We may not have the course you’re looking for. If you enquire or give us a call on +918037244591 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

When it comes to Financial Planning, the lack of a structured approach can lead to a myriad of consequences and challenges. Without a clear roadmap for managing finances, individuals may face issues such as overspending, inadequate savings, and uncertainty about long-term goals. This is where Wealth Management comes into play. Understanding the different Types of Wealth Management is paramount in navigating these challenges effectively.

If you are curious to learn more about the different Wealth Management types, then this blog is for you. In this blog, you will learn what Wealth Management is, its importance and the different Types of Wealth Management. Let's dive in!

Table of Contents

1) What is Wealth Management?

2) Various Types of Wealth Management

a) Financial Planning

b) Asset Allocation

c) Asset Management

d) Estate Planning

e) Tax Accounting

3) Why is Wealth Management required?

4) Conclusion

What is Wealth Management?

Before delving into specific types, it's essential to understand the concept of Wealth Management. It is a holistic approach to managing and optimising one's financial resources to achieve specific long-term objectives. It transcends the traditional notions of investment advice, extending its reach to encompass a comprehensive array of financial disciplines.

At its core, Wealth Management involves a strategic and personalised process of planning, protecting, and growing assets in alignment with an individual's or a family's financial goals.

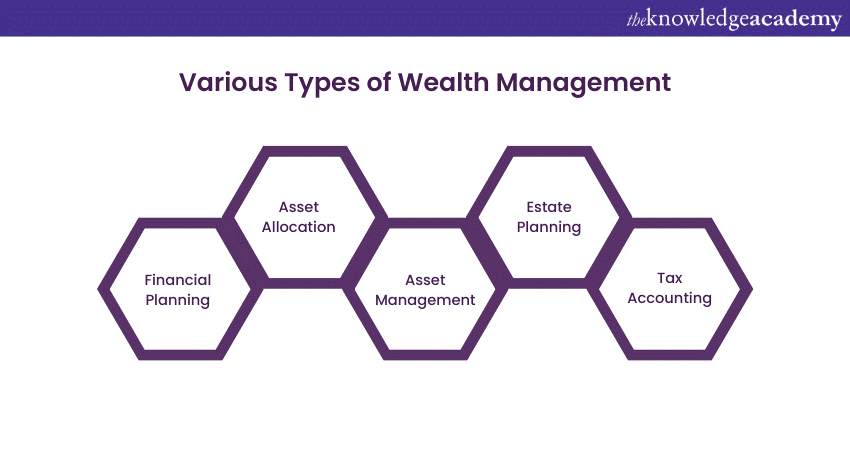

Various Types of Wealth Management

Wealth Management is a nuanced discipline, encompassing various strategies and practices tailored to meet diverse financial goals. Understanding the different Types of Wealth Management is crucial for individuals seeking a comprehensive approach to securing and growing their financial assets. Let's delve into the distinct categories that constitute the tapestry of Wealth Management:

Financial Planning

Financial Planning serves as the bedrock of effective Wealth Management. It involves a detailed analysis of an individual's or family's current financial status, future goals, and risk tolerance. This process goes beyond budgeting and savings, delving into aspects such as investment planning, debt management, and setting realistic objectives for major life events like purchasing a home or funding education.

By crafting a comprehensive financial plan, individuals can navigate their financial journey with purpose, ensuring that each financial decision contributes to their overall objectives.

Asset Allocation

Asset Management is the active supervision of an investment portfolio by professionals who leverage their expertise to make informed decisions. This includes monitoring market trends, analysing financial data, and adjusting investments in response to changing conditions. Asset managers work closely with clients to understand their risk tolerance, financial goals, and time horizons.

During periods of economic shifts or market volatility, a well-thought-out Asset Allocation strategy allows for adjustments, optimising the portfolio's performance and minimising potential risks. This approach aims to capture opportunities for growth while mitigating the impact of market fluctuations.

