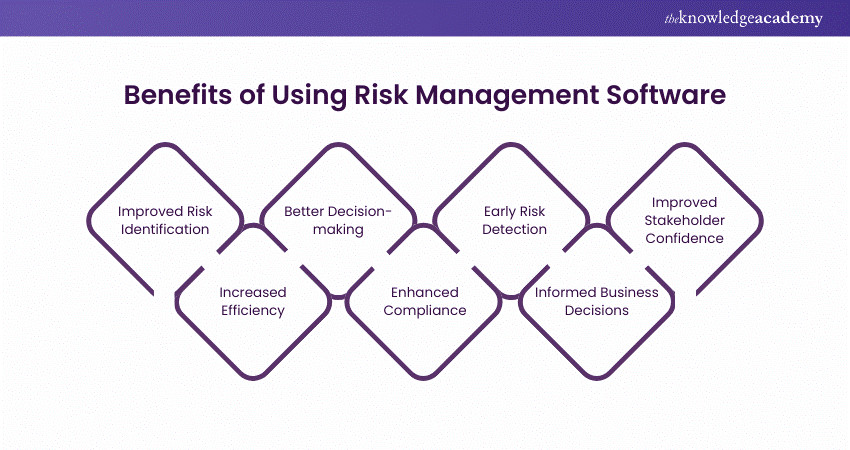

Risk Management Software is pivotal in today’s business arena, where uncertainties and complexities are unavoidable. It enables organisations to effectively identify, assess, and manage risks, thereby safeguarding their assets, reputation, and overall stability. Here are key reasons why Software is important for Risk Management:

a) Proactive Risk Identification: Risk Management Software empowers businesses to identify potential risks before they escalate into significant problems. By leveraging sophisticated algorithms and data analytics, these software solutions can detect patterns, anomalies, and emerging risks across various business areas.

b) Comprehensive Risk Assessment: Organisations can conduct thorough risk assessments to understand various risks' potential impact and likelihood. By evaluating internal and external factors, these software solutions provide a holistic view of risks, allowing businesses to prioritise and allocate resources effectively.

c) Streamlined Risk Response: When risks materialise, having a structured and integrated approach to response is crucial. In such cases, Software for Risk Management facilitates the implementation of predefined response plans, ensuring consistency and adherence to best practices.

d) Enhanced Compliance and Governance: Compliance with industry standards and regulations is essential in today’s regulatory environment. Risk Management Software helps organisations stay compliant by providing tools to document, track, and report on Risk Management activities.

e) Data-driven Decision-making: These Software leverages data analytics to provide meaningful insights into risk trends, correlations, and potential mitigation strategies. By harnessing the power of data, organisations can make informed decisions, reducing uncertainty and improving overall business performance.

f) Improved Stakeholder Confidence: Effective Risk Management instils confidence in stakeholders, including investors, customers, and employees. By demonstrating a proactiveness approach to risk mitigation, organisations can build trust and enhance their reputation, thereby gaining a competitive advantage in the marketplace.

Key Features of Risk Management Software

Not all risk management software is created equal. To ensure the right tool for your needs, here are some must-have features to look for:

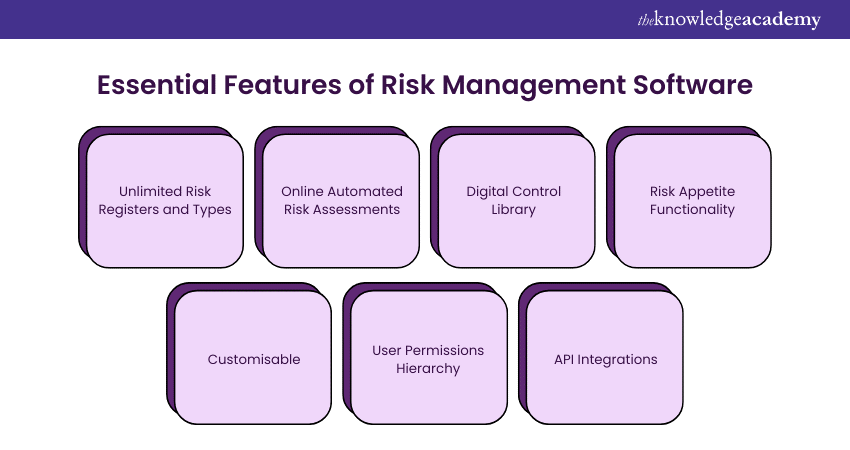

1) Unlimited Risk Registers and Types: Look for a Risk Management tool that enables you to build unlimited risk registers with various categories and types. This will streamline the process of building multiple digital risk registers within the platform and reporting across multiple teams, sites, and departments.

