We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

What truly determines the path to success in the business arena? The answer lies in the tug-of-war between Profit Maximisation and Wealth Maximisation, whose swaying movements can define a company's trajectory. While Profit Maximisation is about grabbing quick profits and chasing after immediate returns, Wealth Maximisation aims for long-lasting prosperity and shareholder satisfaction.

In short, the former is about seizing the moment while the latter is about investing in the future's endless possibilities. This blog dissects the key aspects of these two business philosophies. So read on, learn what Profit Maximisation and Wealth Maximisation entails and streamline your business trajectory with confidence.

Table of Contents

1) What is Profit Maximisation?

a) Benefits of Profit Maximisation

b) Drawbacks of Profit Maximisation

2) What is Wealth Maximisation?

3) Difference between Profit Maximisation and Wealth Maximisation

4) Conclusion

What is Profit Maximisation?

Profit Maximisation is the firm’s ability to generate the maximum return with limited input or utilise minimum input to produce the claimed result. In the business world, Profit Maximisation includes considering a firm's production level of goods or services and the associated costs.

This production must be related to the sales price and the company’s profits made from selling these goods or services to the public. The Profit is computed by deducting the total cost from the total revenue.

Benefits of Profit Maximisation

Profit Maximisation delivers plenty of benefits as it:

a) Helps nurture a business’s financial sustainability.

b) Facilitates earnings growth, which increases shareholder value.

c) Promotes effective resource allocation, improving operational efficiency.

d) Allows companies to develop a strong financial foundation, which is essential for surviving in a competitive market.

Drawbacks of Profit Maximisation

The potential drawbacks of Profit Maximisation include the following:

a) Profit Maximisation strategies can violate ethical standards and social responsibility. Such activities can severely damage an organisation’s reputation and lead to legal consequences.

b) These tactics only focus on the short term and exclude aspects such as R&D, staff training, customer satisfaction, etc., which are essential for long-term success.

c) To maximise profits, businesses may be tempted to go for high-risk projects, which can result in heavy losses.

Want to gain deeper insight into corporate finance and investment analysis? Look no further than our comprehensive Corporate Finance Training – Register now!

What is Wealth Maximisation?

Wealth Maximisation is an economic and financial management concept that prioritises increasing the long-term value of a business for its shareholders. Unlike Profit Maximisation, which emphasises short-term gains, Wealth Maximisation takes a broader perspective by considering the overall value creation for the company’s owners.

Benefits of Wealth Maximisation

Wealth Maximisation comes with a multitude of benefits as it:

a) Helps businesses emphasise long-term sustainability.

b) Focuses on cash flow rather than profits because cash flows are more definite and enable companies to avoid the ambiguity that's usually associated with accounting profits.

c) Considers the time value of money so that future cash flows can be discounted at an appropriate rate to represent their current value appropriately.

d) Considers uncertainty and risk factors while calculating the discount rate, leading to more accurate results.

Drawbacks of Wealth Maximisation

Despite its benefits, Wealth Maximisation comes with significant baggage of drawbacks as:

a) It largely depends on a business' profits.

b) Wealth-maximising tactics are mostly prospective, as they lack proper clarity and description.

c) It can make other business goals suffer.

Learn advanced strategies for asset management in our Certified Wealth Management Course - Sign up now!

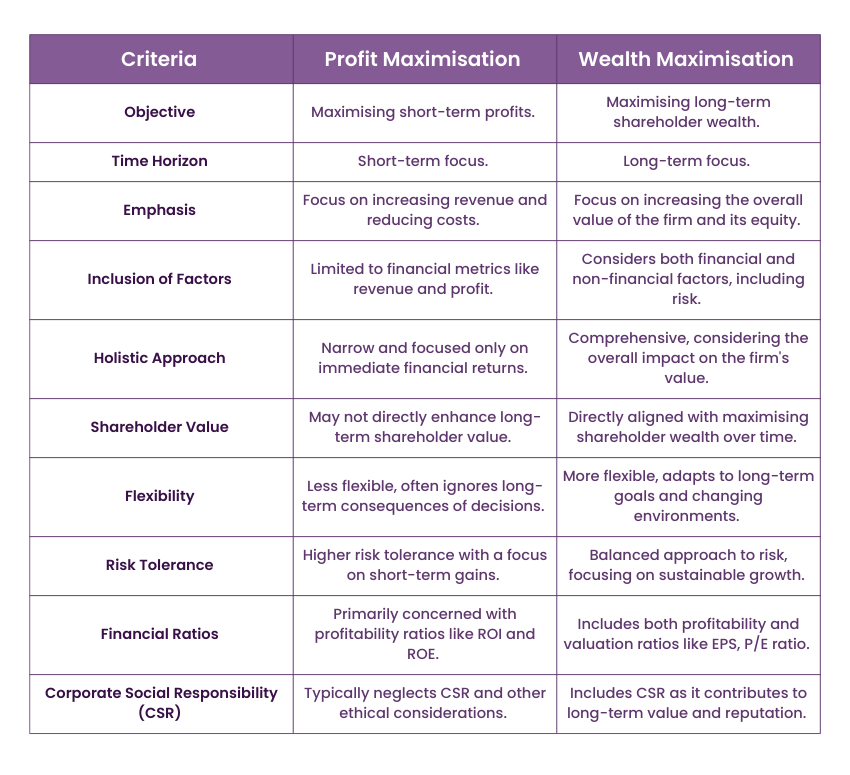

Difference between Profit Maximisation and Wealth Maximisation

This table summarises the difference between Profit Maximisation and Wealth Maximisation covering key metrics including risk tolerance, time horizon, CSR and more:

Don't miss out on your dream job! Practice with our Wealth Management Interview Questions to ensure you're ready for any challenge.

Conclusion

In conclusion, while both are essential strategies, Profit Maximisation and Wealth Maximisation serve distinct purposes. The former focuses on immediate financial gains to boost short-term profits, while the latter emphasises long-term value creation, to ensure sustainable growth and increased shareholder wealth. Having a firm grasp on the difference between these two approaches can help you make informed, strategic decisions that drive your overall business goals.

Master the art of Financial Management through our Certified Wealth Management Course - Sign up now!

Frequently Asked Questions

Why There is a Conflict Between Wealth Maximisation and Profit Maximisation?

The conflict exists because of their temporal perspectives. While Profit Maximisation emphasises immediate financial outcomes (often at the cost of long-term stability), Wealth Maximisation takes a strategic view, balancing short-term gains with long-term value creation.

Is the Concept of Time Value of Money Ignored in Profit Maximisation?

Yes, the time value of money is completely ignored in Profit Maximisation because it considers the immediate profits without considering the timing.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Finance Courses, including the Financial Management Course and the Corporate Finance Course. These courses cater to different skill levels, providing comprehensive insights into What is Corporate Finance.

Our Accounting and Finance Blogs cover a range of topics related to Wealth Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please