We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Digitalisation has revolutionised the way organisations operate, which has turned traditional methods into dynamic, cutting-edge processes. In this digital era, industries across various sectors have embraced Enterprise Resource Planning (ERP) software like SAP to enhance their processes. One notable example is SAP Accounting.

In this blog, you’ll discover how SAP Accounting can transform your organisation's Financial Management processes. You'll also discuss the benefits of this Enterprise Resource Planning (ERP) software and how it can streamline your Accounting operations.

Table of Contents

1) SAP Accounting – An overview

2) What are the Components of SAP Accounting?

3) Types of SAP Modules

4) How to Improve SAP Capabilities?

5) What are the Benefits of Using SAP in Accounting?

6) Conclusion

SAP Accounting – An Overview

SAP Accounting refers to the Financial Accounting module within the ERP system. It is designed to support the Financial Accounting activities of an organisation by providing tools for managing transactions. Exploring an SAP Financial Accounting Guide can help businesses maximise the benefits of SAP in accounting, which offers a range of features such as:

a) Automated posting of transactions

b) Real-time reporting

c) Easy integration with third-party systems

d) Financial analysis reports

e) Real-time insights into financial performance

These features help the users of SAP in Accounting to make informed decisions about their financial performance, and adjust their finances to improve profitability and efficiency. Preparing for Accounting Interview Questions related to SAP in Accounting can further enhance your understanding, as SAP can also be customised to fit the specific needs of an organisation, making it a flexible and scalable solution for enterprises of all sizes and industries.

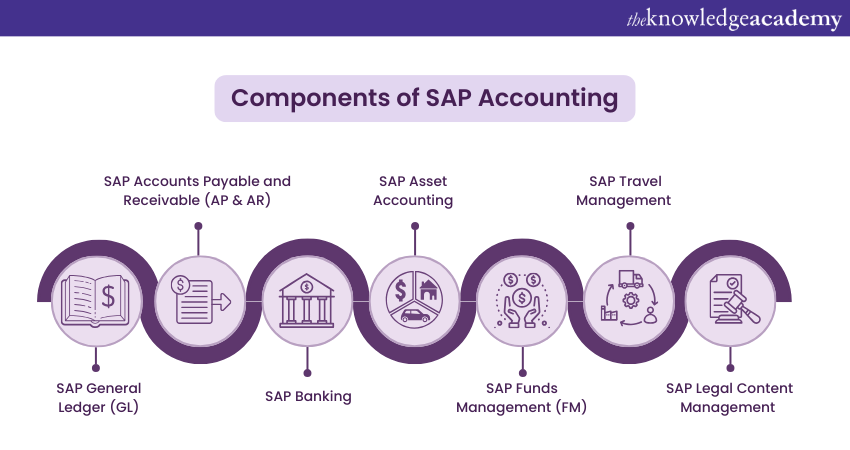

What are the components of SAP Accounting?

Listed below are seven key components of SAP Accounting:

1) SAP General Ledger (GL)

SAP General Ledger (SAP GL) is a module within the ERP system that manages the financial transactions and Accounting data of a business. It serves as the central repository for all financial information, allowing for efficient and accurate reporting, budgeting, and analysis.

SAP GL supports a variety of Accounting methods and standards, including Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), and provides flexibility in configuring chart of Accounts, posting rules, and reporting requirements. It also includes features such as real-time updates, automatic reconciliation, and multi-currency support. With this module, organisations to streamline financial operations and gain better visibility into their financial health. For a deeper understanding of these functionalities, resources like the SAP Cheat Sheet Guide can be valuable.

2) SAP Accounts Payable and Receivable (AP & AR)

SAP Accounts Payable (AP) and Accounts Receivable (AR) are modules within the ERP system that help manage a company's financial transactions related to its customers and vendors. The Accounts Payable module manages the process of recording and paying vendor invoices, while the Accounts Receivable module manages the process of recording and collecting payments from customers.

