We may not have the course you’re looking for. If you enquire or give us a call on +971 8000311193 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Compliance and Risk Management are indeed two sides of the same coin. They are distinct yet interconnected disciplines that play vital roles in organisational success. Thus, understanding the differences between Compliance vs Risk Management can help effectively navigate regulatory requirements, mitigate risks, and ensure long-term success. In this blog, you will learn to explore the difference between Compliance and Risk Management and discover the strategies that drive success in your industry. Read this blog to know more!

Table of Contents

1) What is Compliance?

2) What is Risk Management?

3) Difference between Risk Management and Compliance

4) Integrating Compliance and Risk Management

5) Conclusion

What is Compliance?

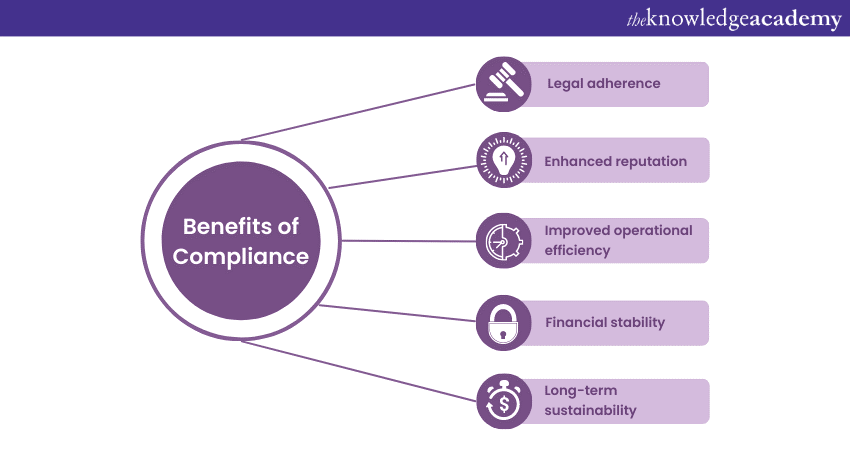

Compliance refers to the adherence to regulations, laws and industry standards applicable to an organisation's operations. It involves aligning business practices with legal and regulatory obligations to maintain ethical standards, ensure transparency, and prevent violations. Some of the benefits of Compliance include the following:

Compliance encompasses various areas, such as financial reporting, data privacy, environmental regulations, employment laws, and more. Organisations implement Compliance programs to establish the following:

1) Guidelines

2) Policies

3) Procedures

Compliance guidelines are established to meet certain obligations and demonstrate their commitment to legal and ethical conduct.

What is Risk Management?

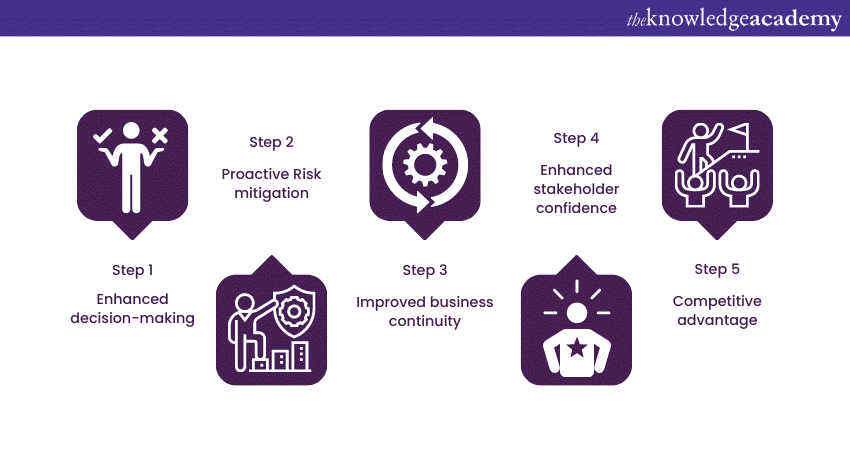

Risk Management, on the other hand, focuses on identifying, assessing, and mitigating risks that could impact an organisation's objectives. Risks can arise from various sources, such as operational, financial, strategic, or external factors. Risk Management involves taking the following steps:

Risk Management involves a systematic approach to identifying potential risks, analysing their potential impact, and implementing measures to minimise or mitigate those risks. This includes risk assessment, risk mitigation strategies, risk monitoring, and ongoing evaluation of risks to align with the organisation's risk appetite

Difference between Risk Management and Compliance

While Compliance and Risk Management are distinct concepts, they intersect in several ways.Thus, understanding their differences is crucial for leadership teams and Risk Managers to effectively navigate these areas and strike a balance. Let's take a look at some of the differences between Compliance vs Risk Management:

Prescriptive vs. predictive

Compliance tends to be prescriptive, often leading to a tactical, checkbox-oriented approach. In contrast, Risk Management endeavours to be predictive, anticipating potential risks, demanding a strategic approach.

Organisations are mandated to conform to prevailing laws and regulations for Compliance. Conversely, Risk Management necessitates a more proactive stance, aiming to foresee and address potential issues before they materialise.

Tactics vs. strategy

Overestimating non-compliance is unwise, it can result in expensive fines and penalties, along with damage to reputation. Compliance, however, demands a testing-oriented strategy to ensure organisational adherence to rules. On the other hand, Risk Management should lean towards a comprehensive, long-term analysis to evaluate the viability of taking specific risks.