2) Online Automated Risk Assessments: Go for a Risk Management tool that helps you roll out the risk assessments online. Access the tool's best practice forms and templates to design risk assessment forms that work for every area of your organisation.

3) Digital Control Library: Select a platform that provides the functionality to create a control library. This will enable you to set controls for each risk in the risk register and build a digital library of controls, including regular checks, policies, procedure documents, step-by-step processes, or safety or security equipment

4) Risk Appetite Functionality: Look for solutions that enable your firm to define and operate within a risk appetite. You must be able to set Key Risk Indicators (KRIs) for each risk in the risk register and monitor risk levels by looking at operational data.

5) Customisable: Opt for a Risk Management tool that is easy to customise and configure in-house without needing costly professional services fees and coding from the software vendor. Choosing a highly configurable platform is essential to ensure it works for your organisation's bespoke needs and can scale and grow.

6) User Permissions Hierarchy: Look for a platform that offers a user permissions hierarchy that will enable firms to set guidelines for what each user can do on the platform. Leadership teams can access high-level risk overview dashboards to understand risk exposure across the organisation.

7) API Integrations: Go for a risk platform that enables API integrations with other systems and data sources. This ensures a single source of truth in the Risk Management program and subsequent reporting outputs, as everyone is working from the same data set.

Top Risk Management Software to Consider

With every year, the market thrives with a diverse range of Risk Management Software solutions, each offering unique features and capabilities. Here are the top 21 Software for Risk Management that have garnered recognition for their effectiveness and innovation across industries:

1) Resolver

Resolver is a highly regarded Software for Risk Management that offers a comprehensive suite of solutions to manage risks and incidents effectively. It provides organisations with the tools to assess, mitigate, and respond to risks across various domains. Here are some key features and functionalities of Resolver:

a) Enables users to report and track incidents in real-time

b) It streamlines Incident Management workflows

c) Helps in identifying trends, investigating root causes, and implementing corrective actions promptly

d) Facilitates risk assessments through customisable templates and risk-scoring methodologies

e) Offers robust investigation and case management capabilities

f) Supports compliance management by providing a centralised repository for policies, regulations, and standards

g) Enables users to conduct impact assessments, create response plans, and perform simulations to ensure preparedness

h) Provides advanced analytics and reporting capabilities

i) Offers customisable dashboards and visualisations to monitor key risk indicators and make data-driven decisions

2) Qualys

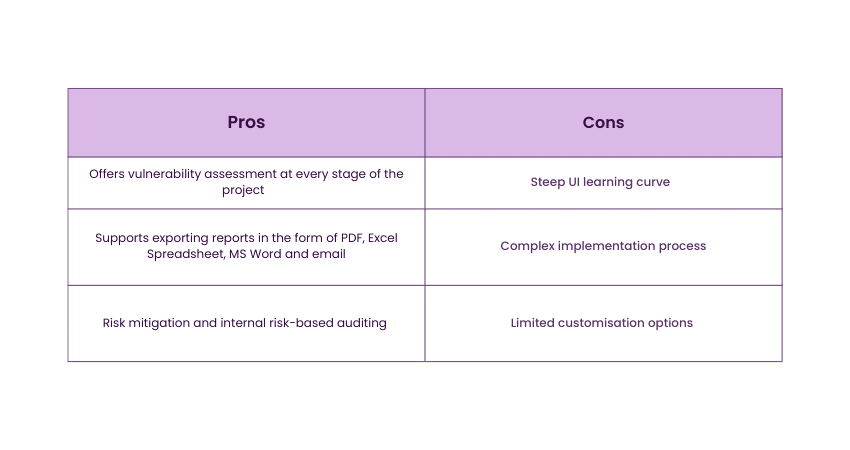

Qualys is a leading cloud-based Risk Management and compliance platform known for its robust security solutions. It delivers a range of features for detecting vulnerabilities, analysing risks, and ensuing compliance with industry standards. Here are key aspects of Qualys:

a) Provides comprehensive vulnerability scanning and management capabilities by identifying vulnerabilities across IT assets

b) Offers continuous monitoring of assets, networks, and applications for potential security risks

c) Provides real-time alerts, enabling proactive threat response and mitigation

d) Helps organisations achieve compliance with various industry regulations and frameworks

e) Provides pre-built templates and workflows for managing compliance requirements and automates compliance assessments

f) Includes robust web application security features, such as scanning web applications for vulnerabilities, detecting malicious activities

g) Container security solutions allow organisations to assess and secure containerised environments

h) Provides real-time alerts and helps maintain the integrity and security of systems to detect unauthorised changes to critical files and configurations