Both modules automate the processes of invoicing, payment processing, and reporting, which can help improve efficiency and accuracy. SAP AP and AR also provide features such as payment reminders, credit management, and dispute resolution, which can help businesses manage their cash flow and avoid insolvency risks. With these two modules, businesses can maintain a complete and accurate record of all financial transactions and have better control over their financial operations.

3) SAP Banking

SAP Banking is a module within the ERP system that provides organisations and financial institutions with a comprehensive platform to manage their banking operations. The module encompasses a broad range of functions, including transaction processing, Risk Management, Accounting, and reporting. Additionally, it enables banks to manage their customer Accounts, loans, and deposits, as well as handle cash management, credit risk analysis, and regulatory compliance.

SAP Banking can also help financial institutions streamline their operations, increase efficiency, and reduce costs while maintaining compliance with regulatory requirements. The module is highly configurable and can be customised to meet the specific needs of individual banks, making it a flexible solution for financial institutions of all sizes.

4) SAP Asset Accounting

SAP Asset Accounting is a module within the ERP system that manages a company's fixed assets. The module allows companies to track, manage, and depreciate their physical assets, such as buildings, equipment, and vehicles, over their useful life. It also provides a comprehensive view of assets across the organisation, enabling companies to make informed decisions about capital expenditures, maintenance, and disposal. Additionally, it supports multiple depreciation methods and can handle complex depreciation calculations for different asset classes.

SAP Asset Accounting also provides tools for managing asset acquisitions, retirements, and transfers, as well as tracking maintenance and repair costs. With this module, companies can maintain an accurate and up-to-date record of their fixed assets and ensure compliance with Accounting standards and regulations. The module integrates with other SAP Modules, such as General Ledger and Controlling, to provide a complete Financial Management solution.

5) SAP Funds Management (FM)

SAP Funds Management (SAP FM) is a module within the ERP system that allows enterprises to manage their budgets and financial resources more effectively. It enables users to plan, allocate, and monitor funds across different departments and cost centres, ensuring that financial resources are used efficiently and in accordance with organisational goals.

SAP FM provides a range of tools for budget planning, including automated workflows for creating, approving, and monitoring budgets, as well as tools for analysing financial data and forecasting future spending. It also supports integration with other modules, such as Controlling and Project System, providing a comprehensive solution for managing financial resources across an organisation. For a deeper understanding of these functionalities, a SAP S/4HANA Guide can offer detailed insights into optimising financial management within the system.

6) SAP Travel Management

This SAP module handles the activities related to business trips arranged by and within an organisation. Activities recorded in this module include approvals, bookings, expenditures, and travel credits. The module enables employees to request, plan, and book a business trip, create expense reports, and transfer funds from other business functions to cover the costs.

Transform your digital career with SAP Cloud Platform Training - Sign up today at The Knowledge Academy!

7) SAP Legal Content Management

This SAP module supports the management of processes related to the production, review, and governance of legal content.

The SAP Legal Content Management System (CMS) provides a central database for all legal documents, such as contracts, policies, and non-disclosure agreements.

By blending these legal documents into a single source allows managers to gain insight into current and accurate legal information.

Types of SAP Modules

SAP modules are different types of software components that provide various functionalities for business processes. SAP modules are grouped into two main types:

1) Functional Module

Functional modules offer business features like Human Resources, order processing and Business Intelligence, which are primarily the front end of SAP. Some of the most endorsed functional SAP modules are SAP Financial Accounting (FI), SAP Controlling (CO), SAP Materials Management (MM), and SAP Sales and Distribution (SD).

2) Technical Module

Technical modules are used to manage your environment, development, and updates, which are the back end of SAP. Some of the most popular technical SAP modules are SAP Advanced Business Application Programming (ABAP), SAP Basis, SAP NetWeaver, and SAP HANA.

Unlock the full potential of SAP integration with our comprehensive SAP Cloud Platform Integration PDF. Grab your copy now and enhance your cloud platform skills.

How to Improve SAP Capabilities?

