We may not have the course you’re looking for. If you enquire or give us a call on + 1-866 272 8822 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Can you guess the most crucial element for a business’s survival? It’s not the flashy marketing campaigns or cutting-edge technology. It’s revenue that truly decides a company’s profitability. But What is Revenue exactly? It’s the income a company earns from selling its goods or services within a specific accounting period. High revenue ensures a healthy cash flow, which is critical for keeping business operations running smoothly.

In this blog, we’ll explore What is Revenue, it's different types, formula to calculate it and how it differs from the income and profit.

Table of Contents

1) What is Revenue?

2) Different Types of Revenue

3) Revenue Formula and Calculation

4) Revenue Example Explained

5) Difference Between Revenue and Income

6) Is Revenue the Same as Profit?

7) Conclusion

What is Revenue?

To better comprehend your business finance, you first need to understand the term ‘Revenue’. Simply put, Revenue refers to the total sum of money that a company accumulates from their products or services over a specific period. Sometimes, Revenue is also referred to as ‘Top Line’ or ‘Gross Sales’ in Accounting.

Since Revenue is the backbone of all businesses, the fundamental goal is to grow it. Here are the following reasons that support its importance:

a) Stability and Sustainability: Revenue growth fosters a stable financial environment to tackle uncertainties and challenges. It assures a company possesses enough resources to make its operations run well.

b) Expansion and Diversification: An increased Revenue help business to expand in the market and diversify their services. This results in a broadened customer base and no dependency on a single Revenue stream.

c) Acquisition and Retention: A company with stable Revenue growth can offer better career opportunities.

d) Gain Investor’s Confidence: A company demonstrating consistent Revenue growth is more likely to attract Investors. This way, the company can have access to increased capital, allowing it to expand more.

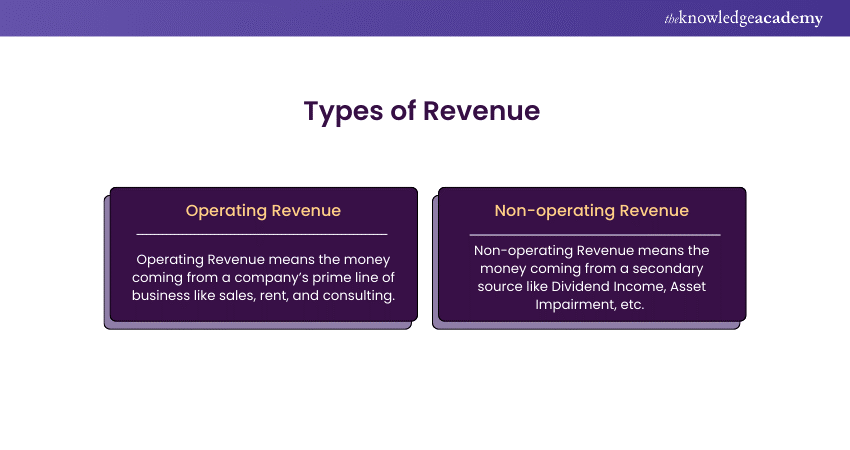

Different Types of Revenue

Companies can separate their Revenue into various divisions. Let’s explore two significant types of Revenue to get a better idea of how money flows into a business.

1) Operating Revenue

Operating Revenue means the money coming from a company’s prime line of business. It’s an important metric that shows how much cash is generated from daily business operations. This includes,

a) Sales: Sales refers to the exchange of a product or service for money between two parties

b) Rent: Rent refers to the Revenue coming from renting out office space

c) Consulting: Companies often charge prospects for consulting

A company with high Operating Revenue can easily maintain its operations and might expand into other areas for profit. This is what makes tracking Operating Revenue essential. Companies can hire a financial expert to analyse their Operating Revenue or utilise bookkeeping software to manage sales and expenses.

Learn pricing tactics with our Revenue Management Training – Register now!

2) Non-operating Revenue

When a business generates money from a secondary source, it is said to be a Non-operating Revenue. The most common source of earning can be,

a) Dividend Income: Dividends are part of a company’s profit distributed to its shareholders

b) Interest on Loans: Interest on loans taken by the company to expand into the global market is the interest incurred on loans taken by the company.

c) Asset Impairment: Every business own physical items like property, inventory and machinery. When the market value of these assets becomes less than the original listing, it is said to be Asset impairment.

d) Taxes: Companies need to pay various taxes to fund government spending. This includes tax on employment, fuel, business structure and communication taxes.

e) Natural Calamities: Natural storms like hurricanes, floods, and firestorms can affect a business. This contributes to lost Revenue from loss of customers, loss of personnel, etc.

Revenue Formula and Calculation

Every business is different, so as the Revenue formula and calculation. A retail business might have a different formula than a service company. However, both follows a basic formula to find out the net Revenue.

Net Revenue = (Number of Units Sold x Unit Price) - Discounts –Allowances – Returns

Instead of calculating it manually, you can easily calculate net Revenue using an accounting software. The software will work out the totals and provide a report.