3) CURA

CURA is a comprehensive Governance, Risk, and Compliance (GRC) platform that helps organisations streamline their Risk Management processes. It's wide range of features can help assess, monitor, and mitigate risks effectively. Key functionalities of CURA include:

a) Provides tools for conducting risk assessments, including qualitative and quantitative risk analysis methodologies

b) Allows organisations to define risk criteria, prioritise risks, and track risk mitigation efforts

c) Enables organisations to create, distribute, and manage policies and procedures

d) Supports compliance tracking, evidence collection, and regulatory reporting to ensure adherence to industry standards

e) Facilitates the planning, execution, and tracking of internal audits

f) Provides tools to evaluate vendors’ compliance, track due diligence activities, and manage vendor contracts

g) Offers organisations the ability to document incidents, investigate root causes, and implement corrective actions

h) Helps in developing and maintaining business continuity and disaster recovery plans by supporting business impact analysis, plan development, and plan testing

4) A1 Tracker

A1 Tracker is another comprehensive Risk Management Software solution focusing on enterprise Risk Management and insurance. It provides organisations with a range of tools to assess, track, and mitigate risks effectively. Key features of the A1 Tracker include:

a) Allows users to identify, evaluate, and prioritise risks based on their impact and likelihood

b) Facilitates policy tracking, renewal notifications, and claims processing, streamlining the insurance management process

c) Helps organisations track contract expiration dates, obligations, and related risks by providing a centralised repository for contracts, agreements, and other important documents

d) Allows users to report incidents, track their status, and initiate investigations

e) Provides visualisations and reports to monitor risk trends and performance indicators

f) Offers feature to manage vendor and supplier risks through assessing vendor compliance, tracking performance, and monitoring contractual obligations

5) SAS

SAS is a renowned provider of advanced analytics and business intelligence software solutions. While SAS offers a range of products, it also offers Risk Management software designed to help organisations identify, analyse, and mitigate risks effectively. Key aspects of SAS Risk Management include:

a) Allows building statistical models, performing simulations, and assessing risk exposures across various scenarios

b) Provides tools to evaluate borrower creditworthiness, monitor credit portfolios, and estimate default probabilities

c) Offers features to identify and manage operational risks, including fraud, operational failures, and regulatory non-compliance

d) Supports market risk analysis by providing tools to monitor and analyse risks associated with market fluctuations, investments, and trading activities

e) Helps track and report on compliance with regulations such as Basel III, Solvency II, and GDPR

f) Offers powerful reporting and visualisation capabilities to present risk information

g) Provides dashboards, interactive charts, and reports to facilitate risk communication and decision-making

Learn about governance principles to shape good governance expectations with our MoR® 4 Practitioner Risk Management Certification.

6) Fusion Risk Management

Fusion Risk Management is another leading provider of cloud-based Risk Management and business continuity solutions. It offers a comprehensive platform to assess, monitor, and respond to organisational risks. Key features of Fusion Risk Management include:

a) Helps organisations develop and maintain business continuity plans

b) Allows users to define critical processes, establish recovery strategies, and conduct plan testing and exercises

c) Helps organisations develop and maintain business continuity plans

d) Enables organisations to assess and monitor risks associated with vendors and supply chains

e) Assists organisations in complying with regulatory requirements

f) Allows users to analyse risk data, generate reports, and create visualisations to support risk-based decision-making

