We may not have the course you’re looking for. If you enquire or give us a call on +91 8037244591 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

If you are new to the financial world, you must have come across the term Capital Market. But What is a Capital Market? It refers to a broad economic landscape integral to the modern economy, where buyers and sellers trade long-term financial instruments. This dynamic marketplace is not just a single entity. It encompasses platforms like stock exchanges and bond markets, where securities such as stocks, bonds, and other long-term investments are traded.

The primary function of Capital Markets is to facilitate the efficient transfer of capital from those who possess it, such as investors, to those who seek it, like businesses and governments, for purposes ranging from expansion and innovation to infrastructure development. In this blog, you will learn about What is a Capital Market, how it functions, its types, and most importantly, the roles and components of Capital Markets.

Table of Contents

1) What are Capital Markets?

2) What is the functioning of a Capital Market?

3) Types of Capital Markets

4) Differentiating primary and secondary markets

5) Components of a Capital Market

6) Roles of the Capital Market

7) Conclusion

What are Capital Markets?

Capital Markets are pivotal financial sectors where individuals, companies, and governments trade long-term debt and equity securities to fund their operations and growth initiatives. These markets encompass stock exchanges and bond markets, offering platforms for issuing and trading stocks, bonds, and other long-term investments. As a crucial channel for the flow of money and resources, Capital Markets link savers and investors with those needing funds, facilitating economic growth and development. By providing opportunities for investment and wealth creation, they play a significant role in the overall health and efficiency of the economy.

What is the functioning of a Capital Market?

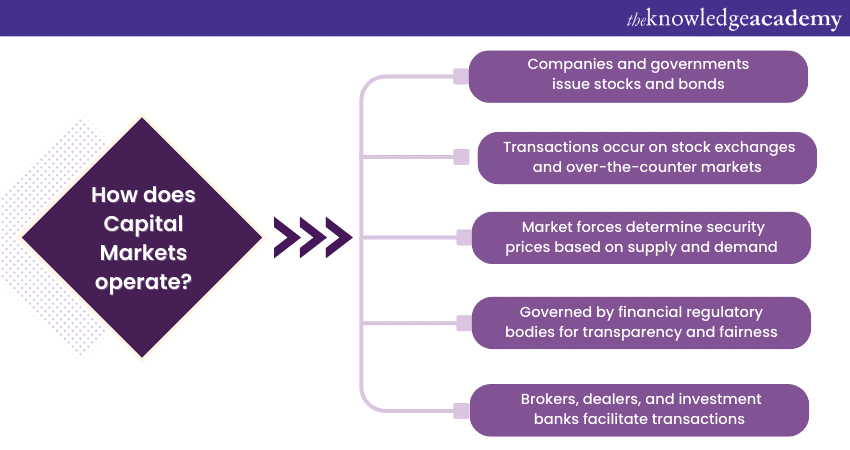

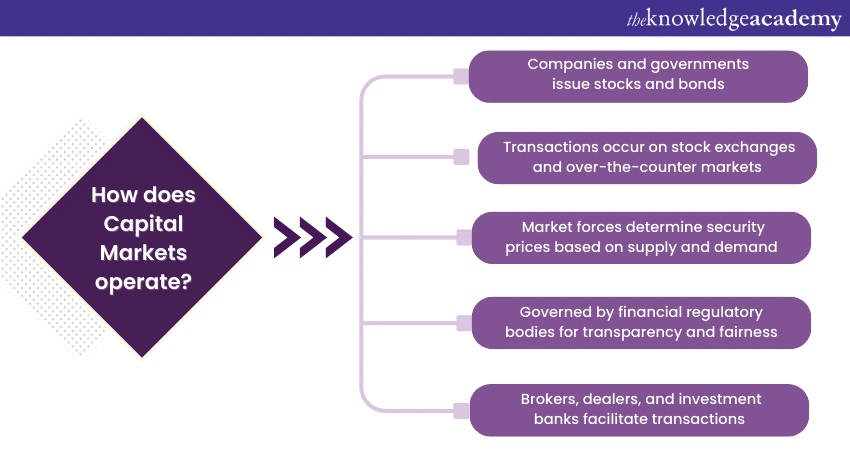

The functioning of Capital Markets involves several key components and processes, which collectively facilitate the efficient allocation of resources and capital across the economy. Here are the main points outlining how Capital Markets operate:

a) Issuance of securities: Companies and governmental entities issue diverse forms of financial instruments like stocks and bonds to generate funds. Owning stocks signifies a share in a company's ownership, whereas bonds are considered a type of borrowing.