If you want to pursue a career in Finance or Project Management, you might want to learn more about SAP Accounting and financial modules. Here are some ways you can boost your knowledge and skills using SAP Database systems:

1) Join in Specialised Courses

After you have decided to learn more about SAP Accounting, you can look for courses in SAP systems under the Accounting category, Finance (FI), or Financial Controlling (FICO). Integrating Category Management into your learning path can also enhance your understanding of how financial data is organised and managed across different segments.

2) Browse Online Tutorials

If you're working with an SAP system and need specific information about how to do a function, you can search for online tutorials to help you use the system. There are several online resources available to help users navigate and understand SAP systems in various formats to suit their needs. Your workplace might also offer training sessions to help you learn their specific system and how to do basic functions within the software.

3) Practise Your Skills

The best way to develop your SAP capabilities is to practise the skills you've learned. As with any new software, using the platform and processes regularly becomes easier. You also must ensure continuous learning.

Join our SAP FICO Training to gain knowledge of how accounting data can be represented using SAP.

What are the Benefits of Using SAP in Accounting?

The following are the main Benefits of SAP usage in accounting:

a) Integration: SAP integrates all financial transactions with other business operations, such as production, sales, and inventory, making it easy to access financial data and ensuring accuracy.

b) Centralisation: SAP centralises all financial data in one place, eliminating the need for separate software systems for each Accounting function. Additionally, this will streamline the Accounting process, making it easier to manage financial data.

c) Automation: SAP automates many manual Accounting processes such as data entry, calculations and reporting, reducing the risk of errors and saving time.

d) Reporting: SAP provides a wide range of financial reports and analytics, giving Accountants, the organisation and other stakeholders real-time access to accurate financial information. This enables them to make informed decisions and identify potential issues or threats quickly.

e) Compliance: SAP helps organisations comply with financial regulation and international standards as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) by providing automated financial control and audit trails.

f) Scalability and flexibility: SAP is scalable and flexible, which implies that it can grow with your business, making it an ideal long-term Accounting solution for small, medium, and large companies. The scalability also helps with organisations being able to restructure without having to worry about their financial processes being affected.

Want to impress your interviewer? Master the SAP Interview Questions and Answers with our proven tips and strategies today!

Conclusion

As businesses continue to grow, adapt, and evolve, the need for powerful accounting software will only become more crucial. SAP Accounting has proven itself to be a reliable and effective solution, offering businesses the essential tools needed to succeed in a rapidly changing global marketplace. By integrating the software into their accounting processes, businesses have improved overall accuracy and gained valuable insights into their financial performance. Furthermore, understanding the SAP Consultant Salary can help businesses gauge the level of investment required in hiring the right talent for successful implementation, aligning with the advancements outlined in the SAP Road Map.

Attain a comprehensive understanding of how SAP and Financial Accounting can be efficiently integrated by joining our SAP Financial Accounting course.

Frequently Asked Questions

Are SAP and Xero the Same?

No, SAP and Xero are not the same. SAP is comprehensive enterprise resource planning (ERP) software that integrates various business processes across large organisations. In contrast, Xero is cloud-based accounting software designed primarily for small and medium-sized businesses, focusing on financial management and bookkeeping.

Which Accounting Software is SAP?

SAP's accounting software (also known as SAP S/4HANA) is designed for financial management, which is part of its comprehensive ERP suite. It provides robust features for financial planning, analysis, accounting, and reporting, and it is designed to support large and complex organisations.

What are the Other Resources and Offers Provided by the Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and How Does It Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by the Knowledge Academy?

The Knowledge Academy offers various SAP Training, including the SAP Financial Accounting, SAP HANA Implementation & Modelling, and Sap Information Steward Training. These courses cater to different skill levels, providing comprehensive insights into SAP Database.

Our IT Infrastructure & Networking Blogs cover a range of topics related to Network Design, Security, and Management, offering valuable resources, best practises, and industry insights. Whether you are a beginner or looking to advance your networking skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Programming & DevOps Resources Batches & Dates

Date

SAP Finance and Controlling FICO Training

SAP Finance and Controlling FICO Training

Mon 4th Aug 2025

Mon 3rd Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please