We may not have the course you’re looking for. If you enquire or give us a call on +353 12338944 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you considering a career as a Treasury Manager? Understanding the Treasury Manager Job Description is essential for grasping the responsibilities and skills required for this financial role.

Treasury Managers oversee an organisation's financial health, managing cash flow, investments, and risk. In this blog, we will explore the key duties, qualifications, and skills necessary to excel in this position. You will get an overview of what to expect in this dynamic field.

Table of Contents

1) What is a Treasury Manager?

2) Treasury Manager Roles and Responsibilities

3) Key Requirements for a Treasury Manager

4) Treasury Manager Skills and Attributes

5) Treasury Manager Salary Guide

6) Treasury Manager Job Description Template

7) Conclusion

What is a Treasury Manager?

Employees are a big part of every company. They are responsible for some tasks which help the business grow. One such job role is Treasury Manager who oversee an organisation’s cash flow, revenue, and overall financial health.

Responsibilities:

a) Oversee cash flow, revenue, and financial health.

b) Analyse fiscal decisions and monitor expenses.

c) Provide financial advice to colleagues.

d) Work Environment:

i) Office-based, collaborating with a team.

e) Employment Sectors:

i) Investment firms, retail companies, financial agencies, and other organisations.

f) Reporting Structure:

i) Report to senior-level staff, typically the Chief Financial Officer (CFO).

g) Team Management:

i) Manage teams, including junior employees.

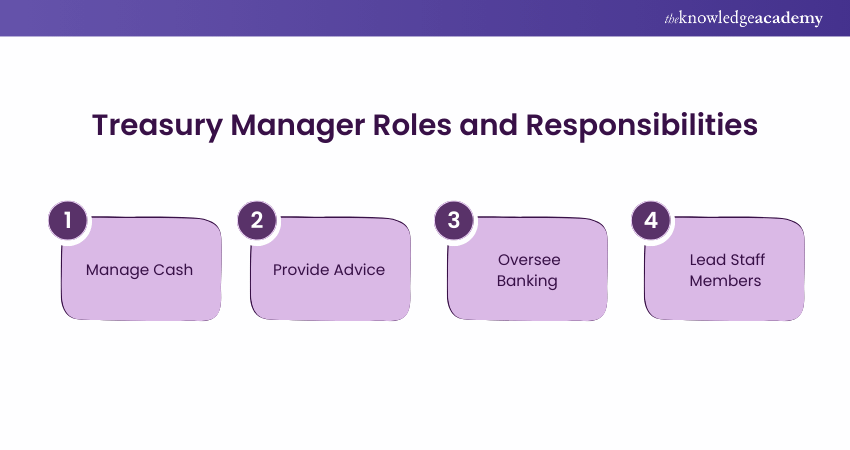

Treasury Manager Roles and Responsibilities

Treasury Managers regularly perform a variety of tasks to monitor their organisation’s financial matters. Here are the core duties and responsibilities of a Treasury Manager:

1) Manage Cash

Treasury Manager manages the organisation’s cash. This includes generating reports on cash operations and overseeing cash transactions. The manager ensures adequate liquidity, determines available cash for use, and forecasts both short-term and long-term cash levels.

2) Provide Advice

Treasury Managers evaluate the organisation’s fiscal decisions and recommend the best possible courses of action. They must be actively involved with nearly every department, analysing the risks and rewards of various decisions. It’s their responsibility to ensure everyone understands the risks of financial decisions and is aware of better alternatives.

3) Oversee Banking

Treasury Managers oversee the company’s banking activities. This includes managing deposit verification, using online banking systems and maintaining bank statements. They also analyse bank fees and implement necessary banking-related changes.

4) Lead Staff Members

Treasury Managers lead a team of staff members. They assist with tasks like deposit verification, banking analysis, auditing, and investor relations.

Sign up with our Cash Cycle Management Training and become familiar with cash management today!

Key Requirements for a Treasury Manager

Every job expects some requirements or qualifications from the potential job seeker. Some of the qualities you must have include:

1) A degree in Finance, Law, Economics, or a related field.

2) Prior experience in a similar role.

3) Extensive experience in managing the treasury function, including treasury accounting, FX, liquidity, cash flow, and various financial instruments.

4) Possess strong analytical skills and a keen attention to detail.

5) Excellent interpersonal and communication skills to build relationships with various stakeholders.

Join our Accounting Courses and learn the foundational skills in financial management.

Treasury Manager Skills and Attributes

The most common skills and attributes you must require may include:

1) Treasury Management: Proven experience in managing a treasury function.

2) Treasury Accounting: Expertise in treasury accounting, including foreign exchange (FX), liquidity, cash flow, and various financial instruments.

3) Accounting Principles: Strong understanding of fundamental accounting principles.

4) Financial Markets: In-depth knowledge of financial markets, instruments, and debt instruments.