7) StandardFusion

StandardFusion is also a cloud-based Risk Management and compliance platform that simplifies the process of managing risks and maintaining compliance. It delivers a broad range of features to streamline risk assessment, mitigation, and compliance tracking. Key functionalities of StandardFusion are as follows:

a) Provides tools for conducting risk assessments and managing compliance obligations

b) Offers a centralised repository for policies, procedures, and other important documents

c) Facilitates incident and issue management by allowing users to report incidents, track the status, and document resolution steps

d) Supports vendor and third-party Risk Management by providing tools to assess vendor risks, track compliance, and manage contracts

e) Supports audit planning, execution, and tracking, ensuring adherence to regulatory requirements

f) Helps track employee training, certifications, and competency levels

8) Risk Cloud

Risk Cloud offers a range of features to streamline risk assessment, mitigation, and compliance management. It equips organisations with the tools they need to spot, evaluate, and respond to risks effectively. Its key features of Risk Cloud include:

a) Enables organisations to conduct risk assessments using customisable templates and methodologies

b) Provides tools to track control effectiveness, monitor control implementation, and manage control testing

c) Supports compliance management by providing tools to track and manage compliance requirements

d) Offers incident and issue management capabilities to track and resolve incidents and non-conformities

e) Enables users to generate real-time reports, track key risk indicators, and support risk-based decision-making

9) OneTrust

OneTrust is a leading privacy, security, and compliance software solutions provider. While it primarily focuses on privacy and data protection, it also offers robust Risk Management capabilities. Here are key aspects of OneTrust software:

a) Helps organisations comply with privacy regulations, such as GDPR and CCPA, by providing features for managing data subject requests, conducting privacy impact assessments, and implementing data protection controls

b) Allows organisations to evaluate vendor compliance, track vendor relationships, and manage data processing agreements

c) Offers incident and breach management capabilities to track and respond to security incidents and data breaches

d) Helps in tracking compliance requirements, monitoring regulatory changes, and generating compliance reports

e) Facilitates audit and assessment processes by providing tools to plan, execute, and track audits and assessments

10) Riskonnect

This is another cloud-based Risk Management Software platform that helps organisations streamline their Risk Management processes. It offers a comprehensive set of tools to assess, monitor, and mitigate risks effectively. The following are the key features of Riskonnect:

a) Provides tools to report incidents, track claims, and manage investigation workflows

b) Offers feature to manage insurance policies and certificates

c) Provides tools to evaluate vendor compliance, track performance, and manage contractual obligations

d) Enables organisations to define critical processes, establish recovery strategies, and conduct plan testing and exercises

e) Allows organisations to assess and monitor risks associated with vendors and supply chains

11) Lendflow

Lendflow Risk Management Software solution is designed specifically for financial institutions, including lenders and banks. It helps organisations like these to streamline their risk assessment and management processes. The key features of Lendflow are as follows:

a) Offers tools for assessing credit risk associated with loans and lending activities

b) Enables organisations to monitor loan performance, identify potential risks, and implement risk mitigation strategies

c) Supports underwriting and approval workflows by providing tools, including credit checks, documentation review, and approval workflows, to streamline the loan origination process

d) Helps to assess collateral value, monitor collateral status, and manage collateral documentation

e) Allows generating risk reports, tracking key risk indicators, and supporting risk-based decision-making, thereby providing real-time visibility into risk exposures

f) Assists organisations in maintaining regulatory compliance by tracking compliance with regulations and industry standards.

12) ServiceNow

Another leading provider of cloud-based Service Management software solutions is ServiceNow. While it is mainly known for its IT Service Management capabilities, it also provides robust Risk Management features. Some of the key aspects of ServiceNow are as follows:

a) Provides tools to identify risks, evaluate their impact and likelihood, establish controls, and track risk treatment plans

b) Allows organisations to report incidents, track their status, and initiate investigations by documenting incident details, assigning responsibilities, and implementing corrective actions

c) Offers to assess vendor compliance, track vendor relationships, and monitor contractual obligations

d) Allows organisations to track compliance requirements, assess compliance status, and generate compliance reports

Learn about risk categories and management processes with our Certified Risk Management Professional CRMP course.

13) NTask

NTask is a user-friendly project and task management software offering Risk Management features. It helps organisations identify, assess, and mitigate project and task risks. The key features of NTask’s Risk Management module include the following:

a) Provides tools to brainstorm potential risks, document risk descriptions, and assign Risk Owners

b) Supports qualitative and quantitative risk analysis methodologies and helps prioritise risks

c) Enables organisations to define risk response actions, assign responsibilities, and set target completion dates through developing risk mitigation strategies and plans

d) Provides tools to monitor and track risks throughout the project or task lifecycle, including updating risk status, tracking risk treatment progress, and capturing risk-related updates

e) Offers features for team members to discuss risks, share updates, and collaborate on risk mitigation efforts

f) Offers visualisations and reports to track key risk indicators, monitor risk trends, and communicate risk information