b) Trading platforms: These securities are traded on different platforms, such as stock exchanges (e.g., NYSE, NASDAQ) and over-the-counter markets, providing a structured environment for trading.

c) Price discovery: Capital Markets enable price discovery through the interaction of buyers and sellers. Prices of securities fluctuate based on supply and demand, reflecting the perceived value and risk of the underlying assets.

d) Investor participation: Individual and institutional investors (like mutual funds, pension funds, and insurance companies) buy and sell securities, seeking to earn returns through dividends, interest, or capital appreciation.

e) Regulatory oversight: Regulatory bodies oversee the functioning of these markets to ensure transparency, fairness, and protection against fraud. This helps in maintaining investor confidence.

f) Market intermediaries: Entities like brokers, dealers, and investment banks play crucial roles in facilitating transactions, providing liquidity, and offering investment advice.

g) Risk management: Capital Markets provide mechanisms for risk management, including diversification and the use of derivative instruments like futures and options.

h) Capital allocation: By channelling savings and investments into productive ventures, these markets support economic growth and innovation, enabling efficient capital allocation.

i) Information dissemination: Publicly traded companies must disclose financial and operational information, ensuring transparency and enabling informed investment decisions.

j) Global integration: Modern Capital Markets are increasingly interconnected, allowing for cross-border investments and global capital flows, thus contributing to the global economy.

Are you interested in learning about Capital Markets? Register now for our Capital Market Training!

Types of Capital Markets

Here are the two major types of Capital Markets:

1) Primary Markets

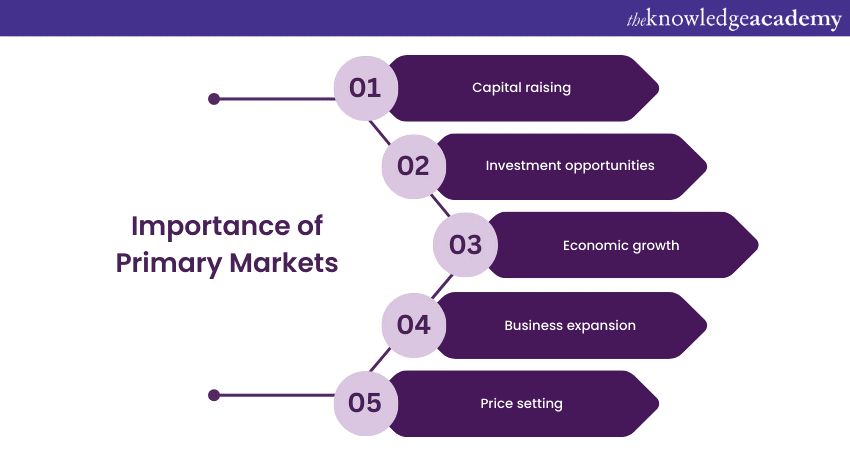

Primary Markets play a crucial role in the financial world by serving as the venue for issuing and selling new securities. Here's an in-depth look at their functioning and importance:

a) New security issuance: In primary markets, companies, governments, or other entities issue new stocks, bonds, or other securities to the public for the first time. This is known as an Initial Public Offering (IPO) for stocks.

b) Capital generation: The primary purpose of primary markets is to enable issuers to raise capital directly from investors. This capital is often used for expansion, development projects, or other operational needs.

c) Pricing of securities: The price of new securities in the primary market is typically determined through various methods, such as book building or auctions, reflecting the market's demand and the issuer's valuation.

d) Investor access: Primary markets provide opportunities for investors to participate in the early stages of a security's life, often offering the potential for significant returns as the security enters secondary trading.

e) Underwriting process: Often, investment banks play a key role as underwriters, helping to set the initial price for the security, managing the IPO process, and sometimes guaranteeing the sale of securities by purchasing them first.

f) Regulatory compliance: Issuers in primary markets must adhere to stringent regulatory requirements, providing detailed information about their business, financial health, and risks associated with the securities offered.

g) Market indicators: The performance and trends in the primary market can be indicators of the broader economic environment, investor confidence, and the appetite for new investments.

h) Exclusivity and accessibility: Initially, primary market offerings may be restricted to institutional investors or high-net-worth individuals, but they often become more accessible to retail investors.

i) Reduction in intermediaries: Transactions in Primary Markets involve fewer intermediaries than Secondary Markets, as investors buy securities directly from the issuer.

j) Economic impact: By facilitating the direct transfer of funds from savers to those requiring capital, primary markets play a vital role in economic development and the efficient allocation of resources.

