We may not have the course you’re looking for. If you enquire or give us a call on +353 12338944 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The world of Forex, or the Foreign Exchange Market, is a global financial hub where currencies are traded around the clock. This dynamic arena is influenced by a multitude of factors, making it a challenging yet rewarding space for Traders. To navigate the Forex Market successfully, one needs to understand What is Forex Market Analysis.

It is the process of evaluating and interpreting data to understand the current and potential future state of the Forex Market. Traders and Investors use various methods and techniques to conduct market analysis, including technical, fundamental, and sentiment analysis. In this blog, you will understand What is Forex Market Analysis and explore the key factors that contribute to its effectiveness.

Table of Contents

1) Understanding What is Forex Market Analysis

2) How does Forex Analysis work?

3) Key factors affecting Forex Market

4) Tools and resources required for Forex Market Analysis

5) Challenges of Forex Analysis

6) Conclusion

Understanding What is Forex Market Analysis

Forex Market Analysis is the systematic process of evaluating and interpreting various factors that influence the rate of currencies in the Foreign Exchange Market worldwide. The primary purpose of Forex Market Analysis is to assist Traders and Investors in informed decision-making about when to buy or sell their currencies. This Analysis helps them anticipate potential price movements, manage risks, and identify Trading Opportunities.

How does Forex Analysis work?

Forex Analysis determines which currency will become stronger when comparing two other currencies over a period. This analysis is mainly used by Forex Traders, which helps them understand and equips them with the knowledge to purchase the currency that is predicted to increase over time. These predictions are made by Forex Traders only after they have analysed the state of the nation's economy, the price of commodities that can make an impact or any other major political or environmental factors that can affect the international financial markets.

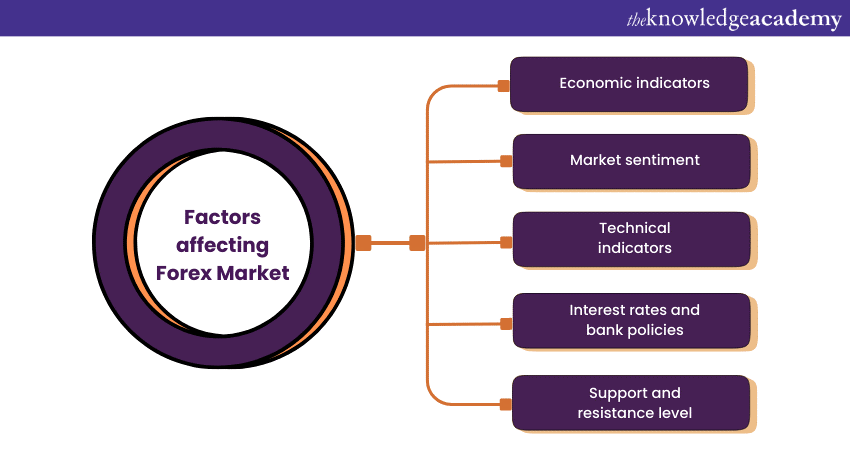

Key factors affecting Forex Market

Forex Market Analysis involves examining the economic, political, and social factors that influence currency values. Understanding these fundamental factors is crucial for Traders to make quick decisions about their trading strategies and positions. Let's dive deeper into the key fundamental factors that impact the Forex Market:

Economic indicators

Economic indicators are vital metrics that provide insights into a country's financial performance and growth prospects. Traders and Analysts closely monitor these indicators as they can significantly influence currency values. Understanding the implications of key economic indicators is essential for making informed Forex Trading decisions. Let's have a look at these factors:

a) Growth implications: A rising Gross Domestic Product (GDP) indicates economic expansion, which can increase interest rates and attract foreign investment. This increased demand for a country's currency can drive its value up.

b) Recession concerns: Contrarily, a decline in GDP may signal an economic slowdown or recession. This can bring down interest rates and a weaker currency.

