We may not have the course you’re looking for. If you enquire or give us a call on +353 12338944 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

QuickBooks Accountant is a powerful accounting software program tailored to meet the needs of Accountants and Bookkeepers and simplify their work. It empowers accounting professionals to efficiently manage their client's financial records and provide valuable insights.

According to Thomson Data, there are more than 92,000 companies that use QuickBooks to manage their accounting and Payroll needs. Read this blog to learn what QuickBooks Accountant is, how to use it, its key features, benefits and who should use this program.

Table of Contents

1) What is QuickBooks Accountant?

2) Getting started with QuickBooks Accountant

3) Key features of QuickBooks Accountant

4) Benefits of QuickBooks Accountant

5) Who Should Use QuickBooks Accountant?

6) Conclusion

What is QuickBooks Accountant?

QuickBooks Accountant is a specialised version of QuickBooks, made to meet the unique needs of accounting professionals. QuickBooks Features offer advanced tools that streamline the accounting process and enable accountants to work more efficiently. With this program, professionals like accountants and bookkeepers can manage multiple clients, access their files simultaneously, and perform tasks like adjusting journal entries, reviewing client data, and creating custom reports, as outlined in the QuickBooks Troubleshooting Guide. QuickBooks provides extensive online resources, tutorials, and customer support, ensuring you have all the necessary tools to excel in your accounting practice with this program.

Getting started with QuickBooks Accountant

The following are the steps that you must follow to use QuickBooks Accountant:

a) Installation and setup: Once you have confirmed that your system meets the requirements, install the program. The installation process is straightforward, with clear instructions provided by the software. You can choose between physical installation from a CD or a digital download from the Intuit website.

After the installation, the software will prompt you to set up your accountant profile. This step involves entering your credentials, such as name, contact information, and practice details. Customising your profile is essential, as it will be associated with your client's financial data.

b) Navigating the interface: The QuickBooks Accountant has a user-friendly interface that features a dashboard with easy-to-navigate menus. There are many tools and options available there. The main dashboard displays a list of your clients, and you can easily switch between their accounts to access their financial data.

The top navigation bar contains tabs for functions like Company, Accountant, Lists, and Reports. This intuitive layout ensures quick access to the most frequently used features. Additionally, QuickBooks Accountant often includes helpful tooltips and guides to assist you as you navigate through the software.

Download the Tally Shortcut Keys PDF now and get quick access to essential shortcuts for streamlining your Tally experience.

c) Setting up company information: Before working with your client's financial data, you must set up their company information within this program. This step provides the foundation for accurate record-keeping and financial analysis.

d) Creating a new company: When working with a new client, you can create a new company file within QuickBooks Accountant. This file will be the repository for all financial data specific to that client's business. You must enter essential details during the setup process, such as company name, address, industry, and fiscal year.

e) Importing data from an existing company: If your client already uses QuickBooks or another accounting software, you can import their existing data into QuickBooks Accountant. This feature streamlines the transition process and ensures the continuity of financial records. The software provides easy-to-follow instructions to guide you through the data import process.

f) Customising company settings: Each business has unique accounting requirements, and QuickBooks Accountant allows you to customise company settings to suit your client's needs. Customisation options include setting the company's reporting currency, fiscal year, and accounting method (cash or accrual).

g) Exploring sample data: It offers the option to explore sample data, which allows you to practice using the software without affecting real client data. Utilising sample data can be an excellent way to familiarise yourself with the various features and functionalities before working with actual client information.

Unlock the world of finance with our Finance For Non-Financial Managers course. Gain essential financial insights and make informed business decisions. Join now and boost your financial acumen!

Key Features of QuickBooks Accountant

The following are some of the key features of QuickBooks Accountant:

a) Accountant's toolbox: It’s a collection of powerful tools that aid accounting professionals in efficiently working with their client's financial data. It includes features like reclassifying transactions, fixing client errors, and making journal entries. These tools streamline the accounting process and ensure accurate financial records.

b) Working trial balance: It gives accountants a real-time view of their client's financial positions. It allows them to review and verify the accuracy of financial data, helping identify any discrepancies and make necessary adjustments.

c) Accountant center: It is another important feature that serves as a centralised dashboard for accounting professionals, offering quick access to tools and reports for managing multiple clients. It provides an organised and efficient way to navigate different client accounts and tasks.

d) Cloud-based platform: It operates on a cloud-based platform, enabling seamless collaboration between accountants and their clients. It facilitates real-time access to financial data, making it easier for accountants to work closely with their clients and provide timely advice.

