We may not have the course you’re looking for. If you enquire or give us a call on +971 8000311193 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The advent of modern technology has changed the working processes of modern-day organisations as we know them. With new technologies surfacing regularly, an organisation needs to adapt to the latest technological trends to maintain a competitive edge over its industry counterparts. One of the most relevant ways in which an organisation aims to keep up with the competition is by implementing a widely implemented Financial Management System (FMS) like SAP Financial Management System.

As per SAP’s 2020 Annual Report, the company had a customer base of over 440,000 in more than 180 countries. SAP provides automation to its clients and improves efficiency with the help of its software solutions such as SAP FMS. The SAP FMS is a powerful and important tool used to manage the financial operations of large and complex organisations. It provides a single source of truth for financial data and streamlines financial processes to increase efficiency and accuracy. This blog will tell you all you need to know about the SAP Financial Management System, including its several components.

Table of Contents

1) What is an SAP Financial Management System?

2) What are the Components of an SAP Financial Management System?

a) General Accounting and Financial Close

b) Revenue, Cash, and Treasury Management

c) Financial Planning and Analysis

d) Governance, Risk, and Compliance

e) Digital Finance Transformation and New Technologies

f) Cloud Financial Management

g) Advanced Finance Analytics

h) Finance Automation

3) Blockchain

4) Conclusion

What is an SAP Financial Management System?

Before exploring the question “What is an SAP Financial Management System?” let us first discuss a Financial Management System. A Financial Management System can be defined as the software and processes used to manage an organisation’s income, expenses, and assets.

A Financial Management System is designed to manage the accounting and financial aspects of an organisation, incorporating specialised functionalities such as SAP Modules. It is a stand-alone system that helps automate financial transactions and supports general inventory, accounts payable, and accounts receivable. It helps manage cash flow, track fixed assets, accommodate bank statements, and offer financial reporting and analysis.

A Financial Management System maximises profits, ensures long-term sustainability, streamlines invoicing and bill collection, optimises cash flow, maintains audits, and automates finance processes to reduce errors, facilitate budgeting, forecasting, and planning, and accelerate financial reporting. It can be part of an ERP system, providing comprehensive insights into the organisation's operations.

The SAP Financial Management System is among the most relevant Financial Management Systems available. This system, integrated within the broader SAP ERP framework, is designed to manage and streamline financial data and processes for organizations. SAP Interview Questions often cover its key Financial Management features, including general ledger, accounts payable (AP), accounts receivable (AR), cash management, and asset accounting.

With SAP FMS, organisations can automate their financial processes, track their transactions in real-time, and generate financial reports for management and compliance purposes. The FMS also facilitates the management of cash flow, the reduction of financial risk, and the improvement of decision-making by providing accurate and timely financial information.

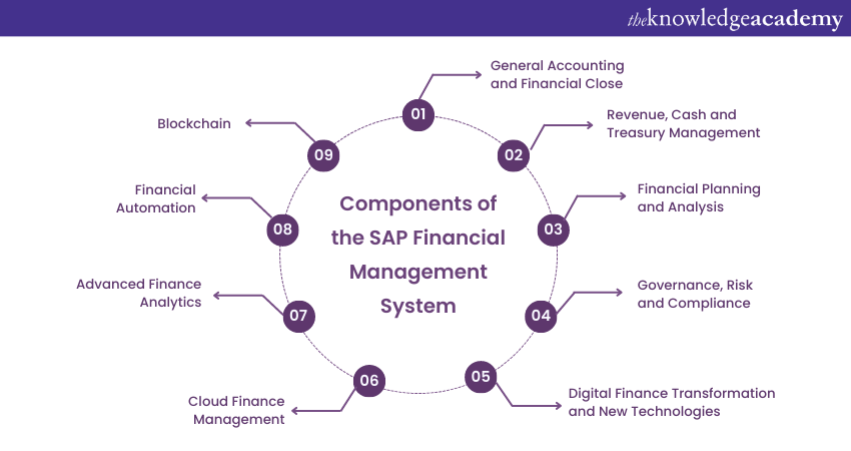

What are the Components of an SAP Financial Management System?

An effective Financial Management System offers organisations a full suite of accounting software. Within the Financial Management System, there are several different tools, which are named as follows:

1) General Accounting and Financial Close

These tools support and handle important inventory activities such as general ledger, AP, AR, and payroll. These tools help teams generate reports, create financial statements to account for income, expenses, and balances, and complete the bookkeeping process with less time and effort. The tax management features included in the tool also help organisations ensure tax accuracy and compliance.

2) Revenue, Cash and Treasury Management

The Revenue tool of a Financial Management System automates billing processes, provides real-time payment status, and ensures compliance with revenue recognition regulations. The Cash and Treasury management tools allow teams to forecast cash flow, improve liquidity, and mitigate risks. Additionally, this software can be integrated with banking systems to provide real-time visibility of bank balances and simplify account management. Staying updated with the latest Trends in Treasury Management enables organisations to leverage innovative solutions, integrate banking systems seamlessly, and gain real-time visibility of bank balances while simplifying account management.