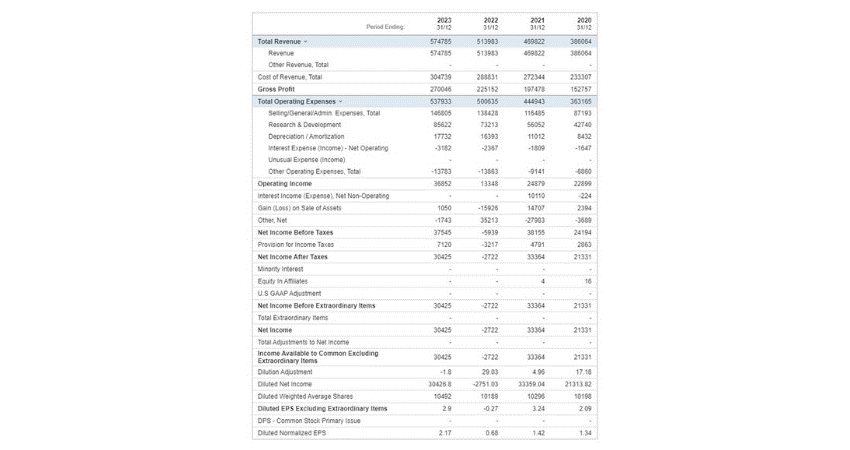

Revenue Example Explained

To understand how Revenue works, let’s take a glance on Amazon’s Income Statement. Amazon generate Revenue through its ‘sales’. This sale can come from products, services, and different categories to make up total net sales.

Source: Amazon.com

As you can clearly see, the top line of the statement states the net Revenue. Amazon accumulates £439,299.55 for the year 2023. Underneath it, all the operating expense and non-operating expense are mentioned. After deducting taxes and interest, the net income comes out to be £23,253.37.

Develop cash flow templates with our Cash Flow Training – Sign up now!

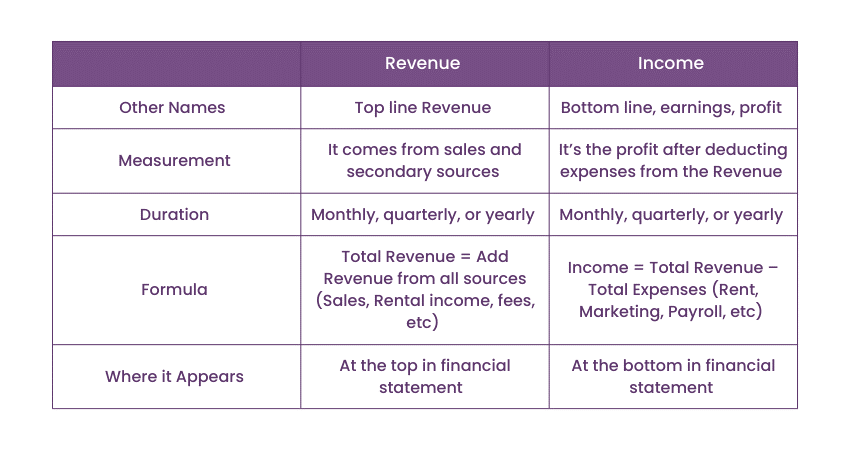

Differences Between Revenue and Income

Revenue refers to the funds a company receives from its services and sales. On the flip side, income refers to the money a business makes after deducting its running cost. Both describe a company’s profitability. Let’s explore some differences between Revenue and income.

By comprehending your business Revenue and Income, you can streamline your business accounting and follow tasks like auditing your cash flow, etc.

Is Revenue the Same as Profit?

Revenue and profit are two different components of a business. Revenue refers to the income that a company generates through business activities like sales of services and goods. Profit is the remaining income after subtracting operation costs, Revenue, and expenses.

Both indicate a business's financial health and provide stakeholders with the necessary data to make informed decisions to increase profits. They can also give competitive positioning and improve the overall financial performance of a business.

In short, both are significant financial figures that contributes greatly to a business growth.

Start Trading Smarter Today! Enroll in Our Cryptocurrency Trading Course Now!

Conclusion

To sum up, we’ve taken a closer look at What is Revenue and what makes it so important. Revenue helps you get a clear picture of your business. It’s also a helpful indicator that decides the future growth of your business. So, make sure you consider the impact of operating costs and expenses on your business to thrives in the market well. Based on the insights, you can modify your strategies to increase total Revenue.

Learn to leverage capital with our Financial Management Course today!

Frequently Asked Questions

All companies release their earnings report on a quarterly basis. A company’s strong earnings report might result in boosting its share price. If the earnings report doesn’t meet the expectations of shareholders, the stock price might scatter.

Deferred Revenue or unearned Revenue is the fund a company receives for services or products that are to be delivered in the future. The company owes the money back to its customers if the service or good gets undelivered.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Training, including the Revenue Management Training, Real Estate Financial Modelling Training, and Bookkeeping Course. These courses cater to different skill levels, providing comprehensive insights into Accounting Principles.

Our Business Blogs cover a range of topics related to Finance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Batches & Dates

Date

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please