Do you want to learn the importance of Letters of Credit? Sign up now for our The Letters of Credit Training Course!

2) Secondary Market

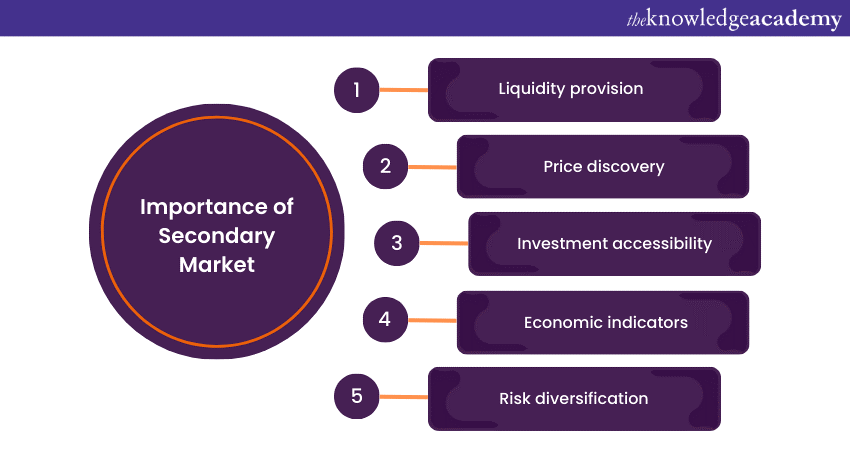

The Secondary Market is a key component of the financial ecosystem, providing a platform for the buying and selling of previously issued securities. This market plays a vital role in the overall financial system:

a) Trading of existing securities: Unlike the Primary Market, where securities are issued for the first time, the secondary market involves trading existing securities among investors.

b) Liquidity provision: It provides liquidity to investors, enabling them to buy and sell securities quickly and efficiently. This liquidity is crucial for investors looking to convert their investments into cash.

c) Price discovery: The secondary market is instrumental in determining the market price of securities through the forces of supply and demand. This continuous price discovery process reflects the current value of the underlying assets.

d) Access to a wider investor base: Securities traded in the secondary market are accessible to a broad range of investors, including individuals and institutional investors, facilitating more involvement in the financial markets.

e) Market indicators: The performance of securities in the secondary market often indicates the financial health of the issuing company and the economy at large.

f) Diversification opportunities: Investors in the secondary market can access various securities, allowing them to diversify their investment portfolios and manage risk.

g) Regulatory oversight: This market operates under strict regulatory oversight to ensure fair trading practices, transparency, and investor protection.

h) Role of brokers and exchanges: Transactions in the secondary market typically occur through stock exchanges and involve brokers and dealers who facilitate the buying and selling of securities.

i) Global reach: The secondary market often has an international scope, allowing for cross-border securities trading, enhancing market depth and investment opportunities.

j) Economic feedback loop: The secondary market's activity provides feedback on the primary market, influencing future pricing and issuance of new securities. It also plays a role in allocating capital in the economy, as the performance of securities can direct funds to sectors and companies showing growth potential.

Are you interested in increasing your knowledge of Financial Management? Join us now for our Financial Management Training!

Differentiating Primary and Secondary Markets

|

Aspect |

Primary Market |

Secondary Market |

|

Purpose |

Issuance of new securities for fundraising. |

Trading of existing securities among investors. |

|

Participants |

Issuers (companies, governments) and investors. |

Investors, including retail and institutions. |

|

Securities |

New issues (stocks, bonds, etc.). |

Existing securities traded among investors. |

|

Pricing |

Determined by the issuer, often with underwriters. |

It is determined by market demand and supply. |

|

Transactions |

Direct purchase from issuer. |

Trading between investors on exchanges. |

|

Liquidity |

Typically lower, as securities are newly issued. |

Higher due to continuous trading activity. |

|

Role of intermediaries |

Underwriters, investment banks. |

Brokers, dealers, stock exchanges. |

|

Regulation |

Stringent regulatory compliance for issuance. |

Regulated trading environment and market rules. |

|

Market indicators |

Reflects fundraising and investment trends. |

Indicates economic health and company performance. |

|

Accessibility |

It may be limited to institutional investors initially. |

Open to a wide range of investors. |

|

Investment horizon |

Often, it is long-term, as investors fund new projects. |

It can be short-term or long-term. |

|

Economic impact |

Capital raising for growth and projects. |

Provides liquidity and aids in capital allocation. |

Enhance your skills in Accounting with our Accounting Masterclass. Sign up now!