3) Financial Planning and Analysis

The Financial Planning and Analysis tool includes planning, forecasting, budgeting, and analytical tools to support the company's financial health. It helps CFOs analyse costs and profitability, enhance performance, provide quick and accurate decision support, and plan in multiple scenarios. The software also facilitates collaboration between finance and other departments.

4) Governance, Risk and Compliance

The Governance, Risk and Compliance tools aid in aligning organisational activities with business goals, identifying and mitigating various types of risk, and ensuring compliance with laws and regulations such as GDPR, SOX, and international trade agreements. GRC software synchronises data across corporate governance, risk management, and compliance activities, enabling companies to operate more efficiently, navigate uncertainty, and act with integrity. It also helps companies monitor and manage capital availability and associated risks.

Learn all you need to know about SAP by signing up for our SAP Training!

5) Digital Finance Transformation and New Technologies

The Digital Finance Transformation and New technologies tool helps organisations adapt to the latest technological innovations, including cloud computing, augmented analytics, Robotic Process Automation (RPA), artificial intelligence (AI), and blockchain. As companies are expected to provide rapid decision support and the COVID-19 pandemic accelerates the adoption of new technologies, the benefits of digital finance transformation, such as instant intelligence, highly accurate predictive modeling, and more agile, automated processes, are becoming increasingly important. AI, in particular, is revolutionising finance analytics, automation, financial closing activities, risk mitigation, and compliance.

6) Cloud Finance Management

In addition to being scalable and cost-efficient, cloud-based Financial Management provides secure access to the system from anywhere, which is especially important in the modern context where many people are working from home due to the COVID-19 pandemic. The cloud also serves as a gateway to other new and intelligent technologies, such as AI, machine learning, and blockchain.

7) Advanced Finance Analytics

When powered by AI and Machine Learning, financial analytics can extract massive amounts of structured and unstructured data from both inside and outside the organisation in real time. These advanced analytics help finance professionals to make forecasts and predictions, model future scenarios, understand the financial impact of decisions, generate reports, and predict risk and opportunity. Overall, advanced finance analytics can help steer the organisation towards meeting its objectives as well as ensure long-term stability.

8) Financial Automation

The emergence of new technologies in finance is expected to result in a significant portion of corporate controllers using a combination of RPA and AI to automate various tasks in the finance department in the next few years. Automation in finance will enable the automation of tasks such as financial reports, tax preparation, and payroll. RPA bots can automate repetitive tasks, reduce errors, and optimise workflows, resulting in faster completion times and lower costs. This will allow finance professionals to focus on higher-value work.

9) Blockchain

In advanced finance, blockchain technology provides a new level of transparency, security and efficiency. For instance, the finance team can use blockchain technology to create a single, immutable ledger that is always updated. Blockchain-based smart contracts, which are self-executing contracts once they meet predetermined obligations, can also be used to automate and accelerate activities such as payment processing and regulatory compliance

Gain a comprehensive understanding of how SAP and Financial Accounting works by joining our SAP Financial Accounting Course.

Conclusion

The best cloud-based financial systems combine intelligent technologies such as advanced analytics, AI, machine learning, and blockchain directly into their tools. This integration of some of the latest modern technologies has accelerated the transformation in digital finance. The element of automation that these new technologies have added to the Financial Management System of an organisation has revolutionised the industry and set new standards for Financial Management.

Gain in-depth knowledge of how SAP financials represent accounting data by joining our SAP FICO Training.

Frequently Asked Questions

How Does SAP Financial Management System Improve Financial Reporting?

The SAP Financial Management System enhances financial reporting by providing real-time data access, automating report generation, and ensuring data accuracy. Its advanced analytics and reporting tools allow for customised reports and insights, enabling informed decision-making and compliance with financial regulations.

Can SAP Financial Management System Integrate with Other SAP Modules?

Yes, the SAP Financial Management System seamlessly integrates with other SAP modules, such as Sales and Distribution, Material Management, and Human Resources. This integration enables unified data flow, improves cross-functional collaboration, and provides a comprehensive view of organisational operations, enhancing overall efficiency.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various SAP Training, including SAP Financial Accounting Course, SAP Cloud Platform Training and SAP Business ByDesign Training. These courses cater to different skill levels, providing comprehensive insights into What is SAP.

Our IT Infrastructure & Networking Blogs cover a range of topics related to SAP, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your SAP Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Programming & DevOps Resources Batches & Dates

Date

SAP Finance and Controlling FICO Training

SAP Finance and Controlling FICO Training

Mon 4th Aug 2025

Mon 3rd Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please