Elevate your proficiency in Cash Flow Analysis with our Forecasting and Analysing Cash Flow Training – Sign up now!

Asset Management

Asset Management is the active supervision of an investment portfolio by professionals who leverage their expertise to make informed decisions. This includes monitoring market trends, analysing financial data, and adjusting investments in response to changing conditions. Asset managers work closely with clients to understand their financial goals, risk tolerance, and time horizon.

By staying vigilant and adapting strategies, asset managers seek to maximise returns and align the portfolio with the client's evolving financial objectives.

Estate Planning

Estate Planning is one of the most popular Wealth Management Strategies that extends beyond the mere creation of a will. It involves meticulous planning for the transfer of assets to heirs or beneficiaries in a tax-efficient manner. Estate Planners consider various factors, including the value of the estate, potential tax implications, and the specific needs of heirs.

By addressing these elements, Estate Planning ensures a smooth and efficient transfer of wealth, minimising the impact of taxes and legal complications.

Tax Accounting

Tax Accounting within Wealth Management focuses on optimising an individual's or family's tax position. This includes strategic planning to minimise tax liabilities, taking advantage of available deductions, and leveraging tax-efficient investment strategies. Tax accountants work to ensure that the overall financial plan aligns with current tax laws, helping clients retain more of their wealth and potentially enhancing overall returns.

Understanding these diverse facets of Wealth Management allows individuals to tailor their financial strategies to their unique circumstances. Each type plays a crucial role in creating a robust financial plan that not only protects assets but also maximises growth potential. As individuals navigate the complexities of managing their wealth, a comprehensive approach that integrates these Types of Wealth Management can pave the way for long-term financial success.

Navigate the complexities of finance with our Accounting Masterclass – Sign up today!

Why is Wealth Management required?

Wealth Management serves as a critical compass in navigating the complex terrain of personal finances. Its necessity becomes evident as it offers a multitude of benefits that go beyond simple asset accumulation. Here are compelling reasons why Wealth Management is indispensable:

Guides you in making informed financial choices

Wealth Management provides a structured framework for making well-informed financial decisions. From significant investment choices to day-to-day budgeting, having a comprehensive Wealth Management plan ensures that every financial move aligns with your overarching goals.

By integrating various financial elements, Wealth Management empowers individuals to make decisions that contribute to long-term financial success, fostering a sense of financial clarity and confidence.

Protects your assets

Effective Wealth Management serves as a safeguard against potential risks and uncertainties. Through strategies like Asset Allocation and risk management, it helps mitigate market volatility, economic downturns, and unforeseen events.

By protecting assets, Wealth Management provides a layer of resilience, ensuring that financial portfolios remain robust even in the face of unpredictable circumstances.

Provides guidance

Navigating the intricate landscape of personal finance can be daunting. Wealth Management professionals offer valuable guidance, leveraging their expertise to tailor strategies that align with your unique financial situation and aspirations. Access to expert guidance allows individuals to navigate financial complexities with confidence, addressing challenges and seizing opportunities with a well-informed perspective.

In essence, Wealth Management is not merely a luxury for the affluent; it is a practical and essential tool for anyone aiming to secure their financial future. It goes beyond the transactional aspects of money management, emphasising a holistic approach that considers the individual's aspirations, risk tolerance, and the ever-changing financial landscape. As a proactive and dynamic process, Wealth Management empowers individuals to build, protect, and grow their wealth over time, ensuring a stable and prosperous financial journey.

Conclusion

We hope you read and understand the different Types of Wealth Management. Understanding and implementing them are essential for financial success. From the foundational aspects of Financial Planning to the nuanced strategies of Tax Accounting, each component plays a vital role in growing wealth and securing it. Embracing Wealth Management is not just about accumulating assets; it's about crafting a resilient financial future that withstands the tests of time.

Chart your success in Accounting and Finance with our Accounting & Finance Training – Sign up now!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Cash Flow Training

Cash Flow Training

Fri 21st Feb 2025

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please