Discover the fundamentals of Payroll Management with our Introduction to Payroll course. Master the art of processing employee payments and tax compliance.

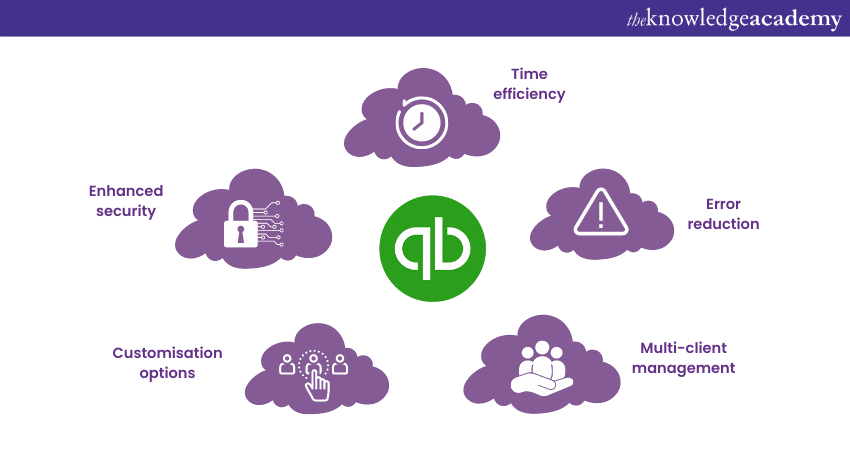

Benefits of Using QuickBooks Accountant

QuickBooks Accountant saves valuable time for accounting professionals by automating several manual accounting tasks. This allows them to focus on more strategic activities, such as financial analysis and providing valuable insights to their clients. With its advanced tools and real-time access to data, the program minimises the risk of errors in financial records. Accountants can quickly identify and resolve discrepancies, ensuring their client's financial information is accurate.

QuickBooks Accountant is specifically designed to handle multiple clients efficiently. accounting professionals can seamlessly switch between different client accounts, making managing and staying organised easier. Customisation is another essential benefit provided by this program. Each business has its unique accounting requirements. This accounting software allows accounting professionals to customise settings and reports to suit clients' needs.

Data security is of utmost importance for accounting professionals. QuickBooks Accountant employs robust security measures, including data encryption and regular backups, to protect sensitive financial information.

Furthermore, the cloud-based nature of QuickBooks Accountant fosters seamless collaboration between accounting professionals and their clients. Real-time access to financial data promotes better communication and allows accountants to provide timely guidance to clients, ultimately contributing to their business growth and success.

Level up your Accounting skills with our Accounting Masterclass. From basics to advanced concepts, learn everything you need to excel in the world of finance.

Who Should Use QuickBooks Accountant?

QuickBooks Accountant is invaluable for various professionals in the accounting and bookkeeping industry. The following are some of the professions where it plays a vital role:

a) Certified Public Accountants (CPAs): CPAs can utilise QuickBooks Accountant to efficiently manage their clients' financial records, perform audits, and provide tax-related services.

b) Bookkeepers: QuickBooks Accountant streamlines daily bookkeeping tasks, making it easier for bookkeepers to organise financial data for their clients.

c) Accounting firms: Accounting firms that handle multiple clients with diverse financial needs can benefit from QuickBooks Accountant's multi-client management capabilities.

d) Financial consultants: Financial consultants can use this program to analyse financial data, create custom reports, and offer valuable financial advice to their clients.

e) Educational institutions: Educational institutions that teach accounting or finance courses can utilise QuickBooks Accountant as an educational tool. It allows students to gain hands-on experience with real-world accounting practices and familiarise themselves with industry-standard software used by accounting professionals.

f) Business owners: While this program primarily targets accounting professionals, small business owners who manage their finances can also benefit from using the software. It lets them keep their financial records organised, generate professional reports, and gain valuable insights into their business's financial health. The collaboration features enable seamless communication with their accountants or bookkeepers, fostering better financial management.

Join our Bookkeeping Training and become a Bookkeeping expert. Learn essential skills to maintain accurate financial records and boost your career prospects.

Conclusion

QuickBooks Accountant is a game-changer software for accounting professionals. It can simplify complex tasks and provide valuable insights to clients. By following this step-by-step guide, you can harness the full potential of this program and enhance your accounting efficiency.

Embark on a journey to master Tally with our comprehensive Tally Training course. Acquire in-demand accounting skills and efficiently manage financial data.

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

QuickBooks Training

QuickBooks Training

Fri 14th Mar 2025

Fri 9th May 2025

Fri 11th Jul 2025

Fri 12th Sep 2025

Fri 14th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please