14)TimeCamp

TimeCamp is a time-tracking and productivity software solution offering basic Risk Management features. While it may not have extensive Risk Management capabilities, it can assist organisations in identifying and assessing time and resource management risks. The key features of TimeCamp Risk Management include:

a) Enables users to document risk descriptions and categorise risks based on their impact and likelihood

b) Supports basic risk assessment by allowing users to assess the risks based on their severity and probability

c) Allows users to update risk status, track risk trends, and capture risk-related updates

d) Provides visualisations and summaries of risks, allowing users to communicate risk information within the organisation

15) Vendor360

Vendor360 is a vendor management software solution that includes Risk Management features. It helps organisations assess, monitor, and manage risks associated with vendors and suppliers. The following are the key functionalities of Vendor360:

a) Enables organisations to assess the risks associated with their vendors and suppliers

b) Allows users to track vendor deliverables, evaluate service levels, and identify potential risks

c) Helps organisations track contract expiration dates, obligations, and terms, ensuring compliance and reducing contractual risks

d) Allows documenting and tracking vendor issues, initiating investigations, and implementing corrective action

e) Supports compliance management by providing tools to track vendor compliance with regulatory requirements and internal policies

f) Provides features for vendor communication, collaboration, and performance reviews, enhancing overall vendor management practices

16) Oracle

This software offers a comprehensive suite of enterprise software solutions, including Risk Management applications. This provides organisations with a range of tools to identify, assess, and mitigate risks effectively. The features of Oracle’s Risk Management Software include the following:

a) Enables organisations to conduct risk assessments using predefined or customisable risk frameworks

b) Helps establish and monitor controls, track control effectiveness, and manage risk treatment plans

c) Assists in assessing compliance status, monitoring regulatory changes, and generating compliance reports

d) Offers incident and issue management capabilities to track and resolve incidents and non-conformities

e) Includes features to support internal audit processes, including planning, executing, and tracking audit engagements, identifying control gaps, and monitoring audit findings and recommendations

f) Provides advanced analytics and reporting capabilities

17) MasterControl Risk Analysis

This Risk Management Software solution is designed to evaluate risks, establish risk mitigation strategies, and monitor risk trends effectively. The key features of MasterControl Risk Analysis include:

a) Enables identifying and documenting risks across various processes and activities by capturing risk descriptions, categorising risks, and assigning risk owners

b) Helps organisations develop risk mitigation strategies and plans

c) Provides updates on risk status, tracks risk treatment progress, and captures risk-related updates

d) Integrates with quality management systems, enabling organisations to align Risk Management activities with quality processes

e) Provides dashboards, visualisations, and reports to track key risk indicators, monitor risk trends, and support risk-based decision-making

18) LogicManager

LogicManager is a state-of-the-art risk management tool that prides itself on boosting business performance. It's a cloud-based solution that

enables users to detect and assess high-impact risks and allocate the resources to resolve them. Here are some of its features:

a) It provides about 100 package variations

b) Has To-do lists to monitor risk management tasks

c) Contains pre-built, configurable risk libraries to boost the detection of threats

d) It's a taxonomy technology to show dependencies

e) Enables companies to evolve with product updates

f) Provides support for account analysts

19) Project Risk Manager

The Project Risk Manager is a project risk management solution that’s easy to install, set up, and use. Its user interface functionality is deep, and it employs pre-set impact categories and rank descriptions to prioritise potential threats better. It’s features include:

a) It's got multiple installation copies in addition to a secure database

b) It's got automatic risk alerts

c) It offers customisable parameters

d) It comes with powerful risk management applications and analysis features

e) It performs an organised aggregation of risks for speedy action

20) Sypro Risk Manager

Sypro Risk Manager is known for its ease of use in tracking and managing risks and compliance tasks (with a simple red, amber, and green status). Here are some features to consider:

a) It has a transparent, top-down view of organisational asset structure

b) Simple processes to ensure statutory compliance

c) It maintains accident, incident, and near misses registers

d) It offers visibility and control of every externally held contract and document