Components of a Capital Market

The Capital Market is a complex and multifaceted system consisting of several key components that work together to facilitate the flow of capital and financial transactions. Understanding these components is essential to grasp how Capital Markets function:

a) Stock Markets: These are platforms where shares of publicly traded companies are bought and sold. Stock markets are a vital component, reflecting the equity-based transactions in the Capital Market.

b) Bond Markets: This segment deals with trading debt securities, such as government and corporate bonds. It allows borrowers to secure long-term funding at fixed interest rates.

c) Primary Markets: New securities are issued for the first time, allowing organisations to raise fresh capital. This includes initial public offerings (IPOs) and the issuance of new bonds.

d) Secondary Markets: These markets facilitate the trading of existing securities among investors. Most investors participate in this, buying and selling stocks, bonds, and other securities.

e) Investment banks: These institutions play a crucial role in Capital Markets, especially underwriting new securities, facilitating mergers and acquisitions, and providing financial advisory services.

f) Regulatory bodies: Organisations like the Securities and Exchange Commission (SEC) in the U.S. oversee the functioning of Capital Markets, ensuring transparency, fairness, and protection for investors.

g) Market indices: These are statistical measures that track the performance of a specific set of stocks or bonds, giving insights into the overall market trends and investor sentiment.

h) Brokers and dealers: They act as intermediaries in the Capital Markets, facilitating transactions for investors. Brokers execute orders on behalf of clients, while dealers trade on their accounts.

i) Derivative Markets: These markets deal with instruments like futures, options, and swaps, which derive their value from underlying assets, providing tools for risk management and speculative opportunities.

j) Foreign Exchange Markets (Forex): Though not a traditional component, Forex intersects with Capital Markets, influencing international investment and capital flows due to currency exchange considerations.

Enhance your skills in Accounting with our Accounting Masterclass. Sign up now!

Roles of the Capital Market

The Capital Market plays several pivotal roles in the functioning of a modern economy, impacting various stakeholders, from individual investors to large corporations and governments. Here's an expanded view of these roles:

a) Resource mobilisation: Capital Markets facilitate the mobilisation of savings from individuals and institutions, channelling them into productive investments, thereby promoting economic growth and development.

b) Investment opportunities: They offer a wide range of investment vehicles for investors, including stocks, bonds, and mutual funds, catering to different risk appetites and investment strategies.

c) Corporate financing: Capital Markets provide a crucial avenue for companies to raise capital through equity (stocks) and debt (bonds), enabling them to fund expansion, research and development, and other strategic initiatives.

d) Price discovery: Through the interaction of buyers and sellers, Capital Markets ensure the efficient pricing of securities, reflecting the current market sentiment, company performance, and economic conditions.

e) Risk management: Derivative instruments available in Capital Markets, like futures and options, allow companies and investors to hedge against risks related to price fluctuations, interest rates, and currency exchange rates.

f) Economic indicators: The trends and performance in Capital Markets often act as indicators of broader economic health, influencing policy decisions and investor confidence.

g) Corporate governance: Publicly traded companies in Capital Markets are subject to stringent reporting requirements and governance standards, promoting transparency and accountability.

h) Liquidity provision: Secondary markets, in particular, provide liquidity, enabling investors to easily convert their securities into cash and enhancing the attractiveness of investments.

i) Global Capital Flows: Capital Markets facilitate cross-border investments, contributing to global capital flows and economic integration.

j) Innovation and entrepreneurship: By providing access to capital, these markets encourage innovation and entrepreneurship, supporting new ventures and technological advancements.

Do you want to become familiar with Financial Modelling? Register now for our Financial Modelling Training!

Conclusion

We hope you learned what a Capital Market is to smooth your financial journey. These are essential in shaping the global economy and efficiently channelling savings into productive investments. They offer diverse opportunities for growth, risk management, and wealth creation, linking investors with entities needing funds. Understanding their dynamics is critical to grasping economic functioning and financial decision-making.

Explore and enhance your understanding of Regression Analysis with our Regression Analysis Training!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Capital Market Course

Capital Market Course

Fri 21st Feb 2025

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please