Market sentiment

The market sentiment reflects Traders' emotions and attitudes towards a currency. Feelings like fear and greed can drive short-term price movements. Positive views can lead to buying, while negative sentiment can lead to selling. During periods of risk aversion, Traders often seek much safer currencies, such as the Dollar and Japanese Yen, leading to their appreciation.

Technical indicators

Technical indicators are based on mathematical calculations, historical price, volume, or open interest data. Forex Traders widely use these tools to analyse trends, recognise potential entry and exit points, and gain insights into the strength of currency movements. Here’s how technical indicators work:

a) Moving averages: Moving averages trigger price data and show the average price over a specific period. They help identify current market trends and potential reversal points.

b) Moving Average Convergence Divergence (MACD): MACD consists of two moving averages and a histogram. It helps identify momentum and potential trend changes.

c) Bollinger bands: Bollinger bands indicators consist of a Moving Average and two standard deviation lines above and below the moving average. They indicate volatility and potential breakout points.

Unlock the secrets of Forex trading success – join our Forex Trading Masterclass and start trading with confidence today!

Support and resistance level

Support and resistance levels are basic factors that influence Technical Analysis that assist Forex Traders in understanding price movements and making informed trading decisions. These levels are critical for identifying potential entry and exit points, understanding price trends, and managing risk. Let's explore the significance of support and resistance levels in Forex Market Analysis:

a) Support levels: Support levels represent price levels at which a currency pair has historically found buying interest, preventing it from falling further. These levels act as "floors" that the price tends to bounce off.

b) Resistance levels: Resistance levels represent price levels at which a currency pair has historically faced selling pressure, preventing it from rising further. These levels act as "ceilings" that the price tends to stall or reverse.

Interest rates and bank policies

Banks play a vital role in nurturing the Forex Market through their interest rate and monetary policy decisions. Understanding how interest rates and significant bank policies affect currency values is essential for successful Forex Market Analysis. Banks set interest rates, which influence borrowing costs and overall economic activities. Interest rates imply the following:

a) Higher interest rates: A bank raising interest rates often attracts foreign capital seeking better returns. This increased demand for domestic currency can lead to currency appreciation.

b) Lower interest rates: Lower bank interest rates can make lending more affordable for Traders, stimulating spending and investment. However, they may weaken the currency as the investment return becomes less attractive.

Monetary policy, on the other end, encompasses a range of tools central banks use to manage a country's money supply, inflation, and overall economic growth. Banks implement measures to curb inflation by raising interest rates and reducing the money supply. This can attract foreign capital and strengthen the currency. Banks may lower interest rates and increase the money supply to stimulate economic growth. This can weaken the currency as a result of decreased returns on investments.

Master the art of Foreign Exchange with our comprehensive Foreign Exchange Training – start your journey to financial freedom now!

Tools and resources required for Forex Market Analysis

After you have read about What is Forex Market Analysis and the key factors affecting it, it’s time to learn about the tools used to perform this Analysis. Practical Forex Market Analysis requires access to various tools and resources that provide timely information, data, and insights. Traders rely on these resources to make informed trading decisions and stay updated on current market trends. Here are some essential tools and resources for conducting a thorough Forex Market Analysis:

Economic calendars

Economic calendars provide a timetable of upcoming economic events, announcements, and data releases that can impact currency markets. They include indicators like GDP reports, interest rate decisions, employment data, and more. Traders can use these calendars to plan their trading activities around significant market-moving events.

News outlets and Analysis platforms

News outlets, financial websites, and Analysis platforms offer real-time news, expert opinions, and Market Analysis. These sources provide insights into the latest market developments, trends, and potential catalysts that can influence currency prices.

Charting software and technical indicators

Charting software allows Traders to visualise price movements and apply technical indicators to analyse historical and real-time data. Platforms like MetaTrader offer customisable charts, multiple timeframes, and various technological tools for conducting Technical Analysis.

Empower your financial future with our Finacial Modelling And Forecasting Training – make informed decisions and excel in finance!