Risk aversion vs. value creation

Adhering to rules and regulations typically doesn't yield value-generating business opportunities unless coupled with a forward-looking Risk Management strategy. Compliance often ends at verification to mitigate risk.

However, a precise Risk Management approach can convert a Compliant organisation into a compelling value proposition. This, in turn, can enhance a company's capacity to navigate complex regulatory landscapes. This transformation can make the company a more appealing business partner for others concerned about navigating stringent regulatory environments.

Siloed vs. integration

Often, Compliance is driven by a segmented Compliance department or separate initiatives within different departments. In contrast, successful Risk Management programs cannot operate independently. It is essential to integrate processes, departments, and IT systems to assess all risks across a business comprehensively and manage them to either avert their consequences or create value.

Take a proactive approach to compliance excellence with our Effective Compliance Training .Sign up today!

Integrating Compliance and Risk Management

Compliance and Risk Management have distinct objectives and approaches, as they are not mutually exclusive. In fact, they can be integrated to create a more robust and effective risk governance framework within an organisation.

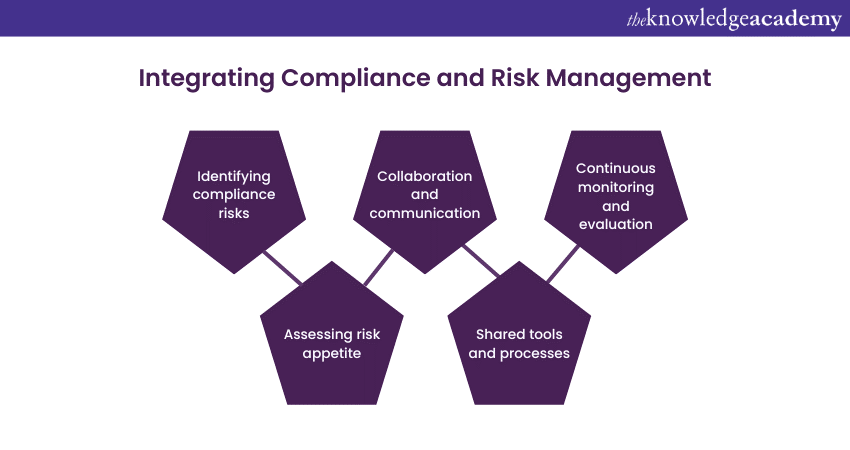

Integrating Compliance and Risk Management involves aligning Compliance efforts with Risk Management strategies. This approach allows organisations to identify Compliance risks as potential business risks and assess their impact on overall objectives.

By considering Compliance as an integral part of Risk Management, organisations can address legal obligations while proactively managing risks. Key steps to integrating Compliance and Risk Management include:

Integrating Compliance and Risk Management involves aligning Compliance efforts with Risk Management strategies. This approach allows organisations to identify Compliance risks as potential business risks and assess their impact on overall objectives.

By considering compliance as an integral part of Risk Management, organisations can address legal obligations while proactively managing risks. Key steps to integrating compliance and Risk Management include:

1) Identifying compliance risks: Recognise the requirements as potential risks and assess their impact on organisational objectives. Identify areas where compliance failures could pose significant risks.

2) Assessing risk appetite: Define the organisation's risk appetite and tolerance levels concerning compliance risks. Determine the acceptable level of non-Compliance and develop strategies to manage risks within those limits.

3) Collaboration and communication: Promote collaboration between Compliance and Risk Management teams to ensure a comprehensive understanding of risks and their potential impact. Establish effective communication channels to share information and insights.

4) Shared tools and processes: Utilise shared tools, technologies, and processes to streamline Compliance and Risk Management efforts. Implement risk assessment methodologies that consider Compliance risks as part of the broader risk landscape.

5) Continuous monitoring and evaluation: Establish mechanisms for continuous monitoring, evaluation, and reporting of Compliance Risks. Regularly review Compliance Programs and Risk Management strategies to ensure they remain aligned and effective.

Enhance your organisation's security governance and compliance practices with our Security Governance And Compliance Training. Sign up today!

Conclusion

We hope you read and understood everything about Compliance vs Risk Management. Compliance and Risk Management are integral for organisational success. By understanding their differences and integrating them effectively, organisations can navigate regulations, mitigate risks, and achieve long-term growth.

Equip your team with comprehensive Compliance Training to proactively navigate regulatory landscapes with our Compliance Training. Sign up now!

Frequently Asked Questions

Compliance and Risk Management are linchpins in ensuring business success. A robust Compliance framework ensures adherence to laws and regulations, fostering ethical conduct and safeguarding reputation.

Moreover, compliance and risk alignment optimise resource allocation, reducing financial exposure.

Absolutely. Industry-specific benefits of prioritising Compliance and Risk Management include enhanced reputation and trust, crucial in finance and healthcare. In the technology sector, it ensures data security and privacy. In manufacturing, compliance improves product quality and safety. For energy and environmental industries, it addresses regulatory standards. Ultimately, tailored compliance strategies not only mitigate industry-specific risks but also foster long-term sustainability and competitiveness by aligning with sector-specific expectations and regulations.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Compliance courses, including PCI DSS Implementer, Consumer Protection Masterclass and Effective Compliance Training. These courses cater to different skill levels, providing comprehensive insights into Compliance and Risk Management.

Our blogs on Compliance covers a range of topics related to Consumer Protection and Security Governance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Compliance vs Risk Management, The Knowledge Academy's diverse courses and informative blogs have you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please