e) It boasts easy-to-manage admin and preference settings

f) It offers easy-to-implement graphical governance tools

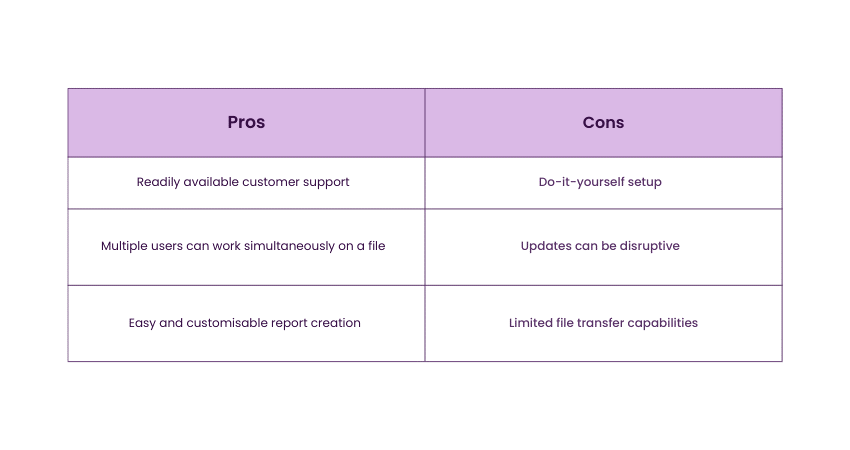

21) Clickup

ClickUp is the one-stop shop for all things productivity. Offering hundreds of fully customisable, transparent, and functional features, ClickUp provides the ideal platform for teams of any size to manage risks, monitor project updates, and work together in one place. Its features include the following:

a) Dashboards in ClickUp provide a high-level overview of every aspect of a project in one customisable and informative place through over 50 widgets tailored to diverse work processes.

b) Through native time tracking, ClickUp performs tasks ranging from recording the time spent in a web browser to staying on top of your billable time.

c) By automating repetitive tasks, ClickUp helps reduce unnecessary time spent on repetitive or basic tasks.

d) ClickUp has hundreds of customisable templates, from Kanban boards and whiteboards to dynamic Gantt charts.

How to Select the Right Risk Management Software?

Picking the right Risk Management Software is a critical decision for businesses aiming to mitigate and manage risks effectively. Here are some key considerations to help you select the most suitable software for your organisation:

a) Identify Your Requirements: Assess your organisation's specific Risk Management needs, including the types of risks you need to address and the desired functionality of the software.

b) Evaluate Features: Look for software that offers comprehensive risk assessment, tracking, and reporting features. Consider additional capabilities such as compliance management, workflow automation, and integration with other systems.

c) Scalability and Flexibility: Ensure the software can scale with your organisation's growth and adapt to evolving Risk Management needs. Look for customisable solutions that can be tailored to your unique requirements.

d) Integration Capabilities: Consider whether the software can seamlessly integrate with existing systems, including Project Management tools, CRM platforms, or data analytics software. This enables efficient data exchange and a unified Risk Management approach.

e) User-friendliness: Choose software with an intuitive interface and user-friendly features. This reduces the learning curve for your team and promotes widespread adoption.

f) Vendor Reputation and Support: Research the vendor's reputation, customer reviews, and level of customer support. Ensure they offer reliable technical assistance, regular updates, and ongoing training resources.

g) Cost Considerations: Evaluate the software's pricing structure, including upfront costs, licensing fees, and any additional charges for implementation, customisation, or ongoing support. Consider the software's value in relation to its features and benefits.

h) Trial and Demo: Take advantage of free trials or product demonstrations to assess the software’s usability and compatibility with your organisation’s workflows.

Conclusion

In conclusion, selecting the right Risk Management Software is vital for organisations to effectively detect, assess, and mitigate potential risks. From financial pitfalls to operational hiccups, by implementing the right software, organisations can enhance their Risk Management practices and ensure a proactive mindset to mitigating potential threats.

Register for our MoR® Management of Risk training.

Frequently Asked Questions

The main categories of risks include:

a) Schedule risks

b) Budget risks

c) Operational risks

d) Technical risks

e) Programmatic risks

The biggest problems and failures in Risk Management include:

a) Failure to use appropriate risk metrics

b) Mismeasurement of known risks

c) Failure to take known risks into account

d) Failure to communicate risks to top management

e) Failure to monitor and manage risks

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various MoR® Management of Risk Courses including the MoR® 4 Practitioner Risk Management Certification Course and the Management of Risk (MoR®) Foundation V3 Course. These courses cater to different skill levels, providing comprehensive insights into the Risk Management Process.

Our Project Management Blogs cover a range of topics related to Risk Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Risk Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Project Management Resources Batches & Dates

Date

Certified Risk Management Professional CRMP

Certified Risk Management Professional CRMP

Thu 27th Feb 2025

Thu 22nd May 2025

Thu 24th Jul 2025

Thu 23rd Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please