5) Banking Relationships: Familiarity with banking relationships and covenants.

6) Autonomy and Teamwork: Ability to work independently while being an effective team player.

7) Confidentiality: Skilled in handling sensitive information appropriately.

8) Time Management: Excellent organisational and time management abilities.

9) Attention to Detail: High level of attention to detail.

10) Client Relationship Management: Strong skills in managing client relationships and providing exceptional customer service.

11) Communication and Coordination: Effective communication and coordination with multiple parties.

12) Software Proficiency: Intermediate to advanced skills in computer software, including Excel and other accounting packages.

Treasury Manager Salary Guide

According to Glassdoor, the average annual salary for a Treasury Manager in the United Kingdom is £81,872. The base pay ranges from £59,000 to £88,000, and the average extra cash compensation is £10,088, ranging from £5,972 to £17,040.

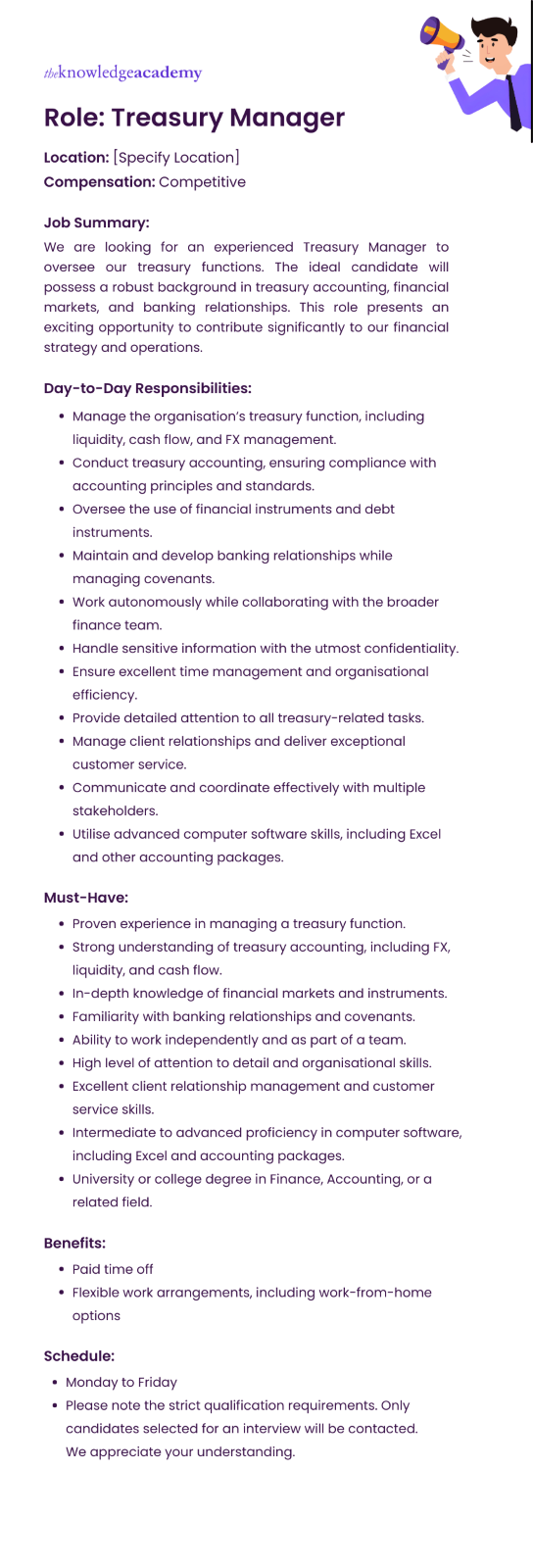

Treasury Manager Job Description Template

Here is a sample template for your reference. It will help you better understand the responsibilities and requirements of a Treasury Manager Job Description Template. Let’s dive in!

Conclusion

A clear Treasury Manager job description is vital for attracting qualified candidates to manage an organisation's financial activities. By detailing responsibilities and required skills, companies can find professionals who enhance financial strategies, maintain liquidity, manage risks, and strengthen banking relationships, ultimately contributing to overall business success.

Enhance financial decision-making skills and how the Treasury works with our Treasury Management Training – Sign up today!

Frequently Asked Questions

Key skills include treasury accounting, financial market knowledge, banking relationships, attention to detail, and advanced software proficiency.

Treasury Managers often face challenges like managing liquidity risks, navigating volatile financial markets. This ensures regulatory compliance and maintain effective banking relationships.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including Treasury Management Training Course, Inventory Accounting and Costing Course and Accounting and Financial Statement Analysis Course. These courses cater to different skill levels, providing comprehensive insights into What is Corporate Finance.

Our Accounting and Finance Blogs cover a range of topics related to Accounting, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Finance Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Treasury Management Training Course

Treasury Management Training Course

Fri 28th Feb 2025

Fri 4th Apr 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 24th Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please