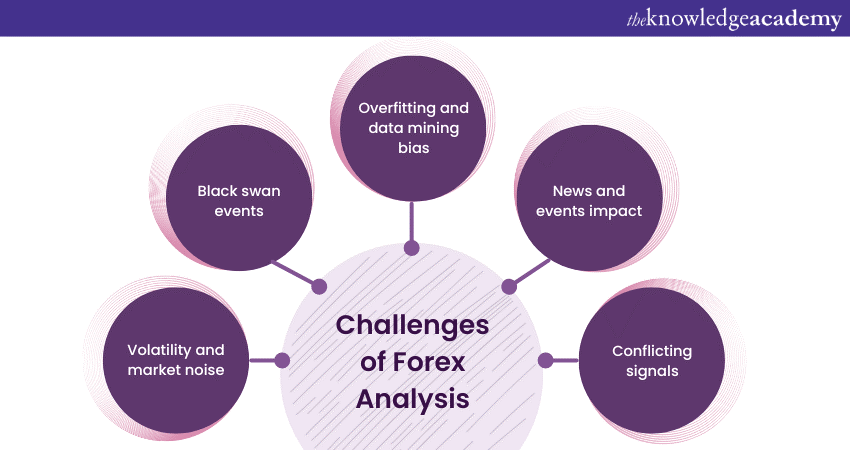

Challenges of Forex Analysis

Forex Analysis is a multifaceted endeavour that requires a combination of skills, experience, and adaptability. While it provides valuable insights for Traders, it also comes with several challenges that traders must navigate. Understanding these challenges is essential for successful trading in the Forex Market. Let's have a close look at some of them:

a) Volatility and market noise: The Forex Market can experience high levels of volatility and noise, leading to sudden and unpredictable price movements. Volatility can trigger false signals and cause trades to be stopped prematurely.

b) Black swan events: Black swan events are unexpected and highly impactful events that can disrupt markets and invalidate existing Analysis. Examples include geopolitical crises, natural disasters, and unanticipated economic shifts.

c) Overfitting and data mining bias: Overfitting occurs when a trading strategy is tailored too closely to historical data, making it less effective in new market conditions. Traders must ensure that their systems are robust and adaptable rather than overfitting past data.

d) News and events impact: News releases and unexpected events can cause rapid and extreme price movements. This can lead to gaps in the charts that can be challenging to predict or react to effectively.

e) Conflicting signals: Different Analysis techniques can sometimes provide conflicting signals. For instance, Fundamental Analysis might suggest a specific direction, while Technical Analysis indicates the opposite. Traders must learn to synthesise multiple sources of information.

Start Trading Smarter Today! Register to our Cryptocurrency Trading Course Now!

Conclusion

We hope that after reading this blog, you have understood What is Forex Market Analysis. It is an indispensable tool for Traders seeking success in the complex world of currency trading. Remember that Forex Trading carries inherent risks; a well-rounded analysis strategy can help mitigate those risks while capitalising on potential opportunities.

Elevate your financial game with our Investment and Trading Training – unleash your potential in the world of finance.

Frequently Asked Questions

Here are some potential career paths in finance that you can explore after mastering Forex Market Analysis:

a) Forex Market Analyst

b) Forex Account Manager

c) Forex Industry Regulator

d) Forex Exchange Operations

e) Trade Audit Associate

f) Exchange Operations Manager

g) Forex Software Developer

Algorithms are now widely used to execute trades based on predefined criteria. They facilitate faster execution, minimise human errors, and provide trading systems to analyse vast data sets and patterns.<

Here are some ways that you can stay updated with latest technological trends in Forex Analysis:

a) You can follow latest tech news or blogs which discuss the technological trends

b) You can attend tech conferences and webinars

c) You can join online tech communities

d) Follow social media influences who talk about the new trends in Forex Analysis

e) You can explore online courses that teach about how to integrate these new trends

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy offers various Investment and Trading Training, including Cryptocurrency Trading Training, Investment Management Masterclass, and Day Trading Course. These courses cater to different skill levels, providing comprehensive insights into Investment methodologies.

Our Investment and Trading blogs cover a range of topics related to Investment, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Trading skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please